Titan Mining Corporation (TSX: TI, OTCQB: TIMCF)

(“

Titan” or the "

Company") is

pleased to announce district scale exploration plans, updated

mineral resource estimate and extended mine life for its Empire

State Mines (“

ESM”) zinc operations. The regional

and near mine exploration plans cover ESM’s 80,000 acres of

controlled mineral rights in upstate New York and target multiple

high quality, near mine and district scale targets with potential

to increase near term production and further extend mine life.

Highlights:

- Increase in

measured & indicated contained pounds of zinc by 22%1 as

compared to Titan’s 2020 Zinc Mineral Resource Estimate (net of

depletions)

- Updated base

case life of mine plan with extended life of mine until 2033

- The updated life

of mine plan (the “Zinc LOM Plan”) provides total

recoverable zinc of 636 million pounds and payable zinc production

of 541 million pounds.

- Established

operating base with 5,000 tpd mill and 130+ employee workforce in a

Tier 1 jurisdiction

- 40,000 ft of

near mine underground drilling planned in 2025 within existing

mining areas. 31,000 ft of exploration drilling also planned for

2025 with 13,000 ft in near mine drilling and 18,000 ft in regional

surface drilling

- The 100+ year

track record at ESM of converting near-mine exploration targets

into production suggests the Company’s exploration program has the

potential to continue adding incremental production in the near

term

- The exploration

drilling comprises fifteen drill ready targets. Of these, eleven

are within the historic Balmat (ESM) – Pierrepont trend

- Total near mine

targets for further exploration are estimated to contain between

4.8mt-5.3mt of mineralized material at average zinc grades of

10-14%, containing 935 mlbs to 1,470 mlbs of contained zinc

The potential quantity and grade of these

exploration targets are based on historic production figures from

geologically similar horizons. The potential quantity and grade is

conceptual in nature and there has been insufficient exploration to

define a mineral resource at these targets. It is uncertain if

further exploration will result in these targets being delineated

as a mineral resource.

Don Taylor, CEO of Titan commented: “We are

pleased with the results of the most recent Zinc LOM Plan

demonstrating an increased mine life and a strong base case

production. As we ramp up exploration plans in 2025, we aim for

increased production and a significantly enhanced mine-life. We see

a bright future for ESM in 2025 and beyond, as the team continues

to focus on lowering unit costs, expanding the mineral resource,

growing zinc production while we continue our evaluation of the

Kilbourne graphite project.”

Rita Adiani, President of Titan commented: “Our

Zinc business demonstrates a robust growth profile and significant

volumes of contained zinc in near mine exploration targets. Our

existing infrastructure and 5,000 tpd mill provide the unique

opportunity to translate exploration into production in the near

term at a low capital cost. Our management team remains focused on

delivering value growth for shareholders as we assess and deliver

on the district scale potential in a Tier 1 jurisdiction.”

2024 Zinc Mineral Resource Tables

Table 1: Underground Mineral Resource

Estimate

|

Classification |

Tons (000’s US short tons) |

Zn (%) |

Contained pounds (Mlbs) |

|

Measured |

295 |

17.1 |

101 |

|

Indicated |

1,158 |

15.7 |

364 |

|

Measured + Indicated |

1,453 |

16.0 |

465 |

|

Inferred |

4,327 |

12.1 |

1,049 |

Source: ESM 2024

Notes:

- The qualified person for the 2024 Zinc Mineral Resource

Estimate (the “2024 Zinc MRE”), as defined by National Instrument

(“NI”) 43-101 guidelines, is Donald (Don) R. Taylor, of Titan

Mining Corp., SME registered member (#4029597).

- Three-dimensional (3D) wireframe models of mineralization were

prepared in Leapfrog Geo based on the geological interpretation of

the logged lithology on contiguous grade intervals defining

mineralized sub-domains. The 2024 Zinc MRE (underground)

encompasses 36 vein domains and 6 indicator RBF interpolant shells

totaling 42 individual wireframes.

