Stingray Group Inc. (TSX: RAY.A; RAY.B) (the “Corporation”;

“Stingray”), a leading distributor of audio and video music brands

in the world, announced today its financial results for the first

quarter of fiscal 2024 ended June 30, 2023.

|

Financial Highlights(in thousands of dollars,

except per share data) |

Three months endedJune 30 |

|

|

Q1-2024 |

Q1-2023 |

% |

|

|

Revenues |

78,992 |

78,136 |

1.1 |

|

|

Adjusted EBITDA(3) |

28,266 |

26,086 |

8.4 |

|

|

Net income |

14,118 |

9,397 |

50.2 |

|

|

Per share – diluted ($) |

0.20 |

0.13 |

53.8 |

|

|

Adjusted Net income(3) |

11,893 |

13,245 |

(10.2 |

) |

|

Per share – diluted ($) |

0.17 |

0.19 |

(10.5 |

) |

|

Cash flow from operating activities |

24,260 |

16,346 |

48.4 |

|

|

Adjusted free cash flow(3) |

18,457 |

15,659 |

17.9 |

|

|

(1) |

Subscription Revenues includes Digital Streaming and Apps and other

Digital Sales and Commercial Subscription Recurring Revenues. |

|

(2) |

Advertising Revenues include FAST channels and Retail Media

Advertising revenues. |

|

(3) |

This is a non-IFRS measure and is not a standardized financial

measure. The Corporation’s method of calculating such financial

measures may differ from the methods used by other issuers and,

accordingly, the definition of these non-IFRS financial measures

may not be comparable to similar measures presented by other

issuers. Refer to “Non-IFRS Measures” on page 4 of this news

release for more information about each non-IFRS measure and refer

to pages 5-6 for the reconciliations to the most directly

comparable IFRS financial measures. |

|

|

|

Reporting on first quarter results, Stingray's

President, co-founder and CEO Eric Boyko stated:

“In the first quarter of 2024, we delivered

robust adjusted EBITDA of $28.3 million, representing 35.8% of

sales, thanks to cost-saving initiatives implemented over the past

year. Despite a temporary slowdown in revenue growth at Stingray

due to the timing of retail media advertising campaigns, I am

pleased to report that revenue growth within our Stingray

Advertising business has picked up early in the second quarter. We

remain on target to achieve our goal of 40% growth in Advertising

revenues for 2024.”

“Our recent sales agreement with Mood Media’s

Vibenomics advertising division, which creates the largest retail

audio ad network in the U.S. with more than 25,000 locations,

combined with our new deal with Loblaw Media that spans nearly 300

grocery stores across Canada, puts us on track to more than double

revenues for Stingray Advertising to $100 million in the next 12 to

36 months. Our goal is to offer a single, large-scale network of

retailers for advertisers seeking national reach to promote their

brands.”

“We also anticipate accelerated momentum for our

in-car entertainment segment, driven by the recent partnership with

BYD, the world’s leading manufacturer of new energy vehicles, to

bring our popular Stingray Karaoke product to its fleet around the

world. In addition, Audi cars are beginning to roll out of

manufacturing plants with our embedded Karaoke app, while we keep

expanding our presence at Tesla.”

“In terms of FAST channels, they generated solid

organic growth in the first quarter as we began better monetizing

our content for connected TVs by contracting third parties to

resell unsold inventory by major television manufacturers. As

planned, revenues from our SVOD business were slightly down given

our sharpened focus on B2B-driven customers, but profitability

improved year-over-year.”

“Altogether, revenues for our Broadcasting and

Commercial Music business increased 2.3% to $47.2 million in the

first quarter of 2024, while Radio revenues declined 0.6% to $31.8

million as we still outperformed the industry,” Mr. Boyko

concluded.

First Quarter ResultsRevenues

increased $0.9 million, or 1.1%, to $79.0 million in Q1 2024 from

$78.1 million in Q1 2023. The increase was primarily due to

equipment and installation sales related to digital signage, in-car

revenues increase and to a positive foreign exchange impact largely

offset by a decrease in B2C and in retail media advertising

revenues.

For the quarter, revenues in Canada rose $0.7

million, or 1.3%, to $47.3 million from $46.6 million in Q1

2023. The growth mainly reflects enhanced equipment and

installation sales related to digital signage.

