Finning International Inc. (TSX: FTT) (“Finning” or the “Company”

or “we”, “our” or “us”) reported second quarter 2020 results today.

All monetary amounts are in Canadian dollars unless otherwise

stated.

HIGHLIGHTSAll comparisons are to

Q2 2019 results unless indicated otherwise.

- Q2 2020 net revenue(1)(3) of $1.3 billion was down 33%,

including a 24% reduction in Canada’s product support revenue, as

many customers parked equipment fleets and temporarily shut

operations in response to low commodity prices and COVID-19

restrictions.

- SG&A(2) decreased by 12%, down in all operations, driven by

effective cost management and lower variable costs.

- The Canada Emergency Wage Subsidy (“CEWS”) program allowed the

Company to preserve a significant number of jobs and technical

capabilities through a unique period of uncertainty. As a result,

the Company recognized $64 million of wage subsidy in Q2 2020 as

other income. Without the benefit of this wage subsidy, the

Canadian operations would have taken available alternative actions,

which would have reduced SG&A by $15 to 20 million in Q2 2020,

an equivalent of approximately $0.08 per share.

- Strong free cash flow(3) conversion in Q2 2020 resulted in free

cash flow of $312 million, bringing year-to-date free cash flow to

$262 million and further strengthening the Company’s financial and

liquidity position. As at June 30, 2020, net debt to Adjusted

EBITDA ratio(2)(3)(4) was 2.1, down from 2.8 at June 30, 2019.

- The Company has accelerated existing strategic plans to drive

productivity gains in Canada and South America, while maximizing

flexibility and competitiveness to serve customers. As a result,

the Company expects to reduce the global workforce by 8% by the end

of 2020 from the end of 2019.

- Q2 2020 EPS(2) of $0.12 included the benefit of the CEWS

program of $0.30 per share and global severance and restructuring

costs of $0.24 per share.

“I am pleased with how our global teams have been

navigating through various stages of lockdowns and re-openings

across our regions, with a focus on safely servicing our customers

and controlling what we can – costs and capital. In these

challenging times, our Total Injury Frequency rate decreased by

over 40%, and our customer loyalty scores increased by 20% in Q2

2020 compared to Q2 2019. In Q2 2020, our SG&A(2) was down 12%

year over year, and our net capital expenditures were minimized to

$7 million. This performance speaks to the resiliency of our

business model and adaptability and engagement of our people,” said

Scott Thomson, president and CEO of Finning International.

“COVID-19 disruptions have significantly impacted

our people, customers, and operations. Our challenges in the second

quarter included postponed equipment orders and deliveries, an

unprecedented slowdown in product support activity in most sectors,

and reduced productivity and labour utilization at our branches.

Where we have qualified, the use of government programs has helped

us to preserve a significant number of jobs and technical

capabilities through a unique period of significant uncertainty,

and has provided an effective bridge to enable us to ramp up faster

as the economy recovers.”

“While Q2 was difficult and the pace of economic

recovery in our regions remains uncertain, we have seen signs of

our markets recovering since May, with notable increases in rental

activity, machine utilization hours, and product support revenue

run rates. With the recent recovery in oil prices, most oil sands

producers have put their truck fleets back to work and are expected

to be operating at pre-COVID-19 levels by the end of August. The

price of copper has also improved, providing continued support and

stability for copper mining in Chile. However, increased cases of

COVID-19 infections in South America have presented a significant

challenge for our customers and our operations in the region, and

we have deployed necessary resources and efforts to maintain

operations and keep our employees safe. In the UK and Ireland,

construction and power systems projects have resumed, and

earthmoving work on the High Speed Rail 2 mega-project, which

represents a significant opportunity for Finning, is expected to

begin later this year.”

