Impact Shares YWCA Women’s Empowerment ETF Debuts on the NYSE

August 27 2018 - 7:15AM

Business Wire

YWCA Partners with First-Ever Nonprofit ETF

Sponsor Impact Shares to Create Product to Further Mission of

160-year-old Organization

Impact investing has taken another step forward in the world of

exchange traded funds (ETFs). Today, nonprofit ETF sponsor Impact

Shares introduces the Impact Shares YWCA Women's Empowerment ETF

(NYSE:WOMN). The new ETF allows investors to deploy capital in

companies that have aligned their business practices with

gender-equality standards while also powering the future efforts of

YWCA, an organization that has been a leader in women’s advocacy

for the last 160 years.

Impact Shares, with backing from The Rockefeller Foundation’s

Zero Gap Portfolio, has set out to partner with leading nonprofit

organizations who want to leverage capital markets to further their

missions and increase their social impact. The Zero Gap portfolio

is focused on building new financial products and markets which can

channel critical capital toward the world’s most challenging

problems. This partnership with YWCA to launch WOMN follows on the

heels of the recent debut of the Impact Shares NAACP Minority

Empowerment ETF (NACP) and an anticipated launch in collaboration

with the United Nations Capital Development Fund next month.

“The WOMN ETF puts the power to empower women in everyone’s

hands. It allows us to leverage the capital markets to further our

160-year mission to eliminate racism and empower women. The entire

YWCA network, made up of more than 200 local associations, is

excited about this innovative product that provides the investor

the opportunity to generate both financial and social returns, and

helps fuel the future of our work,” said Alejandra Y. Castillo, CEO

of YWCA USA.

WOMN is designed to track the Morningstar Women’s Empowerment

Index, built with the gender equality data and scoring methodology

of Equileap, which represents 200 companies culled from 1200 of the

largest U.S.-listed publicly traded companies based on each

company’s Gender Equality Score, which is evaluated under a set of

19 gender equality criteria.

Impact Shares, itself a 501(c)(3) charity, will donate the net

advisory proceeds it receives from each ETF it sponsors back to the

collaborating nonprofit partner, creating meaningful engagement

with corporate America and providing the investing public with more

targeted, credible social-impact investing options.

“We believe this is an important step in the evolution of

women’s advocacy. YWCA has established themselves as the leading

women’s organization and the ETF provides them with the tools

needed to expand their impact into the private sector and help

companies demonstrate leadership on issues impacting women. We are

excited to partner with YWCA in providing investors access to a

basket of companies that have strong policies and practices in

support of women’s empowerment and gender equality,” said Ethan

Powell, CEO of Impact Shares.

About Impact Shares

Impact Shares is a nonprofit fund sponsor and investment manager

that is creating a new and innovative platform for clients seeking

maximum social impact with market returns. Impact Shares' goal is

to build a capital markets bridge between leading non-profits,

investors and corporate America to direct capital and social

engagement on societal priorities. Impact Shares is a tax-exempt

non-profit organization under Section 501(c)(3) of the Internal

Revenue Code. For more information about Impact Shares visit

impactetfs.org.

About YWCA USA:

YWCA USA is on a mission to eliminate racism, empower women,

stand up for social justice, help families, and strengthen

communities. As one of the oldest and largest women’s organizations

in the nation, YWCA USA represents over 200 YWCAs in 46 states and

the District of Columbia, serving over 2 million women, girls, and

their families each year.

YWCA has been at the forefront of the most pressing social

movements for 160 years — from voting rights to civil rights, from

affordable housing to pay equity, from violence prevention to

health care reform. Today, we combine programming and advocacy to

generate institutional change in three key areas: racial justice

and civil rights, empowerment and economic advancement of women and

girls, and health and safety of women and girls. Learn

more: www.ywca.org.

Statements in this communication may include forward-looking

information and/or may be based on various assumptions. The

forward-looking statements and other views or opinions expressed

herein are made as of the date of this publication. Actual future

results or occurrences may differ significantly from those

anticipated and there is no guarantee that any particular outcome

will come to pass. The statements made herein are subject to change

at any time. Impact Shares disclaims any obligation to update or

revise any statements or views expressed herein.

The information in the prospectus (or Statement of Additional

Information) for the Impact Shares Sustainable Development Goals in

Least Developed Countries ETF is not complete and may be changed.

Impact Shares may not sell this ETF until the registration

statement filed with the Securities and Exchange Commission is

effective. The prospectus is not an offer to sell the Impact Shares

Sustainable Development Goals in Least Developed Countries ETF and

is not soliciting an offer to buy the ETF in any state where the

offer or sale is not permitted.

Carefully consider the Funds’ investment objective, risk

factors, and expenses before investing. This and additional

information can be found in the Impact Shares statutory and summary

prospectus, which may be obtained by calling 855-267-3837. Read the

prospectus carefully before investing.

Investing involves risk, including the possible loss of

principal. Narrowly focused investments and investments in smaller

companies typically exhibit higher volatility. Investments in

commodities are subject to higher volatility than more traditional

investments. The Fund may invest in derivatives, which are often

more volatile than other investments and may magnify the Fund’s

gains or losses. The Fund is non-diversified.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180827005170/en/

Sales:Impact

Shares844-GIVE-ETFinfo@impactetfs.orgorMedia:Gregory FCA for

Impact SharesRyann Bucher,

215-475-5950impactshares@gregoryfca.com

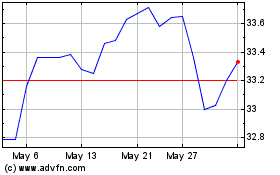

BMO Women in Leadership ... (TSX:WOMN)

Historical Stock Chart

From Oct 2024 to Nov 2024

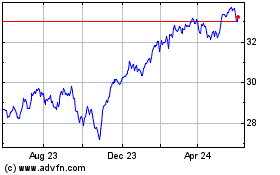

BMO Women in Leadership ... (TSX:WOMN)

Historical Stock Chart

From Nov 2023 to Nov 2024