Razor Energy Corp. (“Razor” or the “Company”) (TSXV: RZE) announces

its fourth quarter and year end 2022 financial and operating

results. Selected financial and operational information is outlined

below and should be read in conjunction with Razor’s audited

consolidated financial statements, management’s discussion and

analysis and annual information form (“AIF”) for the year ended

December 31, 2022 which are available on SEDAR at www.sedar.com and

the Company’s website www.razor-energy.com.

All amounts are expressed in Canadian dollars.

Certain metrics, including those expressed on an adjusted basis,

are non-IFRS and other financial measures. See “Non-IFRS and Other

Financial Measures” below.

RECAPITALIZATION

TRANSACTION

Summary

On May 1, 2023, the Company announced a

recapitalization transaction (the “Recapitalization Transaction”),

including debt settlement (“Debt Settlement”) and a rights offering

to all holders of common shares in the capital of Razor (“Razor

Common Shares”) by way of a rights offering circular (the “Rights

Offering”), pursuant to which:

- Razor will dispose of 70% of its

common share holdings in FutEra Power Corp. (“FutEra”) and 100% of

a class of newly created voting, convertible preferred shares in

FutEra to settle $63.2 million of secured debt with Alberta

Investment Management Corporation, on behalf of certain designated

entities managed and advised by AIMCo, (“AIMCo”);

- Razor will retain a 30% common

share position in FutEra (subject to dilution upon preferred share

conversion as described below); and

- FutEra will be responsible for

repayment of US$7.9 million of Razor’s current senior secured debt

owed to Arena Investors, LP under Razor’s Amended and Restated Term

Loan Agreement dated March 9, 2022 (the “Arena Debt”).

No Razor Common Shares will be issued as part of

the Debt Settlement.

As a condition to the completion of the

transactions contemplated by the Debt Settlement Agreement (as

defined below), Razor is launching the Rights Offering to

re-accelerate production development. It anticipates investing

approximately $5 million to increase corporate production by 800

boe/d or less than $6,500 per flowing boe. Closing of the Rights

Offering is conditional upon and will happen concurrently with

closing of the Debt Settlement.

The Recapitalization Transaction deleverages

Razor, allowing for a greater potential for transactions and

additional interest savings to reinvest further in the oil and gas

portfolio.

Debt Settlement

On May 1, 2023, the Company entered into a Debt

Settlement Agreement (the “Debt Settlement Agreement”) with AIMCo,

pursuant to which AIMCo and the Company have agreed, subject to

certain terms and conditions, to the settlement of all obligations

owing by Razor to AIMCo under the AIMCo Term Loan through the

transfer to AIMCo of equity interests held by Razor in FutEra.

The Debt Settlement Agreement provides for the

following transactions:

- Following the

Internal Reorganization (as defined below), Razor will settle all

outstanding indebtedness owed to AIMCo in the approximate aggregate

amount of $63.2 million by way of the sale and transfer by Razor to

AIMCo of that number of common shares in the capital of FutEra

(“FutEra Common Shares”) representing 70% of the issued and

outstanding FutEra Common Shares and 100% of the issued and

outstanding FutEra Preferred Shares (as defined below), in each

case following the Internal Reorganization. At the time of issuance

and transfer to AIMCo, the FutEra Preferred Shares will be

convertible (subject to further adjustment in the manner

contemplated by the FutEra Preferred Share provisions) into that

number of FutEra Common Shares representing 30% of the aggregate

number of FutEra Common Shares outstanding at such time and then

issuable upon conversion of the FutEra Preferred Shares.

- FutEra will

create a new class of voting, convertible preferred shares (“FutEra

Preferred Shares”) and Razor and FutEra will complete an internal

corporate restructuring to exchange a portion of the FutEra Common

Shares held by Razor for FutEra Preferred Shares (the “Internal

Reorganization”). The FutEra Preferred Shares will have, among

other rights, the right to receive cumulative dividends which will

accrue daily at a rate of 12% per annum and compound quarterly; a

liquidation preference per share equal to the original issue price

plus all unpaid accrued and compounded dividends; the right to

convert each FutEra Preferred Share into a number of FutEra Common

Shares equal to the liquidation preference at the time of

conversion divided by the original issue price (subject to

adjustment in certain circumstances); and voting rights on an

as-converted basis with FutEra Common Shares.

Rights Offering

The Rights Offering will be for proceeds of up

to $10 million.