“Despite the unique times and numerous challenges

we have faced, I am pleased with how our teams have stayed focused

on what we set out to do at the beginning of the year, namely

improving execution in South America, lowering the cost base in

Canada, positioning to capture HS2 opportunities in the UK, and

reducing our finance costs. Looking ahead, we are accelerating our

strategic plans to position our business to achieve improved

productivity, profitability, and ROIC(2)(3) in each region. I am

confident that our continued vigilance on costs, improved

productivity, and tight management of invested capital will ensure

we maintain our financial strength and are well positioned to

succeed in the upcoming recovery phase,” concluded Mr. Thomson.

Q2 2020 FINANCIAL SUMMARY

All comparisons are to Q2 2019 results unless

indicated otherwise.

|

Quarterly Overview $ millions, except per share

amounts |

Q2 2020 |

|

Q2 2019 |

|

% change |

|

|

Revenue |

1,419 |

|

2,137 |

|

(34 |

) |

|

Net revenue |

1,335 |

|

1,995 |

|

(33 |

) |

|

EBIT(2) |

52 |

|

137 |

|

(62 |

) |

|

EBIT as a percentage of net revenue(3) |

3.9 |

% |

6.9 |

% |

|

|

EBITDA(3) |

130 |

|

213 |

|

(39 |

) |

|

EBITDA as a percentage of net revenue(3) |

9.7 |

% |

10.7 |

% |

|

|

Net income |

18 |

|

88 |

|

(79 |

) |

|

EPS |

0.12 |

|

0.54 |

|

(78 |

) |

|

Free cash flow |

312 |

|

(162 |

) |

292 |

|

|

Q2 2020 EBITDA and EBIT by Operation $ millions,

except per share amounts |

Canada |

|

South America |

|

UK & Ireland |

|

Corporate & Other |

|

Finning Total |

|

EPS |

|

|

EBITDA / EPS |

110 |

|

24 |

|

4 |

|

(8 |

) |

130 |

|

0.12 |

|

|

CEWS support |

(60 |

) |

- |

|

- |

|

(4 |

) |

(64 |

) |

(0.30 |

) |

|

Severance costs |

20 |

|

17 |

|

4 |

|

1 |

|

42 |

|

0.20 |

|

|

Facilities restructuring costs and impairment losses |

5 |

|

4 |

|

- |

|

- |

|

9 |

|

0.04 |

|

|

Adjusted EBITDA(3)(4) / Adjusted EPS(3)(4) |

75 |

|

45 |

|

8 |

|

(11 |

) |

117 |

|

0.06 |

|

|

Adjusted EBIT(3)(4) |

28 |

|

23 |

|

(1 |

) |

(11 |

) |

39 |

|

|

|

Adjusted EBITDA as a percentage of net revenue(3)(4) |

10.6 |

% |

9.8 |

% |

4.9 |

% |

- |

|

8.8 |

% |

|

|

Adjusted EBIT as a percentage of net revenue(3)(4) |

4.0 |

% |

5.1 |

% |

(1.0 |

%) |

- |

|

2.9 |

% |

|

|

|

Q2 2019 EBITDA and EBIT by Operation $ millions,

except per share amounts |

Canada |

|

South America |

|

UK & Ireland |

|

Corporate & Other |

|

Finning Total |

|

EPS |

|

|

EBITDA / EPS |

138 |

|

62 |

|

23 |

|

(10 |

) |

213 |

|

0.54 |

|

|

EBIT |

92 |

|

41 |

|

14 |

|

(10 |

) |

137 |

|

|

|

EBITDA as a percentage of net revenue |

12.9 |

% |

9.8 |

% |

7.7 |

% |

- |

|

10.7 |

% |

|

|

EBIT as a percentage of net revenue |

8.5 |

% |

6.5 |

% |

4.8 |

% |

- |

|

6.9 |

% |

|

|

|

Invested Capital(3) and

ROIC(2)(3) |

Q2 2020 |

|

Q2 2019 |

|

Q4 2019 |

|

|

Invested capital ($ millions) |

|

|

|

|

Consolidated |

3,495 |

|

3,964 |

|

3,591 |

|

|

Canada |

2,037 |

|

2,285 |

|

2,026 |

|

|

South America (US dollars) |

812 |

|

983 |

|

918 |

|

|

UK & Ireland (UK pound sterling) |

207 |

|

235 |

|

210 |

|

|

Invested capital turnover(3) (times) |

1.71 |

|

2.04 |

|

1.92 |

|

|

Working capital(3) to net revenue

ratio(3) |

29.9 |

% |

26.7 |

% |

27.8 |

% |

|

Inventory turns (dealership)(3) (times) |

1.97 |

|

2.36 |

|

2.53 |

|

|

Adjusted ROIC(3)(4) (%) |

|

|

|

|

Consolidated |

9.7 |

|

12.3 |

|

12.0 |

|

|

Canada |

11.6 |

|

15.4 |

|

14.4 |

