TSX VENTURE COMPANIES

ALLANA RESOURCES INC. ("AAA")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced May 28, 2008:

Number of Shares: 10,000,000 shares

Purchase Price: $0.20 per share

Warrants: 5,000,000 share purchase warrants to purchase

5,000,000 shares

Warrant Exercise Price: $0.30 for a two year period

Number of Placees: 25 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Peter J. MacLean Y 100,000

Don Dudek Y 100,000

D&S Gower Holding Inc. Y 100,000

Doug Bell P 175,000

Ron D'Ambrosio P 125,000

Mike Young P 250,000

For further details, please refer to the Company's news release dated June

16, 2008.

TSX-X

---------------------------------------------------------------------

BANDERA GOLD LTD. ("BGL")

BULLETIN TYPE: Warrant Term Extension

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has consented to the extension in the expiry date of

the following warrants:

Private Placement:

# of Warrants: 2,047,750

Original Expiry Date of

Warrants: July 13, 2008 (as to 1,242,000 warrants)

August 7, 2008 (as to 805,750 warrants)

New Expiry Date of Warrants: July 13, 2009 (as to 1,242,000 warrants

August 7, 2009 (as to 805,750 warrants)

Exercise Price of Warrants: $1.25

These warrants were issued pursuant to a private placement of 4,095,500

shares with 2,047,570 share purchase warrants attached, which was accepted

for filing by the Exchange effective July 27, 2007 (first tranche) and

August 21, 2007 (second tranche).

TSX-X

---------------------------------------------------------------------

BOXXER GOLD CORP. ("BXX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced April 30, 2008:

Number of Shares: 2,500,000 Units

(Each Unit consists of one common share and

one share purchase warrant.)

Purchase Price: $0.08 per Unit

Warrants: 2,500,000 share purchase warrants to purchase

2,500,000 shares

Warrant Exercise Price: $0.12 for a period of 24 months from the date

of issuance

Number of Placees: 1 placee

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s).

TSX-X

---------------------------------------------------------------------

BRAZALTA RESOURCES CORP. ("BRX")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: June 18, 2008

TSX Venture Tier 1 Company

Effective at 11:30 a.m. PST, June 18, 2008, shares of the Company resumed

trading, an announcement having been made over Marketwire.

TSX-X

---------------------------------------------------------------------

GALE FORCE PETROLEUM INC. ("GFP")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation pursuant to

a Letter of Intent dated May 7, 2008 between the Company, Derby Resources

LLC ("Derby"), Wind Hydrogen Limited ("WHL") and NAFG, LLC ("NAFG"), in

connection with the acquisition by the Company of a 50% interest in the

Kentucky Shale Gas Property (the "Property"), inclusive of 22,000 acres of

oil and gas leases, 9 gas wells and 5 miles gathering lines, including

compressors, all located in the State of Kentucky, United States, from

NAFG. The acquisition price payable consists of US$2,500,000 in cash (of

which US$1,250,000 is payable by the Company) and a 5% Net Profit Interest

("NPI") payable to NAFG on production from geological formations below the

Devonian (the Company being responsible for half of the NPI in proportion

to its ownership of the property). The Company's two joint venture

partners, Wind and Derby, will hold the remaining 50% ownership in the

Property. The Company has confirmed that it deals at arm's length from all

other parties of the transaction. No shares will be issued in consideration

of the acquisition.

For further information, please refer to the Company's press releases dated

May 7, May 15, May 29 and June 13, 2008.

PETROLE GALE FORCE INC. ("GFP")

