TSX VENTURE COMPANIES

BULLETIN TYPE: Cease Trade Order

BULLETIN DATE: May 4, 2009

TSX Venture Tier 2 Companies

A Cease Trade Order has been issued by the British Columbia Securities

Commission on May 4, 2009, against the following Companies for failing

to file the documents indicated within the required time period:

Symbol Company Failure to File Period Ending (Y/M/D)

("APK") Altek Power comparative financial 08/12/31

Corporation statement

management discussion 08/12/31

& analysis

("LPI") Landstar comparative financial 08/12/31

Properties statement

Inc. management discussion 08/12/31

& analysis

("MXM") Maxim comparative financial 08/12/31

Resources Inc. statement

management discussion 08/12/31

& analysis

("HUB.P") Terminal City comparative financial 08/12/31

Capital Inc. statement

management discussion 08/12/31

& analysis

("TSU") TransEuro comparative financial 08/12/31

Energy Corp. statement

management discussion 08/12/31

& analysis

("XCC") Xcel comparative financial 08/12/31

Consolidated statement

Ltd. management discussion 08/12/31

& analysis

("SMS") Yangtze comparative financial 08/12/31

Telecom Corp. statement

management discussion 08/12/31

& analysis

("ZR") Zoloto comparative financial 08/12/31

Resources Ltd. statement

management discussion 08/12/31

& analysis

Upon revocation of the Cease Trade Order, the Company's shares will

remain suspended until the Company meets TSX Venture Exchange

requirements. Members are prohibited from trading in the securities of

the company during the period of the suspension or until further notice.

TSX-X

------------------------------------------------------------------------

ALEGRO HEALTH CORP. ("AGO")

BULLETIN TYPE: Halt

BULLETIN DATE: May 5, 2009

TSX Venture Tier 1 Company

Effective at 6:00 a.m. PST, May 5, 2009, trading in the shares of the

Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

------------------------------------------------------------------------

AXMIN INC. ("AXM")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced March 19, 2009:

Number of Shares: 25,000,000 shares

Purchase Price: $0.10 per share

Warrants: 25,000,000 share purchase warrants to

purchase 25,000,000 shares

Warrant Exercise Price: $0.14 for a three year period

Number of Placees: 1 placee

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

AOG Holdings BV Y 25,000,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

has issued a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). Note

that in certain circumstances the Exchange may later extend the expiry

date of the warrants, if they are less than the maximum permitted term.

TSX-X

------------------------------------------------------------------------

BACTECH MINING CORPORATION ("BM")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced April 22, 2009:

Number of Shares: 4,000,000 shares

Purchase Price: $0.05 per share

Warrants: 4,000,000 share purchase warrants to

purchase 4,000,000 shares

Warrant Exercise Price: $0.07 for a one year period

$0.10 in the second year

Number of Placees: 3 placees

Finder's Fee: $6,000 payable to Jones Gable & Company

Limited

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

has issued a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). Note

that in certain circumstances the Exchange may later extend the expiry

date of the warrants, if they are less than the maximum permitted term.

TSX-X

------------------------------------------------------------------------

CASH MINERALS LTD. ("CHX")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: May 5, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation pertaining to

a Purchase Agreement (the "Agreement") dated May 5, 2009, between Cash

Minerals Ltd. (the "Company") and Dynamite Resources Ltd. (the

"Vendor"), whereby the Company has agreed to acquire a 100% interest in

the Mike Lake Property, located in Yukon Territory, and an indirect 100%

interest in the Kokomeren, Barskaun, Arabelsu and Moldatau Properties,

located in the Kyrgyz Republic. The Kyrgyz Republic Properties are

indirectly held by a wholly-owned subsidiary of the Vendor, Tau Mining

Limited.

Pursuant to the terms of the Agreement, the Company will acquire the

Mike Lake Property and all the issued and outstanding shares of Tau

Mining Ltd. and in consideration shall issue 22,750,000 common shares

and 11,375,000 common share purchase warrants to the Vendor. Each

common share purchase warrant entitles the holder to acquire one common

share at $0.10 for a two year period.

For further details, please refer to the Company's new release dated

March 12, 2009.

TSX-X

------------------------------------------------------------------------

CPVC FINANCIAL CORPORATION ("LHB")

BULLETIN TYPE: Delist

BULLETIN DATE: May 5, 2009

TSX Venture Tier 1 Company

Further to the news releases dated January 26, 2009, March 31, 2009 and

April 8, 2009, the common shares of CPVC Financial Corporation will be

delisted from TSX Venture Exchange effective at the close of business

May 5, 2009. The delisting of the Company's shares results from the

completion of a going-private transaction, as described in the Company's

Management Proxy Circular dated February 27, 2009.

