Aeterna Zentaris Inc. (NASDAQ: AEZS) (TSX: AEZS) (“Aeterna” or the

“Company”), a specialty biopharmaceutical company developing and

commercializing a diversified portfolio of pharmaceutical and

diagnostic products, today reported its financial and operating

results for the quarter ended June 30, 2023.

“Our continued progress advancing our

development and regulatory strategies are evolving and designed to

provide us with a pathway towards our first-in-human clinical

studies with our lead indication, neuromyelitis optica spectrum

disorder (NMOSD). Further, we established solid traction with our

ongoing DETECT trial and are working towards meeting our goal of

completing enrollment by year's end,” commented Dr. Klaus Paulini,

Chief Executive Officer of Aeterna. “Importantly, we have

maintained a strong cash position to enable us to continue our

strategy.”

Summary of Second

Quarter 2023

Financial Results

All amounts are in U.S. dollars

Cash and cash equivalents

The Company had $42.2 million in cash and cash equivalents at

June 30, 2023.

Results of operations for the three-month period

ended June 30, 2023

For the three-month period ended June 30, 2023,

we reported a consolidated net loss of $2.5 million, or $0.52 loss

per common share (basic and diluted), as compared with a

consolidated net loss of $4.2 million, or $0.87 net loss per common

share (basic) for the three-month period ended June 30, 2022.

Revenues

- Our total revenue for the

three-month period ended June 30, 2023 was $2.2 million as compared

with ($0.2 million) for the same period in 2022, representing an

increase of $2.4 million. The increase was due primarily to an

increase in license fee revenue recognized of $1.0 million and

development services revenue of $1.4 million relating to the

Company’s amended agreement with Novo Nordisk Healthcare.

Operating Expenses

- Our total operating expenses for

the three-month period ended June 30, 2023 were $5.1 million as

compared with $4.5 million for the same period in 2022,

representing an increase of $0.6 million. This increase arose from

a $0.5 million increase in research and development expenses,

primarily related to our DETECT trial, and a $0.1 million increase

in cost of sales.

Net Finance Income

- For the three-month period ended

June 30, 2023, our net finance income was $0.3 million as compared

to $0.5 million for the three-month period ended June 30, 2022,

representing a decrease of $0.2 million. This decrease was the

result of a $0.5 million decrease in gains due to changes in

foreign currency rates offset by a $0.3 million increase in

interest income.

Results of operations for the

six-month period ended

June 30, 2023

For the six-month period ended June 30, 2023, we

reported a consolidated net loss of $6.8 million, or $1.39 loss per

common share (basic and diluted), as compared with a consolidated

net loss of $6.9 million, or $1.41 net loss per common share

(basic) for the six-month period ended June 30, 2022.

Revenues

- Our total revenue for the six-month

period ended June 30, 2023, was $4.4 million as compared to $1.3

million for the same period in 2022, representing an increase of

$3.1 million. The increase was primarily due to an increase in

license fee revenue recognized of $1.3 million and development

services revenue of $1.9 million relating to the Company’s amended

agreement with Novo Nordisk Healthcare, offset by a $0.1 million

decrease in product sales.

Operating Expenses

- Our total operating expenses for

the six-month period ended June 30, 2023 were $11.4 million as

compared with $8.8 million for the same period in 2022,

representing an increase of $2.6 million. This increase arose from

a $2.1 million increase in research and development expenses,

primarily related to our DETECT trial and our AEZS-130 Macimorelin

ALS project, increases of $0.4 million in selling, general &

administrative expenses, and a $0.1 million increase in cost of

sales.

Net Finance Income

- For the six-month period ended June

30, 2023, our net finance income was $0.3 million as compared to

$0.7 million for the six-month period ended June 30, 2022,

representing a decrease of $0.4 million. This decrease was the

result of a $0.7 million decrease in gains due to changes in

foreign currency rates offset by a $0.3 million increase in

interest income.

Consolidated Financial Statements and Management's

Discussion and Analysis

For reference, the Company’s Management's

Discussion and Analysis of Financial Condition and Results of

Operations for the second quarter 2023, as well as the Company's

unaudited consolidated interim financial statements as of June 30,

2023, will be available on the Company's website (www.zentaris.com)

in the Investors section or at the Company's profile at

www.sedarplus.com and www.sec.gov.