Pursuant to the Rights Offering, all eligible

holders of Razor Common Shares will receive one transferable right

(a “Right”) for each Razor Common Share held. The Rights will

entitle the holder thereof to subscribe for units of Razor

(“Unit”), with the number of Units available for subscription and

the subscription price to be determined at the time of the Rights

Offering. Each Unit will be comprised of one Razor Common Share and

one Razor Common Share purchase warrant of Razor. Each warrant will

entitle the holder to acquire, subject to adjustment in certain

circumstances, one Razor Common Share at an exercise price to be

determined at the time of the Rights Offering. In connection with

the Rights Offering, all eligible holders of Razor Common Shares on

the close of business on the record date for the Rights Offering

will be provided the right to: (i) exercise their basic

subscription privilege to acquire their pro-rata portion of Units

in such Rights Offering; and (ii) provided they have exercised

their basic subscription privilege, exercise an additional

subscription privilege to acquire, subject to proration, such

number of additional unsubscribed Units, if any, in the Rights

Offering.

Razor and AIMCo have entered into a Standby

Purchase Agreement pursuant to which AIMCo has agreed to exercise

its basic subscription privilege under the Rights Offering and to

provide a standby commitment with respect to unsubscribed Units

under the Rights Offering, following all exercises of both the

basic and additional privileges by other holders of Rights, to a

maximum of $4 million, subject to the terms and conditions in the

Standby Purchase Agreement, including that a minimum of $1 million

of subscription proceeds shall have been received from holders of

Rights other than AIMCo.

OUTLOOKRazor

Razor continues to look forward with plans for

the future while remaining focused on its mid to long-term

sustainability. Razor recognizes multiple deep value streams in its

assets and is actively engaged in liberating them for the benefit

of shareholders. The Company has an extensive opportunity set of

high-quality wells requiring reactivation, many of which have

payout metrics which exceed the Company’s economic thresholds.

Razor will continue production enhancement activity into 2023.

Certain activities involve repairs and maintenance work which will

be expensed for accounting purposes and operating netbacks will be

reduced during this timeframe. In aggregate, the annual base

decline of these wells is anticipated to

be consistent with the Company’s current

corporate rate of approximately 12%.

The Company continues to focus on cost control

on its operated properties. In addition to the planned production

enhancement program, Razor will take a cautious and case-by-case

approach to capital spending in 2023, focusing on low risk, capital

efficient opportunities to increase field efficiencies and

corporate netbacks.

While the Company anticipates reducing its

working capital deficit and net debt1 over time, it is still

projecting to have a working capital deficit at December 31,

2023.

Razor has high reservoir quality, low decline,

isolate carbonate Swan Hills reef light oil pools that contain

large original oil in place with over 60 years of production

history. Razor believes these reefs are ideally suited for carbon

capture, utilization and storage and enhanced oil recovery (“EOR”)

purposes2, in addition to geothermal power production and

conventional open-hole horizontal development drilling upside.

FutEraFutEra, a subsidiary of

Razor Energy, is now operating the first co-produced geothermal

power plant in Canada with a nameplate capacity of 21 MW of which

up to 30% will be sustainable clean power generation. The Swan

Hills Geothermal Power Project began producing power to the grid on

September 9, 2022. The final stages of construction were completed

in January 2023, with commissioning nearing completion.

Power generation revenue for September to

December 2022 from the Swan Hills Geothermal Power Project was $7.9

million, which exceeded expectations due to a historically higher

than average merchant power price which averaged $220/MWH. FutEra

has successfully partnered with provincial and federal government

agencies to invigorate the emerging geothermal industry. To date,

Razor has received $16.3 million in government grants to support

this power generation project. The total construction budget for

the Swan Hills Geothermal Power Project is $49 million.

Legacy oil and gas fields can face economic

challenges with lower production levels and high fixed costs.

However, these fields also have practical advantages when

considering the existing infrastructure, pipelines, wells, and

operational footprints. The Swan Hills Geothermal Power Project is

an example of leveraging existing assets to lower carbon economic

outcomes. Razor and FutEra continue to demonstrate the synergies

and cooperation needed to define a type of transformation energy

and sets the standard of how oil and gas companies can evolve into

the ‘energy and technology’ companies necessary for the future of

the Alberta energy complex.

