Calibre Mining Corp. (TSX: CXB; OTCQX: CXBMF)

(“Calibre” or the “Company”) announces financial and operating

results for the three months (“Q3”) and nine months (“YTD”) ended

September 30, 2024. Consolidated Q3 and YTD 2024 filings can be

found at

www.sedarplus.ca and on the Company’s

website at

www.calibremining.com. All figures are

expressed in U.S. dollars unless otherwise stated.

Darren Hall, President and Chief

Executive Officer of Calibre, stated: “As previously

reported, the Company delivered 46,076 ounces in the quarter and

166,200 ounces year to date. Consolidated Q4 production is expected

to be the strongest of the year, delivering 70,000 - 80,000 ounces,

driven by Nicaragua’s Q4 mine plans which are tracking and plan for

significantly higher ore tonnes mined. After increasing ore haulage

to Libertad by 30% to 3,000 tonnes per day, we forecast a stockpile

build of approximately 30,000 ounces which will be processed in

2025.

The Valentine team continues to make significant

progress with construction completion at 81% at the end of

September and we remain on track to deliver first gold during Q2

2025. I am pleased with the increased focus, and we are confidently

heading toward mechanical and electrical completion in early Q1,

2025.

The Valentine Gold Mine and surrounding property

offers an impressive 5-million-ounce resource base and numerous

discovery opportunities. Previously disclosed results at Valentine

indicate robust growth potential below and adjacent to existing

Mineral Resources. Our extensive, multi-rig drill program is

focused on high priority targets beyond the originally explored 6

km section of defined reserves/resources of the 32 km long

Valentine Lake Shear Zone to unlock the significant resource

expansion and discovery potential across the property.”

YTD & Q3 2024 Highlights

- Construction of the

multi-million-ounce Valentine Gold Mine surpasses 81%

construction with a remaining cost to complete on an incurred basis

of C$197 million as at September 30, 2024 and remains on

track for gold production in Q2 2025;

- Tailings Management Facility is

complete and ready to receive water;

- CIL leaching area tanks

construction is nearing completion;

- Reclaim tunnel and coarse ore

stockpile construction is progressing;

- Primary crusher installation is

well advanced and overland conveyor construction has commenced;

and

- Pre-commissioning is underway;

- With approximately C$300 million in

cash (US$115.8-million and restricted cash US$100-million) at

September 30, 2024, Valentine's initial project capital remains

fully financed;

- Bolstered cash position as part of

our capital management program with $55 million to be received from

an additional gold prepayment arrangement whereby Calibre will

physically deliver an additional 20,000 ounces of gold (2,500

ounces of gold per month at $2,816 per ounce) from May 2025 to

December 2025;

- Calibre Strengthens its

Executive Leadership Team with the Appointment of Chief Operating

Officer and Vice President of Technical Services,

Nicaragua;

- Expanded the Valentine Gold Mine

(“Valentine”) resource expansion and discovery drill program with a

100,000 metre drill program, in addition to the

60,000 metre program already in place at the Leprechaun and

Marathon deposits;

- Received the Federal

Environmental Assessment approval for the third open pit,

the Berry Pit at Valentine scheduled to commence construction

activities in Q4 2024;

- Ore control drilling

results at the Marathon Pit at Valentine yielded 44%

additional gold on 47% higher grades than modelled in the 2022

Mineral Reserve statement, increasing confidence of the deposit as

the Company advances toward first gold in Q2 2025;

- New Discovery along the

VTEM Gold Corridor and continued step out drilling intercepts

high-grade gold mineralization at the Talavera deposit,

both located within the Limon mine complex in Nicaragua,

reinforcing Limon’s ability to continually deliver compelling

results, leading to new discoveries and resource expansion:

- 13.26 g/t gold over 4.9 metres ETW

including 33.50 g/t gold over 1.2 metres ETW; and

- 6.38 g/t gold over 10.5 metres

ETW;

- Continued to intercept high

grade gold mineralization from the resource conversion and

expansion program within the Guapinol open pit area at the Eastern

Borosi mine in Nicaragua, reinforcing the potential for mine life

extension:

- 13.24 g/t gold over 5.8 metres ETW

including 18.52 g/t gold over 4.0 metres ETW; and

- 9.24 g/t gold over 6.2 metres ETW

including 17.45 g/t gold over 3.1 metres ETW;

- Discovered additional near

surface, above reserve grade gold mineralization at the Pan

Mine (“Pan”) in Nevada, demonstrating the potential to

increase resources, grade and mine life around Pan:

- 0.45 g/t gold over 117.4 meres ETW;

and

- 0.56 g/t gold over 59.4 metres

including 1.31 g/t gold over 9.1 metres ETW;

- Consolidated gold sales of 46,076

ounces; Nicaragua 36,427 ounces and Nevada 9,649 ounces;

- Consolidated TCC1 of $1,580/oz;

Nicaragua $1,615/oz and Nevada $1,451/oz;

- Consolidated AISC1 of $1,946/oz;

Nicaragua $1,880/oz and Nevada $1,813/oz; and

- Cash and restricted cash of $115.8

million and $100.0 million, respectively, as at September 30,

2024.

YTD 2024 Gold Sales and Cost

Metrics

- Consolidated gold sales of 166,200

ounces grossing $374.9 million in revenue, at an average realized

gold price1 of $2,256/oz; Nicaragua 140,646 ounces and Nevada

25,554 ounces;

- Consolidated TCC1 of $1,379/oz;

Nicaragua $1,364/oz and Nevada $1,463/oz;

- Consolidated AISC1 of $1,656/oz;

Nicaragua $1,554/oz and Nevada $1,734/oz; and

- Cash provided by operating

activities of $88.8 million.

Click here to learn more about the Valentine Gold

Mine – Building Atlantic Canada’s Largest

Open Pit Gold Mine

Installation of the Primary Crusher –

September 2024

A photo accompanying this announcement is

available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/a6073327-6b82-4aaf-bf52-e1cb2221d7b4

