Sonoro Gold Corp. (TSXV: SGO | OTCQB: SMOFF | FRA: 23SP) (“Sonoro”

or the “Company”) is pleased to announce an updated Mineral

Resource Estimate (“MRE”) for the Cerro Caliche gold project in

Sonora, Mexico. The MRE has been prepared by SRK Consulting (U.S.)

Inc. (SRK) in accordance with the requirements of National

Instrument 43-101 and is based on a total 59,500 meters of drilled

data including 544 drill holes, 17 trenches and assays for 57,500

meters of the drilled data.

An NI 43-101 technical report detailing the

updated MRE will be completed and filed on SEDAR (www.sedar.com)

within 45 days.

Kenneth MacLeod, President and CEO commented,

“We are very pleased to announce the MRE prepared by SRK Consulting

which provides a comprehensive analysis of all the historical and

recent drilling and trenching carried on Cerro Caliche to date. We

are now evaluating the economic impact of the MRE on the project

while we continue the permitting process.”

John Darch, Sonoro's Chairman added "We are

delighted to reach this milestone as SRK's conclusions and

recommendations align with Sonoro’s declared business plan and

unwavering commitment to shareholders to advance Cerro Caliche to

production. SRK’s resource estimate and suggested potential for

expansion will assist us considerably as we work towards financing

and building our proposed heap leach mining operation.”

Mel Herdrick, Vice President of Exploration

added “The SRK analysis and estimation of Cerro Caliche resources

has been completed to very high standards so that Sonoro can move

confidently forward with advancing the project towards

production.”

Mineral Resource Estimate

Highlights

- Indicated Mineral Resources

(cut-off of 0.20 g/t AuEq) of 19.9 million tonnes (“Mt”) at 0.44

g/t Au and 3.5 g/t Ag grade;

- Contains within an optimized pit

shell:

- 280,000 ounces of gold (“Au”)

- 2,240,000 ounces of silver

(“Ag”)

- 290,000 ounces

of gold equivalent1 (“AuEq”)

- Inferred Mineral Resources (cut-off

of 0.20 g/t AuEq) of 10.5 Mt at 0.42 g/t Au and 4.0 g/t Ag

grade;

- Contains within an optimized pit

shell:

- 140,000 ounces of Au

- 1,345,000 ounces of Ag

- 150,000 ounces

of AuEq

- 65% of the

combined resource tonnage is within the Indicated category;

- Amenable to a

combination of open pit mining and heap leach extraction;

- An updated

Preliminary Economic Assessment (“PEA”) based on the updated MRE is

expected by the end of Q2 2023.

Mineral Resource Estimate

Mineral resources are estimated using a

three-dimensional block model with a nominal block size of 5x5x6

meters (LxWxH). Drill holes, collared from surface, penetrate the

steeply dipping mineralized zones to depths of generally within 125

meters below surface but several holes have intersected gold

mineralization to depths approaching 200 meters below surface. The

resource estimate is generated using drill hole sample assay

results and the interpretation of a geological model which relates

to the spatial distribution of gold and silver. Interpolation

characteristics are defined based on the geology, drill hole

spacing, and geostatistical analysis of the data. The effects of

outlying high-grade sample data, composited to 6.0-meter intervals,

are controlled by traditional capping of the composites. Block

grades are estimated using ordinary kriging and have been validated

using a combination of visual and statistical methods. Mineral

resources that exhibit good continuity of mineralization along with

a consistent pattern of drill holes on a maximum nominal spacing

between 45 and 55 meters, are included in the Indicated category.

Mineral resources in the Inferred category are based on a nominal

spacing of 110 meters.

This updated MRE for Cerro Caliche is based on

data with a cut-off date of January 4, 2023 and is reported with an

effective date of January 26, 2023, in Table 1.