- Geological and block models for the 2024 Zinc MRE (underground)

used data from a total of 1,100 surface and underground diamond

drill holes (core). The drill hole database was validated prior to

resource estimation and QA/QC checks were made using

industry-standard control charts for blanks and commercial

certified reference material inserted into assay batches by Empire

State Mine personnel.

- High-grade capping was evaluated and implemented on the raw

assay data on a per-zone basis using histograms and log-probability

plots. Outliers were further evaluated during estimation and

limited if necessary using the Leapfrog Edge clamping method.

- The 2024 Zinc MRE was compiled from 10 individual block models

that were prepared using Leapfrog Edge. Block models were

sub-blocked at domain boundaries and samples were composited using

vein length intervals where a single composite is generated for

each complete vein intersection with a drillhole. Composites were

generated within the indicator RBF interpolant models as 10 foot

run-length composites with residuals less than 5 feet added to the

prior interval, honoring the modeled geological boundaries. Grade

estimation was carried out using Inverse Distance Weighted (IDW)

methods coupled with variably orientated search ellipses derived

from modelled vein surfaces.

- The specific gravity (SG) assessment was carried out for all

domains using measurements collected during the core logging

process. Where there is sufficient sampling the SG is interpolated

into model blocks using IDW techniques. If insufficient sampling

exists then density was assigned to models based on calculated

means or by a regression formula.

- Resources are reported using a 5.3% Zinc cut‑off grade, based

on actual break-even mining, processing, G&A costs, and smelter

terms from the ESM operation at a zinc recovery of 96.4%.

- Resources stated as in‑situ grade at a Zinc price of

$1.30/lb.

- The resource classification considered the quality, quantity

and distance to the data informing blocks in the model, as well as

the geological continuity of the mineralized zones. Classification

parameters vary slightly depending on the nature and continuity of

the individual zones. Block classification was explicitly domained

based on a calculation that used quality, quantity, and distance

parameters.

- Quantities and grades in the 2024 Zinc MRE are rounded to an

appropriate number of significant figures to reflect that they are

estimations.

- The 2024 Zinc MRE was prepared following the CIM Estimation of

Mineral Resources & Mineral Reserves Best Practice Guidelines

(November 29, 2019).

- CIM definitions and guidelines for Mineral Resource Estimates

have been followed.

- The effective date of the underground mineral estimate is July

16, 2024.

Zinc LOM Plan Update Summary

Table 2 presents the key metrics of the Zinc LOM

Plan compared to the LOM Report issued in 2021 (the “2021

Zinc LOM Plan”), considering the comparable periods from

July 16, 2024 onwards (the effective date of the Zinc LOM

Plan).

The total zinc production in the Zinc LOM Plan

has increased by 35% compared to the 2021 LOM Plan. LOM throughput

rate increased by 37% to 1,775 tons per day with total tons

processed increased by 35% to 4.5mt over LOM.

Table 2- Summary of the Zinc LOM Plan and Comparison to

the 2021 Zinc LOM Plan

|

LOM Plan comparisons |

Unit |

Latest Zinc LOM Plan |

2021 Zinc LOM Plan |

Change |

Change (%)2 |

|

Mine Life |

Years |

9 |

7 |

2 |

29% |

|

Resource Mined |

kt |

4,469 |

3,309 |

1,160 |

35% |

|

LOM Throughput Rate |

t/d |

1,775 |

1,294 |

481 |

37% |

|

Average Head Zinc Grade |

% Zn |

7.4 |

6.6 |

0.8 |

12% |

|

LOM Recovered Zinc |

Mlbs |

636 |

470 |

166 |

35% |

|

LOM Payable Zinc |

Mlbs |

541 |

400 |

141 |

35% |

Mineral Resources are not Mineral Reserves and

do not have demonstrated economic viability. There is no certainty

that any part of the Mineral Resources estimated will be converted

into a Mineral Reserves Estimate. The results disclosed herein are

the results of a preliminary economic assessment. On this basis, it

is considered preliminary in nature, it includes inferred mineral

resources that are considered too speculative geologically to have

the economic considerations applied to them that would enable them

to be categorized as mineral reserves, and there is no certainty

that the preliminary economic assessment will be realized.

