Parex Resources Inc. (“Parex” or the “Company”) (TSX: PXT) reports

that with testing completed, it has abandoned the Chirimoya

exploration well at VIM-43 (100% W.I.).

As previously announced, Parex reached the

Chirimoya exploration wells’ target depth of approximately 17,500

feet. Following open hole evaluation, including logging operations,

the Company made the decision to case and test the well. All three

prospective zones were evaluated and confirmed that the potential

reservoirs had no economic hydrocarbons.

The Chirimoya exploration well was the first

prospect in a three well 2023 big ‘E’, high-impact exploration

program. The Northern Llanos Arauca-8 well at Arauca (50% W.I.) and

the Llanos Foothills Arantes-1 well at LLA-122 (50% W.I.) are

expected to be spud in Q4 2023.

Parex will release its Q2 2023 results as well

as provide an operational update post-market on August 2, 2023,

with plans to host a conference call for investors, analysts and

other interested parties the following day.

About Parex Resources Inc.

Parex is the largest independent oil and gas

company in Colombia, focusing on sustainable, conventional

production. The Company’s corporate headquarters are in Calgary,

Canada, with an operating office in Bogotá, Colombia. Parex is a

member of the S&P/TSX Composite ESG Index and its shares trade

on the Toronto Stock Exchange under the symbol PXT.

For more information, please contact:

Mike KruchtenSenior Vice President, Capital Markets &

Corporate PlanningParex Resources Inc.

403-517-1733investor.relations@parexresources.com

Steven EirichInvestor Relations & Communications

AdvisorParex Resources

Inc.587-293-3286investor.relations@parexresources.com

Not for distribution or dissemination in the United

States.

Advisory on Forward-Looking

Statements

Certain information regarding Parex set forth in

this document contains forward-looking statements that involve

substantial known and unknown risks and uncertainties. The use of

any of the words "plan", "expect", “prospective”, "project",

"intend", "believe", "should", "anticipate", "estimate",

“forecast”, "guidance", “budget” or other similar words, or

statements that certain events or conditions "may" or "will" occur

are intended to identify forward-looking statements. Such

statements represent Parex's internal projections, estimates or

beliefs concerning, among other things, future growth, results of

operations, production, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, plans for and results of drilling activity,

environmental matters, business prospects and opportunities. These

statements are only predictions and actual events or results may

differ materially. Although the Company’s management believes that

the expectations reflected in the forward-looking statements are

reasonable, it cannot guarantee future results, levels of activity,

performance or achievement since such expectations are inherently

subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Many factors could

cause Parex's actual results to differ materially from those

expressed or implied in any forward-looking statements made by, or

on behalf of, Parex.

In particular, forward-looking statements

contained in this document include, but are not limited to,

statements with respect to: the Company’s focus, plans, priorities

and strategies; the anticipated timing of when the Northern Llanos

Arauca-8 well at the Arauca block and the Llanos Foothills

Arantes-1 well at block LLA-122 will spud; and the anticipated

timing of when Parex will release its quarterly results and hold

its quarterly conference call.

These forward-looking statements are subject to

numerous risks and uncertainties, including but not limited to, the

impact of general economic conditions in Canada and Colombia;

prolonged volatility in commodity prices; industry conditions

including changes in laws and regulations including adoption of new

environmental laws and regulations, and changes in how they are

interpreted and enforced in Canada and Colombia; impact of the

COVID-19 pandemic and the ability of the Company to carry on its

operations as currently contemplated in light of the COVID-19

pandemic; determinations by OPEC and other countries as to

production levels; competition; lack of availability of qualified

personnel; the results of exploration and development drilling and

related activities; obtaining required approvals of regulatory

authorities in Canada and Colombia; risks associated with

negotiating with foreign governments as well as country risk

associated with conducting international activities; volatility in

market prices for oil; fluctuations in foreign exchange or interest

rates; environmental risks; changes in income tax laws or changes

in tax laws and incentive programs relating to the oil industry;

changes to pipeline capacity; ability to access sufficient capital

from internal and external sources; failure of counterparties to

perform under contracts; risk that Brent oil prices are lower than

anticipated; risk that Parex's evaluation of its existing portfolio

of development and exploration opportunities is not consistent with

its expectations; the risk that the Northern Llanos Arauca-8 well

at the Arauca block and the Llanos Foothills Arantes-1 well at

block LLA-122 may not spud when anticipated, or at all; and other

factors, many of which are beyond the control of the Company.

Readers are cautioned that the foregoing list of factors is not

exhaustive. Additional information on these and other factors that

could affect Parex's operations and financial results are included

in reports on file with Canadian securities regulatory authorities

and may be accessed through the SEDAR website (www.sedar.com).

Although the forward-looking statements

contained in this document are based upon assumptions which

Management believes to be reasonable, the Company cannot assure

investors that actual results will be consistent with these

forward-looking statements. With respect to forward-looking

statements contained in this document, Parex has made assumptions

regarding, among other things: current and anticipated commodity

prices and royalty regimes; the impact (and the duration thereof)

that COVID-19 pandemic will have on the demand for crude oil and

natural gas, Parex’s supply chain and Parex’s ability to produce,

transport and sell Parex’s crude oil and natural; gas; availability

of skilled labour; timing and amount of capital expenditures;

future exchange rates; the price of oil, including the anticipated

Brent oil price; the impact of increasing competition; conditions

in general economic and financial markets; availability of drilling

and related equipment; effects of regulation by governmental

agencies; receipt of partner, regulatory and community approvals;

royalty rates; future operating costs; uninterrupted access to

areas of Parex's operations and infrastructure; recoverability of

reserves and future production rates; the status of litigation;

timing of drilling and completion of wells; on-stream timing of

production from successful exploration wells; operational

performance of non-operated producing fields; pipeline capacity;

that Parex will have sufficient cash flow, debt or equity sources

or other financial resources required to fund its capital and

operating expenditures and requirements as needed; that Parex's

conduct and results of operations will be consistent with its

expectations; that Parex will have the ability to develop its oil

and gas properties in the manner currently contemplated; that

Parex's evaluation of its existing portfolio of development and

exploration opportunities is consistent with its expectations;

current or, where applicable, proposed industry conditions, laws

and regulations will continue in effect or as anticipated as

described herein; that the estimates of Parex's production and

reserves volumes and the assumptions related thereto (including

commodity prices and development costs) are accurate in all

material respects; that Parex will be able to obtain contract

extensions or fulfill the contractual obligations required to

retain its rights to explore, develop and exploit any of its

undeveloped properties; and other matters.

Management has included the above summary of

assumptions and risks related to forward-looking information

provided in this document in order to provide shareholders with a

more complete perspective on Parex's current and future operations

and such information may not be appropriate for other purposes.

Parex's actual results, performance or achievement could differ

materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurance can be

given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what

benefits Parex will derive. These forward-looking statements are

made as of the date of this document and Parex disclaims any intent

or obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

PDF

available: http://ml.globenewswire.com/Resource/Download/4f92d4c1-d3c3-4fb0-9585-16ccae998f37

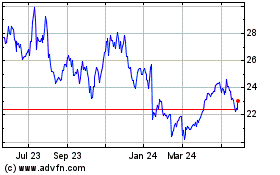

Parex Resources (TSX:PXT)

Historical Stock Chart

From Dec 2024 to Jan 2025

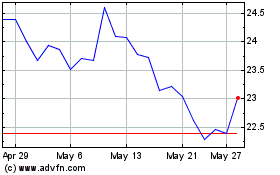

Parex Resources (TSX:PXT)

Historical Stock Chart

From Jan 2024 to Jan 2025