On May 11, 2022, Razor closed a rights offering

for $5.0 million of common shares (“Rights Offering”). The common

shares were issued on a flow-through basis in respect of Canadian

Renewable and Conservation Expense (“CRCE”) within the meaning of

the Income Tax Act (Canada). The proceeds will be used to fund

certain eligible expenses on the Swan Hills Geothermal Power

Project, solar and eligible expenses on various early-stage power

projects including additional geothermal initiatives in 2022 and

2023 of which $2.1 million was spent in Q4 2022 for a total of $2.9

million spent in 2022.

SELECT QUARTERLY & ANNUAL

HIGHLIGHTSThe following tables summarizes key financial

and operating highlights associated with the Company’s financial

performance.

|

|

Three Months Ended |

|

Year Ended |

|

|

|

December 31 |

|

December 31 |

|

|

($000s, except for per share amounts and production) |

2022 |

2021 |

% Change |

2022 |

2021 |

% Change |

|

Production |

|

Light oil (bbl/d) |

2,429 |

2,774 |

(14) |

2,673 |

2,250 |

19 |

|

Natural gas (mcf/d)1 |

3,098 |

5,023 |

(38) |

4,324 |

4,209 |

3 |

|

NGLs (boe/d) |

913 |

747 |

22 |

898 |

572 |

57 |

|

Total (boe/d) |

3,859 |

4,355 |

(11) |

4,291 |

3,524 |

22 |

|

Sales Volumes |

|

|

|

|

|

|

|

Light oil (bbl/d) |

2,448 |

2,693 |

(9) |

2,687 |

2,231 |

20 |

|

Natural gas (mcf/d)1 |

3,668 |

4,481 |

(18) |

4,107 |

3,772 |

9 |

|

NGLs (boe/d) |

913 |

747 |

22 |

898 |

572 |

57 |

|

Total (boe/d) |

3,972 |

4,187 |

(5) |

4,270 |

3,432 |

24 |

|

Oil inventory volumes (bbls) |

9,921 |

15,200 |

(35) |

9,921 |

15,200 |

(35) |

|

Financial |

|

|

|

|

|

|

|

Oil and NGL sales |

27,313 |

25,157 |

9 |

130,020 |

72,265 |

80 |

|

Natural gas sales |

1,770 |

2,052 |

(14) |

8,701 |

5,231 |

66 |

|

Power generation |

5,964 |

- |

100 |

7,857 |

- |

100 |

|

Blending and processing income |

711 |

623 |

14 |

3,403 |

3,222 |

6 |

|

Other revenue |

(186) |

6 |

(3,200) |

1,484 |

806 |

84 |

|

Total Revenue |

35,573 |

27,838 |

28 |

151,465 |

81,524 |

86 |

|

Cash flow from (used in) operating activities |

11,104 |

13,514 |

18 |

27,058 |

8,060 |

236 |

|

Funds flow2 |

(93) |

1,655 |

(106) |

19,082 |

900 |

2,020 |

|

Adjusted funds flow2 |

1,702 |

2,408 |

(29) |

20,339 |

3,260 |

524 |

|

Net income (loss) |

(10,778) |

19,531 |

(155) |

(22,620) |

17,738 |

(228) |

|

Per share – basic and diluted |

(0.43) |

0.85 |

(151) |

(0.92) |

0.83 |

(211) |

|

Common shares outstanding, end of period |

25,275 |

23,314 |

8 |

25,275 |

23,314 |

8 |

|

Weighted average, basic |

25,275 |

22,757 |

11 |

24,572 |

21,491 |

14 |

|

Weighted average, diluted4 |

25,275 |

22,757 |

11 |

24,572 |

21,491 |

14 |

|

Total Assets |

200,761 |

239,168 |

(17) |

200,761 |

239,168 |

(17) |

|

Cash |

2,424 |

2,841 |

(15) |

2,424 |

2,841 |

(15) |

|

Total debt |

89,309 |

73,192 |

22 |

89,309 |

73,192 |

22 |

|

Net debt2 |

125,592 |

99,020 |

26 |

125,592 |

99,020 |

26 |

|

Netback ($/boe)2 |

|

|

|

|

|

|

|

Oil and gas sales |

82.32 |

67.85 |

21 |

88.65 |

60.26 |

47 |

|

Royalties |

(19.83) |

(14.82) |

34 |

(22.37) |

(10.21) |

119 |

|

Adjusted net operating expenses2 3 |

(51.78) |

(36.90) |

43 |

(40.59) |

(38.08) |

9 |

|

Production enhancement expenses2 |

(1.65) |

(5.78) |

(129) |

(6.00) |

(5.57) |

8 |

|

Transportation and treating |

(3.97) |

(1.57) |

153 |

(2.88) |

(2.11) |

36 |

|

Realized gain (loss) on commodity contracts |

(3.45) |

(0.68) |

407 |

(1.42) |

(0.36) |

294 |

|

Operating Netback2 |

1.64 |

8.10 |

(96) |

15.39 |

3.93 |

268 |

|

1) Natural gas production includes internally consumed natural gas

primarily used in power generation.2) See "Non-IFRS and other

financial measures".3) Excludes production enhancement expenses

incurred in the period.4) The Company uses the weighted average

common shares (basic) when there is a net loss for the period to

calculate net income (loss) per share diluted. |

FOURTH QUARTER & YEAR END 2022 OPERATIONAL

UPDATE

Production volumes in Q4 2022 averaged 3,859

boe/d, an decrease of 11% from Q4 2021 volumes of 4,359 boe/d and

represents a 4% decrease from Q3 2022 volumes of 4,514 boe/d.