CONSOLIDATED RESULTS: Q3 and Nine Months Ended

2024

Consolidated

Results2

|

|

Three Months Ended |

Nine Months Ended |

|

$'000 (except per share and per ounce amounts) |

Q3 2024 |

Q2 2024 |

Q3 2023 |

YTD 2024 |

YTD 2023 |

|

Financial Results |

|

|

|

|

|

|

Revenue |

$ |

113,684 |

|

$ |

137,325 |

|

$ |

143,884 |

|

$ |

382,897 |

|

$ |

410,107 |

|

| Cost of sales, including

depreciation and amortization |

$ |

(97,437 |

) |

$ |

(94,685 |

) |

$ |

(101,128 |

) |

$ |

(294,753 |

) |

$ |

(281,556 |

) |

| Earnings from mine

operations |

$ |

16,247 |

|

$ |

42,640 |

|

$ |

42,756 |

|

$ |

88,144 |

|

$ |

128,551 |

|

| EBITDA (3) |

$ |

29,988 |

|

$ |

52,886 |

|

$ |

61,899 |

|

$ |

109,352 |

|

$ |

170,416 |

|

| Adjusted EBITDA (3) |

$ |

28,943 |

|

$ |

54,022 |

|

$ |

62,998 |

|

$ |

122,694 |

|

$ |

172,852 |

|

| Net earnings |

$ |

954 |

|

$ |

20,762 |

|

$ |

23,412 |

|

$ |

18,079 |

|

$ |

73,024 |

|

| Adjusted net earnings (4) |

$ |

2,199 |

|

$ |

19,035 |

|

$ |

24,530 |

|

$ |

26,545 |

|

$ |

74,361 |

|

| Operating cash flows before

working capital (5) |

$ |

4,170 |

|

$ |

68,618 |

|

$ |

49,826 |

|

$ |

125,170 |

|

$ |

138,605 |

|

| Operating cash flow |

$ |

(17,833 |

) |

$ |

60,826 |

|

$ |

54,226 |

|

$ |

88,808 |

|

$ |

140,776 |

|

| Capital expenditures

(sustaining) |

$ |

10,849 |

|

$ |

10,358 |

|

$ |

3,696 |

|

$ |

28,916 |

|

$ |

19,545 |

|

| Capital expenditures

(growth) |

$ |

136,103 |

|

$ |

97,581 |

|

$ |

29,294 |

|

$ |

301,833 |

|

$ |

70,204 |

|

| Capital

expenditures (exploration) |

$ |

12,387 |

|

$ |

8,967 |

|

$ |

7,705 |

|

$ |

28,991 |

|

$ |

21,448 |

|

|

Operating Results |

|

|

|

|

|

| Gold ounces produced |

|

45,697 |

|

|

58,754 |

|

|

73,485 |

|

|

166,218 |

|

|

208,011 |

|

| Gold

ounces sold |

|

46,076 |

|

|

58,345 |

|

|

73,241 |

|

|

166,200 |

|

|

208,020 |

|

| Per Ounce

Data |

|

|

|

|

|

|

Average realized gold price1 ($/oz) |

$ |

2,418 |

|

$ |

2,302 |

|

$ |

1,929 |

|

$ |

2,256 |

|

$ |

1,932 |

|

| TCC ($/oz)1 |

$ |

1,580 |

|

$ |

1,264 |

|

$ |

1,007 |

|

$ |

1,379 |

|

$ |

1,047 |

|

| AISC

($/oz)1 |

$ |

1,946 |

|

$ |

1,533 |

|

$ |

1,115 |

|

$ |

1,656 |

|

$ |

1,195 |

|

|

Per Share Data |

|

|

|

|

|

| Earnings per share –

basic |

$ |

0.00 |

|

$ |

0.03 |

|

$ |

0.05 |

|

$ |

0.02 |

|

$ |

0.16 |

|

| Earnings per share – fully

diluted |

$ |

0.00 |

|

$ |

0.03 |

|

$ |

0.05 |

|

$ |

0.02 |

|

$ |

0.15 |

|

| Adjusted net earnings per

share – basic (3) |

$ |

0.00 |

|

$ |

0.02 |

|

$ |

0.05 |

|

$ |

0.04 |

|

$ |

0.16 |

|

| Operating cash flows before

working capital per share |

$ |

0.01 |

|

$ |

0.09 |

|

$ |

0.11 |

|

$ |

0.17 |

|

$ |

0.31 |

|

|

Operating cash flow per share |

$ |

(0.02 |

) |

$ |

0.08 |

|

$ |

0.12 |

|

$ |

0.12 |

|

$ |

0.31 |

|

|

Balance Sheet Data |

|

|

|

|

|

| Cash |

$ |

115,800 |

|

$ |

127,582 |

|

$ |

97,293 |

|

$ |

115,800 |

|

$ |

97,293 |

|

| Net debt (6) |

$ |

178,345 |

|

$ |

164,809 |

|

$ |

(77,927 |

) |

$ |

178,345 |

|

$ |

(77,927 |

) |

| Adj.

