Liberty Gold Corp. (TSX:LGD; OTCQX:LGDTF) (“Liberty Gold” or the

“Company”) is pleased to announce the discovery of a third zone of

high-grade antimony mineralization at Antimony Ridge. As a result,

the Company intends to “spin-out” the Goldstrike Project with the

Antimony Ridge discovery into a separate entity. This creates for

shareholders, an interest in both Liberty Gold, moving Black Pine

Oxide Gold through permitting into production and in “NewCo”, a new

United States (“U.S.”) strategic metal focussed exploration &

development company initially based on the high-grade antimony

discovery at Antimony Ridge. Full details of the proposed

arrangement will be released in due course and it is expected to be

subject to customary conditions, including shareholder, regulatory

and court approval.

Antimony Ridge Highlights

- Discovery of a new +400 meter (“m”)

long, third zone of coarse-grained, high-grade antimony (“Sb”)

oxide mineralization, located ~1.5 kilometres (“km”) west of the

previously identified high-grade mineralization (see previous news

releases dated September 5, 2024 and November 18, 2024).

- The silicified breccia bodies,

which host the antimony mineralization have now been mapped in

outcrop over a cumulative strike length of more than 2 km, with

anomalous antimony values in soils indicating an additional ~3 km

of potential strike length of mineralized bodies.

- Surface samples from the new

discovery show significant antimony values, up to +3% Sb and up to

0.68 grams per tonne (“g/t”) gold (“Au”). Large areas of surface

outcrop remain unsampled and are the focus of currently active

field programs.

- Metallurgical results from two

surface samples of high-grade oxide mineralization tested indicate

that an overall antimony recovery of between 51% and 76% could be

achieved using combined gravity and flotation circuits, with the

final grade of the antimony concentrate potentially ranging from

45% to 50% Sb.

- 3 drill sites surrounding the

historic Lejaiv (antimony) Mine at Antimony Ridge are permitted and

ready to drill. Additional drill site permit applications over the

wider extent of the antimony mineralization have been

initiated.

- New mineral claims totalling ~2

square kilometers (“km2”) have been staked over the southern soil

anomalies, bringing the total claim block area at Antimony Ridge to

~10 km2, 100% owned by Liberty Gold, with no royalty burden on any

metals.

Cal Everett, CEO and Director of Liberty

Gold: “Antimony Ridge is an exciting, emerging story that

is demanding more attention with every high-grade assay coming out

of the lab. We believe that separating Liberty Gold into two

independent entities will unlock significant shareholder value and

maximize market exposure to both the Black Pine Oxide Gold Project

in Idaho and to the new Antimony Ridge discovery at our Goldstrike

Project in Utah. Terms of the spin-out concept are being finalized

now. This firmly establishes Liberty Gold, with its flagship Black

Pine Project, as a pure-play developer-producer in Carlin-style,

sediment-hosted oxide gold systems and provides all Liberty Gold

shareholders with exposure to a new minerals direction in ‘NewCo’.

Of course, ‘NewCo’ also includes a 1 million ounce oxide gold

resource at Goldstrike in addition to the antimony discovery.”

New High-Grade Discovery

Zone

In the second phase of field exploration work at

Antimony Ridge, completed in December 2024, surface sampling along

the multiple north-west trending soil anomalies, has identified a

new zone of coarse-grained antimony oxide mineralization. Sampling

in this zone returned values of up to 3.01% (30,100 parts per

million (“ppm”)) antimony and up to 0.68 g/t Au. This new

high-grade discovery is associated with a silicified breccia body

located approximately 1.5 km to the west of the previously

high-grade discovery areas around and adjacent to the historic

Lejaiv Mine (see Figure 1).

The new zone, as currently sampled, has a strike

length greater than 400 m and is located within a larger,

northwest-trending antimony-in-soil anomaly that is more than 2.5

km long. This zone has limited outcrop, indicating much of the

mineralized zone is likely not exposed at surface and will require

drilling to fully evaluate.