Production volumes averaged 4,291 boe/d for the year ended December

31, 2022, an increase of 22% from production volumes of 3,524 boe/d

for the year ended December 31, 2021. Highlights of the changes in

production volumes are as follows:

- Swan Hills –

production volumes increased 25% for the year ended December 31,

2022 as compared to the year ended December 31, 2021 and decreased

14% for Q4 2022 as compared to Q4 2021. The increase in production

volumes for the year ended December 31, 2022, is the result of the

Company conducting a production enhancement program in Swan Hills

in Q2 and Q3 2022. This program has increased production on an IP

30 basis by approximately 434 boe/d for the year ended December 31,

2022. In addition, the operator in Swan Hills Unit No.1 conducted

various production enhancement activities throughout 2022.

Production in 2022 was negatively impacted by approximately 500

boe/d as a result of a non-operated partner reclaiming their

working interest in certain properties during Q2 2022. The decrease

in Q4 2022 as compared to Q4 2021 is the result of the working

interest change as discussed above partially offset by the impact

of production enhancement activity.

- Kaybob –

production volumes increased 15% for the year ended December 31,

2022 as compared to the year ended December 31, 2021 and decreased

13% for Q4 2022 as compared to Q4 2021. The increased in production

volumes for the year ended December 31, 2022 was the result of the

Company’s production enhancement program which was focused in the

Kaybob area in the first half of 2022 increasing production by for

the year ended December 31, 2022. This program has increased

production on an IP 30 basis by approximately 366 boe/d for the

year ended December 31, 2022. The decrease in Q4 2022 can be

attributed to non-operated turnaround activity which decreased

production throughout the quarter.

- Southern Alberta –

production volumes increased 15% for the year ended December 31,

2022 as compared to December 31, 2021 and 10% for Q4 2022 as

compared to Q4 2021 as the result of the Company’s production

enhancement program positively impacting volumes for the year ended

December 31, 2022 and for Q4 2022.

The increase in production volumes for the year

ended December 31, 2022, as compared to the year ended December 31,

2021, is largely due to production enhancement activities

increasing production for the year ended December 31, 2022, offset

by natural declines, various third-party operational downtime,

temporary infrastructure issues and reclaimed working interest by a

non-operated partner as discussed above. The decrease in production

volumes for Q4 2022 as compared to Q4 2021 can be largely

attributed to various third-party operational downtime, temporary

infrastructure issues, natural declines and reclaimed working

interest by a non-operated partner as discussed above partially

offset by the impact of production enhancement activity throughout

2022.

Adjusted net operating expenses decreased $1.9

million or 9% on a total dollar basis and increased 43% on a per

boe basis in Q4 2022 compared to the same period in 2021. The

decrease in the adjusted net operating expense on a total dollar

basis was due to lower production enhancement spending in Q4 2022

as compared to Q4 2021. The increase on a per boe basis was due

primarily to the decrease in production volumes in Q4 2022.

The primary factors affecting operating costs on

a $/boe basis are production levels, workover activity and

electricity pricing. Inherent within the Company’s hydrocarbon

operations is a prominent fixed cost element, or those costs that

are not correlated to production levels. On a relative basis these

costs are higher with lower production. Razor’s reactivation

program took place throughout 2022 and will resume in 2023.

In the year ended December 31, 2022, Razor

experienced more than expected operational spending in both

operated and non-operated areas. Over the last couple of years, due

to lower commodity prices, Razor and its operating partners

deferred certain operations where possible. These operations were

deferable at the time but had to be executed in the 2022 year. A

majority of these deferred projects were completed in the 2022

year, which will allow for normal operations and spending in future

years.

