G2 Goldfields Inc. (“

G2” or the

“

Company”) (TSXV: GTWO; OTCQX: GUYGF) is pleased

to announce an updated Mineral Resource Estimate

(“

MRE” or “

Resource”) within the

Company’s 27,719-acre OKO project, Guyana. The updated MRE is

comprised of a discrete high-grade resource for the Oko Main Zone

(OMZ) and a disseminated bulk mineable resource for the Ghanie

Zone. Total contained gold increased by 69% to

2.0 million

ounces. Total indicated gold increased by 320% to 922,000

ounces.

The total combined open pit and underground Resource reported in

the MRE for the OMZ includes 686,000

ounces (oz) of gold (Au) in

Indicated Resource contained within 2.36 million

tonnes (Mt) grading 9.03 grams per tonne (g/t) Au,

with an additional 495,000 oz of gold in Inferred

Resources, contained within 2.41 Mt grading 6.38

g/t Au.

The total combined open pit and underground Resource reported in

the MRE for the Ghanie Zone includes

236,000 ounces (oz) of gold (Au)

in Indicated Resource contained

within 3.34 million tonnes (Mt) grading

2.20 grams per tonne (g/t) Au, with an additional

604,000 oz of gold in Inferred

Resources, contained within 12.22 Mt grading 1.54

g/t Au.

The MRE was prepared by Micon International Limited with an

effective date of March 27, 2024.

Patrick Sheridan, Executive Chairman, comments, “The OMZ has

proven to yield exceptional high grade at mineable widths as we

drill deeper, and Ghanie is taking shape to be highly complementary

to the OKO gold system. We will continue to aggressively explore

the Oko to Aremu trend and anticipate an updated resource in

Q4.”

Ghanie Zone Maiden MRE

This Maiden Mineral Resource Estimate at Ghanie signifies a

major shift towards realising the district-scale nature of the OKO

gold system. The Ghanie Zone represents a disseminated bulk

mineable and open-pittable deposit which strongly complements the

adjacent high-grade underground deposit at the OMZ.

Ghanie South (GS), Central (GC), and North (GN) all remain open

with substantial depth potential. A recent high-grade discovery at

Ghanie North (GDD-93) returned 24.5m @ 5.3 g/t Au from 124 metres

downhole (including 4.5m @ 25.2 g/t Au from 134.5m). This intercept

is indicative of additional near surface mineralization and there

is much evidence to suggest the potential for further zones to be

discovered along the 1.75-kilometre strike.

OMZ Updated MRE

Since April 2022, the Oko Main Zone (OMZ) has been further

defined with additional Indicated resources confirmed. The OMZ is

characterised by shear vein hosted mineralization with

spectacularly high grade. Notably, the Shear 5 Indicated

Underground Resource averages 15.78 g/t Au. The Resource at the OMZ

has been diluted to a minimum mining width of 2 metres.

Exploration Update

The Company’s geological model is evolving and becoming more

predictive, leading to regular discoveries along the

20-kilometre-long Oko-Aremu trend. Approximately 500 metres to the

North-West of the OMZ lies the recent NW OKO discovery where

NWOD-22 intercepted 15.0m @ 6.3 g/t [See Press Release dated

February 13, 2024]. The company will be introducing an additional

drill rig at NW OKO.

The Company’s mandate is to add value through additional

discoveries to complement the continuing expansion of the OMZ and

Ghanie resource with a focused on exploring near surface

mineralization. In April 2024, the Company is to commence drilling

at Tracy, located a further 5-kilometres along strike.

Subsequently, G2 will initiate drilling at Aremu.

Dan Noone, CEO, comments, “the updated MRE provides an excellent

platform from which to continue district wide target definition and

drill programs in parallel with resource expansion at OMZ and

Ghanie.” To this end, the Company is targeting a further resource

estimate update in Q4 2024.