Net debt/Adj. EBITDA (LTM) ratio (7) |

$ |

0.91 |

|

$ |

0.72 |

|

$ |

(0.37 |

) |

$ |

0.91 |

|

$ |

(0.37 |

) |

Operating Results

|

|

Three Months Ended |

Nine Months Ended |

|

NICARAGUA |

Q3 2024 |

Q2 2024 |

Q3 2023 |

YTD 2024 |

YTD 2023 |

| Ore

mined (t) |

574,878 |

359,295 |

491,835 |

1,468,960 |

1,588,631 |

| Ore

milled (t) |

557,635 |

455,616 |

546,555 |

1,544,261 |

1,545,123 |

| Grade

(g/t Au) |

2.30 |

3.48 |

4.35 |

3.00 |

4.03 |

|

Recovery (%) |

88.9 |

92.5 |

91.6 |

91.2 |

92.3 |

| Gold

produced (ounces) |

36,427 |

49,208 |

63,756 |

140,642 |

177,145 |

|

Gold sold (ounces) |

36,427 |

49,210 |

63,517 |

140,646 |

177,100 |

|

|

|

|

|

|

|

|

NEVADA |

Three Months Ended |

Nine Months Ended |

|

Q3 2024 |

Q2 2024 |

Q3 2023 |

YTD 2024 20243,256,527 |

YTD 2023 |

| Ore

mined (t) |

1,187,591 |

1,080,242 |

1,129,042 |

3,256,527 |

3,513,948 |

| Ore

placed on leach pad (t) |

1,158,381 |

1,062,001 |

1,076,876 |

3,195,736 |

3,452,753 |

|

Grade (g/t Au) |

0.44 |

0.44 |

0.34 |

0.42 |

0.37 |

|

Gold produced (ounces) |

9,270 |

9,546 |

9,729 |

25,576 |

30,866 |

|

Gold sold (ounces) |

9,649 |

9,135 |

9,724 |

25,554 |

30,920 |

2024 REVISED GUIDANCE

|

|

CONSOLIDATED |

NICARAGUA |

NEVADA |

|

Gold Production/Sales (ounces) |

230,000 – 240,000 |

200,000 - 210,000 |

34,000 - 36,000 |

|

TCC ($/ounce)1 |

$1,300 - $1,350 |

$1,300 - $1,350 |

$1,450 - $1,500 |

|

AISC ($/ounce)1 |

$1,550 - $1,600 |

$1,450 - $1,500 |

$1,650 - $1,750 |

|

Growth Capital ($ million)* |

$60 - $70 |

|

Updated Exploration Capital ($ million) |

$40 - $45 |

*Initial project capital at the Valentine Gold Mine not

included

Given Calibre’s proven track record, the Company

will continue to reinvest into exploration and growth with over

160,000 metres of drilling and development of new satellite

deposits across its asset portfolio.

Consolidated Q4 production is expected to be

70,000 – 80,000 ounces, while TCC and AISC are forecast to be

lower. The stronger Q4 outlook is driven by Nicaragua’s mine plans

which are tracking and plan for significantly higher ore tonnes

mined. After increasing ore haulage to Libertad by 30% to 3,000

tonnes per day we forecast a stockpile build of approximately

30,000 ounces which will be processed in 2025.

Exploration activities include multi-rig

diamond, RC and RAB drilling in Newfoundland, Nevada and Nicaragua

along with several geo-science initiatives through the exploration

pipeline. Growth capital includes new underground development and

open pit mine development, leach pad expansion, waste stripping and

land acquisition.

Since acquiring the Nicaraguan assets in October

2019, the Nevada assets in 2022, and the Newfoundland &

Labrador assets in 2024, Calibre has consistently reinvested in

mine development and exploration programs. These investments have

led to the discovery of new deposits and growth in both production

and Mineral Reserves. This progress positions Calibre well to

diversify its portfolio and enhance profitability as it expands its

operations into Canada with the Valentine Gold Mine anticipated to

deliver first gold during Q2 2025.

The Company's mineral endowment includes 4.1

million ounces of Reserves, 8.6 million ounces of Measured and

Indicated Resources (inclusive of Mineral Reserves), and 3.6

million ounces of Inferred Resources, as detailed in the

press release dated March 12,

2024.

Calibre held a Q3 and YTD 2024 Production and

Valentine Gold Mine Construction update conference call on October

18, 2024, please visit the Calibre Mining website here, to access

the replay of the conference call.

Qualified Person

The scientific and technical information

contained in this news release was approved by David Schonfeldt

P.GEO, Calibre Mining’s Corporate Chief Geologist and a "Qualified

Person" under National Instrument 43-101.

About Calibre

Calibre is a Canadian-listed, Americas focused,

growing mid-tier gold producer with a strong pipeline of

development and exploration opportunities across Newfoundland &

Labrador in Canada, Nevada and Washington in the USA, and

Nicaragua. Calibre is focused on delivering sustainable value for

shareholders, local communities and all stakeholders through

responsible operations and a disciplined approach to growth. With a

strong balance sheet, a proven management team, strong operating

cash flow, accretive development projects and district-scale

exploration opportunities Calibre will unlock significant

value.