CAPITAL EXPENDITURESTotal

capital expenditures, before grant proceeds was $6.7 million in Q4

2022 and $28.2 million for the year ended December 31, 2022. For

the year ended December 31, 2022, Razor invested $21.1 million in

its Swan Hills Geothermal Power Project.

About Razor

Razor is a publicly traded junior oil and gas

development and production company headquartered in Calgary,

Alberta, concentrated on acquiring, and subsequently enhancing, and

producing oil and gas from properties primarily in Alberta. The

Company is led by experienced management and a strong, committed

Board of Directors, with a long-term vision of growth focused on

efficiency and cost control in all areas of the business. Razor

currently trades on TSX Venture Exchange under the ticker

“RZE.V”.

www.razor-energy.com

About FutEra

FutEra leverages Alberta’s resource industry

innovation and experience to create transformational power and

sustainable infrastructure solutions to commercial markets and

communities, both in Canada and globally. FutEra has constructed,

commissioned and is operating Canada’s first co-produced geothermal

and natural gas hybrid power project in Swan Hills, Alberta.

www.futerapower.com

About Blade

Blade Energy Services is a subsidiary of Razor.

Operating in west central Alberta, Blade’s primary services include

fluid hauling, road maintenance, earth works including well site

reclamation and other oilfield services.

www.blade-es.com

| For

additional information please contact: |

| Doug

Bailey |

|

Kevin

Braun |

| President and Chief Executive Officer |

|

Chief Financial Officer |

Razor Energy Corp.800, 500-5th Ave SWCalgary Alberta T2P

3L5Telephone: 403-262-0242

READER ADVISORIES

FORWARD-LOOKING STATEMENTS:

This press release may contain certain

statements that may be deemed to be forward-looking statements.

Such statements relate to possible future events, including, but

not limited to, the Company’s objectives and anticipated results,

including the completion of the Recapitalization Transaction

(including the various elements thereof), the potential benefits

and effects of the Recapitalization Transaction on Razor, the

ability of Razor to satisfy the closing conditions for the

Recapitalization Transaction and related matters, the conditions to

closing of the Recapitalization Transaction, the Company’s capital

program and other activities; the Swan Hills Geothermal Power

Project and its capacity, construction and commissioning budget;

the CO2 enhanced oil recovery; opportunities for power generation,

oil blending and services integration; restarting wells; execution

of production enhancement programs; future rates of production;

expectations regarding commodity prices, cash flow from operating

activities, working capital and net debt; possible business

combination transactions; and future projects including solar, wind

and other low carbon technologies. All statements other than

statements of historical fact may be forward-looking statements.

Forward-looking statements are often, but not always, identified by

the use of words such as “anticipate”, “believe”, "expect", “plan”,

“estimate”, “potential”, “will”, “should”, “continue”, “may”,

“objective” and similar expressions. The forward-looking statements

are based on certain key expectations and assumptions made by the

Company, including but not limited to expectations and assumptions

concerning the ability of Razor to complete the Rights Offering and

all other portions of the Recapitalization Transaction in the

manner described herein, the availability of capital, current

legislation, receipt of required regulatory approvals, the timely

performance by third-parties of contractual obligation, the success

of future geothermal, drilling and development activities, the

performance of existing wells, the performance of new wells, the

Company’s growth strategy, general economic conditions,

availability of required equipment and services prevailing

commodity prices, price volatility, price differentials and the

actual prices received for the Company's products. Although the

Company believes that the expectations and assumptions on which the

forward-looking statements are based are reasonable, undue reliance

should not be placed on the forward-looking statements because the

Company can give no assurance that they will prove to be correct.

Since forward-looking statements address future events and

conditions, by their very nature they involve inherent risks and

uncertainties. Actual results could differ materially from those

currently anticipated due to a number of factors and risks. These

include, but are not limited to, risks associated with the oil and

gas industry and geothermal electricity projects in general (e.g.,

operational risks in development, exploration and production;