Revenues in the United States remained stable

year-over-year at $19.1 million in Q1 2024 as in-car and FAST

Channel revenues increased and to positive foreign exchange impact,

largely offset by a decrease in B2C and in retail media advertising

revenues. Revenues in Other countries improved $0.2 million, or

2.1%, to $12.6 million in Q1 2024 from $12.4 million in Q1 2023.

The increase can primarily be attributed to a positive foreign

exchange impact, offset in part by lower audio channel and

subscription revenues.

Broadcasting and Commercial Music revenues grew

$1.1 million, or 2.3%, to $47.2 million in Q1 2024 from $46.1

million in Q1 2023. The growth was primarily due to equipment and

installation sales related to digital signage, to in-car and FAST

Channel revenues increases and to a positive foreign exchange

impact largely offset by a decrease in B2C and in retail media

advertising revenues. Radio revenues declined $0.2 million, or

0.6%, to $31.8 million in Q1 2024 from $32.0 million in the same

period in 2023. The slight decrease can be attributed to reductions

in national advertising revenues.

Consolidated Adjusted EBITDA(3) improved $2.2

million, or 8.4%, to $28.3 million in Q1 2024 from $26.1 million in

Q1 2023. Adjusted EBITDA margin(3) reached 35.8% in Q1 2024

compared to 33.4% in the same period in 2023. The growth in

Adjusted EBITDA(3) was mainly due to higher revenues, while the

increase in Adjusted EBITDA margin(3) can be attributed to lower

operating costs in the Broadcasting and Commercial Music segment

following cost-saving initiatives implemented in fiscal 2023.

Net income totaled $14.1 million ($0.20 per

share) in Q1 2024 compared to $9.4 million ($0.13 per share) in

Q1 2023. The increase was mainly due to a one-time settlement

gain from a trademark dispute and higher gain on the fair value of

derivative financial instruments. These factors were partially

offset by a greater interest expense.

Adjusted net income(3) reached $11.9 million

($0.17 per share) in Q1 2024 compared to $13.2 million ($0.19 per

share) in the same period in 2023. The decrease can mainly be

attributed to a higher interest expense, partially offset by better

operating results.

Cash flow generated from operating activities

totaled $24.3 million in Q1 2024 compared to $16.3 million in Q1

2023 with a one-time settlement gain from a trademark dispute and

better operating results mainly accounting for the year-over-year

improvement. Adjusted free cash flow(3) amounted to $18.5 million

in Q1 2024 compared to $15.7 million in the same period in 2023.

The increase was mainly related to better operating results and

lower taxes paid, partially offset by a higher interest

expense.

As at June 30, 2023, the Corporation had cash

and cash equivalents of $11.7 million, subordinated debt of $25.6

million and credit facilities of $374.1 million, of which

approximately $53.7 million was available. The Net Debt to Pro

Forma Adjusted EBITDA ratio(3) stood at 3.28x as at June 30, 2023

compared to 3.25x as at June 30, 2022.

Declaration of DividendOn

August 8, 2023, the Corporation declared a dividend of $0.075 per

subordinate voting share, variable subordinate voting share and

multiple voting share. The dividend will be payable on or around

September 15, 2023 to shareholders on record as of August 31,

2023.

The Corporation’s dividend policy is at the

discretion of the Board of Directors and may vary depending upon,

among other things, our available cash flow, results of operations,

financial condition, business growth opportunities and other

factors that the Board of Directors may deem relevant.

The dividends paid are designated as "eligible"

dividends for the purposes of the Income Tax Act (Canada) and any

corresponding provisions of provincial and territorial tax

legislation.

Business Highlights and Subsequent

Events

- On August 7, 2023, the Corporation

announced a global deal with BYD, the world’s leading manufacturer

of new energy vehicles, to bring its popular Stingray Karaoke

product to their cars around the world. BYD will incorporate

Stingray’s interactive and engaging Karaoke product as an embedded

app in their popular models sold across a dozen countries in 2023

with the rest to follow in subsequent years.

- On August 1, 2023, Stingray

Advertising, North America’s largest audio advertising network, and

Loblaw Media™, the retail media division of Loblaw Companies

Limited™ (Loblaw), announced a new relationship that expands

Stingray’s retail audio advertising network into Loblaw grocery

stores this summer. The Loblaw store audio network will span nearly

300 stores, including Loblaws®, Zehrs®, Real Canadian Superstore®,

and other retail banners, with campaigns expected to begin

mid-August. The collaboration provides brands with a unique

opportunity to connect with customers throughout their in-store

journey via Stingray’s proprietary streaming media technology and

Hivestack, Canada’s leading place-based ad server and SSP.

