Arrow Amends and Extends Canacol Promissory Note and Appoints New Director

January 02 2020 - 6:00AM

ARROW Exploration Corp. (“

Arrow” or the

“

Company”) (

TSXV: AXL) is pleased

to announce that it has successfully negotiated an amendment and

extension to its US$5 million promissory note with Canacol Energy

Ltd. (“

Canacol”) (the “

Amended

Note”). Under terms of the Amended Note, Arrow has agreed

to appoint Mr. Anthony Zaidi, VP of Business Development and

General Counsel at Canacol, to the Board of Directors of Arrow to

fill an existing vacancy, subject to regulatory approvals including

the TSX Venture Exchange.

Revised Canacol

Promissory Note Terms

Arrow and Canacol have agreed to a third

amendment and extension to the existing US$5 million Canacol

promissory note, effective December 31, 2019. Under terms of the

Amended Note, as more fully described below, repayment of the

principal and accrued and outstanding interest, which now total

US$5.6 million, has been deferred an additional six months to

commence on April 1, 2021 with the outstanding interest to be paid

in full at that time and the principal to be fully paid in six

monthly installments by September 1, 2021.

The Amended Note provides Arrow with additional

flexibility to manage its long-dated payables while the strategic

alternatives process progresses, with support from Arrow’s

financial advisor, Stifel FirstEnergy.

Key terms under the Amended Note are as

follows:

- On or before April 1, 2021 the Company shall pay in full all

accrued and outstanding interest owing on the principal sum of US$5

million (the “Principal Sum”) from the origination

date of the promissory note to July 31, 2019 being US$628,767 plus

interest on such sum at a rate equal to 15.0% per annum accruing as

of December 31, 2019 until the date of payment (the

“Interim Accrued Interest”).

- Commencing September 1, 2019 and on the first day of each month

thereafter until no further obligations are owing, the Company

shall make interest-only monthly payments equal to the total amount

of the outstanding interest on the Principal Sum and the Interim

Accrued Interest.

- Commencing April 1, 2021 and on the first day of each of the

following six (6) months thereafter the Company shall make equal

monthly payments of the balance of the Principal Sum which remains

outstanding as of April 1, 2021, amortized over such six (6) month

period, such that all remaining obligations are paid in full on or

before September 1, 2021.

- At any time, all or any portion of the obligations then

outstanding, may be prepaid by the Company to Canacol without

penalty or prepayment fee.

- In case of a Change in Control of the Corporation, all of the

Amended Note obligations shall be immediately due and payable to

Canacol. For purposes of the Amended Note, a change in control

means (i) any direct or indirect change in control of the Company

(whether through merger, sale of shares or other equity interest,

or otherwise through a single transaction or series of related

transactions, from one or more transferors to one or more

transferee or (ii) any change in the composition of the board of

directors of the Company where the majority of the current

directors of the Company are replaced (whether at the same time or

separately) at any time within a time period of 12 months from

December 31, 2019. Control means the ownership directly or

indirectly of more than 50% of the voting rights in a legal

entity.

- Until all Amended Note obligations are paid in full, the

Company shall arrange to appoint two (2) Canacol employees of

Canacol´s choice to sit on Arrow’s board of directors at all times.

In the normal course such appointments are subject to approval of

regulatory authorities including the TSX Venture Exchange.

- The general security agreement granted to Canacol as part of

the second amendment to the Canacol promissory note in July 31,

2019 remains in place as updated to reflect linkage to this third

amendment.

- Other terms of the original Canacol promissory note remain

unchanged.

Appointment of New Director

Under terms of the Amended Note, Arrow has

agreed to appoint Mr. Anthony Zaidi, VP Business Development and

General Counsel at Canacol, to the Board of Directors of Arrow to

fill an existing vacancy, subject to regulatory approvals including

the TSX Venture Exchange. With this appointment, Canacol will have

two of its executives on the Arrow Board of Directors also

including Mr. Ravi Sharma, the Chief Operating Officer of Canacol

and a founding director of Arrow. Dr. Luis Baena, a founding

director of Arrow originally nominated by Canacol, is no longer an

employee of Canacol. The Arrow Board of Directors will now include

Mr. Dominic Dacosta (Chair), Dr. Luis Baena, Mr. James McFarland,

Mr. Juan Carlos Salazar, Mr. Ravi Sharma, Mr. Steve Smith and Mr.