delays or changes in plans with respect to exploration or

development projects or capital expenditures; variability in

geothermal resources; as the uncertainty of reserve estimates; the

uncertainty of estimates and projections relating to production,

costs and expenses, and health, safety and environmental risks),

electricity and commodity price and exchange rate fluctuations,

changes in legislation affecting the oil and gas and geothermal

industries and uncertainties resulting from potential delays or

changes in plans with respect to exploration or development

projects or capital expenditures. In addition, the Company cautions

that COVID-19 or other global pandemics may have a material adverse

effect on global economic activity and worldwide demand for certain

commodities, including crude oil, natural gas and NGL, and may

continue to result in volatility and disruption to global supply

chains, operations, mobility of people and the financial markets,

which could continue to affect commodity prices, interest rates,

credit ratings, credit risk, inflation, business, financial

conditions, results of operations and other factors relevant to the

Company. The duration of the current commodity price volatility is

uncertain. Please also refer to the risk factors identified in the

most recent annual information form and management discussion and

analysis of the Company which are available on SEDAR at

www.sedar.com. The forward-looking statements contained in this

press release are made as of the date hereof and the Company

undertakes no obligation to update publicly or revise any

forward-looking statements or information, whether as a result of

new information, future events or otherwise, unless so required by

applicable securities laws.

This press release contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about Razor's prospective results of

operations, sales volumes, including sale of inventory volumes,

production and production efficiency, balance sheet, capital

spending, cost and net debt reductions, operating efficiencies,

investment infrastructure and components thereof, all of which are

subject to the same assumptions, risk factors, limitations, and

qualifications as a set forth in the above paragraph. FOFI

contained in this document was approved by management as of the

date of this document and was provided for the purpose of providing

further information about Razor's future business operations. Razor

disclaims any intention or obligation to update or revise any FOFI

contained in this document, whether as a result of new information,

future events or otherwise, unless required pursuant to applicable

law. Readers are cautioned that the FOFI contained in this document

should not be used for purposes other than for which it is

disclosed herein.

NON-IFRS AND OTHER FINANCIAL

MEASURESThis press release contains certain specified

measure consisting of non-IFRS measures and non-IFRS financial

ratios. Since these specified financial measures may not have a

standardized meaning, they must be clearly defined and, where

required, reconciled with their nearest IFRS measure. Accordingly,

they may not be comparable to similar measures used by other

companies.

FUNDS FLOW AND ADJUSTED FUNDS

FLOWFunds Flow

Management utilizes funds flow as a useful

measure of Razor’s ability to generate cash not subject to

short-term movements in non-cash operating working capital. As

shown below, funds flow is calculated as cash flow from operating

activities excluding change in non-cash working capital.

Adjusted funds flow

Management utilizes adjusted funds flow as a key

measure to assess the ability of the Company to generate the funds

necessary for financing activities, operating activities, and

capital expenditures. As shown below, adjusted funds flow is

calculated as funds flow excluding purchasing of commodity

contracts, and decommissioning expenditures since Razor believes

the timing of collection, payment or incurrence of these items

involves a high degree of discretion and variability. Expenditures

on decommissioning obligations vary from period to period depending

on the maturity of the Company’s operating areas and availability

of adjusted funds flow and are viewed as part of the Company’s

capital budgeting process.

The following table reconciles cash flow

from operating activities, funds flow and adjusted funds

flow:

| |

Three Months Ended |

Nine Months Ended |

| |

September 30 |

September 30 |

|

($000’s) |

2022 |

2021 |

2022 |

2021 |

|

Cash flow from (used in) operating activities |

12,235 |

(2,340) |

15,954 |

(5,454) |

| Changes

in non-cash working capital |

(8,809) |

2,646 |

3,221 |

4,699 |

|

Funds flow |

3,426 |

306 |

19,175 |

(755) |

| Decommissioning costs

incurred |

550 |

758 |

995 |

1,040 |

| Sale

(purchase) of commodity contracts |

(1,047) |

49 |

(1,533) |

567 |

|

Adjusted funds

flow |

2,929 |

1,113 |

18,637 |

852 |

NET DEBT

Net debt is calculated as the sum of the

long-term debt (includes AIMCo Term Loan, Arena Amended and

Restated Term Loan and Promissory Notes) and lease obligations,

less working capital (or plus working capital deficiency), with

working capital excluding mark-to-market risk management contracts.

Razor believes that net debt is a useful supplemental measure of

the total amount of current and long-term debt of the Company.

|

Reconciliation of net debt |

September 30, |

December 31, |

|

($000’s) |

2022 |

2021 |

|

Long term debt |

(75,328) |

(64,047) |

| Long

term lease obligation |

(2,932) |

(435) |

|

|

(78,260) |

(64,482) |

| Less: Working capital |

|

|

| Current assets |

31,174 |

22,108 |

| Exclude commodity

contracts |

3,275 |

573 |

| Current liabilities |

(66,935) |

(57,219) |

|

|

(32,486) |

(34,538) |

|

Net debt |

110,746 |

99,020 |

Adjusted operating expenses

Adjusted operating expenses are regular field or

general operating costs that occur throughout the year and do not

include production enhancement expenses. Management believes that

removing the expenses related to production enhancements from total

operating expenses is a useful supplemental measure to analyze

regular operating expenses.

