ProntoForms Reports Q3 2021 Financial Results

November 04 2021 - 6:00AM

ProntoForms Corporation (TSXV: PFM), the global leader in

field-focused low-code application platforms for enterprise,

announced today its third quarter (Q3) financial results for the

period ended September 30, 2021.

“We are pleased to report that our Annual

Recurring Revenue Base (ARR) increased by 3.2% in the 2021 third

quarter following increases of 4.7% and 4.2% in the first and

second quarters. The Q3 growth in bookings was reduced by

approximately 1.1% caused by a discontinuation of our Mexico

operator reseller agreement. Our base is now $19.2 million and

overall customer usage continues to be resilient with 41% of our

base from customers with greater than $100,000 of ARR. We continue

to steadily add new, large customer logos with good expansion

profiles,” said Alvaro Pombo, Founder and Chief Executive

Officer.

Mr. Pombo continued, “We are encouraged by the

continued steady growth in net bookings and enterprise

opportunities. Our platform continues to provide value to

world-class enterprise organizations thanks to our continued

investment in vertical product solutions, platform capabilities,

and enterprise go-to-market. This quarter was marked by our user

conference, EMPOWER’21 - sessions featured Fortune 500 field

service leaders, Service Council and ServiceMax, industry analysts,

and ProntoForms product experts. During this event, ProntoForms’

new customer community was also announced and officially

launched.”

“The number and pedigree of enterprise customers

here at Prontoforms is impressive and through personal discussions

they are very pleased with how the solution meets their business

requirements, especially in the field,” said Mike Kramer, Chief

Revenue Officer. “We have enormous potential for geographic and

use-case expansion for these existing and new enterprise customers

that continue to come onboard and often see hard ROI in excess of

100% within the first year.”

Financial Highlights – 2021 Third

Quarter

- Recurring revenue in Q3 2021

increased by 15% to $4.66 million compared to $4.06 million in Q3

2020, and increased by 2% compared to $4.55 million in Q2

2021.

- Total revenue for Q3 2021 increased

by 8% to $4.89 million compared to $4.55 million in Q3 2020, and

increased by 1% compared to $4.84 million in Q2 2021.

- Gross margin for Q3 2021 was 84% of total revenue compared to

82% in Q3 2020 and 85% in Q2 2021. Gross margin on recurring

revenue was 89% for Q3 2021 compared to 91% in Q3 2020 and 90% in

Q2 2021.

- Operating loss for Q3 2021 was

$1.00 million, up from an operating loss of $0.49 million in Q3

2020 and down from an operating loss of $1.07 million in Q2

2021.

- Net loss for Q3 2021 was $1.11

million, up from a net loss of $0.61 million in Q3 2020 and

remained flat from a net loss of $1.12 million in Q2 2021.

- As at September 30, 2021,

ProntoForms’ cash and net working capital balances were $6.51

million and $3.20 million respectively, compared to $7.75 million

and $5.10 million as at December 31, 2020.

Recent Operational Highlights

- Notable new and expansion progress from enterprise customers,

including:

- A Fortune 500 oil & gas company deployed ProntoForms in

partnership with a leading EHS and quality solution to 700 field

technicians to support their asset compliance and leak inspection

workflows.

- A Fortune 500 energy supplier deployed ProntoForms to their

technicians to achieve step-by-step delivery workflows, transparent

customer service, and report generation capabilities.

- A Fortune 500 building material supplier expanded their

commitment to ProntoForms by over 150 subscriptions. They use

ProntoForms for quality and safety inspections with data collection

that fuels operational analytics.

- A global leader in fuel storage deployed ProntoForms to support

their QA inspections and asset management workflows. ProntoForms is

connected to their field service management platform.

- ProntoForms EMPOWER’21 user conference occurred on September

1st, with over 700 registrants for the digital event.

- New features and improvements to the ProntoForms platform,

including:

- Data Routing that provides simple tools to process complex data

that flows into a form and to use it to run the business logic in

that form, automating as much of the process in the field as

possible.

- Mobile search enhancements including additional search

parameters and a Recent Searches list to increase the efficiency of

our mobile search capabilities.

- ProntoForms Teamwork Direct Transfer that enables a mobile user

to transfer a partially completed form to the user of their

choosing with the form appears in that person’s inbox.

ProntoForms will hold a conference call on

November 4th, at 9:00am EST hosted by CEO Alvaro Pombo and CFO Dave

Croucher. A question and answer session will follow.