Opportunities - Near Term Increase in Production and

District Scale Potential

Titan is assessing various near term production

increase opportunities at N2D and Turnpike. Accelerating mining of

N2D and commencement of open pit mining at Turnpike could increase

near term production, cash flows and project NPV over the life of

the zones. Near mine exploration targets provide opportunities for

mineral resource expansion that could increase mine life and are

summarized in Figure 3 below.

Figure 3- Near mine exploration and production

opportunity targets

Targets for exploration drilling can be broken

into three categories, near mine, within the Balmat (ESM #1-#4) -

Pierrepont trend, and within the greater district. Figure 4 shows

the current near mine drill targets.

In 2025, near mine exploration is expected to

expand the Mahler, Mud Pond Main and New Fold zones with planned

underground drilling totaling 40,000 ft and test Arnold Pit/Wight,

Streeter East, Streeter West, and Little York with planned surface

drilling totaling 13,000 ft.

Total near mine targets for further exploration

are estimated to contain between 4.8mt-5.3mt of mineralized

material at average zinc grades of 10-14%, containing 935 Mlbs to

1,470 Mlbs of contained zinc, providing significant potential to

increase mine life. The potential quantity and grade of these

exploration targets are based on historic production figures from

geologically similar horizons. The potential quantity and grade is

conceptual in nature and there has been insufficient exploration to

define a mineral resource at these targets. It is uncertain if

further exploration will result in these targets being delineated

as a mineral resource.

In addition to the near mine targets, the

Company has developed an additional fifteen drill ready targets. Of

these, eleven are within the historic Balmat (ESM) – Pierrepont

trend. Targeting has focused on: the extension of historic

mineralized intercepts with room down dip, and along strike to

accommodate a significant body of mineralization; testing

historically productive stratigraphic units; and testing down dip

from surficial zinc anomalies. Targets for the 2025 in trend drill

program include Pleasant Valley, Pork Creek, and Bend (See Figure 4

below).

There are currently four drill ready targets

within the district. These target: the down dip extensions of zinc

anomalies identified through surface geochemical sampling;

stratigraphy with known past base metal production; and conceptual

geologic and geophysical targets. The Company currently has 18,000

ft planned to test targets within the trend and district. The

primary district drill target for 2025 is Moss Ridge.

In addition to the 71,000 ft planned for the

2025 drill programs, the Company plans on collecting greater than

2,000 soil samples annually from its existing and future mineral

tenure. This program will begin targeting historically productive

stratigraphic units within the trend, and historic geochemical

samples (rock and soil) with elevated Zn recorded. The Company’s

2022 soil program led to the development of the Pork Creek, and

Moss Ridge drill targets.

Figure 4 – District Drilling and Geochemical Sampling

Targets

An NI 43-101 technical report supporting the

results disclosed herein will be filed on SEDAR+ within 45 days of

the Company’s December 3, 2024 press release.

Quality Assurance and Quality Control

Core drilling was completed using ESM owned and

operated drills which produced AWJ (1.374 in) size drill core. All

core was logged by ESM employees. The core was washed, logged,

photographed, and sampled. All core samples were cut in half,

lengthwise, using a diamond saw with a diamond-impregnated blade

and sampled on 5 ft intervals with adjustments made to match

geological contacts. After a sample is cut, one half of the core

was returned to the original core box for reference and long-term

storage. The second half was placed in a plastic or cloth sample

bag, labeled with the corresponding sample identification number,

along with a sample tag. All sample bags were secured with staples

or a draw string, weighed and packed in shipping boxes.

For graphitic samples, shipping boxes are placed

onto pallets and shipped by freight to SGS Lakefield laboratory in

Lakefield, ON, Canada for sample preparation and graphitic carbon

analysis. Pulps are forwarded to SGS Burnaby laboratory in Burnaby,

BC, Canada for multi-element analysis. SGS Lakefield is a Canadian

accredited laboratory (ISO/IEC 17025) and independent of ESM. SGS

Lakefield prepares the pulps and analyzes each sample for graphitic

carbon (Cg-CSA06V) with a detection limit of >0.01%. Pulps are

shipped to SGS Burnaby for multi-element analysis by aqua regia

digestion (GE-ICP21B20 for 34 elements) with an ICP – OES finish.