Production enhancement

expenses

Production enhancement expenses are expenses

made by the Company to increase production volumes which are not

regular field or general operating costs that occur throughout a

year. Management believes that separating the expenses related to

production enhancements is a useful supplemental measure to analyze

the cost of bringing wells back on production and the related

increases in production volumes.

Reconciliation of Adjusted Operating

expenses, Production Enhancement Expenses and Operating

Expenses

| |

Three Months Ended |

Nine Months Ended |

| |

September 30 |

September 30 |

|

($000's) |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Operating expenses |

21,499 |

|

14,240 |

|

57,154 |

|

39,021 |

|

| Production enhancement

expenses |

(2,588 |

) |

(1,271 |

) |

(8,935 |

) |

(4,844 |

) |

|

Other corporate operating expenses & elimination entries1 |

(481 |

) |

- |

|

(481 |

) |

- |

|

|

Adjusted operated expenses |

18,430 |

|

12,969 |

|

47,738 |

|

34,177 |

|

| 1) Represents

operating costs and intercompany eliminations on the Company’s

non-oil & gas production activities. |

Adjusted Net Operating Expenses

Adjusted net operating expenses equals adjusted

operating expenses less net blending and processing income.

Management considers adjusted net operating expenses and important

measure to evaluate its operational performance.

| |

Three Months Ended |

Nine Months Ended |

| |

September 30 |

September 30 |

|

($000's) |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Adjusted operating expenses |

18,430 |

|

12,969 |

|

47,738 |

|

34,177 |

|

|

Net blending and processing income |

(577 |

) |

(304 |

) |

(1,691 |

) |

(1,486 |

) |

|

Adjusted net operating expenses |

17,853 |

|

12,665 |

|

46,047 |

|

32,691 |

|

NET BLENDING AND PROCESSING

INCOME

Net blending and processing income is calculated

by adding blending and processing income and deducting blending and

processing expense. Net blending and processing income may not be

comparable to similar measures used by other companies.

| |

Three Months Ended June 30, |

Nine Months Ended |

| |

September 30, |

September 30, |

|

($000’s) |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Blending and processing income |

873 |

|

455 |

|

2,692 |

|

2,599 |

|

| Blending and processing

expenses |

(296 |

) |

(151 |

) |

(1,001 |

) |

(1,113 |

) |

|

Net blending and processing income |

577 |

|

304 |

|

1,691 |

|

1,486 |

|

OPERATING NETBACK

Operating netback is a measure that represents

sales net of royalties and operating expenses. Management believes

that operating netback is a useful supplemental measure to analyze

operating performance and provide an indication of the results

generated by the Company’s principal business activities prior to

the consideration of other income and expenses.

| |

Three Months Ended |

Nine Months Ended |

| |

September 30, |

September 30, |

|

($000’s) |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Petroleum and natural gas sales1 |

35,137 |

|

20,643 |

|

109,637 |

|

50,287 |

|

| Royalties |

(10,128 |

) |

(3,738 |

) |

(28,001 |

) |

(7,192 |

) |

| Adjusted net operating

expenses |

(17,853 |

) |

(12,969 |

) |

(46,047 |

) |

(34,177 |

) |

| Production enhancement

expenses |

(2,588 |

) |

(1,271 |

) |

(8,935 |

) |

(4,844 |

) |

| Transportation and treating

expenses |

(1,144 |

) |

(870 |

) |

(3,096 |

) |

(2,091 |

) |

|

Realized derivative gain (loss) on settlement |

(1,135 |

) |

(138 |

) |

(1,003 |

) |

(190 |

) |

|

Operating netback |

2,289 |

|

1,657 |

|

22,555 |

|

1,793 |

|

| 1) Natural gas

production includes internally consumed natural gas primarily used

in power generation. |

|

|

|

|

|

|

|

NON-IFRS AND FINANCIAL

RATIOSOperating expenses per BOE

Operating expenses per boe is consists of

adjusted operating expenses per boe and production enhancement

expenses per boe. Operating expense per boe is a useful

supplemental measure to calculate the efficiency of its operating

expenses on a per unit of production basis.