Table 1: Cerro Caliche Project - Mineral Resource

Estimate – 0.20 AuEq g/t Cut-off

Grade1-7

|

Classification |

Tonnes |

Average Grade |

Metal Contents |

|

Au |

Ag |

AuEq |

Au |

Ag |

AuEq |

|

kt |

g/t |

g/t |

g/t |

(000s Oz) |

(000s Oz) |

(000s Oz) |

|

Indicated |

19,900 |

0.44 |

3.5 |

0.46 |

280 |

2,235 |

290 |

|

Inferred |

10,550 |

0.42 |

4.0 |

0.44 |

140 |

1,345 |

150 |

Notes to Table 1:

- The Mineral

Resources in this estimate were calculated using the CIM Standards

on Mineral Resources and Reserves, Definitions and Guidelines (CIM,

2014) prepared by the CIM Standing Committee on Reserve Definitions

and adopted by CIM Council.

- All dollar

amounts are presented in U.S. dollars.

- Pit shell

constrained resources with reasonable prospects for eventual

economic extraction (“RPEEE”) are stated as contained within

estimation domains above 0.20 g/t AuEq cut-off grade. Pit shells

are based on an assumed gold price of $1800/oz and gold recovery of

74%. Silver was not included in the optimization parameters. An

overall slope angle of 50 degrees was applied based on preliminary

geotechnical data. Operating cost assumptions include mining cost

of $1.90/tonne (“t”), processing cost and G&A cost of $6.96/t,

and selling costs of $0.20/oz.

- Average bulk

density assigned by lithology as discussed in the NI 43-101

technical report.

- AuEq is

calculated by domain based on the metallurgical recoveries. Gold

price is $1800/oz, silver price is $25/oz, gold recovery is 74% and

silver recovery is 27.2%. For example: AuEq = [(Au grade* Au

recovery* Au price)+(Ag grade*Ag recovery*Ag price)] / (Au

recovery*Au price).

- Mineral

Resources are not Mineral Reserves and do not have demonstrated

economic viability. There is no certainty that all or any part of

the Mineral Resources will be converted into Mineral Reserves in

the future. The estimate of Mineral Resources may be materially

affected by environmental permitting, legal, title, taxation,

sociopolitical, marketing or other relevant issues.

- All quantities

are rounded to the appropriate number of significant figures;

consequently, sums may not add up due to rounding.

- The mineral

resources were estimated by Doug Reid, P.Eng. of SRK, a Qualified

Person under the terms of CIM guidelines.

SRK also comments favorably on the upside

potential of the project in terms of exploration. The current

geological volumes and grade estimates, located outside of the pit

shells, are consider too limited to establish grade continuity to

meet the present requirements for reasonable prospects of economic

extraction for the mineralized area to be considered Mineral

Resources. SRK has defined the ranges for the potential exploration

targets outside of the current pits shell and are within the

current modelled mineralized zones.

The reader is cautioned that the potential

quantity and grade ranges noted above are conceptual in nature and

insufficient exploration has been conducted to define this material

as a Mineral Resource. It is uncertain if further exploration will

result in these exploration target estimates being delineated as

Mineral Resources or converted to Mineral Reserves in the future.

SRK cautions that estimates of exploration targets are not a

CIM-defined category, are not Mineral Resources and are too

speculative to fulfill the definition of Mineral Resources.

Based on the analysis SRK considers the exploration potential

within drilled areas for Cerro Caliche to be as follows:

|

Cut-offAuEq (g/t) |

Tonnage Range |

Grade Ranges |

Contained Metal |

|

Tonnage Range (‘000) |

AuEq Range (g/t) |

Au Range (g/t) |

Ag Range (g/t) |

AuEQ(‘000 oz) |

Au(‘000 oz) |

Ag(‘000 oz) |

|

|

min |

max |

min |

max |

min |

max |

min |

max |

min |

Max |

min |

max |

min |

max |

|

0.20 |

15,000 |

22,500 |

0.26 |

0.39 |

0.25 |

0.38 |

2.2 |

3.2 |

125 |

285 |

120 |

275 |

1,045 |

2,350 |

There are additional opportunities along strike and parallel to

the current vein trends and this potential may be quantified

through additional drilling. In addition to drilling, surface

mapping and sampling suggests that several mineralized trends have

potential for additional resources along-strike. Further

exploration drill programs are warranted.

