DIVERGENT Energy Services Announces the Release of Q2 2021 Financial Results

August 12 2021 - 8:00AM

DIVERGENT Energy Services Corp.

(“Divergent”, the "

Company", or

“

DVG”

) announces the release of

its financial results for the three and six months ended June 30,

2021. All amounts are in thousands (000’s) of United States

Dollars, unless otherwise noted.

HIGHLIGHTS FOR THE QUARTER

- Revenues of

$1,991, an increase of 427% over Q2 2020.

- Operating income

of ($57) and adjusted EBITDA of ($13) in Q2 2021 as compared to

($316) and ($201) in Q2 2020 demonstrated improved operating

performance year over year.

- Cash flow in the

quarter was sufficient to pay interest on debentures in cash, and

not in shares of the Company as done in previous quarters.

INDUSTRY OUTLOOK

The continuous increases in the oil and gas

commodity prices are expected to increase submersible pump sales

across the United States in 2021. Both markets demonstrated strong

pricing over the 2020/2021 winter months, a trend which has

continued into the third quarter 2021. The amount of work available

for the remainder of the year is dependent on the price of gas and

how each client makes its internal decisions for the use of its

working capital such as improving its balance sheet versus

increasing production.

In the ongoing COVID-19 pandemic, the Company

continues to maintain its health and safety protocols, working from

home when necessary and where practical, and actively monitoring

the health of our employees.

The Company’s largest client has indicated that

it intends to perform workovers for the remainder of the year at a

pace similar to H1 2021, with the expectation that activity could

increase should commodity prices continue on their current

trend.

During the second quarter, the Small Business

Administration (the “SBA”) was accepting applications for

forgiveness of loans under its Paycheck Protection Program (the

“PPP”). As previously announced, the Company anticipates that its

$226 PPP loan will be forgiven as the funds had been used in

accordance with the SBA guidelines for the loan. The Company has

completed its application through its banking institution and has

received notification from the bank that its use of funds meets the

SBA guidelines for forgiveness. The bank has passed the application

on to the SBA for final approval, for which we are still awaiting.

Should the loan receive final approval, its forgiveness will have a

positive impact on the Company’s working capital.

FINANCIAL AND OPERATING HIGHLIGHTS –

THREE AND SIX MONTHS ENDED JUNE 30, 2021

Select Financial Information for the three and

six month period ended June 30, 2021 have been summarized below.

Tables contain first quarter results for 2021 and 2020. Refer to

the Company’s unaudited condensed consolidated financial statements

and related management’s discussion and analysis (“MD&A”) for a

full description.

(All figures in ‘000’s of US dollars except

number of shares and per share data, unless otherwise stated)

Unaudited Interim Condensed Consolidated Statements of

Net Income (Loss) and Comprehensive Income (Loss)