|

|

South America |

11.2 |

|

8.5 |

|

10.5 |

|

|

UK & Ireland |

4.6 |

|

14.5 |

|

12.1 |

|

- Excluding the impact of foreign exchange, invested capital

decreased by approximately $517 million from Q2 2019 mostly due to

inventory reduction in all regions. Inventory decreased by $473

million compared to Q2 2019.

Q2 2020 HIGHLIGHTS BY OPERATION

All comparisons are to Q2 2019 results unless indicated otherwise.

All numbers are in functional currency: Canada – Canadian dollar;

South America – US dollar; UK & Ireland – UK pound sterling

(GBP).

Canada

- Net revenue decreased by 34% with lower revenue across all

sectors and lines of business reflecting challenging market

conditions from COVID-19 and volatility in commodity prices. New

equipment sales were down 49% due to significantly reduced customer

activity, particularly in Alberta. Product support revenue declined

by 24% as customers in the oil sands and other mining operations

parked a portion of their fleets during Q2 2020 and postponed major

rebuilds and non-essential maintenance. In the construction sector,

product support volumes were impacted by parked fleets, lower

equipment utilization hours, temporary shutdowns of customer

operations, and deferral of some customer projects due to COVID-19.

Used equipment sales improved sequentially from Q1 2020. Rental

revenue was down 35% from Q2 of last year on lower rental

utilization.

- Due to a significant reduction in revenues year over year, the

Company’s Canadian operations qualified for CEWS and, as a result,

recognized $60 million of this wage subsidy in Q2 2020. The Company

estimates that approximately 500 full-time jobs, including

technical capabilities and talent, have been preserved in Canada as

a result of this program.

- SG&A was reduced by 11% compared to Q2 2019, a lower

decrease compared to other regions due in part to the preservation

of employment as a result of the above-noted government support

program. Without the benefit of the wage subsidy, the Company would

have taken available alternative actions in Canada, which would

have reduced SG&A by a further $15 to 20 million in Q2 2020,

and SG&A would have been approximately 20% lower than Q2

2019.

- The Canadian operations are taking methodical and strategic

actions to continue improving employee and facility productivity.

These actions include re-shaping the facilities network and

workforce reductions. As a result, the Company’s Canadian

operations recorded severance and facility restructuring costs

totaling $25 million in Q2 2020. The Canadian workforce is expected

to be reduced by 11% by the end of 2020 from the end of 2019.

- The Canadian operations benefitted from the strong performance

of 4Refuel in Q2 2020. 4Refuel achieved 5% growth in Adjusted

EBITDA on a 4% decline in net revenue compared to Q2 2019 and

contributed $13 million of positive free cash flow in Q2 2020.

4Refuel contributed $33 million of positive free cash flow since

the acquisition date of February 1, 2019. In July 2020, 4Refuel

secured a fueling agreement with AECON for a portion of the Coastal

GasLink Project in Northern British Columbia.

South America

- Net revenue decreased by 28% reflecting challenging market

conditions across all countries and sectors, primarily as a result

of COVID-19 impacts. New equipment sales were down 48% due to lower

mining and construction deliveries in Chile, and a slowdown in

customer activity in Argentina. Product support revenue declined by

17% as a result of lower product support volumes in Chilean mining

operations and very weak market conditions in Argentina compared to

Q2 2019.

