Aeterna Zentaris Inc. (NASDAQ: AEZS) (TSX: AEZS)

(“

Aeterna” or the “

Company”), a

specialty biopharmaceutical company commercializing and developing

therapeutics and diagnostic tests, today announced that the Company

has filed articles of amendment, to effect the previously announced

share consolidation (or reverse stock split) (the

“

Consolidation”) of its issued and outstanding

common shares (the “

Common Shares”) on the basis

of one post-Consolidation Common Share for every twenty-five

pre-Consolidation Common Shares.

Aeterna expects that the price of its Common

Shares will reflect the Consolidation by July 21, 2022, marking a

positive outcome for the Company as it works to further its

development pipeline. Aeterna’s board of directors also thanks all

shareholders for their support of the Consolidation initiative.

The Consolidation will reduce the number of

Common Shares issued and outstanding from approximately 121,397,007

Common Shares to approximately 4,855,876 Common Shares. The Common

Shares are expected to commence trading on the Toronto Stock

Exchange (the “TSX”) and on the Nasdaq Capital

Market (the “Nasdaq”) on a post-Consolidation

basis on or about the opening of trading on July 21, 2022.

Remaining listed on Nasdaq is important to the

Company’s performance, corporate visibility as well as overall

awareness of Aeterna to current and potential investors. Aeterna

proceeded with the Consolidation in order to satisfy Nasdaq’s

minimum bid price requirement. Under this rule, if the Company

fails to meet a minimum bid price for its common shares above

US$1.00, for a minimum of at least ten consecutive days before July

25, 2022, the Company could be subject to delisting from Nasdaq

unless the Company timely requests a hearing before a Nasdaq

Hearings Panel. While the Consolidation is expected to result in

Aeterna’s Common Shares achieving the requisite minimum bid price

by later this week, the Company will not meet the requirement for

the Common Shares to trade at this level for a minimum of ten

consecutive days before July 25, 2022. However, Aeterna expects to

be in full compliance with Nasdaq Listing Rules by August 3, 2022,

having traded for a minimum of ten consecutive business days at or

above $1.00 per Common Share by that date.

Given that the Company does not expect to trade

at or above $1.00 per Common Share for ten consecutive trading days

by July 25, 2022, the current expiration date of its grace period,

the Company expects to receive a notice of delisting during the

week of July 25, 2022. Such notice would afford the Company seven

calendar days to request a hearing. If the Company has not been

deemed in compliance by the due date for requesting a hearing, the

Company intends to timely request a hearing. The hearing request

will automatically stay any suspension or delisting action pending

the conclusion of the hearings process. Should the Company regain

compliance after it has requested a hearing, the Company expects

that the hearing will be canceled, provided it meets all other

requirements for continued listing at the time. At present, the

Company meets all other requirements for continued listing, with

the exception of the bid price requirement.

The Company’s transfer agent, Computershare

Investor Services Inc., will be sending a letter of transmittal to

the registered holders of Common Shares. The letter of transmittal

will contain instructions on how to surrender Common Share

certificate(s) representing pre-Consolidation Common Shares to the

transfer agent. Shareholders may also obtain a copy of the letter

of transmittal by accessing the Company’s SEDAR profile at

www.sedar.com or the Company’s EDGAR profile at www.sec.gov. Until

surrendered, each certificate representing pre-Consolidation Common

Shares will be deemed for all purposes to represent the number of

Common Shares to which the holder thereof is entitled as a result

of the Consolidation. If shareholders hold their Common Shares

through an intermediary and they have questions in this regard,

they are encouraged to contact their intermediaries.

The Company’s new CUSIP number is 007975501 and

its new ISIN number is CA0079755017.

For additional information regarding the

Consolidation, please refer to the Company’s Notice of Annual

General and Special Meeting of Shareholders and Management

Information Circular dated May 16, 2022, which are available on

SEDAR at www.sedar.com or EDGAR at www.sec.gov.

About Aeterna Zentaris Inc.

