Edison Lithium

Spin-Out of Cobalt

Assets

Vancouver, British Columbia, Canada -- May 19,

2022 -- InvestorsHub NewsWire

-- Edison

Lithium Corp. (TSXV: EDDY, OTCQB: EDDYF; FSE:

VV00) ("Edison" or

the "Company") is

pleased to announce that its Board

of Directors has unanimously approved a proposed spinout of its

cobalt assets in northeastern Ontario, referred to as the Kittson

Cobalt Property (the "Spin-Out"), into a newly

incorporated subsidiary ("SpinCo"). The Company will

continue to hold its interest in the Antofalla Salar and Pipanaco

Salar lithium projects in Argentina.

It is

proposed that the Spin-Out will be carried out by way of statutory

plan of arrangement (the "Arrangement") pursuant to

the Business Corporations

Act (British Columbia). Common shares of SpinCo (the

"SpinCo

Shares") will be distributed to shareholders of

Edison on the basis of one SpinCo Share for every one common share

of Edison held. There will be no change in Edison shareholders'

holdings in the Company as a result of the Spin-Out. If the

Spin-Out is completed, shareholders will own shares in both

companies - Edison, which will be focused on its Argentinian

lithium brine projects, and SpinCo, which will be focused on cobalt

exploration in Canada. The Company expects the Spin-Out will

increase shareholder value by allowing capital markets to ascribe

value to the Kittson Cobalt Property independent of the Company's

lithium properties and by providing management focus and

concentration.

The

proposed Spin-Out will be subject to the terms of an arrangement

agreement between Edison and SpinCo, the approval of shareholders

at a meeting of Edison shareholders, the approval of the British

Columbia Supreme Court and the approval of the TSX Venture Exchange

(the "Exchange").

The

Company intends to seek a listing of the SpinCo Shares on the

Exchange but no assurance can be provided that such a listing will

be obtained. Listing will be subject to SpinCo fulfilling all of

the requirements of the Exchange.

Nathan Rotstein, Chief Executive Officer of Edison comments,

"It is our intention to build shareholder value by providing

investors with an ownership stake in two separate specialized

companies. Both companies will be in the hot battery metals sector.

Each company will operate as a separate entity and will enjoy

distinction in the exponential growth of the EV market."

In

connection with the Spin-Out, the Company intends to undertake a

private placement ("Private

Placement") of up to 60,000,000 subscription

receipts ("Subscription

Receipts", and each a "Subscription Receipt") priced at

$0.05 per Subscription Receipt in order to raise gross proceeds of

up to $3,000,000 (the "Escrowed Proceeds"), which will

be held in escrow subject to the satisfaction or waiver of certain

customary escrow release conditions (the "Escrow Release Conditions"). Each

Subscription Receipt will entitle the holder thereof to receive,

upon conversion and without any further action on the part of such

holder or payment of any additional consideration, one unit of

SpinCo (a "Unit"), with each Unit comprised

of one (1) SpinCo Share and one common share purchase warrant

(each, a "Warrant"). Each Warrant shall be

exercisable into one (1) SpinCo Share at an anticipated exercise

price of $0.08 per SpinCo Share, for an exercise period of two

years. The conversion of the Subscription Receipts will be subject

to the satisfaction or the Escrow Release Conditions, including the

closing of the Arrangement and the listing of the SpinCo Shares on

the Exchange, on or prior to a date to be determined (the

"Outside

Date"). Upon the satisfaction or waiver of the

Escrow Release Conditions, the Escrowed Proceeds would be released

to SpinCo. Upon receipt thereof, SpinCo is expected to use the

Escrowed Proceeds to fund exploration of the Kittson Cobalt

Property and for general working capital, including, potential

future acquisitions. In the event that the Escrow Release

Conditions are not satisfied prior to the Outside Date, the

Escrowed Proceeds would be returned pro rata to each holder of

Subscription Receipts, and the Subscription Receipts will be

automatically cancelled, void and of no value or effect. The

Subscription Receipts and the SpinCo Shares and Warrants issuable

in exchange for the Subscription Receipts will be subject to a

four-month statutory hold period expiring four months and one day

from the closing date of the Private Placement.

Further details of the Spin-Out and the related Private

Placement will follow by additional press releases. Timing of the

Spin-Out and Private Placement will be based on prevailing market

conditions. The particulars of the Spin-Out and related Private

Placement are not yet final and shareholders are cautioned that

there can be no assurance that the Spin-Out and Private Placement

will be completed on the terms described herein or at

all.

About the Kittson Cobalt

Property

The Kittson Cobalt Property includes three historical

producing Co-Ag mines, namely the Kittson-Cobalt Mine, Shakt-Davis

and Edison (also known as Darby) Mine. These mines, unlike those in

the nearby Cobalt silver camp, were developed primarily for their

cobalt content, and interestingly possessed significant gold

content (locally >1 oz/ton).

To view the National Instrument 43-101 compliant technical

report titled "Technical Report on the Kittson-Cobalt Property"

with a report date of June 9, 2021, and an effective date of July

16, 2021, as prepared by SGS Geological Service and GeoVector

Management Inc. (the "Technical Report"), please visit

Edison's website at www.edisonlithium.com.