Date: Thursday, November 4th, 2021Time: 9:00 AM Eastern Time

Participant Dial-in Numbers:Local Toronto – (+1)

647-792-1240Toll Free – (+1) 866-269-4262Conference ID: 7363323

Recording Playback Numbers:Local Toronto– (+1) 647-436-0148Toll

Free – (+1) 888-203-1112Passcode: 7363323Expiry Date: November

11th, 2021 at 11:59pm EST

A live audio webcast and archive of the

conference call will be available by visiting the Company’s website

at www.prontoforms.com/company/investor-relations. Please connect

at least 15 minutes prior to the conference call to ensure time for

any software download that may be needed to hear the webcast.

About ProntoForms Corporation

ProntoForms is the global leader in field-focused low-code

application platforms for enterprise. The Company's solution is

used to create apps and forms to collect and analyze field data

with smartphones and tablets – either as a standalone solution or

as a mobile front-end to enterprise systems of record.

The Company’s 100,000+ subscribers harness the intuitive,

secure, and scalable solution to increase productivity, improve

quality of service, and mitigate risks. The Company is based in

Ottawa, Canada, and trades on the TSXV under the symbol PFM.

ProntoForms is the registered trademark of ProntoForms Inc., a

wholly owned subsidiary of ProntoForms Corporation.

For additional information, please contact:

|

Alvaro PomboChief Executive Officer ProntoForms Corporation

613.599.8288 ext. 1111 apombo@prontoforms.com |

Babak PedramInvestor RelationsVirtus Advisory Group

Inc.416-644-5081bpedram@virtusadvisory.com |

Certain information in this press release may

constitute forward-looking information. For example, statements

about the Company’s future growth or value, the potential for

geographic and use-case expansion these existing and new enterprise

customers, ROI levels experienced by customers and anticipated

market trends are forward-looking information. This information is

based on current expectations that are subject to significant risks

and uncertainties that are difficult to predict. Actual results

might differ materially from results suggested in any

forward-looking statements. The Company’s business and value may

not grow as anticipated or at all, its partnering strategy may not

generate increasing lead flow or maintain current lead flow levels

and anticipated market trends may not occur or continue. Historical

growth levels and results may not be indicative of future growth

levels or results. The Company assumes no obligation to update the

forward-looking statements, or to update the reasons why actual

results could differ from those reflected in the forward

looking-statements unless and until required by securities laws

applicable to the Company. Annual Recurring Revenue Base is a key

performance indicator used by the Company which does do not have a

definition in IFRS and may be calculated in a manner different from

similar key performance indicators used by other companies. Please

refer to the Company’s most recent management discussion and

analysis available at www.sedar.com for a discussion of the

Company’s use and method of calculation of key performance

indicators such as Annual Recurring Revenue Base. There are a

number of risk factors that could cause future results to differ

materially from those described herein. Please see “Risk

Factors Affecting Future Results” in the Company’s annual

management discussion and analysis dated March 16, 2018 found at

www.sedar.com for a discussion of such factors.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