About Aeterna Zentaris Inc.

Aeterna Zentaris is a specialty

biopharmaceutical company developing and commercializing a

diversified portfolio of pharmaceutical and diagnostic products

focused on areas of significant unmet medical need. The Company's

lead product, macimorelin (Macrilen®; Ghryvelin™), is the first and

only U.S. FDA and European Commission approved oral test indicated

for the diagnosis of adult growth hormone deficiency (AGHD). The

Company is leveraging the clinical success and compelling safety

profile of macimorelin to develop it for the diagnosis of

childhood-onset growth hormone deficiency (CGHD), an area of

significant unmet need.

Aeterna Zentaris is dedicated to the development

of its therapeutic asset and has established a pre-clinical

development pipeline to potentially address unmet medical needs

across a number of indications, including neuromyelitis optica

spectrum disorder (NMOSD), Parkinson's disease (PD),

hypoparathyroidism and amyotrophic lateral sclerosis (ALS; Lou

Gehrig's disease).

For more information, please visit

www.zentaris.com and connect with the Company on Twitter, LinkedIn

and Facebook.

Forward-Looking Statements

This press release contains statements that may

constitute forward-looking statements within the meaning of U.S.

and Canadian securities legislation and regulations, and such

statements are made pursuant to the safe-harbor provision of the

U.S. Securities Litigation Reform Act of 1995. Forward-looking

statements are frequently, but not always, identified by words such

as "expects," "aiming", "anticipates," "believes," "intends,"

"potential," "possible," and similar expressions. Such statements,

based as they are on current expectations of management, inherently

involve numerous risks, uncertainty and assumptions, known and

unknown, many of which are beyond our control.

Forward-looking statements in this press release

include, but are not limited to, those relating to Aeterna's

expectations regarding: its ability to use cash to fund its future

operations; recruitment efforts with respect to the DETECT trial;

plans regarding first-in-human studies; and commercialization

efforts regarding macimorelin.

Forward-looking statements involve known and

unknown risks and uncertainties, and other factors which may cause

the actual results, performance or achievements stated herein to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

information. Such risks and uncertainties include, among others: we

may not be successful in finding a commercialization partner for

Macrilen® (macimorelin) in North America or other territories not

currently partnered; we may not be able to re-launch sales of

Macrilen® (macimorelin) in the United States; our reliance on the

success of the DETECT trial in CGHD; results from our ongoing or

planned pre-clinical studies and our DETECT trial may not be

successful or may not support advancing the product further in

pre-clinical studies, to human clinical trials or regulatory

approval; our ability to raise capital and obtain financing to

continue our currently planned operations; our now heavy dependence

on the success of macimorelin (Macrilen®; GHRYVELIN™) and related

out-licensing arrangements and the continued availability of funds

and resources to successfully commercialize the product; our

ability to enter into out-licensing, development, manufacturing,

marketing and distribution agreements with other pharmaceutical

companies and keep such agreements in effect; and our ability to

continue to list our common shares on the NASDAQ. Investors should

consult our quarterly and annual filings with the Canadian and U.S.

securities commissions for additional information on risks and

uncertainties, including those risks discussed in our Annual Report

on Form 20-F and annual information form under the caption "Risk

Factors". Given the uncertainties and risk factors, readers are

cautioned not to place undue reliance on these forward-looking

statements. We disclaim any obligation to update any such factors

or to publicly announce any revisions to any of the forward-looking

statements contained herein to reflect future results, events or

developments, unless required to do so by a governmental authority

or applicable law.

No securities regulatory authority has either

approved or disapproved of the contents of this news release. The

Toronto Stock Exchange accepts no responsibility for the adequacy

or accuracy of this release.

Investor Contact:

Jenene ThomasJTC TeamT: +1 (833) 475-8247E: aezs@jtcir.com

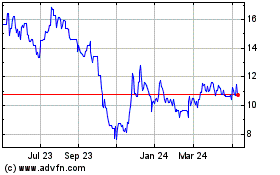

Aeterna Zentaris (TSX:AEZS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Aeterna Zentaris (TSX:AEZS)

Historical Stock Chart

From Dec 2023 to Dec 2024