CPVC FINANCIAL CORPORATION ("LHB")

TYPE DE BULLETIN: Retrait de la cote

DATE DU BULLETIN: Le 5 mai 2009

Societe du groupe 1 de TSX croissance

Suite aux communiques de presse emis le 26 janvier 2009, le 31 mars 2009

et le 8 avril 2009, les actions ordinaires de CPVC Financial Corporation

seront retirees de la cote de Bourse de croissance TSX a la fermeture

des affaires le 5 mai 2009. Le retrait de la cote des actions de la

societe survient suite a une transaction de privatisation, telle que

divulguee dans la circulaire de sollicitation de procurations par la

direction datee du 27 fevrier 2009.

TSX-X

------------------------------------------------------------------------

DYNAMITE RESOURCES LTD. ("DNR.A")("DNR.WT")

BULLETIN TYPE: Halt

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

Effective at the open, May 5, 2009, trading in the shares and warrants

of the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

------------------------------------------------------------------------

DYNAMITE RESOURCES LTD. ("DNR.A")("DNR.WT")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement, Remain

Halted

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to

a Purchase Agreement (the "Agreement") dated May 5, 2009, between

Dynamite Resources Ltd. (the "Company") and Cash Minerals Ltd. ("Cash"),

whereby the Company has agreed to sell its 100% interest in the Mike

Lake Property, located in Yukon Territory, and its indirect 100%

interest in the Kokomeren, Barskaun, Arabelsu and Moldatau Properties,

located in the Kyrgyz Republic. The Kyrgyz Republic Properties are

indirectly held by a wholly-owned subsidiary of the the Company, Tau

Mining Limited.

Pursuant to the terms of the Agreement, Cash will acquire the Mike Lake

Property and all the issued and outstanding shares of Tau Mining Ltd.

and in consideration shall issue 22,750,000 common shares and 11,375,000

common share purchase warrants to the Company. Each common share

purchase warrant entitles the holder to acquire one common share at

$0.10 for a two year period.

For further details, please refer to the Company's new release dated

March 12, 2009.

TSX-X

------------------------------------------------------------------------

EGX GROUP INC. ("EGX")

BULLETIN TYPE: Suspend-Failure to Maintain a Transfer Agent

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange Bulletin dated April 24, 2009,

effective at the opening Wednesday, May 6, 2009, trading in the shares

of the Company will be suspended, the Company having failed to maintain

the services of a transfer agent in accordance with Policy 3.1.

Members are prohibited from trading in the securities of the Company

during the period of the suspension or until further notice.

TSX-X

------------------------------------------------------------------------

ESO URANIUM CORP. ("ESO")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced April 27, 2009:

Number of Shares: 3,000,000 flow-through shares

Purchase Price: $0.07 per share

Number of Placees: 1 placee

Insider / Pro Group Participation: N/A

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly.

TSX-X

------------------------------------------------------------------------

FIRST NARROWS RESOURCES CORP. ("UNO")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 10,334,466 shares to settle outstanding debt for $413,378.83.

Number of Creditors: 20 Creditors

Insider / Pro Group Participation:

Insider equals Y / Amount Deemed Price

Creditor Progroup equals P / Owing per Share # of Shares

Angelica Balderas-Lozano Y $5,863.00 $0.04 146,575

ARC Geobac Y $4,968.42 $0.04 124,210

James Lynch Y $20,526.18 $0.04 513,154

Pacifica Business

Management Solutions Y $12,500 $0.04 312,500

Pamela Lynch Y $9,375.42 $0.04 234,385

Peter K. Gummer Y $72,367.45 $0.04 1,809,186

The Company shall issue a news release when the shares are issued and

the debt extinguished.

TSX-X

------------------------------------------------------------------------

GALENA CAPITAL CORP. ("FYI")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced April 13, 2009:

Number of Shares: 10,722,000 shares

Purchase Price: $0.075 per share

Warrants: 10,722,000 share purchase warrants to

purchase 10,722,000 shares

Warrant Exercise Price: $0.15 for a five year period

Number of Placees: 53 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

John Seaman Y 66,666

Jeffrey Scott Y 1,000,000

Jama Holdings Inc. P 70,000

Erik M. Dekker P 100,000

Arni Johansson Y 125,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly.