Table 1 – Summary of

Mineral Resource Estimate

|

Deposit |

Mining Method |

Category |

Zone |

Tonnage |

Gold Avg. Grade |

Contained Gold |

|

t |

g/t |

oz |

|

Oko (OMZ) |

Surface (OP) |

Indicated |

S1 |

110,000 |

1.04 |

4,000 |

|

S2S |

7,000 |

0.78 |

200 |

|

S3 |

225,000 |

1.84 |

13,000 |

|

S4 |

75,000 |

4.71 |

11,000 |

|

Total Indicated |

417,000 |

2.12 |

28,000 |

|

Inferred |

S1 |

19,000 |

1.42 |

1,000 |

|

S3 |

40,000 |

0.68 |

1,000 |

|

S4 |

66,000 |

0.89 |

2,000 |

|

S5 |

282,000 |

1.07 |

10,000 |

|

Total Inferred |

406,000 |

1.02 |

14,000 |

|

|

|

|

Underground (UG) |

Indicated |

S1 |

124,000 |

2.29 |

9,000 |

|

S3 |

1,043,000 |

8.64 |

290,000 |

|

S4 |

348,000 |

12.52 |

140,000 |

|

S5 |

432,000 |

15.78 |

219,000 |

|

Total Indicated |

1,947,000 |

10.51 |

658,000 |

|

Inferred |

S1 |

309,000 |

2.26 |

22,000 |

|

S3 |

923,000 |

5.17 |

153,000 |

|

S4 |

18,000 |

10.93 |

6,000 |

|

S5 |

758,000 |

12.28 |

299,000 |

|

Total Inferred |

2,007,000 |

7.46 |

480,000 |

|

|

|

|

OP + UG |

Total Indicated |

2,364,000 |

9.03 |

686,000 |

|

Total Inferred |

2,413,000 |

6.38 |

495,000 |

|

|

|

Ghanie |

Surface (OP) |

Indicated |

GC |

2,633,000 |

2.17 |

183,000 |

|

GS |

711,000 |

2.34 |

53,000 |

|

Total Indicated |

3,344,000 |

2.20 |

236,000 |

|

Inferred |

GN |

4,886,000 |

0.89 |

140,000 |

|

GC |

4,612,000 |

1.49 |

222,000 |

|

GS |

1,318,000 |

2.69 |

114,000 |

|

Total Inferred |

10,816,000 |

1.37 |

476,000 |

|

|

Underground (UG) |

Inferred |

GC |

1,384,000 |

2.85 |

127,000 |

|

GS |

15,000 |

2.93 |

1,000 |

|

Total Inferred |

1,400,000 |

2.86 |

128,000 |

|

OP + UG |

Total Indicated |

3,344,000 |

2.20 |

236,000 |

|

Total Inferred |

12,216,000 |

1.54 |

604,000 |

| |

|

|

|

|

|

|

Notes:

- The effective

date of this Mineral Resource Estimate is March 27, 2024.

- The MRE

presented above uses economic assumptions for both, surface mining

in saprolite and fresh rock and underground mining on fresh rock

only.

- The MRE has been

classified in the Indicated and Inferred categories following

spatial continuity analysis and geological confidence.

- The calculated

gold cut-off grades to report the MRE for surface mining are 0.33

g/t Au in saprolite, 0.39 g/t Au in fresh rock and for underground

mining is 1.80 g/t Au in fresh rock.

- The economic

parameters used a gold price of US$1,900/oz with a single

metallurgical recovery of 85%, a mining cost of US$2.5/t in

saprolite, US$2.75/t in fresh rock and US$75.0/t in underground.

Processing cost of US$12/t for saprolite and US$15/t for fresh rock

and a General and Administration cost of US$2.5/t.

- For surface

mining the open pits at Oko and Ghanie use slope angles of 30° in

saprolite and 50° in fresh rock.

- The MRE has been

classified in the Indicated and Inferred categories following

spatial continuity analysis and geological confidence.

