Solar Alliance provides update on Canadian solar acquisition, extends exclusivity period as due diligence continues

July 20 2023 - 6:00AM

Solar Alliance Energy Inc. (‘Solar Alliance’ or the

‘Company’) (TSX-V: SOLR), a leading solar energy solutions

provider focused on the commercial and industrial solar sector, is

pleased to provide an update on the Letter of Intent (“LOI”) the

Company entered into on May 16, 2023 to acquire a growing,

profitable Canadian solar company (the “Target”) in a predominantly

share-based transaction (the “Transaction”). The Target is a

Western Canadian leader in solar for commercial and utility

customers, with more than 33 MW of commercial and utility solar

projects installed.

The Company is pleased to provide an update of

the Target’s revenue and contracted project backlog. At the time of

the signing of the LOI on May 16, 2023 (the “LOI Execution Date”),

the Target reported year-to-date unaudited 2023 fiscal year (July

31, 2023 year-end) revenue of $5,801,023. The Target’s current

year-to-date unaudited 2023 fiscal year (July 31, 2023 year-end)

revenue is $6,977,528.

At the time of the LOI Execution Date, the

Target had a backlog of contracted projects totaling more than $5.6

million. The Target’s updated backlog of contracted projects is now

$5.2 million.

The Company and the Target have entered into an

amendment agreement dated July 19, 2023 (the “Amendment”) to amend

the LOI by extending the exclusivity period for an additional 30

days. The exclusivity period is now 120 days from the LOI Execution

Date. In consideration of the increased unaudited revenue reported

by the Target, the Amendment also adjusts the number of warrants

issuable upon closing of the Transaction. One common share purchase

warrant (a “Warrant”) will now be issued for each common share of

the Company (a “Common Share”) issued. Each Warrant will entitle

the Target to purchase one Common Share at an exercise price equal

to the lesser of $0.20 or the exercise price of warrants of the

Company to be issued in any financing undertaken by Solar Alliance

in connection with the Transaction.

The total consideration of $6,000,000,

represented by; (a) a cash payment of $500,000, (b) an unsecured

convertible debenture of $700,000, and (c) the issuance of units of

the Company (each, a “Unit”) valued at $4,800,000, with each Unit

comprised of one Common Share and one Warrant, all remain unchanged

except as described above. Further details on the LOI are described

in the Company’s news release dated May 18, 2023.

“Extending the exclusivity period for this

letter of intent is a reflection of the progress we are making as

we continue due diligence,” said CEO Myke Clark. “The updated

financial results from the Target are encouraging and only

strengthen our desire to enter into a binding definitive agreement.

The Amendment represents a reasonable adjustment to the total

consideration while still providing for a highly accretive

acquisition opportunity.”

Closing of the Transaction remains subject to a

number of conditions, including satisfactory completion of due

diligence, the execution of a binding definitive agreement,

shareholder approval and the approval of the TSX Venture

Exchange.

Myke Clark, CEO

|

For more information: |

|

Investor RelationsMyke Clark,

CEO416-848-7744mclark@solaralliance.com |

About Solar Alliance Energy Inc.

(www.solaralliance.com)

Solar Alliance is an energy solutions provider

focused on the commercial, utility and community solar sectors. Our

experienced team of solar professionals reduces or eliminates

customers' vulnerability to rising energy costs, offers an

environmentally friendly source of electricity generation, and

provides affordable, turnkey clean energy solutions. Solar

Alliance’s strategy is to build, own and operate our own solar

assets while also generating stable revenue through the sale and

installation of solar projects to commercial and utility customers.

The Company currently owns a 33% interest in two operating solar

projects in New York and actively pursuing opportunities to grow

its ownership pipeline. The technical and operational synergies

from this combined business model supports sustained growth across

the solar project value chain from design, engineering,

installation, ownership and operations/maintenance.

Statements in this news release, other than

purely historical information, including statements relating to the

Company's future plans and objectives or expected results,

constitute Forward-looking statements. The words “would”, “will”,

“expected” and “estimated” or other similar words and phrases are

intended to identify forward-looking information. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the Company’s actual results,

level of activity, performance or achievements to be materially

different than those expressed or implied by such forward-looking

information. Such factors include but are not limited to:

satisfactory due diligence of the Target, the ability to settle the

definitive agreement with the Target, obtaining the approval of the

TSX Venture Exchange for the Transaction and completion of the

Transaction on the terms as announced or at all; the ability to

complete the Company’s solar projects on the anticipated timelines,

the ability to pursue new solar projects uncertainties related to

the ability to raise sufficient capital, changes in economic

conditions or financial markets, litigation, legislative or other

judicial, regulatory, legislative and political competitive

developments, technological or operational difficulties, the

ability to maintain revenue growth, the ability to execute on the

Company’s strategies, the ability to complete the Company’s current

and backlog of solar projects and convert such projects into

revenue and the ability to grow the Company’s market share.

Consequently, actual results may vary materially from those

described in the forward-looking statements.

"Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release."

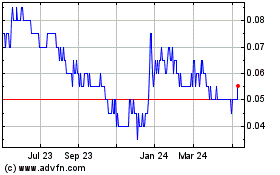

Solar Alliance Energy (TSXV:SOLR)

Historical Stock Chart

From Oct 2024 to Nov 2024

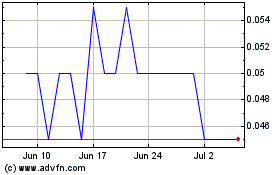

Solar Alliance Energy (TSXV:SOLR)

Historical Stock Chart

From Nov 2023 to Nov 2024