|

PRONTOFORMS CORPORATION |

|

|

|

|

|

|

| Condensed Interim

Consolidated Statements of Income (Loss) and Comprehensive Income

(Loss) |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| For the three and

nine months ended September 30 2021 and 2020 |

|

|

|

|

|

|

|

|

| (in US

dollars) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

|

|

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

| |

Recurring

revenue |

$ |

4,663,400 |

|

|

4,056,073 |

|

$ |

13,520,106 |

|

|

11,888,948 |

|

| |

Professional and

other services |

|

229,114 |

|

|

494,364 |

|

|

826,918 |

|

|

1,066,547 |

|

| |

|

|

|

|

4,892,514 |

|

|

4,550,437 |

|

|

14,347,024 |

|

|

12,955,495 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue

(1): |

|

|

|

|

|

|

|

|

|

|

Recurring

revenue |

|

490,935 |

|

|

370,730 |

|

|

1,336,320 |

|

|

968,395 |

|

|

|

Professional and

other services |

|

278,464 |

|

|

450,433 |

|

|

853,217 |

|

|

964,533 |

|

| |

|

|

|

|

769,399 |

|

|

821,163 |

|

|

2,189,537 |

|

|

1,932,928 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

margin |

|

|

4,123,115 |

|

|

3,729,274 |

|

|

12,157,487 |

|

|

11,022,567 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

|

|

|

|

Research and

development (1) |

|

1,662,040 |

|

|

1,480,276 |

|

|

5,354,452 |

|

|

3,823,516 |

|

| |

Selling and

marketing (1) |

|

2,647,524 |

|

|

1,991,105 |

|

|

7,316,475 |

|

|

5,402,342 |

|

| |

General and

administrative (1) |

|

810,781 |

|

|

750,383 |

|

|

2,616,034 |

|

|

2,179,434 |

|

| |

|

|

|

|

5,120,345 |

|

|

4,221,764 |

|

|

15,286,961 |

|

|

11,405,292 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income

(loss) from operations |

|

(997,230 |

) |

|

(492,490 |

) |

|

(3,129,474 |

) |

|

(382,725 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign exchange

(loss) gain |

|

(89,495 |

) |

|

(14,221 |

) |

|

(128,442 |

) |

|

108,884 |

|

| Finance costs |

|

|

(28,165 |

) |

|

(103,000 |

) |

|

(86,401 |

) |

|

(296,094 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) and comprehensive income (loss) |

$ |

(1,114,890 |

) |

|

(609,711 |

) |

$ |

(3,344,317 |

) |

|

(569,935 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss)

and comprehensive income (loss) |

|

|

|

|

|

|

|

|

| |

per common share

basic and diluted |

$ |

(0.01 |

) |

|

(0.01 |

) |

$ |

(0.03 |

) |

|

(0.00 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of common shares |

|

|

|

|

|

|

|

|

|

|

basic and

diluted |

|

125,918,010 |

|

|

117,666,390 |

|

|

125,231,045 |

|

|

118,536,260 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Amounts

include share-based compensation expense as follows: |

|

|

|

|

| |

|

|

|

|

|

|

| Cost of

revenue |

$ |

7,047 |

|

$ |

11,823 |

|

$ |

10,261 |

|

$ |

41,520 |

|

| Research and

development |

|

32,481 |

|

|

46,455 |

|

|

115,347 |

|

|

98,373 |

|

| Selling and

marketing |

|

60,712 |

|

|

38,762 |

|

|

101,039 |

|

|

107,587 |

|

| General

and administrative |

|

76,633 |

|

|

50,975 |

|

|

226,001 |

|

|

146,804 |

|

|

Total share-based compensation expense |

$ |

176,873 |

|

$ |

148,015 |

|

$ |

452,648 |

|

$ |

394,284 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

PRONTOFORMS CORPORATION |

|

|

|

|

|

| Condensed Interim

Consolidated Statements of Financial Position |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| September 30, 2021

and December 31, 2020 |

|

|

|

|

|

| (in US

dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

September 30, |

|

|

|

December 31, |

|

|

|

|

|

|

|

2021 |

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

| |

Cash and cash

equivalents |

$ |

6,512,069 |

|

|

$ |

7,747,542 |

|

| |

Accounts

receivable |

|

2,568,265 |

|

|

|

3,333,139 |

|

| |

Investment tax

credits receivable |

|

175,525 |

|

|

|

117,092 |

|

|

|

Unbilled

receivables |

|

123,721 |

|

|

|

235,518 |

|

| |

Related party loan

receivable |

|

84,338 |

|

|

|

84,392 |

|

| |

Prepaid expenses

and other receivables |

|

1,117,722 |

|

|

|

738,415 |

|

| |

Contract

acquisition costs |

|

225,786 |

|

|

|

214,583 |

|

| |

|

|

|

|

10,807,426 |

|

|

|

12,470,681 |

|

| |

|

|

|

|

|

|

|

|

| Property, plant

and equipment |

|

351,601 |

|

|

|

407,522 |

|

| Contract

acquisition costs |

|

80,163 |

|

|

|

28,950 |

|

| Right-of-use

asset |

|

466,800 |

|

|

|

657,771 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

11,705,990 |

|

|

$ |

13,564,924 |

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and

Shareholders' Equity |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

| |

Accounts payable

and accrued liabilities |

$ |

2,782,402 |

|

|

$ |

2,434,376 |

|

| |

Deferred revenue -

current portion |

|

4,530,012 |

|

|

|

4,657,581 |

|

| |

Lease obligation -

current portion |

|

298,131 |

|

|

|

274,312 |

|

| |

|

|

|

|

7,610,545 |

|

|

|

7,366,269 |

|

| |

|

|

|

|

|

|

|

|

| Long-term

debt |

|

|

3,238,537 |

|

|

|

3,219,484 |

|

| Deferred

revenue |

|

47,418 |

|

|

|

- |

|

| Lease

obligation |

|

260,911 |

|

|

|

486,302 |

|

|

|

|

|

|

|

11,157,411 |

|

|

|

11,072,055 |

|

| |

|

|

|

|

|

|

|

|

| Shareholders'