- The block models

for Oko and Ghanie are orthogonal and use a parent block size of 10

m x 3 m x 10 m with the narrow side across strike (East-West) and a

minimum child block of 2 m x 0.5 m x 1 m.

- The open pit

optimization uses a re-blocked size of 10 m x 9 m x 10 m and for

the underground optimization uses stopes of 20 m long by 20 m high

and a minimum mining width of 2 m.

- The mineral

resources described above have been prepared in accordance with the

Canadian Institute of Mining, Metallurgy and Petroleum Standards

and Practices.

- Messrs. Alan J.

San Martin, MAusIMM(CP) and William J. Lewis, P.Geo. from Micon

International Limited are the Qualified Persons (QPs) for this

Mineral Resource Estimate (MRE).

- Numbers have

been rounded to the nearest thousand and differences may occur in

totals due to rounding.

- Mineral

resources are not mineral reserves as they have not demonstrated

economic viability. The quantity and grade of reported Indicated

and Inferred mineral resources in this news release are uncertain

in nature and there has been insufficient exploration to define any

measured resource; however, it is reasonably expected that a

significant portion of inferred mineral resources could be

upgraded into indicated mineral resources with further

exploration.

- The QPs are not

aware of any known environmental, permitting, legal, title-related,

taxation, socio-political, marketing or other relevant issue that

could materially affect the mineral resource estimate.

Figure 1. – Oko Project Long

Section Looking West

Figure 2. – Oko Project Vertical

Section Looking North

A plan view of the Oko and Ghanie Zones is available

here.

Data validation

The drilling database used to estimate the Mineral Resources

reported in this press release was reviewed by Micon International

Limited. A site visit was conducted by Alan J. San Martin,

MAusIMM(CP), to inspect mineralized intervals, alteration

assemblages and QA/QC protocols and to conduct field checks of

trenches and to validate drill collars. Database verifications

consisted of drill logs (including lithology, alteration,

weathering), assay certificates, sample intervals, drill hole

collars, downhole survey information and QA/QC results

validations.

QA/QC

Drill core is logged and sampled in a secure core storage

facility located on the OKO project site, Guyana. Core samples from

the program are cut in half, using a diamond cutting saw, and are

sent to MSALABS Guyana, in Georgetown, Guyana, which is an

accredited mineral analysis laboratory, for analysis. Samples from

sections of core with obvious gold mineralisation are analysed for

total gold using an industry-standard 500g metallic screen fire

assay (MSALABS method MSC 550). All other samples are analysed for

gold using standard Fire Assay-AA with atomic absorption finish

(MSALABS method; FAS-121). Samples returning over 10.0 g/t gold are

analysed utilizing standard fire assay gravimetric methods (MSALABS

method; FAS-425). Certified gold reference standards, blanks, and

field duplicates are routinely inserted into the sample stream, as

part of G2 Goldfield’s quality control/quality assurance program

(QAQC). No QA/QC issues were noted with the results reported

herein.

Technical Report and Qualified Person

The Company intends to file a technical report to support the

updated MRE on sedarplus.ca within 45 days of this news release in

accordance with National Instrument 43-101 – Standard of Disclosure

of Mineral projects (“NI 43-101”).

All scientific and technical information in this news release

has been reviewed and approved by Dan Noone (CEO of G2 Goldfields

Inc.), a “qualified person” within the meaning of National

Instrument 43-101. Mr. Noone (B.Sc. Geology, MBA) is a Fellow of

the Australian Institute of Geoscientists.

About MiconMicon’s Qualifications and

QPs

Micon International Limited (“Micon”) is a firm of senior

geological, mining, metallurgical and environmental consultants

headquartered in Toronto, Canada with an office in the United

Kingdom. The professionals of Micon have extensive experience in

mineral resource estimation. Micon’s practice is worldwide and

covers all base and precious metals. The firm’s clients include

major and junior mining companies, all the major Canadian banks and

investment houses and a large number of financial institutions in

other parts of the world, including developmental financial

institutions and export credit agencies. Micon’s technical, due

diligence and valuation reports are accepted by regulatory agencies

such as the US Securities and Exchange Commission, the Ontario

Securities Commission, the Australian Stock Exchange, and the

London Stock Exchange.

