Medexus Pharmaceuticals Announces C$10 Million Bought-Deal Public Offering of Units

September 05 2023 - 5:41PM

Medexus Pharmaceuticals Inc. ("

Medexus" or the

"

Company")

(TSX: MDP) (OTCQX:

MEDXF), is pleased to announce that it has entered into an

agreement with Research Capital Corporation, as sole bookrunner and

sole underwriter (the “

Underwriter”), pursuant to

which the Underwriter has agreed to purchase, on a bought-deal

basis, 3,389,900 units of the Company (the

“

Units”) at a price of C$2.95 per Unit for gross

proceeds to the Company of C$10,000,205 (the

“

Offering”).

Each Unit will consist of one common share of

the Company (a “Common Share”) and one-half of one

Common Share purchase warrant (each whole warrant, a

“Warrant”). Each Warrant will entitle the holder

thereof to purchase one Common Share at an exercise price of C$3.65

at any time up to 30 months following the Closing Date (as defined

below).

The net proceeds of the Offering will be used

for working capital and general corporate purposes.

The Company has granted the Underwriter an

option (the “Over-Allotment Option”), exercisable

in part or in whole at the Underwriter’s discretion, at any time

until thirty (30) days following the Closing Date, to purchase up

to the number of additional Units, and/or the components thereof,

equal to 15% of the aggregate number of Units sold in the Offering

to cover over-allotments, if any, and for market stabilization

purposes.

The Offering will be completed: (i) by way of a

short form prospectus to be filed in all provinces of Canada other

than Quebec pursuant to National Instrument 44-101 – Short Form

Prospectus Distributions; and (ii) on a private placement basis in

the United States pursuant to exemptions from the registration

requirements of the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”), and

applicable U.S. state securities laws.

The closing of the Offering is expected to occur

on or about September 21, 2023 (the “Closing

Date”), or such later or earlier date as the Underwriter

and the Company may agree upon, and is subject to certain

conditions including, but not limited to, the Company receiving all

necessary regulatory approvals, including the approval of the

Toronto Stock Exchange, and the securities regulatory authorities,

and the satisfaction of other customary closing conditions.

The securities referred to in this press release

have not been, nor will they be, registered under the U.S.

Securities Act or any U.S. state securities laws, and may not be

offered or sold within the United States or to, or for the account

or benefit of, U.S. persons absent U.S. registration or an

applicable exemption from the U.S. registration requirements. This

press release does not constitute an offer for sale of securities,

nor a solicitation for offers to buy any securities in the United

States, nor in any other jurisdiction in which such offer,

solicitation or sale would be unlawful.

About Medexus

Medexus is a leading specialty pharmaceutical

company with a strong North American commercial platform and a

growing portfolio of innovative and rare disease treatment

solutions. Medexus's current focus is on the therapeutic areas of

oncology, hematology, rheumatology, auto-immune diseases, allergy,

and dermatology. For more information about Medexus and its product

portfolio, please see the company's corporate website at

www.medexus.com and its filings on SEDAR+ at www.sedarplus.ca.

Contacts

Ken d'Entremont | CEO, Medexus

PharmaceuticalsTel: 905-676-0003 | Email:

ken.dentremont@medexus.com

Marcel Konrad | CFO, Medexus PharmaceuticalsTel:

312-548-3139 | Email: marcel.konrad@medexus.com

Forward Looking Statements

Certain statements made in this press release

contain forward-looking information within the meaning of

applicable securities laws (“forward-looking statements”). The

words “anticipates”, “believes”, “expects”, “will”, “plans” and

similar expressions are often intended to identify forward-looking

statements, although not all forward-looking statements contain

these identifying words. Specific forward-looking statements

contained in this news release include, but are not limited to,

statements with respect to the proposed closing date of the

Offering, the receipt of regulatory approvals and the anticipated

use of proceeds of the Offering. These statements are based on

factors or assumptions that were applied in drawing a conclusion or

making a forecast or projection, including assumptions based on

historical trends, current conditions and expected future

developments. Since forward-looking statements relate to future

events and conditions, by their very nature they require making

assumptions and involve inherent risks and uncertainties. The

Company cautions that although it is believed that the assumptions

are reasonable in the circumstances, these risks and uncertainties

give rise to the possibility that actual results may differ

materially from the expectations set out in the forward-looking

statements. Material risk factors include those set out in the

Company’s materials filed with the Canadian securities regulatory

authorities from time to time, including the Company’s most recent

annual information form and management’s discussion and analysis.

Accordingly undue reliance should not be placed on these

forward-looking statements, which apply only as of the date hereof.

Other than as specifically required by law, the Company undertakes

no obligation to update any forward-looking statements to reflect

new information, subsequent or otherwise.

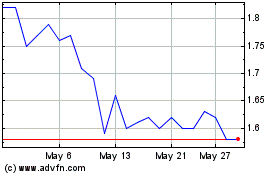

Medexus Pharmaceuticals (TSX:MDP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Medexus Pharmaceuticals (TSX:MDP)

Historical Stock Chart

From Nov 2023 to Nov 2024