TSX-X

------------------------------------------------------------------------

GOLDEN DORY RESOURCES CORP. ("GDR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced April 23, 2009:

Number of Shares: 1,200,000 shares

Purchase Price: $0.05 per share

Warrants: 600,000 share purchase warrants to purchase

600,000 shares

Warrant Exercise Price: $0.10 for a two year period

Number of Placees: 2 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

John Ryan Y 200,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. (Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.)

TSX-X

------------------------------------------------------------------------

HEALTHSCREEN SOLUTIONS INCORPORATED ("MDU")

BULLETIN TYPE: Regional Office Change

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

Pursuant to Policy 1.2, TSX Venture Exchange has been advised of, and

accepted the change of the Filing and Regional Office from Vancouver,

British Columbia to Toronto, Ontario.

TSX-X

------------------------------------------------------------------------

ILI TECHNOLOGIES (2002) CORP. ("ILI")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced May 1, 2009:

Number of Shares: 3,938,781 common shares

Purchase Price: $0.10 per common share

Warrants: 1,969,390 share purchase warrants to

purchase 1,969,390 common shares

Exercise Price: $0.20 per share for a period of two years

Number of Placees: 22 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Units

Larry Lloyd P 100,000

Finders: Paul Andreiola

Phil D'Angelo

Canaccord Capital Corporation

Raymond James Ltd.

CIBC Wood Gundy

Jones Gable & Co. Ltd.

Fab Carella

All Group Financial Services

Finder's Fees: Paul Andreiola - $2,161.47 cash and 21,614

broker warrants

Phil D'Angelo - $ 20, 571.47 cash

Canaccord Capital Corporation - $1,050 cash

and 10,500 Broker warrants

Raymond James Ltd. - $5,460 cash and 54,600

broker Warrants

CIBC Wood Gundy - $3,500 cash and 35,000

broker warrants

Jones Gable & Co. Ltd. - $ 7,000 cash and

70,000 broker Warrants

Fab Carella - $1,400 cash and 14,000 broker

warrants

All Group Financial Services - $10,000 cash

and 70,000 Broker warrants

Each broker warrant is exercisable at a

price of $0.10 per share for a period of

two years

TSX-X

------------------------------------------------------------------------

ILI TECHNOLOGIES (2002) CORP. ("ILI")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced March 31, 2009:

Number of Shares: 10,000,000 common shares

Purchase Price: $0.10 per common share

Warrants: 5,000,000 share purchase warrants to

purchase 5,000,000 common shares

Exercise Price: $0.20 per share for a period of two years

Number of Placees: 29 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Units

Bill Godson P 750,000

Christiaan ter Keurs P 100,000

Finders: Paul Andreiola

Ian Pederson

Paul Lopoth

Phil D'Angelo

Canaccord Capital Corporation

Raymond James

Finder's Fees; Paul Andreiola - $33,250 cash and 332,500

broker warrants

Ian Pedersen - $1,050 cash and 10,500

broker warrants

Paul Lopoth - $11,200 cash and 112,000

broker warrants

Phil D'Angelo - $70,000 cash

Canaccord Capital Corporation - $ 350 cash

and 3,500 broker warrants

Raymond James Ltd. - $24,150 cash and

241,500 broker Warrants

Each broker warrant is exercisable at a

price of $0.10 per Unit for a period of two

years

TSX-X

------------------------------------------------------------------------

KERMODE CAPITAL LTD. ("KER.P")

BULLETIN TYPE: New Listing-CPC-Shares

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

This Capital Pool Company's ('CPC') Prospectus dated April 15, 2009 has

been filed with and accepted by TSX Venture Exchange and the British

Columbia, Alberta and Saskatchewan Securities Commissions effective

April 16, 2009, pursuant to the provisions of the British Columbia,

Alberta and Saskatchewan Securities Act. The Common Shares of the

Company will be listed on TSX Venture Exchange on the effective date

stated below.

The Company has completed its initial distribution of securities to the

public. The gross proceeds received by the Company for the Offering

were $200,000 (2,000,000 common shares at $0.10 per share).

Commence Date: At the opening Wednesday, May 6, 2009, the

Common shares will commence trading on TSX

Venture Exchange.

Corporate Jurisdiction: British Columbia

Capitalization: unlimited common shares with no par value

of which 4,000,000 common shares are issued

and outstanding

Escrowed Shares: 2,040,000 common shares

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: KER.P

CUSIP Number: 49224T 10 3

Sponsoring Member: Canaccord Capital Corp.

