Mayfair Gold Increases Private Placement Financing

October 25 2023 - 5:00PM

Mayfair Gold Corp. (“

Mayfair” or the

“

Company”) (

TSX-V: MFG; OTCQB:

MFGCF) today announced that the previously announced

non-brokered private placement financing of common shares has been

increased from $5 million to $6.05 million due to strong demand.

The Company announced

on October 10, 2023, that it had arranged a non-brokered private

placement financing of 2,381,000 common shares (the

“Shares”) at a price per Share of $2.10 for gross

proceeds of approximately $5 million, and a concurrent non-brokered

private placement financing of 2,040,000 common shares on a

flow-through basis (the “FT Shares”) at a price

per FT Share of $2.94 (together the “Offering”)

for gross proceeds of approximately $6 million.

Under the increased

Offering, the Company will issue 2,881,000 Shares at a price per

Share of $2.10 for gross proceeds of approximately $6.05 million.

The aggregate gross proceeds of the Offering are expected to be

approximately $12.05 million.

Proceeds of the Offering will be used to further

exploration, and metallurgical and engineering studies at the

Fenn-Gib gold project in the Timmins region of Ontario. A portion

of net proceeds of the Share issuance will be reserved for working

capital.

Shares issued under the Offering will be subject

to a four-month hold period. The Offering is expected to close on

or about November 2, 2023, and is subject to customary closing

conditions, including TSX Venture Exchange acceptance.

This press release is not an offer of common

shares for sale in the United States. The Shares may not be offered

or sold in the United States absent registration or an available

exemption from the registration requirements of the US. Securities

Act of 1933, as amended (the "U.S. Securities Act") and applicable

U.S. state securities laws. Mayfair will not make any public

offering of the Shares in the United States. The Shares have not

been and will not be registered under the U.S. Securities Act, or

any state securities laws.

About Mayfair

Mayfair Gold is a

Canadian mineral exploration company focused on advancing the 100%

controlled Fenn-Gib gold project in the Timmins region of Northern

Ontario. The Fenn-Gib gold deposit is Mayfair’s flagship asset and

currently hosts an updated NI 43-101 resource estimate with an

effective date of April 6, 2023 with a total Indicated Resource of

113.69M tonnes containing 3.38M ounces at a grade of 0.93 g/t Au

and an Inferred Resource of 5.72M tonnes containing 0.16M ounces at

a grade of 0.85 g/t Au at a 0.40 g/t Au cut-off grade (Source: Tim

Maunula, P. Geo., of T. Maunula & Associates Consulting Inc.,

who is deemed a qualified person as defined by NI 43-101). The

Fenn-Gib deposit has a strike length of over 1.5km with widths

ranging over 500m. The gold mineralized zones remain open at depth

and along strike to the east and west. Recently completed

metallurgical tests confirm that the Fenn-Gib deposit can deliver

robust gold recoveries of up to 94%.

For further information contact:

Patrick Evans, President and CEOEmail:

patrick@mayfairgold.caPhone: (480) 747-3032Web:

www.mayfairgold.ca

Forward Looking Statements

This news release contains forward-looking

statements and forward-looking information within the meaning of

Canadian securities legislation (collectively,

"forward-looking statements") that relate to

Mayfair’s current expectations and views of future events. Any

statements that express, or involve discussions as to,

expectations, beliefs, plans, objectives, assumptions or future

events or performance (often, but not always, through the use of

words or phrases such as "will likely result", "are expected to",

"expects", "will continue", "is anticipated", "anticipates",

"believes", "estimated", "intends", "plans", "forecast",

"projection", "strategy", "objective" and "outlook") are not

historical facts and may be forward-looking statements and may

involve estimates, assumptions and uncertainties which could cause

actual results or outcomes to differ materially from those

expressed in such forward-looking statements. No assurance can be

given that these expectations will prove to be correct and such

forward-looking statements included in this news release should not

be unduly relied upon. These statements speak only as of the date

of this news release.

Forward-looking statements are based on a number

of assumptions and are subject to a number of risks and

uncertainties, many of which are beyond Mayfair’s control, which

could cause actual results and events to differ materially from

those that are disclosed in or implied by such forward-looking

statements. Such risks and uncertainties include, but are not

limited to, the impact and progression of the COVID-19 pandemic and

other factors. Mayfair undertakes no obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by law. New factors emerge from time to time, and it is not

possible for Mayfair to predict all of them, or assess the impact

of each such factor or the extent to which any factor, or

combination of factors, may cause results to differ materially from

those contained in any forward-looking statement. Any

forward-looking statements contained in this news release are

expressly qualified in their entirety by this cautionary

statement.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

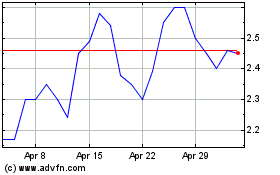

Mayfair Gold (TSXV:MFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

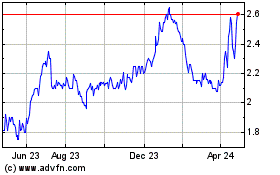

Mayfair Gold (TSXV:MFG)

Historical Stock Chart

From Apr 2023 to Apr 2024