Figure 1: Plan map of Antimony Ridge

With Soil Anomalies and Mineral Claim Boundaries

Antimony Mineralization

The mineralization at Antimony Ridge occurs at

surface as large, bladed to massive disseminated stibiconite in a

multi-phase, silicified breccia with gold (see Figure 2).

Stibiconite, is an antimony oxide formed from the in-situ oxidation

of stibnite, the primary antimony sulfide mineral. Many of the

surface exposures of stibiconite have a core of primary stibnite

when broken apart. It is expected that the near-surface antimony

oxide mineralization would transition into primary antimony sulfide

down dip, below the limit of shallow surface oxidation.

Figure 2: Bladed crystals of white

antimony oxide (stibiconite) with grey/black cores of antimony

sulphide (stibnite), from a surface exposure of high-grade antimony

mineralization in a silicified breccia host rock

The known high-grade mineralized zone is hosted

within a laterally extensive silicified breccia developed along the

intersection of high-angle normal faults where they cut through a

sequence of Eocene to Miocene lacustrine limestones, epiclastics

and tuffs that regionally dip 20-25 degrees to the northeast.

Soil sampling conducted by Liberty Gold in 2015

exhibits pronounced north-west oriented linear trends anomalous in

antimony (see Figure 1), as well as strong values continuing to the

south of the known occurrences. Field follow-up to map and sample

these areas in detail, is a key next step in the exploration

program currently in progress.

Early Metallurgical Test

Results

In December 2024, two ~20-kilogram samples of

high-grade antimony oxide mineralization were sent to the Kappes,

Cassiday & Associates laboratory in Reno, Nevada, for

preliminary metallurgical test work. The samples were taken from

surface outcrop, 75 m apart along the same mineralized trend as the

historic Lejaiv Mine. The antimony content of the two oxide samples

were similar at ~5% Sb. Mineralogical test work and elemental

analysis indicate that both samples are very largely comprised of

antimony oxide, with minor to trace antimony sulfide, as suspected

from field observations.

Preliminary metallurgical test work was

conducted using gravity and flotation methods, both separately and

combined. Limited optimization work was attempted at this early

stage. Results indicate that an overall antimony recovery of

between 51% and 76% could be achieved using both gravity and

flotation. The grade of the final antimony concentrate would likely

range from 45% to 50% Sb.

Test work results are available through this link:

https://libertygold.ca/images/news/2025/February/KCATestWork02112025.pdf

A further, more comprehensive metallurgical test

program on both antimony oxide and sulphide will follow-up on the

proposed surface exploration drill program.

Next Steps

- Formation of

‘NewCo’: Full details of the proposed arrangement will be

released in due course.

- Additional Surface Sampling

& Field Mapping: Conduct a third phase of surface

mapping and detailed sampling guided by soils data and portable XRF

to further delineate the high-grade antimony and gold horizons.

Refine existing geologic mapping to define the structural controls

and to determine the presence of additional mineralized zones. The

next phase of exploration will include a regional detailed IP

geophysical survey.

- Drill Program

Development: Submittal of a "Notice of Intent" drill

permit application in Q1 with the Bureau of Land Management to

evaluate the lateral and depth extent of high-grade mineralized

antimony and gold zones with a first pass surface drill program of

up to 5,000 m from 16 drill sites.

- Funding: Work has

begun to engage with the current round of grants with the U.S. and

Canadian Governments to act as potential funding partners.

- Antimony

Processing: Initial studies are underway to understand the

nature and location of suitable processing facilities either as

part of the Antimony Ridge asset or through toll processing to

process the material. Further studies are exploring options of U.S.

based treatment facilities to handle a future potential antimony

concentrate.