Agent's Options: 200,000 non-transferable stock options. One

option to purchase one share at $0.10 per share up to 24 months.

For further information, please refer to the Company's Prospectus dated

April 15, 2009.

Company Contact: Jason Bloom

Company Address: 615 Discovery Street

Victoria, BC V8T 5G4

Company Phone Number: (250) 477-9969

Company Fax Number: (250) 477-9912

Company Email Address: jason@flexiblesolutions.com

TSX-X

------------------------------------------------------------------------

PENNINE PETROLEUM CORPORATION ("PNN")

BULLETIN TYPE: Private Placement-Non-Brokered, Convertible Debenture/s

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced March 27, 2009:

Convertible Debenture: $197,300

Conversion Price: Convertible into common shares consisting

of 20 common shares per $1 of principal at

a price of $0.05 per share in the first

year and $0.10 per share thereafter until

December 31, 2010

Maturity date: December 31, 2010

Interest rate: 15% per annum

Number of Placees: 9 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / Principal Amount

600086 Alberta Ltd. (Desmond Smith) Y $18,900

769644 Alberta Ltd. (Lyle Wunderlich) Y $110,500

Randall S. Marshall Y $7,850

Finder's Fee: $4,690 payable to Wolverton Securities Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly.

TSX-X

------------------------------------------------------------------------

PHARMENG INTERNATIONAL INC. ("PII")

BULLETIN TYPE: Suspend-Failure to Maintain Tier Maintenance

Requirements

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

Further to the TSX Venture Bulletin dated April 16, 2009, effective at

the open, on Wednesday, May 6, 2009, trading in the shares of the

Company will be suspended, the Company having failed to maintain Tier

Maintenance Requirements in accordance with Policy 2.5.

Members are prohibited from trading in the securities of the Company

during the period of the suspension or until further notice.

TSX-X

------------------------------------------------------------------------

RESULT ENERGY INC. ("RTE")

BULLETIN TYPE: Halt

BULLETIN DATE: May 5, 2009

TSX Venture Tier 1 Company

Effective at 6:00 a.m. PST, May 5, 2009, trading in the shares of the

Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

------------------------------------------------------------------------

RHINO RESOURCES INC. ("RHI.P")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated March 23, 2009 and the

Company's press release dated May 1, 2009, the Company's proposed

Qualifying Transaction has been terminated.

Effective at the opening May 6, 2009, trading will resume in the

Securities of the Company.

RHINO RESOURCES INC. ("RHI.P")

TYPE DE BULLETIN : Reprise de la negociation

DATE DU BULLETIN : Le 5 mai 2009

Societe du groupe 2 de TSX croissance

Suite au bulletin de Bourse de croissance TSX date du 23 mars 2009 et au

communique de presse de la societe date du 1er mai 2009, l'operation

admissible projetee par la societe a ete abandonnee.

La negociation des titres de la societe sera reprise a l'ouverture des

marches le 6 mai 2009.

TSX-X

------------------------------------------------------------------------

ROCKY OLD MAN ENERGY INC. ("RO")

BULLETIN TYPE: Delist

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

Effective at the close of business Friday, May 15, 2009, the common

shares of the Company will be de-listed from TSX Venture Exchange at the

request of the Company.

TSX-X

------------------------------------------------------------------------

ROXGOLD INC. ("ROG")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced February 23, 2009:

Number of Shares: 3,805,000 shares

Purchase Price: $0.04 per share

Warrants: 3,805,000 share purchase warrants to

purchase 3,805,000 shares

Warrant Exercise Price: $0.05 for a one year period

$0.10 in the second year

Number of Placees: 15 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

David Makepeace Y 50,000

Robert McMorron Y 300,000

Alan Raven Y 625,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. (Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.)

TSX-X

------------------------------------------------------------------------

SEANESS CAPITAL CORPORATION ("NSC.P")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated March 26, 2009, effective

at the open, May 5, 2009 trading in the shares of the Company will

remain halted pending receipt and review of acceptable documentation

regarding the Qualifying Transaction pursuant to Listings Policy 2.4.

TSX-X

------------------------------------------------------------------------

SOLARA EXPLORATION LTD. ("SAA.A)(SAA.B")

BULLETIN TYPE: Normal Course Issuer Bid

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has been advised by the Company that pursuant to a

Notice of Intention to make a Normal Course Issuer Bid dated April 28,

2009, it may repurchase for cancellation, up to 1,225,547 Class A shares

and up to 49,335 Class B shares in its own capital stock. The purchases

are to be made through the facilities of TSX Venture Exchange during the

period May 6, 2009 to May 5, 2010. Purchases pursuant to the bid will

be made by Jennings Capital Inc. on behalf of the Company.