Sensitivity AnalysisThe results

of grade sensitivity analysis are presented below to illustrate the

continuity of the grade estimates at various cut-off increments and

the sensitivity of the potentially minable resource to changes in

cut-off grade. The reader is cautioned that figures in the

following tables should not be misconstrued as Mineral Resources or

confused with the Mineral Resource Statement reported above. These

figures are only presented to show the sensitivity of the block

model estimated grades and tonnages to the selection of cut-off

grade. The sensitivity analysis for Indicated blocks have been

separated from Inferred blocks for reporting.

The grade-tonnage data presented below for open

pit sensitivity reports tonnes and grade of the pit constrained

mineral resource at various cut-off increments.

Table 2: Grade-Tonnage for Indicated and Inferred

Mineral Resources

|

Cut-offAuEq (g/t) |

Indicated |

Inferred |

|

Tonnes(kt) |

AuEq (g/t) |

Contained Metal (koz AuEq) |

Tonnes(kt) |

AuEq (g/t) |

Contained Metal (koz AuEq) |

|

0.05 |

38,850 |

0.29 |

360 |

24,600 |

0.25 |

195 |

|

0.10 |

30,750 |

0.35 |

345 |

17,300 |

0.32 |

180 |

|

0.15 |

24,750 |

0.40 |

320 |

13,250 |

0.39 |

165 |

|

0.20 |

19,900 |

0.46 |

290 |

10,550 |

0.44 |

150 |

|

0.25 |

15,650 |

0.52 |

260 |

8,400 |

0.50 |

135 |

|

0.30 |

12,250 |

0.59 |

230 |

6,200 |

0.58 |

115 |

|

0.35 |

9,750 |

0.66 |

205 |

4,700 |

0.65 |

100 |

|

0.40 |

7,700 |

0.73 |

180 |

3,650 |

0.73 |

85 |

|

0.45 |

6,300 |

0.80 |

160 |

2,900 |

0.82 |

75 |

|

0.50 |

5,250 |

0.86 |

145 |

2,450 |

0.88 |

70 |

Figure 1: Grade-Tonnage Curves for Indicated and

Inferred Mineral Resources

Please click here to view image

Geological Model

Due to the nature of the mineralization,

interpretated as a structurally controlled low-sulfidation

epithermal Au-Ag model, a robust structural model was constructed

using Seequent Leapfrog® Geo software. The geological model has

integrated multiple geological sources including, detailed surface

mapping and downhole drill data, collected by Sonoro. Structural

orientations and cross-cutting relationships were modeled to

reflect field observations by Sonoro geologists which include two

NE-SW post mineralization extensional faults, which divide the

mineral resource area into three distinct regions. Indicator grade

shells were generated at the 0.10 Au g/t cut-off for each region

resulting in three mineralized domains. The QP has integrated

structural trends, based on the detailed structural modelling, that

were utilized to capture orientation changes of mineralized

material along strike and down-dip. Capturing these inflections is

critical for properly modelling continuity of mineralization along

mineralized trends that cannot be captured using a “best fit”

search orientation.

Data Verification

The data used in this MRE is supported by

industry standard Quality Assurance and Quality Control (“QA/QC”)

procedures, such as the insertion of certified standards and blanks

into the sample stream and the utilization of certified independent

analytical laboratories for all assays. Historical QA/QC data and

methodology on the project were reviewed and will be summarized in

the NI 43-101 technical report. No significant QA/QC issues were

discovered during review of the data.