TYPE DE BULLETIN : Convention d'achat de propriete, d'actif ou d'actions

DATE DU BULLETIN : Le 18 juin 2008

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de documents en vertu d'une

lettre d'intention datee du 7 mai 2008 entre la societe, Derby Resources

LLC ("Derby"), Wind Hydrogen Limited ("WHL") et NAFG, LLC ("NAFG"),

relativement a l'acquisition par la societe d'un interet de 50 % dans la

propriete des schistes gaziers "Shale Gas" du Kentucky (la "propriete"),

laquelle consiste principalement en 22 000 acres en sous location destinees

a l'exploitation petroliere et gaziere, 9 puits gaziers et un reseau de

canalisations de transport de gaz d'une mesure lineaire de 5 "milles",

incluant les compresseurs, situes dans l'Etat du Kentucky aux Etats-Unis,

aupres de NAFG. Le prix d'acquisition comporte 2 500 000 $ US en especes

(dont 1 250 000 $ est payable par la societe) et un interet economique

direct de 5 % ("IED") a partir de la production des formations geologiques

en-dessous du Devonien (la societe est responsable pour la moitie de ce

IED, en proportion a son interet dans la propriete). Les deux partenaires

de la societe dans cette coentreprise, Wind et Derby, detiendront l'interet

residuel de 50 % dans la propriete. La societe a confirme qu'elle transige

sans lien de dependance avec les autres parties a l'operation. Il n'y aura

aucune action emise en vertu de cette acquisition.

Pour plus d'information, veuillez vous referer au communique de presse emis

par la societe les 7 mai, 15 mai, 29 mai et 13 juin 2008.

TSX-X

---------------------------------------------------------------------

GENOIL INC. ("GNO")

BULLETIN TYPE: Shares for Bonuses

BULLETIN DATE: June 18, 2008

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 1,200,000 bonus warrants ("Warrants") to David K. Lifschultz

("Lifschultz"), the Company's Chief Executive Officer and Chairman, in

connection with a bridge financing facility of up to $5,000,000 to be

granted by Lifschultz to the Company. Each Warrant is exercisable for one

common share at a price of $0.37, for a period of one year from the date of

issuance. The bonus was announced in the Company's press release on May 12,

2008.

TSX-X

---------------------------------------------------------------------

GOLDCLIFF RESOURCE CORPORATION ("GCN")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced April 30, 2008:

Number of Shares: 2,700,000 flow-through shares and 437,000 non

flow-through shares

Purchase Price: $0.30 per flow-through share and $0.28 per non

flow-through share

Warrants: 1,350,000 share purchase warrants to purchase

1,350,000 shares are attached to the

flow-through shares and 218,500 share purchase

warrants to purchase 218,500 shares are

attached to the non flow-through shares

Warrant Exercise Price: $0.55 for a one year period for the share

purchase warrants attached to the flow-through

shares and $0.50 for a one year period for the

share purchase warrants attached to the non

flow-through shares.

Number of Placees: 7 placees

Agents' Fees: $30,600 payable to First Canadian Securities

Inc.

$7,329.60 payable to Raymond James Ltd.

$18,000 payable to Lakeco Holdings Ltd.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

(Note that in certain circumstances the Exchange may later extend the

expiry date of the warrants, if they are less than the maximum permitted

term.)

TSX-X

---------------------------------------------------------------------

GUARDIAN EXPLORATION INC. ("GX")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: June 18, 2008

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced April 15, May 15, and June 5, 2008:

Number of Shares: 2,095,100 common shares

7,934,600 flow-through shares

Purchase Price: $0.30 per common share

$0.35 per flow-through share

Number of Placees: 72 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Keith M. Bekker P 55,000

Randall G. Bergh P 100,000

James Buchanan P 5,000

Lothar Fabian P 25,000

Philip Heinrich P 48,500

John Kotrly P 25,000

Maria Kotrly P 25,000

James Rogers P 45,000

Clive Stockdale P 100,000

Nargis Sunderji P 20,000

Ryan Yeo P 50,000

Agent's Fee: $306,507.60 and 1,002,970 Agent's Warrants

payable to Blackmont Capital Inc.

Each Agent's Warrant is exercisable for one

common share at a price of $0.30 for a period

of 24 months from the closing date.

TSX-X

---------------------------------------------------------------------

IBERIAN MINERALS CORP. ("IZN")

BULLETIN TYPE: Miscellaneous

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining a

convertible loan agreement ("the Agreement") dated May 27, 2008 between

Iberian Minerals Corp. (the "Company") and Investec Bank (UK) Limited

(London) (the "Lender"), whereby the Lender has agreed to provide a loan of

US$10,000,000 (the "Loan"). The Loan matures June 30, 2013 and bears an

interest rate of (i) LIBOR plus 2.25% per annum prior to the date of

completion of certain tests and conditions on Aguas Tenidas Project (the

"Completion Date") as outlined in the Agreement and (ii) LIBOR plus 1.90%

per annum following the Completion Date until June 30, 2013. In the event

of default, the interest rate increases by 1% per annum. The Company has

agreed to issue the Lender 7,640,353 warrants in connection with the Loan.

