HEXO Granted Additional 180 Calendar Day Grace Period by Nasdaq to Regain Compliance with Minimum Bid Price Rule

July 27 2022 - 3:00PM

HEXO Corp. (TSX: HEXO; NASDAQ: HEXO) ("

HEXO" or

the “

Company"), announced today it received an

extension of 180 calendar days from the Nasdaq Stock Market LLC

("

Nasdaq") to regain compliance with the Nasdaq’s

minimum $1.00 bid price requirement set forth in Nasdaq Listing

Rule 5550(a)(2) for continued listing on the Nasdaq Capital Market

(the “

Bid Price Requirement”), following the

expiration of the initial 180 calendar days period to regain

compliance on July 25, 2022. The Nasdaq determination is based on

the Company meeting the continued listing requirement for market

value of publicly held shares and all other applicable requirements

for initial listing on the Nasdaq Capital Market with the exception

of the Bid Price Requirement, and the Company’s written notice of

its intention to cure the deficiency during the second compliance

period by effecting a share consolidation, if necessary.

“This extended grace period will provide the

runway we need to position HEXO for long-term success," noted

Charlie Bowman, President and CEO of HEXO. "Our listing on the

Nasdaq is a critical component of our profitable growth strategy,

providing access to a broad investor base and expanded awareness

within the U.S. market.”

As a result of the extension, the Company now

has until January 23, 2023 to regain compliance with the Bid Price

Requirement. If at any time before January 23, 2023, the bid price

of the Company’s common shares closes at or above US$1.00 per share

for a minimum of 10 consecutive business days, Nasdaq will provide

written notification to the Company that it has achieved compliance

with the Bid Price Requirement. If the Company chooses to implement

a share consolidation to regain compliance, it must complete the

consolidation no later than ten business days prior to the

expiration of the additional 180 calendar day period in order to

timely regain compliance.

If the Company does not regain compliance with

the Bid Price Requirement by January 23, 2023, Nasdaq will provide

written notification to the Company that its shares will be subject

to delisting. At such time, the Company may appeal the delisting

determination to a Nasdaq Hearings Panel. The Company would remain

listed pending the Panel’s decision. There can be no assurance

that, if the Company does appeal a subsequent delisting

determination, such appeal would be successful.

This current notification from Nasdaq has no

immediate effect on the listing or trading of the Company’s shares,

which will continue to trade on the Nasdaq Capital Market under the

symbol “HEXO”. The Company is also listed on the Toronto Stock

Exchange and the notification letter does not affect the Company’s

compliance status with such listing.

Forward-Looking StatementsThis

press release contains forward-looking information and

forward-looking statements within the meaning of applicable

securities laws ("Forward-Looking Statements"),

including with respect to the Company’s ability to regain

compliance with the Bid Price Requirement. Forward-Looking

Statements are based on certain expectations and assumptions and

are subject to known and unknown risks and uncertainties and other

factors that could cause actual events, results, performance and

achievements to differ materially from those anticipated in these

Forward-Looking Statements. Forward-Looking Statements should not

be read as guarantees of future performance or results. Readers are

cautioned not to place undue reliance on these Forward-Looking

Statements, which speak only as of the date of this press release.

The Company disclaims any intention or obligation, except to the

extent required by law, to update or revise any Forward-Looking

Statements as a result of new information or future events, or for

any other reason.

This press release should be read in conjunction

with the management's discussion and analysis and unaudited

condensed consolidated interim financial statements and notes

thereto as at and for the three and nine months ended April 30,

2022. Additional information about HEXO is available on the

Company's profile on SEDAR at www.sedar.com and EDGAR at

www.sec.gov, including the Company's Annual Information Form for

the year ended July 31, 2021 dated October 29, 2021.

About HEXOHEXO is an

award-winning licensed producer of innovative products for the

global cannabis market. HEXO serves the Canadian recreational

market with a brand portfolio including HEXO, Redecan, UP Cannabis,

Original Stash, 48North, Trail Mix, Bake Sale and Latitude brands,

and the medical market in Canada and Israel. The Company also

serves the Colorado market through its Powered by HEXO® strategy

and Truss CBD USA, a joint venture with Molson-Coors. With the

completion of HEXO's acquisitions of Redecan and 48North, HEXO is a

leading cannabis products company in Canada by recreational market

share. For more information, please visit hexocorp.com.

For media or investor inquiries please

contact:

Christy Theriault, Kaiser & Partners

Communicationschristy.theriault@kaiserpartners.com416.993.9047

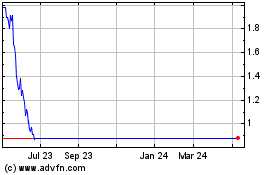

HEXO (TSX:HEXO)

Historical Stock Chart

From Nov 2024 to Dec 2024

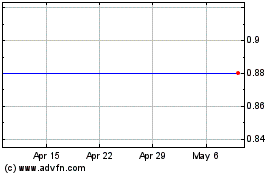

HEXO (TSX:HEXO)

Historical Stock Chart

From Dec 2023 to Dec 2024