All geological data used in the MRE was reviewed

and verified by Douglas Reid, P.Eng. and Scott Burkett, RM-SME,

P.Geo., SRK Principal Consultants. SRK staff visited the Cerro

Caliche project November 4 and 5, 2022. The site visit

included:

- Review of the

geology, available outcrop exposures, and general geological

understanding;

- Review of

historical and recent drill core and procedures used to collect,

record, store and analyze project exploration data;

- Observation of

drill hole locations and an overview of claim/property boundaries

in the field.

SRK compared a portion of the original

laboratory data certificates, geological logs collar and downhole

deviation surveys and sg logs to entries in the Sonoro database.

The database subset was compared to the fundamental data and no

material errors were observed during the review. The verification

data was chosen randomly and contained over 6,000 m of drilling

from 59 drill holes, which represents approximately 10% of total

drilling. Additional discussion on the data verification will be

included in the NI 43-101 technical report for the MRE.

Mineral Resource Estimation Methodology

The Mineral Resource Estimate is based on 544

drill holes and 17 trenches totaling approximately 59,500 m. Assays

exist for 57,500 m of the drilled meters.

Three domains or mineralized grade shells (0.10

Au g/t) were modeled in Leapfrog Geo™ software (version 2022.1.1)

by SRK. Samples were composited into 6m lengths broken by the grade

shells boundaries with residual lengths up to 3.0 m added to the

previous interval. Independent outlier analysis (capping) was

completed on the 6m composites within each grade shell and outside

domain.

The model was rotated to an azimuth of 337

degrees to align with the overall mineralized trend. The model was

constructed with block dimensions of 5 m x 5m x 6m blocks in X-Y-Z.

There were no sub-blocks. The estimation was constrained within the

mineralized grade shells with a separate estimate completed outside

the grade shells. The resource models and block grade estimates

were created using Seequent Leapfrog Edge™ software (version

2022.1.1).

The resource was estimated for gold and silver

using Ordinary Kriging (OK) estimation. Inverse Distance (weight 2)

(ID2) and nearest Neighbor (NN) estimates were completed for

validation purposes. Variable anisotropy was applied to the

searches to match the controls on mineralization. Estimation

outside of the mineralized grade shells was completed with ID2.

Bulk density was scripted by individual lithology units, based on

analysis of specific gravity measurements collected by Sonoro and

previous project operators.

A three-pass search was used to optimize block

estimation, so that well-informed blocks are interpolated using a

tighter search ellipse than less informed blocks. The estimation

search neighborhood was based on gold variograms. Estimation

parameters for silver were identical to gold. Un-estimated blocks

outside of the search neighborhood were scripted to set the values

to 0.001 g/t for both gold and silver.

The selection criteria used for search ellipsoid

size, number of samples and other conditions are derived based on

data spacing to ensure appropriate interpolation, as well as visual

and statistical evaluation, during iterative trial estimation runs.

Across all domains, the estimation is informed by a minimum of 2

composites, maximum of 4 composites and maximum of 1 composite per

drill hole in the first two estimation passes. In the last pass a

minimum of 1 composite was applied.

Limited historical mining has occurred at Cerro

Caliche, but due to the scale of mining and available data, no

depletion has been applied.

The Mineral Resource classification was based on

a recognized industry practice that for an Indicated resource, the

drill hole spacing should be sufficient to predict tonnage, grade

and metal on annual production with ±15 per cent relative precision

at the 90 per cent confidence level (Cl). In the case of a Measured

Mineral Resources, the ±15 per cent relative precision must be

achieved on a quarterly or even monthly production volume. At this

level, the drill spacing is usually close enough to permit the

assumption of grade and volume (tons) continuity between drill

holes.

Within the Western Domain, the study suggests a

spacing of 22 m for Measured and 44 m for Indicated. Within the

Central Domain, the study suggests a spacing of 28 m for Measured

and 55 m for Indicated Resources. A spacing of 110 m was applied to

define Inferred Resources. Remaining material within the grade

shells beyond this spacing was defined as Exploration Potential and

not included in the economic analysis. The Measured Resources

identified by this study were reclassified as Indicated Resources

due to the limited extent of potential Measured Resources.