Aeterna Zentaris is a specialty

biopharmaceutical company developing and commercializing a

diversified portfolio of pharmaceutical and diagnostic products

focused on areas of significant unmet medical need. The Company’s

lead product, macimorelin (Macrilen™; Ghryvelin®), is the first and

only U.S. FDA and European Commission approved oral test indicated

for the diagnosis of adult growth hormone deficiency (AGHD). The

Company is leveraging the clinical success and compelling safety

profile of macimorelin to develop it for the diagnosis of

childhood-onset growth hormone deficiency (CGHD), an area of

significant unmet need, in collaboration with Novo Nordisk.

Aeterna Zentaris is dedicated to the development

of therapeutic assets and has recently taken steps to establish a

growing pre-clinical and clinical pipeline to potentially address

unmet medical needs across a number of indications, including

neuromyelitis optica spectrum disorder (NMOSD), Parkinson’s disease

(PD), hypoparathyroidism and amyotrophic lateral sclerosis (ALS;

Lou Gehrig’s disease). Additionally, the Company is developing an

oral prophylactic bacterial vaccine against SARS-CoV-2 (COVID-19)

and Chlamydia trachomatis.

For more information, please visit

www.zentaris.com and connect with the Company on Twitter, LinkedIn

and Facebook.

Forward-Looking Statements

This press release contains statements that may

constitute forward-looking statements within the meaning of U.S.

and Canadian securities legislation and regulations and such

statements are made pursuant to the safe-harbor provision of the

U.S. Securities Litigation Reform Act of 1995. Forward-looking

statements are frequently, but not always, identified by words such

as “expects,” “anticipates,” “believes,” “intends,” “potential,”

“possible,” and similar expressions. Such statements, based as they

are on current expectations of management, inherently involve

numerous risks, uncertainties and assumptions, known and unknown,

many of which are beyond our control. Forward-looking statements in

this press release include, but are not limited to, those relating

to the timing and impact of the Consolidation and compliance with

the Nasdaq’s rules.

Forward-looking statements involve known and

unknown risks and uncertainties, and other factors which may cause

the actual results, performance or achievements stated herein to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

information. Such risks and uncertainties include, among others,

results from ongoing or planned pre-clinical and clinical studies

of our products under development may not be successful or may not

support advancing the product to human clinical trials; our ability

to raise capital and obtain financing to continue our currently

planned operations; our now heavy dependence on the success of

Macrilen™ (macimorelin) and related out-licensing arrangements and

the continued availability of funds and resources to successfully

commercialize the product, including our heavy reliance on the

success of the license agreement and the amended license agreement

(collectively the Novo Amended License Agreement); the global

instability due to the global pandemic of COVID-19 and the war in

Ukraine and the resulting geopolitical instability, and its unknown

potential effect on our planned operations; our ability to enter

into out-licensing, development, manufacturing, marketing and

distribution agreements with other pharmaceutical companies and

keep such agreements in effect; and our ability to continue to list

our common shares on the NASDAQ. Investors should consult our

quarterly and annual filings with the Canadian and U.S. securities

commissions for additional information on risks and uncertainties,

including those risks discussed in our Annual Report on Form 20-F

and the annual information form, under the caption “Risk Factors”.

Given the uncertainties and risk factors, readers are cautioned not

to place undue reliance on these forward-looking statements. We

disclaim any obligation to update any such factors or to publicly

announce any revisions to any of the forward-looking statements

contained herein to reflect future results, events or developments,

unless required to do so by a governmental authority or applicable

law.

No securities regulatory authority has either

approved or disapproved of the contents of this news release. The

Toronto Stock Exchange accepts no responsibility for the adequacy

or accuracy of this release.

Investor Contact:

Jenene Thomas JTC Team T (US): +1 (833) 475-8247

E: aezs@jtcir.com

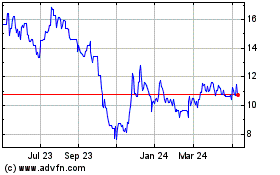

Aeterna Zentaris (TSX:AEZS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Aeterna Zentaris (TSX:AEZS)

Historical Stock Chart

From Jan 2024 to Jan 2025