Qualified Persons for the Technical Report

Mineral Resources are estimated by Alan San Martin, MAusIMM(CP)

and William J. Lewis, P.Geo, consultants of Micon with more than 20

years’ experience in mineral exploration, resource estimation and

mining, including in South America and Canada. Both are considered

“Qualified Persons” for the purposes of National Instrument 43-101

– Standards of Disclosure for Mineral Projects (“NI 43-101”) and

have reviewed and approved the scientific and technical disclosure

contained in this news release. The Qualified Persons have verified

the data underlying the MRE contained in this news release. There

were no limitations imposed on the Qualified Persons for

verification of the data.

About G2 Goldfields Inc.

The G2 Goldfields team is comprised of professionals who have

been directly responsible for the discovery of millions of ounces

of gold in Guyana as well as the financing and development of the

Aurora Gold Mine, Guyana’s largest gold mine. The Oko district has

been a prolific alluvial goldfield since its initial discovery in

the 1870’s, and modern exploration techniques continue to reveal

the considerable potential of the district.

Additional information about the Company is available on

SEDAR (www.sedar.com) and the

Company's website

(www.g2goldfields.com).

For further information, please contact: Dan

NooneCEO +1 416.628.5904news@g2goldfields.com

Forward-Looking Statements

This news release contains certain forward-looking statements,

including, but not limited to, statements about the Strategic

Investment, including the proposed use of proceeds and final TSXV

approval. Wherever possible, words such as “may”, “will”, “should”,

“could”, “expect”, “plan”, “intend”, “anticipate”, “believe”,

“estimate”, “predict” or “potential” or the negative or other

variations of these words, or similar words or phrases, have been

used to identify these forward-looking statements. These statements

reflect management’s current beliefs and are based on information

currently available to management as at the date hereof.

Forward-looking statements involve significant risk,

uncertainties and assumptions. Many factors could cause actual

results, performance or achievements to differ materially from the

results discussed or implied in the forward-looking statements.

These factors should be considered carefully and readers should not

place undue reliance on the forward-looking statements. Although

the forward-looking statements contained in this news release are

based upon what management believes to be reasonable assumptions,

the Company cannot assure readers that actual results will be

consistent with these forward-looking statements. The Company

assumes no obligation to update or revise them to reflect new

events or circumstances, except as required by law.

Cautionary Note on Mineral Resources

This press release contains the terms “Inferred” and “Indicated”

mineral resources. Investors are cautioned not to assume that any

part or all of the Inferred and Indicated Mineral Resources

reported in this press release are or will be economically or

legally mineable. Investors are also cautioned not to assume that

all or any part of mineral deposits in the Inferred and Indicated

Resource categories will ever be converted into a higher category

of Mineral Resources or into Mineral Reserves. Under Canadian

rules, estimates of inferred Mineral Resources may not form the

basis of feasibility studies. The Mineral Resources set out in this

news release are estimates, and no assurance can be given that the

anticipated tonnages and grades will be achieved or that the

Indicated level of recovery will be realized.

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

Photo accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/ab06df2e-7700-4d29-a6b9-7c1189e4e46b

https://www.globenewswire.com/NewsRoom/AttachmentNg/f84279a8-82ff-4b53-a45c-3607b2bfa72e

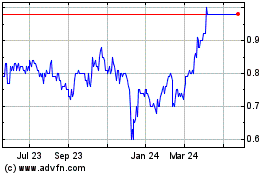

G2 Goldfields (TSXV:GTWO)

Historical Stock Chart

From Nov 2024 to Dec 2024

G2 Goldfields (TSXV:GTWO)

Historical Stock Chart

From Dec 2023 to Dec 2024