Technical Report

The effective date of the herein reported MRE

January 26, 2023. A NI 43-101 technical report prepared by SRK

Consulting (U.S.) Inc. will be filed on SEDAR within 45 days of

this news release and will be available at that time on the Sonoro

website.

For readers to fully understand the information

in this news release they should read the technical report in its

entirety when it is available, including all qualifications,

assumptions, exclusions and risks. The technical report is intended

to be read as a whole and sections should not be read or relied

upon out of context.

Qualified Persons

The scientific and technical information

contained in this news release pertaining to Cerro Caliche has been

reviewed and approved by the following qualified persons under NI

43-101:

- Geology: Scott Burkett, RM-SME,

P.Geo., SRK Principal Consultant

- Mineral

Resources: Douglas Reid, P.Eng., SRK Principal Consultant;

The qualified persons have verified the

information disclosed herein, including the sampling, preparation,

security and analytical procedures underlying such information, and

are not aware of any significant risks and uncertainties that could

be expected to affect the reliability or confidence in the

information discussed herein. Also see the discussion under the

heading “Data Verification.” Each of Messrs. Burkett and Reid is an

"Independent Qualified Person" vis-à-vis Sonoro as such term is

defined in NI 43-101.

About SRK Consulting (U.S.),

Inc.SRK Consulting is an independent international mining

consultancy firm, which provides focused advice and solutions to

clients in the earth and water resource industries. The company has

contributed to its clients' success for over 45 years in over

20,000 projects globally. It is based across 45 offices worldwide

with leading mining specialists in fields such as due diligence,

technical studies, mine waste and water management, permitting and

mine rehabilitation.

About Sonoro Gold Corp.Sonoro

Gold Corp. is a publicly listed exploration and development Company

holding the near-development-stage Cerro Caliche project and the

exploration-stage San Marcial project in Sonora State, Mexico. The

Company has highly experienced operational and management teams

with proven track records for the discovery and development of

natural resource deposits.

On behalf of the Board of Sonoro Gold

Corp.Per: “Kenneth

MacLeod” Kenneth

MacLeod President

& CEO

For further information, please contact: Sonoro Gold Corp. -

Tel: (604) 632-1764 Email: info@sonorogold.com

Forward-Looking Statement

Cautions: This press release may contain "forward-looking

information" as defined in applicable Canadian securities

legislation. All statements other than statements of historical

fact, included in this release, including, without limitation,

statements regarding the future exploration and development on the

Cerro Caliche project, and future plans and objectives of the

Company, constitute forward looking information that involve

various risks and uncertainties. Forward-looking information is

based on a number of factors and assumptions which have been used

to develop such information, but which may prove to be incorrect,

including, but not limited to, assumptions in connection with the

continuance of the Company and its subsidiaries as a going concern,

general economic and market conditions, mineral prices and the

accuracy of Mineral Resource Estimates. There can be no assurance

that such information will prove to be accurate and actual results

and future events could differ materially from those anticipated in

such forward-looking information. Important factors that could

cause actual results to differ materially from the Company's

expectations include exploration and development risks associated

with the Company’s projects, the failure to establish estimated

Mineral Resources, volatility of commodity prices, variations of

recovery rates, and global economic conditions. The forward-looking

information contained in this release is made as of the date of

this release. The Company disclaims any intention or obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by law or the policies of the TSX Venture Exchange.

Readers are encouraged to review the Company’s complete public

disclosure record on SEDAR at www.sedar.com.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accept responsibility for the

adequacy or accuracy of this release.

1 See Notes to Table 1 (Mineral Resources Estimate) in this news

release for the calculation of gold equivalency.

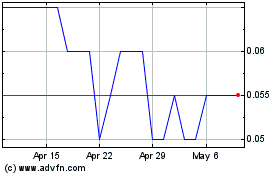

Sonoro Gold (TSXV:SGO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sonoro Gold (TSXV:SGO)

Historical Stock Chart

From Jan 2024 to Jan 2025