- Adjusted EBITDA as a percentage of net revenue was similar to

Q2 2019. A shift in revenue mix to product support resulted in a

higher gross profit margin relative to Q2 2019. The Company is

successfully leveraging one common ERP(2) system to improve

operating efficiencies and reduce cost to serve. SG&A costs

decreased by 17% from Q2 2019 driven by improved execution in

Chilean mining operations, benefits of one common ERP system, and

cost savings from restructuring measures. The Company recorded

severance and restructuring costs totaling US$15 million in South

America in Q2 2020. Improved profitability in Chile from Q2 2019

was offset by a loss in Argentina due to a shutdown of the economy

to stop the spread of COVID-19.

United Kingdom & Ireland

- Net revenue decreased by 45%, driven by 58% lower new equipment

sales. Product support revenue decreased by 21%. Customer activity

in construction and power systems markets slowed down significantly

in compliance with COVID-19 lockdowns and restrictions. In power

systems, the timing of project deliveries in the data centre and

electricity capacity markets impacted revenue in Q2 2020. The

Company has resumed execution of delayed projects, and expects to

deliver additional large power systems projects currently in the

backlog during the second half of 2020.

- UK & Ireland’s SG&A costs were down by 24% from Q2 2019

reflecting cost reduction measures and a £4 million benefit from

the UK government program to offset approximately 80% of furloughed

employee salary costs. The Company did not realize any service

benefits from employees who were furloughed. Nearly half of UK

& Ireland employees were on furlough during Q2 2020.

CORPORATE AND BUSINESS

DEVELOPMENTS

Dividend The Board of Directors

has approved a quarterly dividend of $0.205 per share, payable on

September 3, 2020 to shareholders of record on August 20, 2020.

This dividend will be considered an eligible dividend for Canadian

income tax purposes.