Anthony Zaidi.

Mr. Zaidi is a lawyer and businessman with

significant experience in corporate finance and in the mining and

energy sector in Colombia. Prior to joining Canacol, Mr. Zaidi was

the President and General Counsel of Carrao Energy Ltd., a private

oil and gas exploration company he co-founded and co-managed until

its acquisition by the Canacol in November 2011 and in turn by

Arrow in September 2018. Prior to this time, he had been an officer

or director of several private and public companies, including

Integral Oil Services, Pacific Rubiales Energy, Petro Magdalena

Energy, Medora Resources and others, as well as a securities lawyer

at Blake, Cassels & Graydon LLP. Mr. Zaidi holds a Juris Doctor

degree from the University of Toronto as well as a Bachelor of

Commerce (Finance) degree from McGill University.

About ARROW Exploration

Arrow Exploration Corp. (operating in Colombia

via a branch of its 100% owned subsidiary Carrao Energy S.A.) is a

publicly-traded company with a portfolio of premier Colombian oil

assets that are under-exploited, under-explored and offer high

potential growth. The Company’s business plan is to expand oil

production from some of Colombia’s most active basins, including

the Llanos, Middle Magdalena Valley (MMV) and Putumayo Basin. The

asset base is predominantly operated with high working interests,

and the Brent-linked light oil pricing exposure combines with low

royalties to yield attractive potential operating margins. Arrow’s

seasoned team is led by a hands-on and in-country executive team

supported by an experienced board. Arrow is listed on the TSX

Venture Exchange under the symbol “AXL”.

| For

further information contact: |

|

|

|

|

| |

|

|

|

|

|

Felix Betancourt |

|

John

Newman |

|

Eric

Van Enk, CFA |

| Interim

Chief Executive Officer |

|

Chief

Financial Officer |

|

VP Finance

& IR |

|

E: fbetancourt@carraoenergy.com |

|

P: (403)

237-5700 ext.107 |

|

P: (403)

237-5700 ext. 104 |

| |

|

E: jnewman@arrowexploration.ca |

|

E: ericvanenk@arrowexploration.ca |

Neither the TSX Venture Exchange (TSXV)

nor its regulation services provider (as that term is defined in

the policies of the TSXV) accepts responsibility for the adequacy

or accuracy of this release.

Forward-looking Statements

This news release contains certain statements or

disclosures relating to Arrow that are based on the expectations of

its management as well as assumptions made by and information

currently available to Arrow which may constitute forward-looking

statements or information (“forward-looking statements”) under

applicable securities laws. All such statements and disclosures,

other than those of historical fact, which address activities,

events, outcomes, results or developments that Arrow anticipates or

expects may, could or will occur in the future (in whole or in

part) should be considered forward-looking statements. In some

cases, forward-looking statements can be identified by the use of

the words “continue”, “expect”, “opportunity”, “plan”, “potential”

and “will” and similar expressions. The forward-looking statements

contained in this news release reflect several material factors and

expectations and assumptions of Arrow, including without

limitation: approval by regulatory authorities including the TSX

Venture Exchange for Mr. Anthony Zaidi’s appointment to the

Arrow Board of Directors; potential of Arrow’s Colombian assets to

offer high potential growth; and Arrow’s business plan to expand

oil production and achieve attractive potential operating margins.

Arrow believes the expectations and assumptions reflected in the

forward-looking statements are reasonable at this time but no

assurance can be given that these factors, expectations and

assumptions will prove to be correct.

The forward-looking statements included in this

news release are not guarantees of future performance and should

not be unduly relied upon. Such forward-looking statements involve

known and unknown risks, uncertainties and other factors that may

cause actual results or events to differ materially from those

anticipated in such forward-looking statements. The forward-looking

statements contained in this news release are made as of the date

hereof and the Company undertakes no obligations to update publicly

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, unless so required by

applicable securities laws.

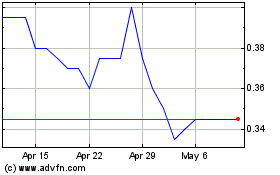

Arrow Exploration (TSXV:AXL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Arrow Exploration (TSXV:AXL)

Historical Stock Chart

From Jan 2024 to Jan 2025