ON BEHALF OF THE BOARD

“Darren Hall”

Darren Hall, President & Chief Executive Officer

For further information, please

contact:Ryan KingSenior Vice President,

Corporate Development & IRT: 604.628.1010E:

calibre@calibremining.comW: www.calibremining.com

Calibre’s head office is located at Suite 1560, 200 Burrard St.,

Vancouver, British Columbia, V6C 3L6.

X / Facebook / LinkedIn / YouTube

The Toronto Stock Exchange has neither reviewed nor accepts

responsibility for the adequacy or accuracy of this news

release.

Notes

(1) NON-IFRS

FINANCIAL MEASURES

Calibre has included certain non-IFRS measures

as discussed below. The Company believes that these measures, in

addition to conventional measures prepared in accordance with IFRS,

provide investors with an improved ability to evaluate the

underlying performance of the Company. These non-IFRS measures are

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. These measures do not

have any standardized meaning prescribed under IFRS, and therefore

may not be comparable to other issuers.

TCC per Ounce

of Gold: TCC include production costs,

royalties, production taxes, refinery charges, and transportation

charges. Production costs consist of mine site operating costs such

as mining, processing, local administrative costs (including

stock-based compensation related to mine operations) and current

inventory write-downs, if any. Production costs are exclusive of

depreciation and depletion, reclamation, capital and exploration

costs. TCC are net of by-product silver sales and are divided by

gold ounces sold to arrive at a per ounce figure.

AISC per

Ounce of Gold: AISC is a

performance measure that reflects the total expenditures that are

required to produce an ounce of gold from current operations. While

there is no standardized meaning of the measure across the

industry, the Company’s definition is derived from the definition

as set out by the World Gold Council in its guidance dated June 27,

2013 and November 16, 2018, respectively. The World Gold Council is

a non-regulatory, non-profit organization established in 1987 whose

members include global senior mining companies. The Company

believes that this measure is useful to external users in assessing

operating performance and the ability to generate free cash flow

from operations.

Calibre defines AISC

as the sum of TCC, corporate general and administrative expenses

(excluding one-time charges), reclamation accretion related to

current operations and amortization of asset retirement obligations

(“ARO”), sustaining capital (capital required to maintain current

operations at existing production levels), lease repayments, and

exploration expenditures designed to increase resource confidence

at producing mines. AISC excludes capital expenditures for

significant improvements at existing operations deemed to be

expansionary in nature, exploration and evaluation related to

resource growth, rehabilitation accretion not related to current

operations, financing costs, debt repayments, and taxes. Total AISC

is divided by gold ounces sold to arrive at a per ounce figure

Average

Realized Price per Ounce Sold: Average Realized Gold Price

Per Ounce Sold is intended to enable management to understand the

average realized price of gold sold in each reporting period after

removing the impact of non-gold revenues and by-produce credits,

which in the Company’s case are not significant, and to enable

investors to understand the Company’s financial performance based

on the average realized proceeds of selling gold production in the

reporting period. Average Realized Gold Price Per Ounce Sold is a

common performance measure that does not have any standardized

meaning. The most directly comparable measure prepared in

accordance with IFRS is revenue from gold sales.

Adjusted Net

Earnings: Adjusted Net Earnings and

Adjusted Net Earnings Per Share - Basic exclude a number of

temporary or one-time items considered exceptional in nature and

not related to the Company’s core operation of mining assets or

reflective of recurring operating performance. Management believes

Adjusted Net Earnings may assist investors and analysts to better

understand the current and future operating performance of the

Company’s core mining business. Adjusted Net Earnings and Adjusted

Net Earnings Per Share do not have a standard meaning under IFRS.

They should not be considered in isolation, or as a substitute for

measures of performance prepared in accordance with IFRS and are

not necessarily indicative of earnings from mine operations,

earnings, or cash flow from operations as determined under

IFRS.

Cash From

Operating Activities Before Changes in Working Capital:

Cash from Operating Activities before Changes in Working Capital is

a non-IFRS measure with no standard meaning under IFRS, which is

calculated by the Company as net cash from operating activities

less working capital items. The Company believes that Net Cash from

Operating Activities before Changes in Working Capital, which

excludes these non-cash items, provides investors with the ability

to better evaluate the operating cash flow performance of the

Company.