The Technical Report is also available under the Company's profile

on SEDAR (www.sedar.com).

About the Antofalla Salar and

Pipanaco Salar Lithium Projects

In

2021, Edison acquired Resource

Ventures S.A., an Argentinian corporation that owns or controls the

rights to over 148,000 hectares (365,708 acres) of prospective

lithium brine claims in the province of Catamarca, Argentina. The

claims are principally located in the two geological basins known

as the Antofalla Salar and the Pipanaco Salar in South America's

famed Lithium Triangle.

The Antofalla

Salar hosts one of the largest lithium-bearing basins in the

region. It is over 130 km long and varies between 5 km and 20 km

across. The Company's assets in and around the Antofalla Salar are

made up of approximately 107,000 hectares (264,397 acres) of

semi-contiguous claims in the northern and southern parts of this

salar.

The Company's

claims in the Pipanaco Salar consist of over 41,000 hectares

(101,311 acres) of core areas in this salar. These properties are

in the very early stages of exploration with minimal surface

samples having been collected to date.

About Edison Lithium

Corp.

Edison Lithium Corp.

is a Canadian-based

junior mining exploration

company focused on

the procurement, exploration and development of

cobalt, lithium, and other energy metal properties. The Company's

acquisition strategy is

based on acquiring

affordable, cost-effective,

and highly regarded

mineral properties in areas with proven

geological potential. Edison is building a portfolio of quality

assets capable of supplying critical materials to the battery

industry and intends to capitalize on and have its shareholders

benefit from the renewed interest in the battery metals

space.

On behalf of

the Board of Directors:

"Nathan Rotstein"

Nathan Rotstein

Chief Executive Officer

and Director

For more information

please contact

Nathan Rotstein:

Tel: 416-526-3217

Email: info@edisonlithium.com

Website: www.edisonlithium.com

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

Forward-Looking

Disclaimer:

This news release

contains certain

forward-looking statements.

Statements that are not historical facts, including

statements about Edison's beliefs and expectations, are forward-

looking statements. Forward-looking statements involve inherent

risks and uncertainties and a number of factors could cause actual

results to differ materially from those contained in any

forward-looking statement. In some

cases, forward-looking

statements can be

identified by words

or phrases such

as "may," "will," "will be", "expect,"

"anticipate," "target," "aim," "estimate," "intend," "plan,"

"believe," "potential," "continue,", "proposes", "contemplates",

"is/are likely to" or other similar expressions. All information

provided in this news release is as of the date of this news, and

the Company undertakes no duty to update such information, except

as required under applicable law.

Forward-looking statements in this press release relate to,

among other things: the incorporation of SpinCo, completion of the

proposed Spin-Out, the completion of the proposed Private

Placement, the Company maintaining its interest in the Antofalla

Salar and Pipanaco Salar properties, distribution of SpinCo Shares

to Edison shareholders and the basis of such distribution, no

changes occurring to Edison shareholders' holdings, the receipt of

required shareholder, court, stock exchange and regulatory

approvals for the Spin-Out and Private Placement, listing of the

SpinCo Shares on the Exchange, increases to shareholder value as a

result of the Spin-Out, the timing of the Spin-Out and related

Private Placement transactions, and the timing of additional

details concerning the Spin-Out and Private Placement. Actual

future results may differ materially. There can be no assurance

that such statements will prove to be accurate, and actual results

and future events could differ materially from those anticipated in

such statements. Forward-looking statements reflect the beliefs,

opinions and projections of management on the date the statements

are made and are based upon a number of assumptions and estimates

that, while considered reasonable by the respective parties, are

inherently subject to significant business, economic, competitive,

political and social uncertainties and contingencies. Many factors,

both known and unknown, could cause actual results, performance or

achievements to be materially different from the results,

performance or achievements that are or may be expressed or implied

by such forward-looking statements and the parties have made

assumptions and estimates based on or related to many of these

factors. Such factors include, without limitation: determination of

acceptable terms for the proposed Spin-Out, receipt of all required

shareholder, court, stock exchange and regulatory approvals for the

Spin-Out; changes in the value of the Kittson Cobalt, Antofalla

Salar, and Pipanaco Salar properties; fluctuations in the

securities markets, commodity pricing and the market price of the

Company's common shares and CSE approval for listing of the SpinCo

Shares. Readers should not place undue reliance on the

forward-looking statements and information contained in this news

release concerning these times. Except as required by law, the

Company does not assume any obligation to update the

forward-looking statements of beliefs, opinions, projections, or

other factors, should they change, except as required by

law.

We seek Safe Harbour.

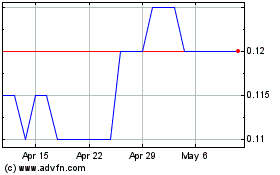

Edison Lithium (TSXV:EDDY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Edison Lithium (TSXV:EDDY)

Historical Stock Chart

From Feb 2024 to Feb 2025