UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

Pursuant

to Rule 13a-16 or 15d-16

Under

the Securities Exchange Act of 1934

For

the month of January 2025

Commission

File Number: 001-35829

Vermilion

Energy Inc.

(Exact

name of registrant as specified in its charter)

3500,

520 – 3rd Avenue S.W., Calgary, Alberta T2P 0R3

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Exhibit

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

VERMILION

ENERGY INC.

| |

|

|

| By: |

|

/s/ Lars Glemser |

| Title: |

|

Lars Glemser, VP and Chief Financial Officer |

Date: January 28, 2025

Exhibit 99.1

Vermilion Energy Inc. Announces the Pricing of

Its Unsecured Notes Offering

CALGARY, AB, Jan. 28, 2025 /CNW/ - Vermilion Energy

Inc. ("Vermilion" or the "Company") (TSX: VET) (NYSE: VET) today announced the pricing of its previously announced

private offering of up to US$400 million of eight-year senior unsecured notes (the "New Notes"). The New Notes will be issued

in the aggregate principal amount of US$400 million, and will have a maturity date of February 15, 2033 and a fixed coupon of 7.250% per

annum, to be paid semi-annually. The offering of the New Notes (the "Offering") is expected to close on or about February 11,

2025, subject to customary closing conditions. The Company intends to use the net proceeds from the New Notes, at its option, to (a) redeem

or repay the outstanding amount of the Company's existing 5.625% senior notes due 2025 (the "Existing Vermilion Notes") prior

to or at their maturity date thereof, (b) fund a portion of the purchase price of the acquisition of Westbrick Energy Ltd. (the "Westbrick

Acquisition"), (c) pay transaction fees and other costs associated with the redemption or repayment of the Existing Vermilion Notes

and the Westbrick Acquisition, as applicable, (d) repay a portion of the outstanding borrowings under our credit facilities related to

any of the foregoing, or (e) any combination of the foregoing.

The New Notes have not been and will not be registered

under the U.S. Securities Act of 1933, as amended ("U.S. Securities Act") or applicable state securities laws, and may not be

offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the U.S. Securities

Act and applicable state securities laws. The New Notes have not been and will not be qualified for sale to the public under applicable

Canadian securities laws and, accordingly, any offer and sale of the New Notes in Canada will be made on a basis which is exempt from

the prospectus requirements of such securities laws. Pursuant to the terms of the offering, the New Notes will be offered and sold only

on a prospectus-exempt basis to institutional "accredited investors" in certain provinces in Canada and, in the United States,

will be offered and sold only to "qualified institutional buyers" in reliance on Rule 144A under the U.S. Securities Act and

to certain non-U.S. persons in transactions outside the United States in reliance on Regulation S under the U.S. Securities Act.

This press release does not constitute an offer to

sell or the solicitation of an offer to buy any security in any jurisdiction and shall not constitute an offer, solicitation or sale of

any securities in any jurisdiction in which such offering, solicitation or sale would be unlawful.

Forward-looking Information Advisory

Certain statements in this press release constitute

"forward-looking information" within the meaning of applicable securities laws. Such forward-looking information includes statements

regarding the size and terms of the Offering and the use of proceeds therefrom. Vermilion believes the expectations reflected in such

forward-looking statements are reasonable but no assurance can be given that these expectations will prove to be correct and such forward-looking

statements should not be unduly relied upon.

The forward-looking statements contained herein are

based upon certain assumptions and factors including, without limitation, current and future economic and financial conditions and expected

future developments. Vermilion believes such assumptions and factors are reasonably accurate at the time of preparing this press release.

However, forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties. Such forward-looking

statements necessarily involve known and unknown risks and uncertainties and other factors, which may cause actual results and circumstances

to differ materially from any projections of future events or results expressed or implied by such forward looking statements. Such factors

include, but are not limited to, risks associated with: closing of the Offering; failure to obtain any necessary consents and approvals

required to complete the Offering; closing of the Westbrick Acquisition on the terms negotiated or at all; and general economic, market

and business conditions and other factors, many of which are beyond the control of Vermilion. There is a specific risk that Vermilion

may be unable to complete the Offering. If Vermilion is unable to complete the Offering, there could be a material adverse impact on Vermilion

and on the value of its securities. See also the risks and uncertainties described under "Special Note Regarding Forward-Looking

Information" and "Risk Factors" included in Vermilion's Annual Information Form dated March 6, 2024 filed under the Company's

issuer profile on SEDAR+ (www.sedarplus.ca).

Any forward-looking statements are made as of the

date hereof and Vermilion does not undertake any obligation, except as required under applicable law, to publicly update or revise such

statements to reflect new information, subsequent or otherwise. The forward-looking statements contained in this press release are expressly

qualified by this cautionary statement.

About Vermilion

Vermilion is an international energy producer that

seeks to create value through the acquisition, exploration, development and optimization of producing assets in North America, Europe

and Australia. The Company's business model emphasizes free cash flow generation and returning capital to investors when economically

warranted, augmented by value-adding acquisitions. Vermilion's operations are focused on the exploitation of light oil and liquids-rich

natural gas conventional and unconventional resource plays in North America and the exploration and development of conventional natural

gas and oil opportunities in Europe and Australia.

Vermilion's priorities are health and safety, the

environment, and profitability, in that order. Nothing is more important than the safety of the public and those who work with Vermilion,

and the protection of the natural surroundings. In addition, the Company emphasizes strategic community investment in each of its operating

areas.

Vermilion trades on the Toronto Stock Exchange and

the New York Stock Exchange under the symbol VET.

View original content to download multimedia:https://www.prnewswire.com/news-releases/vermilion-energy-inc-announces-the-pricing-of-its-unsecured-notes-offering-302362578.html

SOURCE Vermilion Energy Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2025/28/c8647.html

%CIK: 0001293135

For further information: For further information please contact:

Kyle Preston, Vice President, Investor Relations, TEL (403) 269-4884 | IR TOLL FREE 1-866-895-8101 | investor_relations@vermilionenergy.com

| www.vermilionenergy.com

CO: Vermilion Energy Inc.

CNW 17:00e 28-JAN-25

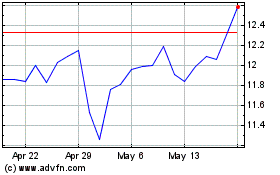

Vermilion Energy (NYSE:VET)

Historical Stock Chart

From Jan 2025 to Feb 2025

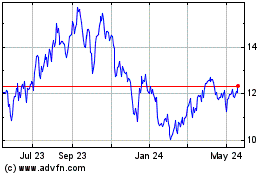

Vermilion Energy (NYSE:VET)

Historical Stock Chart

From Feb 2024 to Feb 2025