- On July 25, 2023, Mood Media’s

Vibenomics advertising division, a leading experiential technology

and retail media solutions provider, and Stingray Advertising, a

prominent provider of innovative retail audio advertising

solutions, announced an agreement to combine their respective

networks creating the largest U.S. retail media in-store network.

This ground-breaking collaboration will provide advertisers with an

unmatched national presence, reaching over 800 million monthly

shoppers through in-store digital audio advertising across 25,000+

brick-and-mortar locations nationwide. The expansive network

encompasses major players in key retail verticals such as grocery,

drug, convenience and home improvement. Expansion to other

verticals will continue in 2024.

- On June 28, 2023, the Corporation

announced the launch of free ad-supported TV channels (FAST

channels) Stingray Music, Stingray Naturescape, Qello Concerts,

Stingray Karaoke, Stingray Classica, Stingray DJAZZ and Stingray

CMusic on VIDAA, the leading smart TV OS powering Hisense, Toshiba,

and other leading regional OEM brands. These distribution

agreements not only grow Stingray’s audience over new platforms in

new territories, adding millions of potential viewers but also open

up new opportunities for collaboration and business growth,

fostering innovation and expanding Stingray’s reach in the global

music and entertainment landscape.

- On June 22, 2023, the Corporation

announced the launch of the Stingray Karaoke TV app on Sky Live,

initially debuting in the United Kingdom and The Republic of

Ireland. Set to launch in the fall, this innovative app will offer

users a new karaoke experience, taking the popular pastime to

unparalleled heights by leveraging state-of-the-art

technology.

- On June 8, 2023, the Corporation

announced that Stingray Classica and Qello Concerts have launched

on YouTube TV and YouTube Primetime Channels in the United States.

For a monthly subscription, users can access the premium streaming

services on all devices supported by YouTube.

Conference CallThe Corporation

will hold a conference call tomorrow, August 9, 2023, at 9:00 AM

(ET) to review its financial results. Interested parties can join

the call by dialing 416-764-8658 (Toronto) or 1-888-886-7786 (toll

free). A rebroadcast of the conference call will be available until

midnight, September 10, 2023, by dialing 416-764-8692 or

877-674-7070 and entering passcode 384520.

Annual Meeting of

ShareholdersStingray will hold its 2023 Annual Meeting of

Shareholders on Wednesday, August 9, 2023 at 11:00 AM (ET) by

videoconference. The meeting can be accessed by logging in online

at https://web.lumiagm.com/413410860.

About StingrayStingray (TSX:

RAY.A; RAY.B), a global music, media, and technology company, is an

industry leader in TV broadcasting, streaming, radio, business

services, and advertising. Stingray provides an array of music,

digital, and advertising services to enterprise brands worldwide,

including audio and video channels, over 100 radio stations,

subscription video-on-demand content, FAST channels, karaoke

products and music apps, and in-car and on-board infotainment

content. Stingray Business, a division of Stingray, provides

commercial solutions in music, in-store advertising solutions,

digital signage, and AI-driven consumer insights and feedback.

Stingray Advertising is North America's largest retail audio

advertising network, delivering digital audio messaging to more

than 20,000 major retail locations. Stingray has close to 1,000

employees worldwide and reaches 540 million consumers in 160

countries. For more information, visit

www.stingray.com.

Forward-Looking InformationThis

news release contains forward-looking information within the

meaning of applicable Canadian securities law. Such forward-looking

information includes, but is not limited to, information with

respect to Stingray's goals, beliefs, plans, expectations,

anticipations, estimates and intentions. Forward-looking

information is identified by the use of terms and phrases such as

"may", "would", "should", "could", "expect", "intend", "estimate",

"anticipate", "plan", "foresee", "believe", and "continue", or the

negative of these terms and similar terminology, including

references to assumptions. Please note, however, that not all

forward-looking information contains these terms and phrases.