TSX-X

------------------------------------------------------------------------

TAC CAPITAL CORP. ("TAC.P")

BULLETIN TYPE: Delist - Failure to Complete a Qualifying Transaction

within the Prescribed Time

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

Effective at the close of business Wednesday, May 6, 2009, the common

shares will be delisted from TSX Venture Exchange for failing to

complete a Qualifying Transaction within the prescribed time.

In accordance with Exchange Policy 2.4, the Company has 90 days from the

date of delisting to, in accordance with applicable law, wind-up and

liquidate the Company's assets and distribute its remaining assets, on a

pro rata basis, to its shareholders unless, within that 90 day period,

the shareholders, pursuant to a majority vote, exclusive of the votes of

Non-Arm's Length Parties to the Company, approve another use of the

remaining assets. The Company is required to provide written

confirmation to the applicable Securities Commissions, with a copy to

the Exchange, no later than 90 days from the date of delisting, that

they have complied with the above requirement.

TSX-X

------------------------------------------------------------------------

TEMPLE REAL ESTATE INVESTMENT TRUST ("TR.UN")

BULLETIN TYPE: Company Tier Reclassification

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

In accordance with Policy 2.5, the Company has met the requirements for

a Tier 1 company. Therefore, effective May 6, 2009 the Company's Tier

classification will change from Tier 2 to:

Classification

Tier 1

TSX-X

------------------------------------------------------------------------

TENAJON RESOURCES CORP. ("TJS")

BULLETIN TYPE: Halt

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

Effective at the open, May 5, 2009, trading in the shares of the Company

was halted at the request of the Company, pending an announcement; this

regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity

Rules.

TSX-X

------------------------------------------------------------------------

TENAJON RESOURCES CORP. ("TJS")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

Effective at 8:00 a.m. PST, May 5, 2009, shares of the Company resumed

trading, an announcement having been made over Canada News Wire.

TSX-X

------------------------------------------------------------------------

URBAN COMMUNICATIONS INC. ("UBN")

BULLETIN TYPE: Private Placement-Non-Brokered, Convertible Debenture/s

BULLETIN DATE: May 5, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced December 4, 2008:

Convertible Debenture: $850,000

Conversion Price: Convertible into units consisting of 1

common share and 1 common share purchase

warrant at $0.12 of principal outstanding,

subject to an accelerated conversion

provision where conversion into units will

occur if the closing price of the Company's

common shares on the TSX Venture Exchange

reaches $0.24 or more for a period of 10

consecutive trading days.

Maturity date: 1 year from closing

Warrants: Each warrant will have a term of 1 year

from the date of closing and entitles the

holder to purchase 1 common share. The

warrants are exercisable at the price of

$0.15 in the first 6 months and at $0.20 in

the next 6 months.

Interest rate: 12.5% per annum

Number of Placees: 3 placees

Insider / Pro Group

Participation: N/A

Finder's Fee: $42,500 in cash payable to Jim Dickinson.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly.

TSX-X

------------------------------------------------------------------------

NEX COMPANIES

FIRST PURSUIT VENTURES LTD. ("FPV.H")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: May 5, 2009

NEX Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced March 27, 2009:

Number of Shares: 5,700,000 shares

Purchase Price: $0.05 per share

Warrants: 5,700,000 share purchase warrants to

purchase 5,700,000 shares

Warrant Exercise Price: $0.10 for a one year period

Number of Placees: 38 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Charles Malette P 200,000

Sean Robert Duncan P 20,000

Mark Bolin P 100,000

Daniel Cruz P 50,000

Yasmin Gordon P 260,000

Duncan Gordon P 260,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly.

TSX-X

------------------------------------------------------------------------

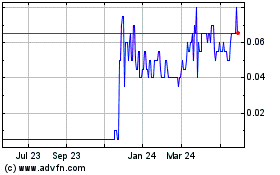

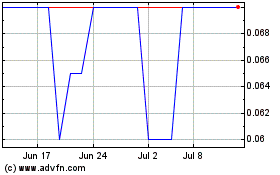

Pambili Natural Resources (TSXV:PNN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Pambili Natural Resources (TSXV:PNN)

Historical Stock Chart

From Dec 2023 to Dec 2024