All samples in which silver, calcium, manganese, iron, zinc and

sulfur exceed their upper limit are re-run using methods of aqua

regia digestion (Fe-ICP21B100), four acid digestion (Ag, Ca, Zn,

and Mn-ICP42Q100) and infrared combustion (S-CSA06V) with the

elements reported in percentage (%). Standards and blanks are

inserted during the logging process. The assays for QA/QC samples

are reviewed as certificates are received from the laboratory.

Failures are identified on a batch basis and followed up as

required.

For samples related to zinc operations and

exploration, shipping boxes are placed on pallets and shipped by

freight to ALS Geochemistry (“ALS”), an independent ISO/IEC

accredited lab located in Sudbury, Ontario, Canada. ALS prepares a

pulp of all samples and sends the pulps to their analytical

laboratory in Vancouver, B.C., Canada, for analysis. ALS analyzes

the pulp sample by an aqua regia digestion (ME-ICP41 for 35

elements) with an ICP – AES finish including Cu (copper), Pb

(lead), and Zn (zinc). All samples in which Cu (copper), Pb (lead),

or Zn (zinc) are greater than 10,000 ppm are re-run using aqua

regia digestion (Cu-OG46; Pb-OG46; and Zn-OG46) with the elements

reported in percentage (%). Silver values are determined by an aqua

regia digestion with an ICP-AES finish (ME-ICP41) with all samples

with silver values greater than 100 ppm repeated using an aqua

regia digestion overlimit method (Ag-OG46) calibrated for higher

levels of silver contained. Gold values are determined by a 30 g

fire assay with an ICP-AES finish (Au-ICP21).

Mr. Taylor has a fulsome staff of experts

on-site that thoroughly review and verify ESM technical data on a

regular basis, as described above. For this reason, Mr. Taylor has

relied entirely on such verification procedures for verifying the

scientific and technical data in this news release. Mr. Taylor has

not identified any legal, political, environmental, or other risks

that could materially affect the potential development of the

mineral resources disclosed herein.

Qualified Person

The scientific and technical information

contained in this news release has been reviewed and approved by

Donald R. Taylor, MSc., PG, Chief Executive Officer of the Company,

and Deepak Malhotra, P. Eng, who is independent of the Company.

Each of Mr. Taylor and Mr. Malhotra is a qualified person for the

purposes of NI 43-101. Mr. Taylor has more than 25 years of mineral

exploration and mining experience and is a Registered Professional

Geologist through the SME (Registered Member #4029597). Dr.

Malhotra has more than 52 years of mineral exploration and mining

experience and is a Registered Professional Geologist through the

SME (Registered Member No. 2006420).

About Titan Mining

Corporation

Titan is an Augusta Group company which produces

zinc concentrate at its 100%-owned Empire State Mine located in New

York state. The Company is focused on value creation and operating

excellence, with a strong commitment to developing critical mineral

assets that enhance the security of the U.S. supply chain. For more

information on the Company, please visit our website

at www.titanminingcorp.com.

Contact

For further information, please contact: Rita Adiani, President.

Email: radiani@titanminingcorp.com, Investor Relations: Email:

info@titanminingcorp.com

Cautionary Note Regarding

Forward-Looking Information

Certain statements and information contained in

this new release constitute "forward-looking statements", and

"forward-looking information" within the meaning of applicable

securities laws (collectively, "forward-looking statements"). These

statements appear in a number of places in this news release and

include statements regarding our intent, or the beliefs or current

expectations of our officers and directors, including realization

of the results of the PEA, including an increased mine life, the

results of the new mine plan, mine design, economic and financial

results; we see a bright future for ESM in 2025 and beyond, as the

team continues to focus on lowering unit costs, expanding the

mineral resource base, and growing production, and potential future

exploration results; our existing infrastructure and 5,000 tpd mill

provides the unique opportunity to translate exploration into

production in the near term at a low capital cost; near term and

existing drilling continues and is expected to expand the Mahler,

Mud Pond Main and New Fold zones with 40,000 ft of drilling

targeted for 2025; accelerating production from N2D has the

potential to increase project NPV over the life of the zone and add

incrementally to near term production and cash flows; drilling of

surface near-mine and district exploration targets to be increased

in 2025 with key targets being Pleasant Valley, Pork Creek, Moss

Ridge, Bend, Little York , Streeter East, and Streeter West; 31,000

ft of exploration drilling planned for 2025 with 13,000 ft in near

mine drilling and 18,000 ft in regional surface drilling;

estimates; total near mine targets for further exploration are

estimated to contain between 4.8mt-5.3mt of mineralized material at

average zinc grades of 10-14%, containing 935 mlbs to 1,470 mlbs of

contained zinc, providing significant potential to increase mine

life; realization of near mine exploration targets that provide

mineral resource expansion and increase mine life; exploration

targets and plans. When used in this news release words such as “to

be”, "will", "planned", "expected", "potential", and similar

expressions are intended to identify these forward-looking

statements. Although the Company believes that the expectations

reflected in such forward-looking statements and/or information are

reasonable, undue reliance should not be placed on forward-looking

statements since the Company can give no assurance that such

expectations will prove to be correct. These statements involve

known and unknown risks, uncertainties and other factors that may

cause actual results or events to vary materially from those

anticipated in such forward-looking statements, including risks

relating to cost increases for capital and operating costs; risks

of shortages and fluctuating costs of equipment or supplies; risks

relating to fluctuations in the price of zinc; the inherently

hazardous nature of mining-related activities; potential effects on

our operations of environmental regulations in New York State;

risks due to legal proceedings; risks related to operation of

mining projects generally and the risks, uncertainties and other

factors identified in the Company's periodic filings with Canadian

securities regulators. Such forward-looking statements are based on

various assumptions, including assumptions made with regard to our

forecasts and expected cash flows; our projected capital and

operating costs; our expectations regarding mining and

metallurgical recoveries; mine life and production rates; that laws

or regulations impacting mining activities will remain consistent;

our approved business plans, our mineral resource estimates and

results of the PEA; our experience with regulators; political and

social support of the mining industry in New York State; our

experience and knowledge of the New York State mining industry and

our expectations of economic conditions and the price of zinc; the

ability to advance exploration efforts at ESM; the results of such

exploration efforts; the ability to secure adequate financing (as

needed); the Company maintaining its current strategy and

objectives; and the Company’s ability to achieve its growth

objectives. While the Company considers these assumptions to be

reasonable, based on information currently available, they may

prove to be incorrect. Except as required by applicable law, we

assume no obligation to update or to publicly announce the results

of any change to any forward-looking statement contained herein to

reflect actual results, future events or developments, changes in

assumptions or changes in other factors affecting the

forward-looking statements. If we update any one or more

forward-looking statements, no inference should be drawn that we

will make additional updates with respect to those or other

forward-looking statements. You should not place undue importance

on forward-looking statements and should not rely upon these

statements as of any other date. All forward-looking statements

contained in this news release are expressly qualified in their

entirety by this cautionary statement.

1 Includes the open pit resource2 Net of depletions

Photos accompanying this announcement are available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/622c7190-1cd7-4239-b68b-29761aa0b2eahttps://www.globenewswire.com/NewsRoom/AttachmentNg/7789056a-44a7-46c1-836d-dd08e24cbc01

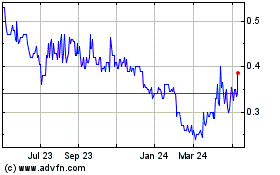

Titan Mining (TSX:TI)

Historical Stock Chart

From Dec 2024 to Jan 2025

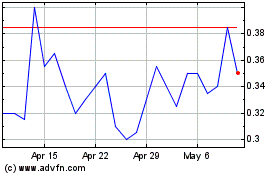

Titan Mining (TSX:TI)

Historical Stock Chart

From Jan 2024 to Jan 2025