Net Debt and

Adjusted Net Debt: The Company believes that in addition

to conventional measures prepared in accordance with IFRS, the

Company and certain investors and analysts use net debt to evaluate

the Company’s performance. Net debt does not have any standardized

meaning prescribed under IFRS, and therefore it may not be

comparable to similar measures employed by other companies. This

measure is intended to provide additional information and should

not be considered in isolation or as a substitute for measures of

performances prepared in accordance with IFRS. Net debt is

calculated as the sum of the current and non-current portions of

loans and borrowings, net of the cash and cash equivalent balance

as at the balance sheet date. Adjusted Net Debt is calculated as

Net Debt less fair value and other non-cash adjustments that will

not result in a cash outflow to the Company. The Company believes

that Adjusted Net Debt provides a better understanding of the

Company’s liquidity.

EBITDA and

Adjusted EBITDA: The Company believes that certain

investors use the EBITDA and the adjusted EBITDA (“Adjusted

EBITDA”) measures to evaluate the Company’s performance and ability

to generate operating cash flows to service debt and fund capital

expenditures. EBITDA and Adjusted EBITDA do not have a standardised

meaning as prescribed under IFRS and should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with IFRS. The Company calculates EBITDA as earnings

or loss before taxes for the period excluding depreciation and

depletion and finance costs. EBITDA excludes the impact of cash

costs of financing activities and taxes and the effects of changes

in working capital balances and therefore is not necessarily

indicative of operating profit or cash flow from operations as

determined under IFRS. Adjusted EBITDA is calculated by excluding

one-off costs or credits relating to non-routine transactions from

EBITDA that are not indicative of recurring operating performance.

Management believes this additional information is useful to

investors in understanding the Company’s ability to generate

operating cash flow by excluding from the calculation these

non-cash and cash amounts that are not indicative of the recurring

performance of the underlying operations for the reporting

periods.

Adjusted Net

Debt to Adjusted EBITDA: The Adjusted Net Debt to Adjusted

EBITDA measures provide investors and analysts with additional

transparency about the Company’s liquidity position, specifically,

the Company’s ability to generate sufficient operating cash flows

to meet its mandatory interest obligations and pay down its

outstanding debt balance in full at maturity. This measure is a

Non-IFRS measure and it is intended to provide additional

information and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS. The calculation of Adjusted Net Debt is shown above.

TCC and AISC per Ounce of Gold Sold

Reconciliations

The tables below reconcile TCC and AISC for the

three months ended September 30, 2024 and 2023.

A table accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/12f215d3-2509-46eb-8dbe-d3166260c70f

1. Sustaining capital expenditures are shown in the Growth and

Sustaining Capital Table in the Q3 2024 MD&A dated September

30, 2024.

A table accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d032d456-8d54-4969-91bb-1cedb6c0a415

1. Sustaining capital expenditures are shown in

the Growth and Sustaining Capital Table in the Q3 2024 MD&A

dated September 30, 2024.

A table accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/6eadfabd-7ebe-4772-a9c0-bb103c6d62a3

The tables below reconcile TCC and AISC for the

nine months ended September 30, 2024 and 2023.

A table accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1e42dd70-f465-4c40-8f33-021e71eb9de9

1. Sustaining capital expenditures are shown in

the Growth and Sustaining Capital Table in the Q3 2024 MD&A

dated September 30, 2024.

A table accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e3a5e547-636e-41f1-b295-99c31a0076b6

1. Production costs include a $0.7 million net realizable value

reversal for the Pan mine.2. Sustaining capital expenditures are

shown in the Growth and Sustaining Capital Table in the Q3 2024

MD&A dated September 30, 2024.