QUALIFIED PERSON

Peter Shabestari, P.Geo., Vice-President

Exploration, Liberty Gold, is the Company's designated Qualified

Person for this news release within the meaning of National

Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI

43-101") and has reviewed and validated that the information

contained in the release is accurate.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and

developing open pit oxide deposits in the Great Basin of the United

States, home to large-scale gold projects that are ideal for

open-pit mining. This region is one of the most prolific

gold-producing regions in the world and stretches across Nevada and

into Idaho and Utah. The Company is advancing the Black Pine

Project in southeastern Idaho, a past-producing, Carlin-style gold

system with a large, growing resource and strong economic

potential. The Company is also actively de-risking and expanding

the Goldstrike Project in southwestern Utah, a past-producing oxide

gold system, which now includes the newly staked Antimony Ridge

Prospect. Antimony Ridge presents an opportunity for additional

resource expansion through ongoing trenching and sampling

programs.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations Phone:

604-632-4677 or Toll Free 1-877-632-4677 info@libertygold.ca

All statements in this press release, other than

statements of historical fact, are “forward-looking information”

with respect to Liberty Gold within the meaning of applicable

securities laws, and the potential quantity and/or grade of

minerals and Liberty Gold’s mineral resources. Forward-looking

information is often, but not always, identified by the use of

words such as “intends”, “seek”, “anticipate”, “plan”, “continue”,

“planned”, “expect”, “project”, “predict”, “potential”,

“targeting”, “intends”, “believe”, “potential”, and similar

expressions, or describes a “goal”, or variation of such words and

phrases or state that certain actions, events or results “may”,

“should”, “could”, “would”, “might” or “will” be taken, occur or be

achieved. Forward-looking information is not a guarantee of future

performance and is based upon a number of estimates and assumptions

of management at the date the statements are made including, among

others, assumptions about future prices of gold and other metal

prices, currency exchange rates and interest rates, favourable

operating conditions, political stability, obtaining governmental

approvals and financing on time, obtaining renewals for existing

licenses and permits and obtaining required licenses and permits,

labour stability, stability in market conditions, the timing and

success of future plans and objectives in the areas of sustainable

development, health, safety, environment, community development;

successful resolution of disputes and anticipated costs and

expenditures and the timing of regulatory approvals. Many

assumptions are based on factors and events that are not within the

control of Liberty Gold and there is no assurance they will prove

to be correct.

Such forward-looking information, involves known

and unknown risks, which may cause the actual results to be

materially different from any future results expressed or implied

by such forward-looking information, including, risks related to

the proposed terms and timing pf the “spin out”; the satisfaction

of the conditions precedent of the “spin out”; the timing, receipt

and anticipated effects of shareholder, regulatory and court

approvals for the “spin out”; the interpretation of results and/or

the reliance on technical information provided by third parties as

related to the Company’s mineral property interests; changes in

project parameters as plans continue to be refined; current

economic conditions; future prices of commodities; possible

variations in grade or recovery rates; the costs and timing of the

development of new deposits; failure of equipment or processes to

operate as anticipated; the failure of contracted parties to

perform; the timing and success of exploration activities

generally; delays in permitting; possible claims against the

Company; labour disputes and other risks of the mining industry;

delays in obtaining governmental approvals, the completion of

exploration as well as those factors discussed in the Annual

Information Form of the Company dated March 28, 2024 in the section

entitled "Risk Factors", under Liberty Gold’s SEDAR+ profile at

www.sedarplus.ca.

Although Liberty Gold has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate as actual results, and future events could

differ materially from those anticipated in such statements.

Liberty Gold disclaims any intention or obligation to update or

revise any forward-looking information, whether as a result of new

information, future events or otherwise.

Photos accompanying this announcement are

available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/caacfbe3-9bf5-47b6-9219-8b696f8245a2

https://www.globenewswire.com/NewsRoom/AttachmentNg/759d2a6b-6241-4ff2-b603-08213500354a

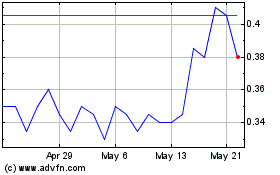

Liberty Gold (TSX:LGD)

Historical Stock Chart

From Jan 2025 to Feb 2025

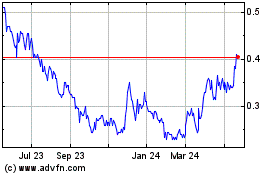

Liberty Gold (TSX:LGD)

Historical Stock Chart

From Feb 2024 to Feb 2025