Anfield Energy Inc. (TSX.V: AEC; OTCQB: ANLDF; FRANKFURT:

0AD) (“Anfield” or “the Company”) is pleased to

announce that it has commenced a 20-hole, 20,000-foot rotary drill

program at its Slick Rock uranium and vanadium project, located in

San Miguel County, Colorado. Anfield has engaged Tri Park

Corporation, a local drilling contractor, to conduct the drill

program, with Wyoming-based Hawkins CBM Logging to provide the

downhole geophysical logging and ore grade analysis. Once the drill

program is complete, Anfield plans to both secure a large mine

permit for the project and use the drill results to upgrade its

uranium and vanadium resource for Slick Rock as found in its

existing PEA.

Corey Dias, Anfield’s CEO, commented: “We are

very pleased to have engaged Tri Park Corp, a local contractor

operating out of Nucla, Colorado, to provide drilling services to

facilitate the advancement of our Slick Rock project. We have also

engaged Hawkins CBM Logging, a company operating out of Cody,

Wyoming, to provide downhole geophysical logging and ore grade

analysis. We expect that this program will both help to confirm

existing historical results and provide an updated uranium and

vanadium resource. Our intent remains to align the development

timelines of both the Slick Rock and Velvet-Wood mines. Our aim is

to have both ready for production prior to the restart of the

Shootaring Canyon mill, with initial feed ready for transport once

the mill is ready to receive it.

“We have seen significant advancement of our

assets over the last few months: the submittal of the mill restart

application in April; the submittal of a Plan of Operations for the

Velvet-Wood mine in May; the receipt of approval for a drill

program at Slick Rock in June; and the confirmation of the

completeness review of the Shootaring mill restart application in

July. The commencement of drilling at Slick Rock will achieve

another important step in our “hub-and-spoke” strategy. It also

underscores our commitment to advancing to near-term uranium and

vanadium production and participating in the renaissance of the

uranium industry.

“With 439 nuclear reactors operating worldwide,

64 under construction and another 88 planned, it is clear that the

nuclear renaissance is well underway -- while risks to the

availability of adequate supply of uranium are becoming greater.

Some of the supply issues include: production cutbacks in

Kazakhstan; the pivot of its largest producer, Kazatomprom, to

primarily supply customers in Asia; political instability in

producing countries such as Niger; and the prospect of a U.S.

import ban on Russian fuel. This means that there is an increasing

need for a robust U.S. domestic uranium supply as it is critical to

energy independence and stability. Anfield is well positioned to

see the benefits of this emerging reality -- with the right assets,

at the right time, in the right place.”

CanaCom Group

The Company also announces that it has

terminated its existing engagement with 2686362 Ontario

Corporation, doing business as CanaCom Group, which was previously

announced by the Company in its news release of June 3, 2024. The

Company previously engaged CanaCom Group to produce articles and

video content for the Company for a twelve-month term which

commenced December 14, 2023. In connection with the engagement,

CanaCom Group participated in a private placement completed by the

Company on December 20, 2023 in the amount of $110,000. The

engagement of CanaCom Group has not been accepted by the TSX

Venture Exchange, as it does not meet the requirements prescribed

by Exchange Policy 3.4 which require that promotional activities be

compensated on a cash basis. Termination of the engagement is

effective August 14, 2024, and CanaCom Group has agreed that the

Company will have an available credit for the remaining four months

of the original engagement.

Qualified Person

Douglas L. Beahm, P.E., P.G., principal engineer at BRS Inc., is

a Qualified Person as defined in NI 43-101 and has reviewed and

approved the technical content of this news release.

About Anfield

Anfield is a uranium and vanadium development

and near-term production company that is committed to becoming a

top-tier energy-related fuels supplier by creating value through

sustainable, efficient growth in its assets. Anfield is a publicly

traded corporation listed on the TSX-Venture Exchange (AEC-V), the

OTCQB Marketplace (ANLDF) and the Frankfurt Stock Exchange (0AD).

Anfield is focused on its conventional asset centre, as summarized

below:

Arizona/Utah/Colorado – Shootaring Canyon Mill

A key asset in Anfield’s portfolio is the

Shootaring Canyon Mill in Garfield County, Utah. The Shootaring

Canyon Mill is strategically located within one of the historically

most prolific uranium production areas in the United States, and is

one of only three licensed uranium mills in the United States.