SELECTED CONSOLIDATED FINANCIAL

INFORMATION

| $

millions, except per share amounts |

Three months ended June 30 |

Six months ended June 30 |

|

|

2020 |

|

2019 |

|

% changefav (unfav) |

|

2020 |

|

2019 |

|

% changefav (unfav) |

|

|

New equipment |

382 |

|

774 |

|

(51 |

) |

736 |

|

1,438 |

|

(49 |

) |

|

Used equipment |

64 |

|

106 |

|

(39 |

) |

132 |

|

187 |

|

(29 |

) |

|

Equipment rental |

41 |

|

62 |

|

(34 |

) |

94 |

|

120 |

|

(22 |

) |

|

Product support |

820 |

|

1,023 |

|

(20 |

) |

1,754 |

|

1,919 |

|

(9 |

) |

|

Net fuel and other |

28 |

|

30 |

|

|

58 |

|

50 |

|

|

|

Net revenue |

1,335 |

|

1,995 |

|

(33 |

) |

2,774 |

|

3,714 |

|

(25 |

) |

| Gross

profit |

344 |

|

482 |

|

(29 |

) |

762 |

|

912 |

|

(16 |

) |

| Gross

profit as a percentage of net revenue |

25.7 |

% |

24.1 |

% |

|

27.5 |

% |

24.6 |

% |

|

|

SG&A |

(306 |

) |

(350 |

) |

12 |

|

(631 |

) |

(693 |

) |

9 |

|

| SG&A

as a percentage of net revenue |

(22.9 |

)% |

(17.5 |

)% |

|

(22.8 |

)% |

(18.7 |

)% |

|

| Equity

earnings of joint ventures |

1 |

|

5 |

|

|

2 |

|

9 |

|

|

| Other

income |

64 |

|

- |

|

|

64 |

|

- |

|

|

| Other

expenses |

(51 |

) |

- |

|

|

(51 |

) |

(29 |

) |

|

|

EBIT |

52 |

|

137 |

|

(62 |

) |

146 |

|

199 |

|

(27 |

) |

| EBIT as

a percentage of net revenue |

3.9 |

% |

6.9 |

% |

|

5.3 |

% |

5.4 |

% |

|

| Adjusted

EBIT |

39 |

|

137 |

|

(72 |

) |

133 |

|

228 |

|

(41 |

) |

| Adjusted

EBIT as a percentage of net revenue |

2.9 |

% |

6.9 |

% |

|

4.8 |

% |

6.1 |

% |

|

|

Net income |

18 |

|

88 |

|

(79 |

) |

72 |

|

116 |

|

(38 |

) |

| Basic

EPS |

0.12 |

|

0.54 |

|

(78 |

) |

0.45 |

|

0.71 |

|

(37 |

) |

|

Adjusted EPS |

0.06 |

|

0.54 |

|

(89 |

) |

0.39 |

|

0.85 |

|

(54 |

) |

|

EBITDA |

130 |

|

213 |

|

(39 |

) |

300 |

|

347 |

|

(14 |

) |

| EBITDA

as a percentage of net revenue |

9.7 |

% |

10.7 |

% |

|

10.8 |

% |

9.3 |

% |

|

| Adjusted

EBITDA |

117 |

|

213 |

|

(45 |

) |

287 |

|

376 |

|

(24 |

) |

| Adjusted

EBITDA as a percentage of net revenue |

8.8 |

% |

10.7 |

% |

|

10.4 |

% |

10.1 |

% |

|

|

Free cash flow |

312 |

|

(162 |

) |

292 |

|

262 |

|

(509 |

) |

151 |

|

|

|

June 30, 2020 |

|

Dec 31, 2019 |

|

|

|

|

| Invested

capital |

3,495 |

|

3,591 |

|

|

|

|

| Invested

capital turnover (times) |

1.71 |

|

1.92 |

|

|

|

|

| Net debt

to Adjusted EBITDA ratio |

2.1 |

|

2.0 |

|

|

|

|

|

ROIC |

10.0 |

% |

11.2 |

% |

|

|

|

|

Adjusted ROIC |

9.7 |

% |

12.0 |

% |

|

|

|

To access Finning's complete Q2 2020 results in

PDF, please visit our website at

https://www.finning.com/en_CA/company/investors.html

Q2 2020 INVESTOR CALLThe Company

will hold an investor call on August 5, 2020 at 10:00 am Eastern

Time. Dial-in numbers: 1-800-319-4610 (Canada and US),

1-416-915-3239 (Toronto area), 1-604-638-5340 (international). The

call will be webcast live and archived for three months at

https://www.finning.com/en_CA/company/investors.html

ABOUT FINNING Finning

International Inc. (TSX: FTT) is the world’s largest Caterpillar

equipment dealer delivering unrivalled service to customers for

over 87 years. Finning sells, rents, and provides parts and service

for equipment and engines to help customers maximize productivity.

Headquartered in Vancouver, B.C., the Company operates in Western

Canada, Chile, Argentina, Bolivia, the United Kingdom and

Ireland.

CONTACT INFORMATIONAmanda

HobsonSenior Vice President, Investor Relations and Treasury Phone:

604-331-4865Email: amanda.hobson@finning.com

https://www.finning.com

FOOTNOTES

- Following the acquisition of 4Refuel, management views total

revenue less cost of fuel (net revenue) as more representative in

assessing the performance of the business as the cost of fuel is

fully passed through to the customer and is not in the Company’s

control. The Company’s results and non-GAAP financial measures,

including key performance indicators and ratios, previously

reported or calculated using total revenue or sales are now

reported or calculated using net revenue. For South American and UK

& Ireland operations, net revenue is the same as total

revenue.

- Earnings Before Finance Costs and Income Taxes (EBIT); Basic

Earnings per Share (EPS); Earnings Before Finance Costs, Income

Taxes, Depreciation and Amortization (EBITDA); Selling, General

& Administrative Expenses (SG&A); Return on Invested

Capital (ROIC); Enterprise Resource Planning (ERP).