(2) CONSOLIDATED FINANCIAL AND

OPERATIONAL RESULTS FOR 2024 INCLUDE THE RESULTS FROM MARATHON

SINCE ITS ACQUISITION ON JANUARY 25, 2024

(3) EBITDA

and ADJUSTED EBITDA

The following table provides a reconciliation of

EBITDA and Adjusted EBITDA to the consolidated statement of

operations and comprehensive income for the reporting periods:

A table accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/f0b9e7a2-f6ab-48e7-abde-7a8a896fb66d

(4) ADJUSTED NET

EARNINGS

The following table provides a reconciliation of

Adjusted Net Earnings and Adjusted Net Earnings Per Share to the

consolidated statement of operations and comprehensive income for

the reporting periods:

A table accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/80deddcb-61d2-4a9b-b3b3-1f783bfed7f9

(5) CASH FROM OPERATING

ACTIVITIES BEFORE CHANGES IN WORKING CAPITAL

The following table provides a reconciliation of Cash from

Operating Activities before Changes in Working Capital to the

consolidated statement of cash flows for the reporting periods:

A table accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/28fecac3-ade3-4e70-beed-31a76462e586

(6) NET DEBT and ADJUSTED

NET DEBT

The following table provides a reconciliation of Net Debt and

Adjusted Net Debt to the consolidated statement of financial

position for the reporting periods:

A table accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e1f17bfe-6ac1-4b5f-9f13-2c415f78e8b6

(7) ADJUSTED NET DEBT TO

ADJUSTED EBITDA

The following table provides the reconciliation of Adjusted Net

Debt to Adjusted EBITDA using the last twelve months of Adjusted

EBITDA for the reporting periods:

A table accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d8b7ab19-8c17-4d0c-ada3-3aff5ef03df3

Cautionary Note Regarding Forward Looking

Information

This news release includes certain

"forward-looking information" and "forward-looking statements"

(collectively "forward-looking statements") within the meaning of

applicable Canadian securities legislation. All statements in this

news release that address events or developments that we expect to

occur in the future are forward-looking statements. Forward-looking

statements are statements that are not historical facts and are

identified by words such as "expect", "plan", "anticipate",

"project", "target", "potential", "schedule", "forecast", "budget",

"estimate", “assume”, "intend", “strategy”, “goal”, “objective”,

“possible” or "believe" and similar expressions or their negative

connotations, or that events or conditions "will", "would", "may",

"could", "should" or "might" occur. Forward-looking statements in

this news release include but are not limited to the Company’s

expectations of gold production and production growth; the upside

potential of the Valentine Gold Mine; the Valentine Gold Mine

achieving first gold production during the second quarter of 2025;

the Company’s reinvestment into its existing portfolio of

properties for further exploration and growth; statements relating

to the Company’s 2024 priority resource expansion opportunities;

the Company’s metal price and cut-off grade assumptions.

Forward-looking statements necessarily involve assumptions, risks

and uncertainties, certain of which are beyond Calibre's control.

For a listing of risk factors applicable to the Company, please

refer to Calibre's annual information form (“AIF”) for the year

ended December 31, 2023, its management discussion and analysis for

the year ended December 31, 2023 and other disclosure documents of

the Company filed on the Company’s SEDAR+ profile at

www.sedarplus.ca.

Calibre's forward-looking statements are based

on the applicable assumptions and factors management considers

reasonable as of the date hereof, based on the information

available to management at such time. Calibre does not assume any

obligation to update forward-looking statements if circumstances or

management's beliefs, expectations or opinions should change other

than as required by applicable securities laws. There can be no

assurance that forward-looking statements will prove to be

accurate, and actual results, performance or achievements could

differ materially from those expressed in, or implied by, these

forward-looking statements. Accordingly, undue reliance should not

be placed on forward-looking statements.

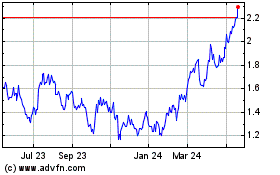

Calibre Mining (TSX:CXB)

Historical Stock Chart

From Nov 2024 to Dec 2024

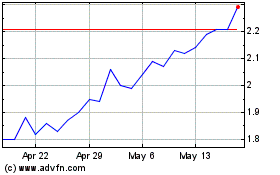

Calibre Mining (TSX:CXB)

Historical Stock Chart

From Dec 2023 to Dec 2024