| |

|

Three months ended June 30, |

Six months ended June 30, |

|

|

|

|

2021 |

|

|

2020 |

|

2021 |

|

|

2020 |

| Revenue |

|

|

$1,991 |

|

|

$378 |

|

$3,712 |

|

|

$2,142 |

| Cost of sales |

|

|

(1,678) |

|

|

(203) |

|

(2,961) |

|

|

(1,702) |

| Provision for slow moving

inventory |

|

|

36 |

|

|

- |

|

160 |

|

|

(195) |

| Gross profit |

|

|

349 |

|

|

175 |

|

911 |

|

|

245 |

| General and

administration |

|

|

(397) |

|

|

(439) |

|

(843) |

|

|

(1,062) |

| Depreciation and

amortization |

|

|

(3) |

|

|

(50) |

|

(5) |

|

|

(62) |

| Stock based compensation |

|

|

(6) |

|

|

(2) |

|

(7) |

|

|

(8) |

| Results from operating

activities |

|

|

(57) |

|

|

(316) |

|

56 |

|

|

(887) |

| |

|

|

|

|

|

| Finance (expense) income |

|

|

(251) |

|

|

(550) |

|

1,883 |

|

|

213 |

| Net income

(loss) |

|

|

(308) |

|

|

(866) |

|

1,939 |

|

|

(674) |

| |

|

|

|

|

|

| Other comprehensive income

(loss) |

|

|

95 |

|

|

224 |

|

186 |

|

|

(281) |

| Total comprehensive

income (loss) for the period |

|

|

($213) |

|

|

($642) |

|

$2,125 |

|

|

($955 |

| |

|

|

|

|

|

| Income (loss) per

share |

|

|

|

|

|

| Net income (loss) – basic and

dilutive |

|

|

($0.01) |

|

|

($0.01) |

|

$0.06 |

|

|

($0.01) |

| |

|

|

|

|

|

| |

|

|

|

|

|

Unaudited Interim Condensed Consolidated Statements of

Financial Position

| |

|

June 30, 2021 |

|

|

December 31, 2020 |

| ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash |

|

$403 |

|

$63 |

|

Prepaid expenses, deposits and advances |

|

|

38 |

|

|

77 |

|

Receivables, net of allowance |

|

|

789 |

|

|

975 |

|

Inventories |

|

|

880 |

|

|

1,261 |

| |

|

|

2,110 |

|

|

2,376 |

|

Non-current assets |

|

|

|

|

Property and equipment |

|

|

151 |

|

|

171 |

|

Right-of-use assets |

|

|

589 |

|

|

630 |

| Total

Assets |

|

$2,850 |

|

$3,177 |

|

LIABILITIES |

|

|

|

|

Current liabilities |

|

|

|

|

Accounts payable and accrued liabilities |

|

$1,322 |

|

$1,401 |

|

Current portion of lease obligations |

|

|

191 |

|

|

170 |

|

Interest payable |

|

|

158 |

|

|

91 |

|

Paycheck protection program loan |

|

|

226 |

|

|

53 |

|

Promissory notes |

|

|

357 |

|

|

156 |

|

Debentures |

|

|

- |

|

|

4,356 |

| |

|

$2,254 |

|

|

6,227 |

|

Non-current liabilities |

|

|

|

|

Lease obligations |

|

|

371 |

|

|

452 |

|

Promissory notes |

|

|

2,084 |

|

|

2,300 |

|

Government loan |

|

|

25 |

|

|

186 |

|

Debentures |

|

|

624 |

|

|

- |

| Total

Liabilities |

|

$5,358 |

|

$9,165 |

| SHAREHOLDERS’

DEFICIT |

|

|

|

|

Share capital |

|

$19,613 |

|

$18,364 |

|

Contributed surplus |

|

|

5,807 |

|

|

5,800 |

|

Warrants |

|

|

240 |

|

|

141 |

|

Accumulated other comprehensive loss |

|

|

(859) |

|

|

(1,045) |

|

Accumulated deficit |

|

|

(27,309) |

|

|

(29,248) |

| Total Shareholders’

Deficit |

|

($2,508) |

|

($5,988) |

| Total Liabilities and

Shareholders’ Deficit |

|

$2,850 |

|

$3,177 |

| |

|

|

|

The Company’s complete set of June 30, 2021

quarter end filings have been filed on the SEDAR website at

www.sedar.com and are also available on the Company’s website at

www.divergentenergyservices.com.

For Further Information:

Ken Berg, President and Chief Executive Officer,

kberg@divergentenergyservices.com

Ken Olson, Interim Chief Financial Officer,

ken.olson@divergentenergyservices.com

ABOUT DIVERGENT ENERGY SERVICES CORP.

Headquartered in Calgary, Alberta, Divergent

provides fluids management products and services for the water, gas

and oil industries through its wholly owned subsidiary Extreme Pump

Solutions LLC. Product lines including Electric Submersible Pumps

and the future development of an Electromagnetic Pump

technology.

DIVERGENT Energy Services Corp., 2020, 715 – 5th Ave SW,

Calgary, AB T2P 2X6, (403) 543-0060, (403) 543-0069 (fax),

www.divergentenergyservices.com

FORWARD LOOKING STATEMENTSThis

press release contains forward-looking statements, including,

without limitation, statements pertaining to anticipated future

operational activity levels of Divergent and of a majority of its

customers, and statements pertaining to interest payments on the

Company’s debentures. All statements included herein, other than

statements of historical fact, are forward-looking information and

such information involves various risks and uncertainties,

including: the risk that the anticipated slowdown in sales and

service of submersible pumps by Divergent’s customers lasts longer

than expected or impacts Divergent’s revenues more severely than

expected, the risk that the COVID-19 pandemic and the low oil and

gas price environment cause additional negative effects on

Divergent’s business, the risk that the suspension of trading of

the Company’s common shares by the TSXV cannot be lifted in a

timely manner or at all, and the risk that the Company cannot

remedy the outstanding interest payments under the terms of its

debenture indenture in a timely manner or at all . There can be no

assurance that such information will prove to be accurate, and

actual results and future events could differ materially from those

anticipated in such information. A description of assumptions used

to develop such forward-looking information and a description of

risk factors that may cause actual results to differ materially

from forward-looking information can be found in the Company's

disclosure documents on the SEDAR website at www.sedar.com.

Forward-looking statements are based on estimates and opinions of

management of the Company at the time the information is presented,

including expectations provided to Divergent by its customers. The

Company may, as considered necessary in the circumstances, update

or revise such forward-looking statements, whether as a result of

new information, future events or otherwise, but the Company

undertakes no obligation to update or revise any forward-looking

statements, except as required by applicable securities laws.

This press release contains financial outlook

information ("FOFI") about prospective revenue reductions, which

are subject to the same assumptions, risk factors, limitations, and

qualifications as set forth in the above paragraphs. FOFI contained

in this press release was made as of the date hereof and was

provided for the purpose of providing an update regarding an

anticipated material reduction in near-term revenue. Divergent

disclaims any intention or obligation to update or revise any FOFI

contained in this press release, whether as a result of new

information, future events or otherwise, unless required pursuant

to applicable law. Readers are cautioned that the FOFI contained in

this press release should not be used for purposes other than for

which it is disclosed herein.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

(Not for dissemination in the United States of

America)

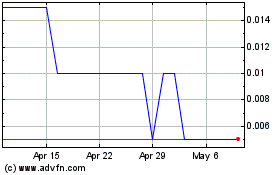

Divergent Energy Services (TSXV:DVG)

Historical Stock Chart

From Nov 2024 to Dec 2024

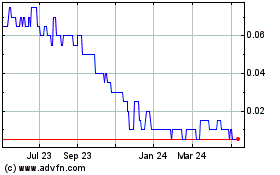

Divergent Energy Services (TSXV:DVG)

Historical Stock Chart

From Dec 2023 to Dec 2024