Energizer Resources Finalizes Molo Graphite Project Acquisition

April 16 2014 - 7:00AM

Marketwired Canada

Energizer Resources Inc. (TSX:EGZ)(OTCQX:ENZR)(FRANKFURT:YE5) ("Energizer" or

the "Company") announces that it has finalized the purchase of the remaining 25%

interest in the Molo Graphite Project from joint venture partner Malagasy

Minerals Limited ("Malagasy") (ASX:MGY).

With the transaction completed, Energizer not only acquires 100% of the flagship

Molo Graphite Mine Project Area but also owns a 100% interest in and to all of

the industrial mineral rights within the acquired property, which comprises

2,120 claims totaling 363 square miles. The actual area of the Molo deposit as

currently delineated is approximately 0.3 square miles, representing less than

1% of the total acquired land package.

Richard Schler, Energizer's Chief Executive Officer stated, "The acquisition of

the remainder of the Molo Graphite Project represents the achievement of another

key milestone and is an important step in the Company's overall mine development

plan. We know through ongoing dialogue with potential strategic partners

regarding off-take agreements and project financing for the future Molo mine

that 100% ownership is highly preferred and so this transaction should certainly

help facilitate those discussions."

Key Terms of the Purchase and Sale Agreement ("PSA")

i) Within five days of TSX approval, Energizer will;

-- Make a cash payment to Malagasy of CAD$400,000;

-- Issue 2,500,000 Energizer shares (held in voluntary escrow for 12

months); and

-- Issue 3,500,000 Energizer warrants (based on a 5 day VWAP prior to date

of signing).

ii) On completion of a Full Feasibility Study ("FS") Energizer will:

-- Make a cash payment to Malagasy of CAD$700,000; and

-- Issue 1,000,000 Energizer shares (held in voluntary escrow for 12

months).

iii) On the commencement of commercial production Energizer will:

-- Make a cash payment to Malagasy of CAD$1,000,000 within 5 business days

of the commencement of commercial production of the Molo mine; and

-- Malagasy is entitled to a 1.5% Net Smelter Return ("NSR") on all

Industrial Mineral related production, which includes graphite.

As part of the PSA finalization:

i) Energizer has also acquired a 100% interest in and to the industrial mineral

rights on approximately 1.5 additional claim blocks totaling an area of 41.7

square miles immediately to the east and adjoining the Molo Graphite Deposit

claim blocks. The Company acquired this additional ground to accommodate

infrastructure build-out required for mine development.

ii) In a related but separate transaction, Malagasy has acquired a 75% interest

for non-industrial minerals on four claims of Energizer's 100%-owned Green Giant

Property in Madagascar. Energizer will own the remaining 25% interest in

non-industrial minerals and have a free carried interest through to the FS

stage. Energizer will continue to own a 100% interest in the industrial mineral

rights, which includes the Company's NI 43-101 compliant vanadium resource

estimate, comprising an indicated resource of 49.5 million tonnes at an average

grade of 0.693% vanadium pentoxide (V2O5) and an inferred resource of 9.7

million tonnes at an average grade of 0.632% V2O5 at a cut-off of 0.5% V2O5.

The PSA, once completed, remains subject to Energizer obtaining final approval

from the Toronto Stock Exchange and the Securities Exchange Commission in the

United States. All securities issued in connection with this finalized

transaction will be subject to a voluntary minimum hold period of one year,

which is greater than the applicable regulatory Canadian and United States hold

periods.

Qualified Person

Craig Scherba, P.Geo., President and COO is the qualified person for the

technical information provided in this release.

About Energizer Resources

Energizer Resources is a mineral exploration and mine development company based

in Toronto, Canada, that is developing its 100%-owned, flagship Molo Graphite

Project in southern Madagascar.

The Molo Graphite Project is one of the largest known crystalline flake graphite

in the world. The Molo Project hosts a NI 43-101 compliant indicated mineral

resource of 84.04 million tonnes grading 6.36% carbon (Cg) and an inferred

resource grading 6.29% Cg of crystalline flake graphite.

The Company released a robust Preliminary Economic Assessment Study of the Molo

in February 2013, resulting in a NPV at 10% discount of US$421 million, a 48%

pre-tax IRR and a 3-year payback.

Energizer's total land package in southern Madagascar encompasses approximately

320 kilometers (198 miles) of continuous graphitic trends, where all graphite

mineralization is immediately at surface. In addition to the Molo, the Company

has also identified through drilling, trenching and geological mapping at least

six other zones that could be potential stand-alone graphite deposits.

Energizer has initiated a Full Feasibility Study, with results to be released to

the market by Q4 2014. Results of the Company's recently completed pilot plant

operation confirmed that 43.5% of the Molo deposit is classified as the

premium-priced large and extra-large flake, with an average purity level in

excess of 97% Cg achieved through standard flotation alone. The Company is

targeting full-scale production by Q2 2016.

For more information on graphite, please visit our website at

www.energizerresources.com.

Safe Harbour: This press release may contain forward-looking statements that may

involve a number of risks and uncertainties. Actual events or results could

differ materially from expectations and projections set out herein. The above

resource estimates were calculated in accordance with National Instrument 43-101

as required by Canadian securities regulatory authorities. For United States

reporting purposes, Industry Guide 7 (under the Securities Exchange Act of

1934), as interpreted by the Staff of the SEC, applies different standards in

order to classify mineralization as a reserve. Among other things, the terms

"measured", "indicated" and "inferred" mineral resources are required pursuant

to National Instrument 43-101, the U.S. Securities and Exchange Commission does

not recognize such terms. Canadian standards differ significantly from the

requirements of the U.S. Securities and Exchange Commission, and mineral

resource information contained herein is not comparable to similar information

regarding mineral reserves disclosed in accordance with the requirements of the

U.S. Securities and Exchange Commission.

Mineral resources are not mineral reserves and do not have demonstrated economic

viability. This mineral resource estimate includes inferred resources that are

normally considered too speculative geologically to have economic considerations

applied to them that would enable them to be categorized as mineral reserves.

There is also no certainty that the inferred mineral resource will be converted

to the measured and indicated mineral resource categories through further

drilling, or into a mineral reserve once economic considerations are applied.

U.S. investors should understand that "inferred" mineral resources have a great

amount of uncertainty as to their existence and great uncertainty as to their

economic and legal feasibility. In addition, investors are cautioned not to

assume that any part or all of the Company's mineral resources constitute or

will be converted into reserves. Cautionary Statement: Neither TSX Exchange nor

its Regulation Services Provider (as that term is defined in the policies of the

TSX Exchange) accepts responsibility for the adequacy or accuracy of this

release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Energizer Resources Inc.

Brent Nykoliation

Senior Vice President, Corporate Development

+1.416.364.4911

bnykoliation@energizerresources.com

Energizer Resources Inc.

Craig Scherba

President and COO

+1.416.364.4911

cscherba@energizerresources.com

www.energizerresources.com

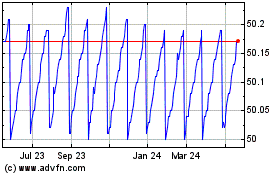

Purpose High Interest Sa... (TSX:PSA)

Historical Stock Chart

From Apr 2024 to May 2024

Purpose High Interest Sa... (TSX:PSA)

Historical Stock Chart

From May 2023 to May 2024