Solar Alliance provides 2024 corporate update

January 24 2024 - 6:00AM

Solar Alliance Energy Inc. (‘Solar Alliance’ or the

‘Company’) (TSX-V: SOLR), a leading solar energy solutions

provider focused on the commercial and industrial solar sector, is

pleased to provide a corporate and operational update as the

Company targets another year of strong growth in the U.S.

commercial solar market.

“2023 was a transformative year for Solar

Alliance as our sales and operations team hit their full stride,

delivering our first profitable quarter in the Company’s commercial

solar history in Q3,” said CEO Myke Clark. “We remain committed to

growing the Company with an emphasis on profitability and we

believe our business plan and contracted backlog support this

strategy.”

“We have focused on larger, higher margin

commercial solar projects, combined with diligent cost control, in

order to drive responsible growth,” said U.S. General Manager Jon

Hamilton. “The second half of 2023 was extremely busy as we built

out our backlog of contracted projects and that pace is continuing

into 2024.”

Key corporate highlights and objectives

Conversion of contracted project backlog

to revenue. The Company experienced a productive fourth

quarter in 2023 as the operations and installation teams executed

on several larger projects. Significant progress was made on the

following projects, which are all expected to be complete in Q1,

2024:

- A 565-kilowatt (“kW”) commercial

solar project for a manufacturing client in Tennessee announced on

May 31, 2023.

- A 872-kW solar project in Tennessee

announced on February 13, 2023, with a $1.8 million capital

cost.

- Two projects, 250-kW and 299-kW,

for a Tennessee client announced on July 10, 2023. The two

projects, with a capital cost of $1.58 million, began construction

in Q4, 2023.

- Multiple smaller commercial solar

projects in the 30-kW to 100-kW range were completed in Q4, 2023

and several other commenced construction.

Sales targets and project sizes

increased. Solar Alliance has systematically, and

responsibly, increased the size and number of commercial solar

projects it has designed and installed. The average system size

being designed and installed by Solar Alliance has grown each of

the last three years and the Company expects continued growth in

system sizes in 2024 while maintaining its focus on

profitability.

|

Year |

Commercial Projects |

Average System Size (kW) |

|

2021 |

6 |

25 |

|

2022 |

7 |

258 |

|

2023 |

22 |

272 |

Project sizes in 2023 range from small

commercial projects in the 30-kW range, up to the Company’s largest

project sold in 2023 of 872-kW. The Solar Alliance sales team is

currently focused on multiple potential opportunities in the 500-kW

to the multi-megawatt range as our capabilities expand.

Southeast U.S. Market Focus.

Based out our Knoxville, Tennessee office, Solar Alliance has

created a centre of excellence that can leverage sales and

operations partners to extend its reach. This model, which includes

outsourcing certain aspects of project installation, allows for

improved pace, efficiency, stronger margins and lower overhead

costs. Critically, the key components of sales, design and

engineering, and project management are maintained in-house to

ensure quality control. In the commercial solar sector in the U.S.

Southeast, Solar Alliance continues to build strong brand

awareness. The addressable market in the region, combined with

demonstrated growth opportunities, has convinced the Company to

remain focused on the U.S. Southeast as demand for commercial solar

intensifies. In addition, Solar Alliance remains strategically

positioned to benefit from interest in Inflation Reduction Act tax

credits and other federal incentives. These credits not only

contribute to our profitability target but also increase the

economic benefits for business that choose to go solar.

Corporate growth opportunities.

Solar Alliance is targeting several potential avenues for growth in

2024 in addition to the Company’s strong organic growth. The

Company is exploring accretive and strategically opportunistic

North American acquisition opportunities, with a bias towards the

U.S. market. Solar Alliance is focused on the following potential

strategic opportunities:

- M&A opportunities that scale

the Company’s current operations. This would include companies with

a similar business model as Solar Alliance.

- M&A opportunities that provides

sector diversification, including solar project developers.

- Joint venture relationship with

entities seeking entry into the U.S. commercial solar market.

Solar Alliance recognizes the benefit of

achieving greater scale and is committed to seeking out

opportunities that provide strategic value for shareholders.

Capital markets volatility in 2023 limited M&A activity in the

small cap sector. Solar Alliance focused on achieving profitability

and positioning the Company in the event market conditions improve.

The Company is optimistic 2024 will provide more favourable market

conditions to execute one or more of the Company’s corporate growth

goals.

“Solar Alliance is well positioned to execute on the next stage

in its growth strategy. We have built a lean, flexible and

technically proficient team that fills a need in the commercial

solar industry. Our strategic opportunities, combined with a large

addressable market and the compelling benefits for business

customers, set the stage for an exciting year ahead,” concluded CEO

Myke Clark.

Myke Clark, CEO

|

|

|

| For more

information: |

|

|

|

|

| |

|

| Investor

RelationsMyke Clark,

CEO416-848-7744mclark@solaralliance.com |

|

|

|

|

About Solar Alliance Energy Inc.

(www.solaralliance.com)Solar

Alliance is an energy solutions provider focused on the commercial,

utility and community solar sectors. Our experienced team of solar

professionals reduces or eliminates customers' vulnerability to

rising energy costs, offers an environmentally friendly source of

electricity generation, and provides affordable, turnkey clean

energy solutions. Solar Alliance’s strategy is to build, own and

operate our own solar assets while also generating stable revenue

through the sale and installation of solar projects to commercial

and utility customers. The Company currently owns two operating

solar projects in New York and actively pursuing opportunities to

grow its ownership pipeline. The technical and operational

synergies from this combined business model supports sustained

growth across the solar project value chain from design,

engineering, installation, ownership and

operations/maintenance.

Statements in this news release, other than

purely historical information, including statements relating to the

Company's future plans and objectives or expected results,

constitute Forward-looking statements. The words “would”, “will”,

“expected” and “estimated” or other similar words and phrases are

intended to identify forward-looking information. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the Company’s actual results,

level of activity, performance or achievements to be materially

different than those expressed or implied by such forward-looking

information. Such factors include but are not limited to:

uncertainties related to the ability to raise sufficient capital;

changes in economic conditions or financial markets; litigation,

legislative or other judicial, regulatory, legislative and

political competitive developments; technological or operational

difficulties; the ability to maintain revenue growth; the ability

to execute on the Company’s strategies; the ability to complete the

Company’s current and backlog of solar projects; the ability to

grow the Company’s market share; the high growth US solar industry;

the ability to convert the backlog of projects into revenue; the

expected timing of the construction and completion of the 872 KW

Tennessee solar project; the targeting of larger customers; the

ability to predict and counteract the effects of COVID-19 on the

business of the Company, including but not limited to the effects

of COVID-19 on the construction sector, capital market conditions,

restriction on labour and international travel and supply chains;

potential corporate growth opportunities and the ability to execute

on the key objectives in 2023. Consequently, actual results may

vary materially from those described in the forward-looking

statements.

“Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release."

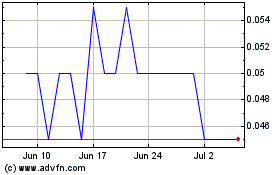

Solar Alliance Energy (TSXV:SOLR)

Historical Stock Chart

From Oct 2024 to Nov 2024

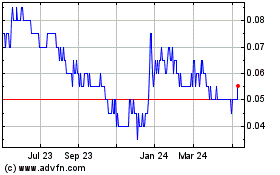

Solar Alliance Energy (TSXV:SOLR)

Historical Stock Chart

From Nov 2023 to Nov 2024