| |

Three Months Ended |

Nine Months Ended |

| |

September 30, |

September 30, |

|

($/boe)1 |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Operating expenses per BOE |

50.61 |

|

43.39 |

|

46.79 |

|

44.08 |

|

|

Production enhancement expenses |

(6.23 |

) |

(3.87 |

) |

(7.38 |

) |

(5.47 |

) |

|

Adjusted operating expenses |

44.38 |

|

39.52 |

|

39.41 |

|

38.61 |

|

|

1) $/boe amounts are calculated using production

volumes |

| |

Three Months Ended |

Nine Months Ended |

| |

September 30, |

September 30, |

|

($/boe)1 |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Adjusted operating expenses |

44.38 |

|

39.52 |

|

39.41 |

|

38.61 |

|

|

Net blending and processing income |

(1.39 |

) |

(0.93 |

) |

(1.40 |

) |

(1.68 |

) |

|

Adjusted net operating expenses per BOE |

42.99 |

|

38.59 |

|

38.01 |

|

36.93 |

|

|

1) $/boe amounts are calculated using production

volumes |

|

|

|

|

|

|

|

|

Operating Netback per

BoeOperating netback per boe is used to calculate the

results of Razor’s operating efficiency of its petroleum and

natural gas assets on a per unit of production basis. Net operating

expense per boe is a useful supplemental measure to analyze

operating performance and provide an indication of the results

generated by the Company’s principal business activities prior to

the consideration of other income and expenses.

| |

Three Months Ended |

Nine Months Ended |

|

| |

September 30, |

September 30, |

|

|

($/boe)2 |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

| Petroleum and

natural gas sales1 |

84.61 |

|

62.91 |

|

90.51 |

|

56.81 |

|

|

| Royalties |

(24.39 |

) |

(11.39 |

) |

(23.12 |

) |

(8.13 |

) |

|

| Adjusted net

operating expenses |

(42.99 |

) |

(39.52 |

) |

(39.41 |

) |

(38.61 |

) |

|

| Production

enhancement expenses |

(6.23 |

) |

(3.87 |

) |

(7.38 |

) |

(5.47 |

) |

|

| Transportation and

treating expenses |

(2.75 |

) |

(2.65 |

) |

(2.56 |

) |

(2.36 |

) |

|

| Realized

derivative gain (loss) on settlement |

(2.73 |

) |

(0.42 |

) |

(0.83 |

) |

(0.21 |

) |

|

|

Operating netback per BOE |

5.52 |

|

5.06 |

|

17.21 |

|

2.03 |

|

|

|

1) Natural gas production includes internally

consumed natural gas primarily used in power

generation.2) $/boe amounts are calculated using

production volumes |

|

|

|

|

|

|

|

ADVISORY PRODUCTION

INFORMATIONUnless otherwise indicated herein, all

production information presented herein is presented on a gross

basis, which is the Company's working interest prior to deduction

of royalties and without including any royalty interests.

BARRELS OF OIL EQUIVALENTThe

term "boe" or barrels of oil equivalent may be misleading,

particularly if used in isolation. A boe conversion ratio of six

thousand cubic feet of natural gas to one barrel of oil equivalent

(6 Mcf: 1 bbl) is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead. Additionally, given that the

value ratio based on the current price of crude oil, as compared to

natural gas, is significantly different from the energy equivalency

of 6:1; utilizing a conversion ratio of 6:1 may be misleading as an

indication of value.

Neither the

TSX

Venture

Exchange

nor its

Regulation

Services

Provider

(as that

term is

defined in the

policies of the

TSX

Venture

Exchange)

accepts

responsibility for the adequacy

or accuracy of this

news release.

1 See "Non-IFRS and other financial measures".2 These programs

have been successfully demonstrated by the previous operator’s

South Swan Hills Unit CO2 EOR Injection Pilot which ran from 2008

to 2010 in addition to CO2 injection programs carried out in the

Swan Hills Unit No. 1 and Judy Creek oil pools from 2004 to

2010.

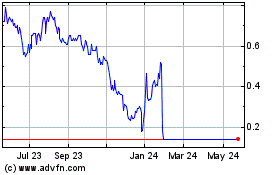

Razor Energy (TSXV:RZE)

Historical Stock Chart

From Apr 2024 to May 2024

Razor Energy (TSXV:RZE)

Historical Stock Chart

From May 2023 to May 2024