Each warrant is exercisable into one common share at a price of US$1.30884

per share until June 30, 2013. If any of the Loan remains outstanding at

the time of exercise of the warrants, the proceeds received from such

exercise shall be applied to the repayment of amounts owing under the Loan.

TSX-X

---------------------------------------------------------------------

KINBAURI GOLD CORP. ("KNB")

BULLETIN TYPE: Private Placement-Brokered, Convertible Debenture/s

BULLETIN DATE: June 18, 2008

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced March 10, 2008:

Convertible Debenture $7,500,000

Conversion Price: Convertible into common shares at $0.958 under

certain circumstances, but only between

January 1, 2013, and May 12, 2013.

Maturity date: May 12, 2013

Warrants 1,500,000 warrants to be issued upon closing,

each warrant will have a term of two years

from the date of issuance of the notes and

entitle the holder to purchase one common

share. The warrants are exercisable at the

price of $0.90 for a period of two years.

Interest rate: 0%, but upon the occurrence of an event of

default, prime plus 3%.

Number of Placees: 1 placee

Agent's Fee: $262,500 to be paid to M Partners Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company has

issued a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s).

TSX-X

---------------------------------------------------------------------

LONGBOW RESOURCES INC. ("LBR")

BULLETIN TYPE: Halt

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

Effective at the open, June 18, 2008, trading in the shares of the Company

was halted at the request of the Company, pending an announcement; this

regulatory halt is imposed by Investment Industry Regulatory Organization

of Canada, the Market Regulator of the Exchange pursuant to the provisions

of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

---------------------------------------------------------------------

MAGNUM URANIUM CORP. ("MM")

BULLETIN TYPE: Halt

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

Effective at 12:00 p.m. PST, June 18, 2008, trading in the shares of the

Company was halted due to unreasonable trades, all trades below 0.45 will

be expunged; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

---------------------------------------------------------------------

MAGNUM URANIUM CORP. ("MM")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

Effective at 12:30 p.m. PST, June 18, 2008, shares of the Company resumed

trading, due to unreasonable trades; all trades below 0.45 will be

expunged.

TSX-X

---------------------------------------------------------------------

MAXY GOLD CORP. ("MXD")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing an option agreement dated

March 13, 2008 between Maxy Gold Corp. (the 'Company') and Southwestern

Resources Corp. ('Southwestern'), a TSX listed company, whereby the Company

will acquire a 100% interest in fifteen separate gold and base metal

exploration stage properties located across central and southern Peru. In

addition to the above properties, Southwestern will transfer to the Company

an additional 3,700 hectares of claims comprising the Sami Property located

in the Ayacucho Department, Peru upon duly executed transfer of the Sami

Property to Southwestern by a third party.

Total consideration consists of $200,000 in cash and 1,000,000 shares of

the Company.

In addition, there is a 2% net smelter return relating to the acquisition.

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P # of Shares

Southwestern Gold (Bermuda)

Limited (subsidiary of

Southwestern Resources

Corp.) Y 1,000,000

TSX-X

---------------------------------------------------------------------

MURGOR RESOURCES INC. ("MGR")

BULLETIN TYPE: Halt

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

Effective at 6:54 a.m. PST, June 18, 2008, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

---------------------------------------------------------------------

MURGOR RESOURCES INC. ("MGR")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

Effective at 9:30 a.m. PST, June 18, 2008, shares of the Company resumed

trading, an announcement having been made over Canada News Wire.

TSX-X

---------------------------------------------------------------------

NEXT MILLENNIUM COMMERCIAL CORP. ("NM")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing an option agreement dated June

3, 2008 between Roadrunner Oil and Gas (USA) Inc., a wholly owned

subsidiary of Next Millennium Commercial Corp. (the 'Company') and Eternal

Energy Corp. ('Eternal'), whereby the Company will acquire a 50% working

interest in 5,950 acres of petroleum and natural gas leases located in San

Juan County, Utah, and San Miguel County, Colorado.