equity: |

|

|

|

|

|

| |

Share capital |

|

31,097,291 |

|

|

|

28,342,861 |

|

| |

Contributed

surplus |

|

864,907 |

|

|

|

864,907 |

|

| |

Share-based

payment reserve |

|

2,152,545 |

|

|

|

3,506,948 |

|

| |

Warrant

reserve |

|

- |

|

|

|

- |

|

| |

Deficit |

|

|

(33,750,599 |

) |

|

|

(30,406,282 |

) |

| |

Accumulated other

comprehensive income |

|

184,435 |

|

|

|

184,435 |

|

| |

|

|

|

|

548,579 |

|

|

|

2,492,869 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

11,705,990 |

|

|

$ |

13,564,924 |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

PRONTOFORMS CORPORATION |

|

|

|

|

|

| Condensed Interim

Consolidated Statements of Cash Flows |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| For the nine

months ended September 30, 2021 and 2020 |

|

|

|

| (in US

dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Nine months ended September 30, |

|

|

|

|

|

|

|

2021 |

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

| Cash provided by

(used in): |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Operating

activities: |

|

|

|

|

|

| |

Net income

(loss) |

$ |

(3,344,317 |

) |

|

$ |

(569,935 |

) |

| |

Items not

involving cash: |

|

|

|

|

|

| |

|

Share-based

compensation |

|

452,648 |

|

|

|

394,284 |

|

| |

|

Accretion on

long-term debt |

|

- |

|

|

|

141,527 |

|

| |

|

Accretion on lease

obligations |

|

27,575 |

|

|

|

35,151 |

|

| |

|

Accretion of

transaction costs |

|

21,135 |

|

|

|

- |

|

| |

|

Change in fair

value of derivative liability |

|

- |

|

|

|

2,794 |

|

| |

|

Amortization of

property, plant and equipment |

|

121,628 |

|

|

|

119,380 |

|

| |

|

Amortization of

right-of-use asset |

|

190,971 |

|

|

|

190,971 |

|

| |

|

Unrealized foreign

exchange losses (gains) |

|

120,086 |

|

|

|

(144,741 |

) |

| |

Other finance

costs |

|

65,266 |

|

|

|

151,773 |

|

| |

Interest paid |

|

(74,438 |

) |

|

|

(159,576 |

) |

| |

Interest

received |

|

9,173 |

|

|

|

7,803 |

|

| |

Lease interest

paid |

|

(27,575 |

) |

|

|

(35,151 |

) |

| |

Changes in

non-cash operating working capital items |

|

644,390 |

|

|

|

(158,230 |

) |

| |

|

|

|

|

(1,793,458 |

) |

|

|

(23,950 |

) |

| |

|

|

|

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

| |

Payment of lease

obligations |

|

(204,918 |

) |

|

|

(176,926 |

) |

| |

Settlement of

derivative liability |

|

- |

|

|

|

(50,075 |

) |

| |

Proceeds from the

exercise of options |

|

947,379 |

|

|

|

249,240 |

|

| |

|

|

|

|

742,461 |

|

|

|

22,239 |

|

| |

|

|

|

|

|

|

|

|

| Investing

activities |

|

|

|

|

|

| |

Purchase of

property, plant and equipment |

|

(65,707 |

) |

|

|

(59,184 |

) |

| |

|

|

|

|

(65,707 |

) |

|

|

(59,184 |

) |

| |

|

|

|

|

|

|

|

|

| Effect of exchange

rate changes on cash |

|

(118,769 |

) |

|

|

45,713 |

|

| |

|

|

|

|

|

|

|

|

| Decrease

in cash and cash equivalents |

|

(1,235,473 |

) |

|

|

(15,182 |

) |

| |

|

|

|

|

|

|

|

|

| Cash and cash

equivalents, beginning of period |

|

7,747,542 |

|

|

|

5,700,003 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, end of period |

$ |

6,512,069 |

|

|

$ |

5,684,821 |

|

| |

|

|

|

|

|

|

|

|

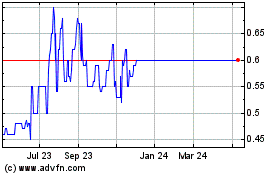

ProntoForms (TSXV:PFM)

Historical Stock Chart

From Nov 2024 to Dec 2024

ProntoForms (TSXV:PFM)

Historical Stock Chart

From Dec 2023 to Dec 2024