Forward-looking information is based upon a number of assumptions

and is subject to a number of risks and uncertainties, many of

which are beyond Stingray's control. These risks and uncertainties

could cause actual results to differ materially from those that are

disclosed in or implied by such forward-looking information. These

risks and uncertainties include, but are not limited to, the risk

factors identified in Stingray's Annual Information Form for the

year ended March 31, 2023, which is available on SEDAR at

www.sedar.com. Consequently, all of the forward-looking information

contained herein is qualified by the foregoing cautionary

statements, and there can be no guarantee that the results or

developments that Stingray anticipates will be realized or, even if

substantially realized, that they will have the expected

consequences or effects on Stingray's business, financial condition

or results of operation. Unless otherwise noted or the context

otherwise indicates, the forward-looking information contained

herein is provided as of the date hereof, and Stingray does not

undertake to update or amend such forward-looking information

whether as a result of new information, future events or otherwise,

except as may be required by applicable law.

Non-IFRS MeasuresThe

Corporation believes that Adjusted EBITDA and Adjusted EBITDA

margin are important measures when analyzing its operating

profitability without being influenced by financing decisions,

non-cash items and income taxes strategies. Comparison with peers

is also easier as companies rarely have the same capital and

financing structure. The Corporation believes that Adjusted Net

income and Adjusted Net income per share are important measures as

it shows stable results from its operation which allows users of

the financial statements to better assess the trend in the

profitability of the business. The Corporation believes that

Adjusted free cash flow and Adjusted free cash flow per share are

important measures when assessing the amount of cash generated

after accounting for capital expenditures and non-core charges. It

demonstrates cash available to make business acquisitions, pay

dividend and reduce debt. The Corporation believes that Net debt

and Net debt to Pro Forma Adjusted EBITDA are important to analyse

the company's debt repayment capacity on an annualized basis,

taking into consideration the annualized adjusted EBITDA of

acquisitions made during the last twelve months.

Each of these non-IFRS financial measures is not

an earnings or cash flow measure recognized by International

Financial Reporting Standards (IFRS) and does not have a

standardized meaning prescribed by IFRS. This method of calculating

such financial measures may differ from the methods used by other

issuers and, accordingly, our definition of these non-IFRS

financial measures may not be comparable to similar measures

presented by other issuers. Investors are cautioned that non-IFRS

financial measures should not be construed as an alternative to net

income determined in accordance with IFRS as indicators of our

performance or to cash flows from operating activities as measures

of liquidity and cash flows.

