Tri-Continental Corporation Declares Third Quarter Distribution

September 02 2022 - 10:23AM

Business Wire

Tri-Continental Corporation (the “Corporation”) (NYSE:

TY) today declared a third quarter ordinary income

distribution of $0.2695 per share of Common Stock and $0.6250 per

share of Preferred Stock. Distributions on Common Stock will be

paid on September 20, 2022 to Common Stockholders of record on

September 12, 2022 and dividends on Preferred Stock will be paid on

October 3, 2022 to Preferred Stockholders of record on September

12, 2022. The ex-dividend date for both the Common Stock and the

Preferred Stock is September 9, 2022. The $0.2695 per share

ordinary income distribution on the Common Stock is in accordance

with the Corporation’s distribution policy.

The Corporation has paid dividends on its common stock for 78

consecutive years. The Corporation’s investment manager is Columbia

Management Investment Advisers, LLC, a wholly-owned subsidiary of

Ameriprise Financial, Inc.

The Corporation’s distributions on common stock will vary. The

Corporation’s current distributions (as estimated by the

Corporation based on current information) are from the earnings and

profits of the Corporation. No amount of the Corporation’s current

distribution consists of a return of capital (i.e., a return of

some or all of your original investment in the Corporation).

The net asset value of the Corporation’s common shares may not

always correspond to the market price of such shares. Shares of

many closed-end funds frequently trade at a discount from their net

asset value. An investment in the Corporation is subject to stock

market risk, which is the risk that market prices for the

Corporation’s common shares may decline over short or long periods,

adversely affecting the value of an investment in the

Corporation.

Securities selected for the Corporation using quantitative

methods may perform differently from the market as a whole, and

there can be no assurance that this methodology will enable it to

achieve its objective. The Corporation’s portfolio investments are

subject to market risk, which may affect a single issuer, sector of

the economy, industry or the market as a whole. Fixed-income

investments, including convertible securities, are subject to

credit risk, interest rate risk, and prepayment and extension risk.

These risks may be more pronounced for longer-term securities and

high-yield securities (“junk bonds”). In general, bond prices rise

when interest rates fall and vice versa. Convertible securities are

subject to both the risks of their security type prior to

conversion as well as their security type after conversion. The

Corporation’s use of leverage, including through its preferred

stock, exposes it to greater risks due to unanticipated market

movements, which may magnify losses and increase volatility of

returns.

You should consider the investment objectives, risks, charges,

and expenses of the Corporation carefully before investing. A

prospectus containing information about the Corporation (including

its investment objectives, risks, charges, expenses, and other

information) may be obtained by contacting your financial advisor

or Columbia Management Investment Services Corp. at 800-345-6611.

The prospectus can also be found on the Securities and Exchange

Commission’s EDGAR database. The prospectus should be read

carefully before investing in the Corporation. There is no

guarantee that the Corporation’s investment goals/objectives will

be met or that distributions will be made, and you could lose

money.

Tri-Continental Corporation is managed by Columbia Management

Investment Advisers, LLC. This material is distributed by Columbia

Management Investment Distributors, Inc., member FINRA.

Columbia Threadneedle Investments is the global brand name of

the Columbia and Threadneedle group of companies.

Past performance does not guarantee future results.

Investment products are not federally or FDIC-insured, are not

deposits or obligations of, or guaranteed by any financial

institution, and involve investment risks including possible loss

of principal and fluctuation in value.

© 2022 Columbia Management Investment Advisers, LLC. All rights

reserved.

columbiathreadneedleus.com

Adtrax #4926975

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220902005221/en/

Stockholder contact: Kevin Howley 617-385-9517

kevin.howley@columbiathreadneedle.com

Media contact: Elizabeth Kennedy 617-897-9394

liz.kennedy@ampf.com

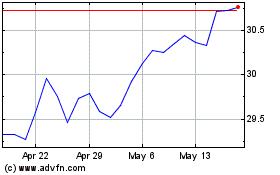

Tri Continental (NYSE:TY)

Historical Stock Chart

From Dec 2024 to Jan 2025

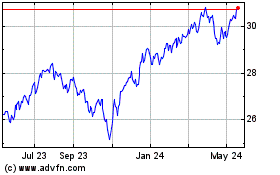

Tri Continental (NYSE:TY)

Historical Stock Chart

From Jan 2024 to Jan 2025