- These financial metrics, referred to as “non-GAAP financial

measures”, do not have a standardized meaning under International

Financial Reporting Standards (IFRS), which are also referred to

herein as Generally Accepted Accounting Principles (GAAP), and

therefore may not be comparable to similar measures presented by

other issuers. For additional information regarding these financial

metrics, including definitions and reconciliations from each of

these non-GAAP financial measures to their most directly comparable

measure under GAAP, where available, see the heading “Description

of Non-GAAP Financial Measures and Reconciliations” in the

Company’s Q2 2020 management discussion and analysis (MD&A).

Management believes that providing certain non-GAAP financial

measures provides users of the Company’s MD&A and consolidated

financial statements with important information regarding the

operational performance and related trends of the Company's

business. By considering these measures in combination with the

comparable IFRS financial measures (where available) set out in the

MD&A, management believes that users are provided a better

overall understanding of the Company's business and its financial

performance during the relevant period than if they simply

considered the IFRS financial measures alone.

- Certain 2020 and 2019 financial metrics were impacted by

significant items management does not consider indicative of

operational and financial trends either by nature or amount; these

significant items are described on pages 5 and 36-37 of the

MD&A. The financial metrics that have been adjusted to take

into account these items are referred to as “Adjusted”

metrics.

FORWARD-LOOKING STATEMENTS

CAUTION

This news release contains statements about our

business outlook, objectives, plans, strategic priorities and other

statements that are not historical facts. A statement we make is

forward-looking when it uses what we know and expect today to make

a statement about the future. Forward-looking statements may

include terminology such as aim, anticipate, assumption, believe,

could, expect, goal, guidance, intend, may, objective, outlook,

plan, project, seek, should, strategy, strive, target, and will,

and variations of such terminology. Forward-looking statements in

this news release include, but are not limited to, statements: that

the Company expects to reduce the global workforce by 8% by the end

of 2020 from the end of 2019; about our ability to ramp up faster

as the economy recovers; about signs of our markets recovering,

with notable increases in rental activity, machine utilization

hours and product support run rates; that most oil sands producers

are expected to be operating at pre-COVID levels by the end of

August; that the improved copper price will provide continued

support and stability for copper mining in Chile; that earthmoving

work on the High Speed Rail 2 mega-project in the UK represents a

significant opportunity for Finning and is expected to being later

this year; that we are accelerating our strategic plans to position

our business to achieve improved productivity, profitability, and

ROIC in each region; about our continued vigilance on costs,

improved productivity, and tight management of invested capital,

and that those measures will ensure we maintain financial strength

and are well positioned to succeed in the upcoming recovery phase;

and about the Canadian income tax treatment of the quarterly

dividend. All such forward-looking statements are made pursuant to

the ‘safe harbour’ provisions of applicable Canadian securities

laws.

Unless we indicate otherwise, forward-looking

statements in this news release reflect our expectations at the

date in this news release. Except as may be required by Canadian

securities laws, we do not undertake any obligation to update or

revise any forward-looking statement, whether as a result of new

information, future events, or otherwise.

Forward-looking statements, by their very nature,

are subject to numerous risks and uncertainties and are based on a

number of assumptions. This gives rise to the possibility that

actual results could differ materially from the expectations

expressed in or implied by such forward-looking statements and that

our business outlook, objectives, plans, strategic priorities and

other statements that are not historical facts may not be achieved.