Total consideration consists of a purchase price of US$1,190,160. In

addition, there is a variable 1.5% to 5% overriding royalty payable to

Eternal. This variable rate is determined based on other pre-existing

royalties on the properties and will result in the Company having a net

revenue interest of 40% in the leases.

TSX-X

---------------------------------------------------------------------

PENNINE PETROLEUM CORPORATION ("PNN")

BULLETIN TYPE: Warrant Price Amendment and Warrant Term Extension

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has consented to the reduction in the exercise price

and term extension of the following warrants:

# of Warrants: 8,024,333

Original Expiry Date of

Warrants: June 29, 2008

New Expiry Date of Warrants: December 29, 2008

Original Exercise Price of

Warrants: Two warrants and $0.60 to purchase one common

share

New Exercise Price of

Warrants: Two warrants and $0.40 to purchase one common

share

These warrants were issued pursuant to an Initial Public Offering ("IPO")

prospectus dated November 27, 2006.

TSX-X

---------------------------------------------------------------------

RIVERSTONE RESOURCES INC. ("RVS")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the first tranche of a Non-Brokered Private Placement announced April 29,

2008:

Number of Shares: 1,750,000 shares

Purchase Price: $0.60 per share

Warrants: 1,750,000 share purchase warrants to purchase

1,750,000 shares

Warrant Exercise Price: $1.20 for a two year period

Number of Placees: 1 placee

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

TSX-X

---------------------------------------------------------------------

TAD CAPITAL CORP. ("TAD.P")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated June 12, 2008, effective at

6:30 a.m. PST, June 18, 2008 trading in the shares of the Company will

remain halted pending receipt and review of acceptable documentation

regarding the Qualifying Transaction pursuant to Listings Policy 2.4.

TSX-X

---------------------------------------------------------------------

TANGARINE PAYMENT SOLUTIONS CORP. ("TAN")

BULLETIN TYPE: Halt

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

Effective at 6:35 a.m. PST, June 18, 2008, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

---------------------------------------------------------------------

TANGARINE PAYMENT SOLUTIONS CORP. ("TAN")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

Effective at 10:30 a.m. PST, June 18, 2008, shares of the Company resumed

trading, an announcement having been made over Marketwire.

TSX-X

---------------------------------------------------------------------

ZENN MOTOR COMPANY INC. ("ZNN")

BULLETIN TYPE: Prospectus-Share Offering

BULLETIN DATE: June 18, 2008

TSX Venture Tier 2 Company

Effective May 23, 2008, the Company's Prospectus dated May 23, 2008 was

filed with and accepted by TSX Venture Exchange, and filed with and

receipted by the Ontario, Alberta, and British Columbia Securities

Commission, pursuant to the provisions of the respective Securities Acts.

TSX Venture Exchange has been advised that closing occurred on May 30,

2008, for gross proceeds of $15,225,000.

Agent: Paradigm Capital Inc.

Offering: 4,060,000 shares (includes 325,000 common

shares on the exercise of the Agent's

over-allotment option)

Share Price: $3.75 per share

Agent's Options: 162,400 compensation options. Each option is

exercisable into one common share at a price

of $3.75 for a period of eighteen months.

Agent's Commission: $770,343.75

For further information, please refer to the Company's final short form

prospectus dated May 23, 2008.

TSX-X

---------------------------------------------------------------------

NEX COMPANIES

ITI WORLD INVESTMENT GROUP INC. ("IWI.H")

BULLETIN TYPE: Delist

BULLETIN DATE: June 18, 2008

NEX Company

Effective at the close of business Wednesday, June 18, 2008, the common

shares of ITI World Investment Group Inc. will be delisted from TSX Venture

Exchange at the request of the Company.

The Company will continue to trade on CNQ.

TSX-X

---------------------------------------------------------------------

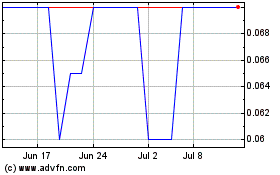

Pambili Natural Resources (TSXV:PNN)

Historical Stock Chart

From Nov 2024 to Dec 2024

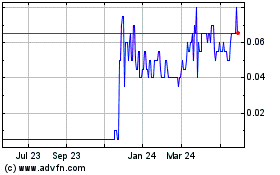

Pambili Natural Resources (TSXV:PNN)

Historical Stock Chart

From Dec 2023 to Dec 2024