Anfield’s conventional uranium assets consist of

mining claims and state leases in southeastern Utah, Colorado, and

Arizona, targeting areas where past uranium mining or prospecting

occurred. Anfield’s conventional uranium assets include the

Velvet-Wood Project, the Frank M Uranium Project, the West Slope

Project, as well as the Findlay Tank breccia pipe. A NI 43-101 PEA

has been completed for the Velvet-Wood Project. The PEA is

preliminary in nature, and includes inferred mineral resources that

are considered too speculative geologically to have economic

considerations applied to them that would enable them to be

categorized as mineral reserves and, resultantly, there is no

certainty that the included preliminary economic assessment would

be realized. All conventional uranium assets are situated within a

200-mile radius of the Shootaring Mill.

Technical Disclosure

Table 1. Anfield’s existing conventional

uranium-vanadium project portfolio resources.

|

Project |

Location |

Classification |

Tons (kt) |

UraniumGrade(%

U3O8) |

Contained Uranium(Mlbs

U3O8) |

VanadiumGrade(%

V2O5) |

Contained Vanadium(Mlbs

V2O5) |

|

Velvet-Wood |

Utah |

M & I |

811 |

0.29% |

4.6 |

- |

- |

|

|

|

Inferred |

87 |

0.32% |

0.6 |

0.404% |

7.3 |

|

West Slope |

Colorado |

Indicated |

1,367 |

0.197% |

5.4 |

- |

- |

|

|

|

Inferred |

1,367 |

- |

- |

0.984% |

26.9 |

|

|

|

Historic* |

630 |

0.31% |

3.9 |

1.59% |

20.0 |

|

Slick Rock |

Colorado |

Inferred |

1,760 |

0.224% |

7.9 |

1.35% |

47.1 |

|

Frank M |

Utah |

Historic* |

1,137 |

0.101% |

2.3 |

- |

- |

|

Findlay Tank |

Arizona |

Historic* |

211 |

0.226% |

1.0 |

- |

- |

|

Date Creek/Artillery Peak |

Arizona |

Historic* |

2,602 |

0.054% |

2.8 |

|

|

|

Marquez-Juan Tafoya |

New Mexico |

Historic* |

7,100 |

0.127% |

18.1 |

|

|

| |

|

|

|

|

|

|

|

* The Company’s Qualified Person has not done

sufficient work to classify these historic estimates as current

mineral resources and Anfield is not treating such historical

resources as current mineral resources.

Velvet-Wood: The PEA for Velvet-Wood/Slick Rock

was authored by Douglas L. Beahm, P.E., P.G. Principal Engineer, of

BRS Inc., Harold H. Hutson, P.E., P.G., Carl D. Warren, P.E., P.G.,

and Terence P. (Terry) McNulty, P.E., D. Sc., of T.P. McNulty and

Associates Inc. (May 6, 2023). Mineral resources are not mineral

reserves and do not have demonstrated economic viability in

accordance with CIM standards. GT cut-off varies by locality from

0.25%-0.50%.

West Slope: NI 43-101 resource estimate for the

JD-6, JD-7, JD-8 and JD-9 properties, completed by BRS Inc.

(effective March 2022); Historic resource estimate for the SR-11,

SR-13A, SM-18 N, SM-18 S, LP-21 and CM-25 properties, completed by

Behre Dolbear for Cotter Corporation (August 2007). Indicated and

Inferred resources using GT cut-off of 0.1 ft% eU3O8; historic

resources using cut-off of 0.05% U3O8.

Slick Rock: The PEA for Velvet-Wood/Slick Rock

was authored by Douglas L. Beahm, P.E., P.G. Principal Engineer, of

BRS Inc., Harold H. Hutson, P.E., P.G., Carl D. Warren, P.E., P.G.,

and Terence P. (Terry) McNulty, P.E., D. Sc., of T.P. McNulty and

Associates Inc. (May 6, 2023). Mineral resources are not mineral

reserves and do not have demonstrated economic viability in

accordance with CIM standards. GT cut-off varies by locality from

0.25%-0.50%.

Frank M: Historic Technical Report for Frank M,

prepared for Uranium One Americas, was authored by Douglas L.

Beahm, P.E., P.G. Principal Engineer of BRS Inc., and Andrew C.

Anderson, P.E., P.G. Senior Engineer/Geologist of BRS Inc., dated

June 10, 2008. Frank M historic resource used a GT cut-off of

0.25%.

Findlay Tank: Historic Technical Report for

Findlay Tank, prepared for Uranium One Americas, was authored by

Douglas L. Beahm, P.E., P.G. Principal Engineer of BRS Inc., dated

October 2, 2008. Findlay Tank historic resource used a grade

cut-off of 0.05% eU3O8.

Artillery Peak: Artillery Peak Exploration

Project, Mohave County, Arizona, 43-101 Technical Report, authored

by Dr. Karen Wenrich, October 12, 2010. GT cut-off varies by

locality from 0.01%-0.05%.