As a result, we cannot guarantee that any forward-looking statement

will materialize. Factors that could cause actual results or events

to differ materially from those expressed in or implied by these

forward-looking statements include: the impact and duration of the

COVID-19 pandemic and measures taken by governments and businesses

in response; general economic and market conditions and economic

and market conditions in the regions where we operate; foreign

exchange rates; commodity prices; the level of customer confidence

and spending, and the demand for, and prices of, our products and

services; our ability to maintain our relationship with

Caterpillar; our dependence on the continued market acceptance of

our products, including Caterpillar products, and the timely supply

of parts and equipment; our ability to continue to sustainably

reduce costs and improve productivity and operational efficiencies

while continuing to maintain customer service; our ability to

manage cost pressures as growth in revenue occurs; our ability to

negotiate satisfactory purchase or investment terms and prices,

obtain necessary regulatory or other approvals, and secure

financing on attractive terms or at all; our ability to manage our

growth strategy effectively; our ability to effectively price and

manage long-term product support contracts with our customers; our

ability to reduce costs in response to slowing activity levels; our

ability to attract sufficient skilled labour resources as market

conditions, business strategy or technologies change; our ability

to negotiate and renew collective bargaining agreements with

satisfactory terms for our employees and us; the intensity of

competitive activity; our ability to raise the capital needed to

implement our business plan; regulatory initiatives or proceedings,

litigation and changes in laws or regulations; stock market

volatility; changes in political and economic environments; the

occurrence of natural disasters, pandemic outbreaks, geo-political

events, acts of terrorism, social unrest or similar disruptions;

fluctuations in defined benefit pension plan contributions and

related pension expenses; the availability of insurance at

commercially reasonable rates and whether the amount of insurance

coverage will be adequate to cover all liability or loss incurred

by us; the potential of warranty claims being greater than we

anticipate; the integrity, reliability and availability of, and

benefits from, information technology and the data processed by

that technology; and our ability to protect ourselves from

cybersecurity threats or incidents. Forward-looking statements are

provided in this news release for the purpose of giving information

about management’s current expectations and plans and allowing

investors and others to get a better understanding of our operating

environment. However, readers are cautioned that it may not be

appropriate to use such forward-looking statements for any other

purpose.

Forward-looking statements made in this news

release are based on a number of assumptions that we believed were

reasonable on the day they were made, including but not limited to

(i) that we will be able to successfully manage our business

through the current challenging times involving the effects of the

COVID-19 response and volatile commodity prices; (ii) that we will

maintain improved execution in South America and a lower cost base

in Canada; (ii) that general economic and market conditions will

improve; (iii) that the level of customer confidence and spending,

and the demand for, and prices of, our products and services will

be maintained; (iv) our ability to successfully execute our plans

and intentions; (v) our ability to attract and retain skilled

staff; (vi) market competition; (vii) the products and technology

offered by our competitors; and (viii) that our current good

relationships with Caterpillar, our suppliers, service providers

and other third parties will be maintained. Some of the

assumptions, risks, and other factors which could cause results to

differ materially from those expressed in the forward-looking

statements contained in this news release are discussed in Section

4 of the our current AIF, in the annual MD&A for the financial

risks, and in the most recent quarterly MD&A for updated risks

related to the COVID-19 pandemic.

We caution readers that the risks described in the

AIF and in the annual and most recent quarterly MD&A are not

the only ones that could impact the Company. We cannot accurately

predict the full impact that COVID-19 will have on our business,

results of operations, financial condition or the demand for our

services, due in part to the uncertainties relating to the ultimate

geographic spread of the virus, the severity of the disease, the

duration of the outbreak, the steps our customers and suppliers may

take in current circumstances, including slowing or halting

operations, the duration of travel and quarantine restrictions

imposed by governments of affected countries and other steps that

may be taken by such governments to respond to the pandemic.

Additional risks and uncertainties not currently known to us or

that are currently deemed to be immaterial may also have a material

adverse effect on our business, financial condition, or results of

operation.

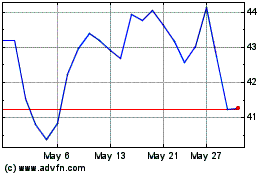

Finning (TSX:FTT)

Historical Stock Chart

From Oct 2024 to Nov 2024

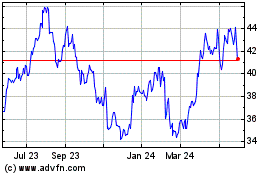

Finning (TSX:FTT)

Historical Stock Chart

From Nov 2023 to Nov 2024