Reconciliation of Net income to Adjusted

EBITDA, Adjusted Net income, LTM Adjusted EBITDA and Pro Forma

Adjusted EBITDA

| |

3 months |

| (in

thousands of Canadian dollars) |

June 30, 2023Q1 2024 |

|

June 30, 2022Q1 2023 |

|

March 31, 2023Q4 2023 |

|

|

Net income |

14,118 |

|

9,397 |

|

4,447 |

|

| Net finance expense (income) |

4,406 |

|

3,975 |

|

3,749 |

|

| Change in fair value of

investments |

107 |

|

(121 |

) |

11 |

|

| Income taxes |

5,738 |

|

3,139 |

|

753 |

|

| Depreciation and write-off of

property and equipment |

2,385 |

|

2,671 |

|

2,406 |

|

| Depreciation of right-of-use

assets |

1,085 |

|

1,123 |

|

1,225 |

|

| Amortization of intangible

assets |

4,433 |

|

4,772 |

|

4,547 |

|

| Share-based compensation |

101 |

|

137 |

|

157 |

|

| Performance and deferred share

unit expense |

(1,207 |

) |

(400 |

) |

2,068 |

|

|

Acquisition, legal, restructuring and other expenses |

(2,900 |

) |

1,393 |

|

7,210 |

|

|

Adjusted EBITDA |

28,266 |

|

26,086 |

|

26,573 |

|

|

Adjusted EBITDA margin |

35.8 |

% |

33.4 |

% |

33.7 |

% |

|

|

|

|

|

| Net income |

14,118 |

|

9,397 |

|

4,447 |

|

| Adjusted for: |

|

|

|

| Change in fair value of

derivative financial instruments |

(3,635 |

) |

(545 |

) |

(70 |

) |

| Amortization of intangible

assets |

4,433 |

|

4,772 |

|

4,547 |

|

| Change in fair value of

investments |

107 |

|

(121 |

) |

11 |

|

| Share-based compensation |

101 |

|

137 |

|

157 |

|

| Performance and deferred share

unit expense |

(1,207 |

) |

(400 |

) |

2,068 |

|

| Acquisition, legal, restructuring

and other expenses |

(2,900 |

) |

1,393 |

|

7,210 |

|

|

Income taxes related to change in fair value of investments,

share-based compensation, performance and deferred share unit

expense, amortization of intangible assets, change in fair value of

derivative financial instruments and acquisition, legal,

restructuring and other expenses |

876 |

|

(1,388 |

) |

(3,702 |

) |

|

Adjusted Net income |

11,893 |

|

13,245 |

|

14,668 |

|

|

Average number of shares outstanding (diluted) |

69,433 |

|

70,277 |

|

69,459 |

|

|

Adjusted Net income per share (diluted) |

0.17 |

|

0.19 |

|

0.21 |

|

|

(in thousands of Canadian dollars) |

June 30,2023 |

June 30,2022 |

March 31,2022 |

|

LTM Adjusted EBITDA |

116,320 |

101,200 |

114,140 |

| Synergies and Adjusted EBITDA for

the months prior to the business acquisitions which are not already

reflected in the results |

– |

11,900 |

– |

| COVID-19 credits allocated due to

mandated store closures |

– |

699 |

– |

|

Permanent cost-saving initiatives |

1,880 |

– |

2,325 |

|

Pro Forma Adjusted EBITDA |

118,200 |

113,799 |

116,465 |

Reconciliation of Cash Flow From

Operating Activities to Adjusted Free Cash Flow

| |

3 months |

| (in

thousands of Canadian dollars) |

June 30, 2023Q1 2024 |

|

June 30, 2022Q1 2023 |

|

March 31, 2023Q4 2023 |

|

|

Cash flow from operating activities |

24,260 |

|

16,346 |

|

27,552 |

|

| Add / Less : |

|

|

|

| Acquisition of property and

equipment |

(1,369 |

) |

(1,151 |

) |

(2,987 |

) |

| Acquisition of intangible assets

other than internally developed intangible assets |

(302 |

) |

(277 |

) |

(383 |

) |

| Addition to internally developed

intangible assets |

(1,300 |

) |

(1,564 |

) |

(1,236 |

) |

| Interest paid |

(5,573 |

) |

(4,252 |

) |

(6,842 |

) |

| Repayment of lease

liabilities |

(1,057 |

) |

(1,057 |

) |

(1,122 |

) |

| Net change in non-cash operating

working capital items |

6,090 |

|

7,456 |

|

(7,077 |

) |

| Unrealized loss (gains) on

foreign exchange |

608 |

|

(1,235 |

) |

(206 |

) |

|

Acquisition, legal, restructuring and other expenses |

(2,900 |

) |

1,393 |

|

7,210 |

|

|

Adjusted free cash flow |

18,457 |

|

15,659 |

|

14,909 |

|

Calculation of Net Debt and Net Debt to

Pro Forma Adjusted EBITDA Ratio

| (in

thousands of Canadian dollars) |

June 30,2023 |

|

June 30,2022 |

|

March 31,2023 |

|

|

Credit facilities |

374,114 |

|

358,440 |

|

360,990 |

|

| Subordinated debt |

25,568 |

|

25,467 |

|

25,543 |

|

|

Cash and cash equivalents |

(11,682 |

) |

(13,816 |

) |

(15,453 |

) |

|

Net debt |

388,000 |

|

370,091 |

|

371,080 |

|

|

Net debt to Pro Forma Adjusted EBITDA |

3.28 |

|

3.25 |

|

3.19 |

|

Note to readers: Consolidated

financial statements and Management’s Discussion & Analysis of

Operating Results and Financial Position are available on the

Corporation’s website at www.stingray.com and on SEDAR at

www.sedar.com.

Contact InformationMathieu

PéloquinSenior Vice-President, Marketing and

CommunicationsStingray(514) 664-1244, ext.

2362mpeloquin@stingray.com

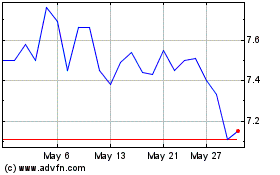

Stingray (TSX:RAY.A)

Historical Stock Chart

From Oct 2024 to Nov 2024

Stingray (TSX:RAY.A)

Historical Stock Chart

From Nov 2023 to Nov 2024