Marquez-Juan Tafoya: The Historical Technical

Report, Preliminary Economic Assessment, for Marquez-Juan Tafoya,

prepared for Uranium Energy Corporation, was authored by Douglas L.

Beahm, P.E., P.G., Principal Engineer of BRS Inc., and Terence P.

McNulty, P.E., PhD, McNulty & Associates, dated June 9, 2021.

The mineral resources are reported at a 0.60 GT cut-off.

On behalf of the Board of DirectorsANFIELD

ENERGY INC.Corey Dias, Chief Executive Officer

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.Contact:Anfield Energy,

Inc.Clive MostertCorporate

Communications780-920-5044contact@anfieldenergy.comwww.anfieldenergy.com

Safe Harbor Statement

THIS NEWS RELEASE CONTAINS “FORWARD-LOOKING

STATEMENTS”. STATEMENTS IN THIS NEWS RELEASE THAT ARE NOT PURELY

HISTORICAL ARE FORWARD-LOOKING STATEMENTS AND INCLUDE ANY

STATEMENTS REGARDING BELIEFS, PLANS, EXPECTATIONS OR INTENTIONS

REGARDING THE FUTURE.

EXCEPT FOR THE HISTORICAL INFORMATION PRESENTED

HEREIN, MATTERS DISCUSSED IN THIS NEWS RELEASE CONTAIN

FORWARD-LOOKING STATEMENTS THAT ARE SUBJECT TO CERTAIN RISKS AND

UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY

FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR

IMPLIED BY SUCH STATEMENTS. STATEMENTS THAT ARE NOT HISTORICAL

FACTS, INCLUDING STATEMENTS THAT ARE PRECEDED BY, FOLLOWED BY, OR

THAT INCLUDE SUCH WORDS AS “ESTIMATE,” “ANTICIPATE,” “BELIEVE,”

“PLAN” OR “EXPECT” OR SIMILAR STATEMENTS ARE FORWARD-LOOKING

STATEMENTS. RISKS AND UNCERTAINTIES FOR THE COMPANY INCLUDE, BUT

ARE NOT LIMITED TO, THE RISKS ASSOCIATED WITH MINERAL EXPLORATION

AND FUNDING AS WELL AS THE RISKS SHOWN IN THE COMPANY’S MOST RECENT

ANNUAL AND QUARTERLY REPORTS AND FROM TIME-TO-TIME IN OTHER

PUBLICLY AVAILABLE INFORMATION REGARDING THE COMPANY. OTHER RISKS

INCLUDE RISKS ASSOCIATED FUTURE CAPITAL REQUIREMENTS AND THE

COMPANY’S ABILITY AND LEVEL OF SUPPORT FOR ITS EXPLORATION AND

DEVELOPMENT ACTIVITIES. THERE CAN BE NO ASSURANCE THAT THE

COMPANY’S EXPLORATION EFFORTS WILL SUCCEED OR THE COMPANY WILL

ULTIMATELY ACHIEVE COMMERCIAL SUCCESS. THESE FORWARD-LOOKING

STATEMENTS ARE MADE AS OF THE DATE OF THIS NEWS RELEASE, AND THE

COMPANY ASSUMES NO OBLIGATION TO UPDATE THE FORWARD-LOOKING

STATEMENTS, OR TO UPDATE THE REASONS WHY ACTUAL RESULTS COULD

DIFFER FROM THOSE PROJECTED IN THE FORWARD-LOOKING STATEMENTS.

ALTHOUGH THE COMPANY BELIEVES THAT THE BELIEFS, PLANS, EXPECTATIONS

AND INTENTIONS CONTAINED IN THIS NEWS RELEASE ARE REASONABLE, THERE

CAN BE NO ASSURANCE THOSE BELIEFS, PLANS, EXPECTATIONS OR

INTENTIONS WILL PROVE TO BE ACCURATE. INVESTORS SHOULD CONSIDER ALL

OF THE INFORMATION SET FORTH HEREIN AND SHOULD ALSO REFER TO THE

RISK FACTORS DISCLOSED IN THE COMPANY’S PERIODIC REPORTS FILED FROM

TIME-TO-TIME.

THIS NEWS RELEASE HAS BEEN PREPARED BY

MANAGEMENT OF THE COMPANY WHO TAKES FULL RESPONSIBILITY FOR ITS

CONTENTS.

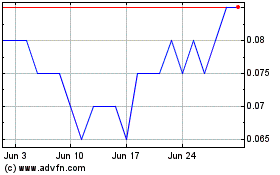

Anfield Energy (TSXV:AEC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Anfield Energy (TSXV:AEC)

Historical Stock Chart

From Nov 2023 to Nov 2024