Tornado Global Hydrovacs Reports First Quarter 2023 Results

May 25 2023 - 6:30AM

Tornado Global Hydrovacs Ltd. (“Tornado” or the “Company”)

(TSX-V: TGH; OTCQX: TGHLF) today reported its unaudited condensed

consolidated financial results for the three months period ended

March 31, 2023. The unaudited condensed consolidated financial

statements and related management discussion and analysis are

available on the Company’s issuer profile in Canada on SEDAR at

www.sedar.com, the United States at www.otcmarkets.com and on

the Company’s website www.tornadotrucks.com. All amounts reported

in this news release are in thousands ($000’s CAD) except per share

amounts.

Financial and Operating

Highlights (in CAD $000’s except per share

data)

| |

|

|

|

|

Three Months ended March 31 |

|

|

|

2023 |

|

|

2022 |

|

| |

|

|

| Revenue |

$ |

21,031 |

|

$ |

9,939 |

|

| Cost of

sales |

|

17,583 |

|

|

7,595 |

|

| Gross Profit (1) |

|

3,448 |

|

|

2,344 |

|

| |

|

|

| Selling and general

administrative expenses |

|

1,789 |

|

|

1,398 |

|

| Depreciation and

amortization |

|

332 |

|

|

307 |

|

| Finance expense |

|

161 |

|

|

45 |

|

| Stock-based compensation |

|

129 |

|

|

53 |

|

| Gain on

disposal of fixed assets |

|

- |

|

|

(136 |

) |

| |

|

|

| Income before tax |

|

1,037 |

|

|

677 |

|

| Income

tax expense |

|

(252 |

) |

|

(203 |

) |

| |

|

|

| Net income |

$ |

785 |

|

$ |

474 |

|

| |

|

|

| Net income per share -

basic |

$ |

0.006 |

|

$ |

0.004 |

|

| Net income per share -

diluted |

$ |

0.006 |

|

$ |

0.004 |

|

| |

|

|

| EBITDAS (1) |

$ |

1,659 |

|

$ |

946 |

|

| EBIT (1) |

$ |

1,198 |

|

$ |

722 |

|

| |

|

|

| Total assets |

$ |

44,326 |

|

$ |

27,016 |

|

|

Shareholders Equity |

$ |

16,998 |

|

$ |

12,703 |

|

| |

|

|

1 EBITDAS (earnings (loss) before interest, tax, depreciation

and amortization, non-cash impairment, gain/loss on disposal of

fixed assets and stock-based compensation), EBIT (earnings before

interest and taxes) and Gross Profit (revenue less cost of sales)

are not defined by IFRS. EBIT is the result of the Company’s

EBITDAS less depreciation and amortization expenses, gains and

losses on the disposal of assets, non-cash impairment and

stock-based compensation. While not IFRS measures, EBITDAS, EBIT

and Gross Profit are used by management, creditors, analysts,

investors and other financial stakeholders to assess the Company’s

performance and management from a financial and operational

perspective. Readers are cautioned that EBITDAS and EBIT should not

be considered to be more meaningful than Loss before Tax determined

in accordance with IFRS.

First Quarter 2023 Overview and Recent

Developments

- The economic environment continued

to improve during Q1/2023 resulting in the improvement of several

key operating financial metrics compared to the same period in

2022. The Company achieved its highest ever quarterly sales, Gross

Profit and EBITDAS.

- Revenue of $21,031 increased 111.6% in Q1/2023 compared to

$9,939 in Q1/2022 as customer demand continued to recover. The

quarter was another record quarterly revenue for the Company.

- Gross Profit of $3,448 increased by

$1,104 in Q1/2023 compared to $2,344 in Q1/2022 due to increased

revenue. Gross Profit was also positively impacted by the benefits

from cost savings on parts sourced globally during Q1/2023. Gross

Profit was negatively impacted by increased material, labour and

freight costs in Q1/2023.

- General and administrative expense

of $1,789 in Q1/2023 increased by $391 compared to $1,398 in

Q1/2022. The increase was principally due to general increased

employee costs in North America incurred to handle present and

anticipated growth.

- EBITDAS of $1,659 increased 75.4%

in Q1/2023 compared to $946 in Q1/2022. This increase was due to

the factors discussed above.

- In July 2022 the Company entered

into a Product Supply and Development Agreement for the

co-development and supply of customized hydrovac trucks (the

“Supply Contract”) with Ditch Witch, a division of The Toro Company

(“Ditch Witch”). The Supply Contract contains a commitment for the

delivery of a number of innovative, proprietary hydrovac trucks to

Ditch Witch that are estimated to generate minimum gross revenue

for the Company in the amount of $44 million USD during the four

year term. In addition the agreement provides for the transfer and

sale of certain intellectual property rights (“IP”) relating to the

proprietary hydrovac trucks developed for Ditch Witch. This

strategic alliance brings together two strong brands with a

collective purpose to better serve customers and meet future demand

including the improved outlook on infrastructure spending and the

effect this spending will have on hydrovac demand globally. In

Q1/2023, twelve customized hydrovac trucks were sold and delivered

to Ditch Witch.

Segmented information (in CAD

$000’s)

| |

|

|

|

|

Three Months ended March 31, 2023 |

North America |

Corporate |

Total |

|

Revenue |

$ |

21,031 |

$ |

- |

|

$ |

21,031 |

|

Cost of sales |

|

17,583 |

|

- |

|

|

17,583 |

| Selling

and general administrative |

|

1,641 |

|

148 |

|

|

1,789 |

|

EBITDAS |

$ |

1,807 |

$ |

(148 |

) |

$ |

1,659 |

|

|

|

|

|

|

|

|

|

|

|

Three Months ended March 31, 2022 |

North America |

Corporate |

Total |

|

Revenue |

$ |

9,939 |

$ |

- |

|

$ |

9,939 |

|

Cost of sales |

|

7,595 |

|

- |

|

|

7,595 |

| Selling

and general administrative |

|

1,181 |

|

217 |

|

|

1,398 |

|

EBITDAS |

$ |

1,163 |

$ |

(217 |

) |

$ |

946 |

|

|

|

|

|

Notes: Non-IFRS Measures - Readers are cautioned that EBITDAS is

not a recognized financial measure under IFRS and as such EBITDAS

should not be considered to be more meaningful than Loss before Tax

determined in accordance with IFRS.

Outlook

Management believes the Company’s business will

continue to strengthen and expects the Company’s production and

sales of hydrovac trucks in North America in 2023 to continue to

grow for the following reasons:

- The positive impact of the Supply

Contract with Ditch Witch including an anticipated total of $3

million USD cash proceeds in 2023 upon meeting certain milestones

related to the transfer of IP.

- The Company anticipates increasing

revenues and benefits from the exclusive sales agreement with its

US strategic partner, Custom Truck One Source (“Custom Truck”), a

single-source provider of specialized truck and heavy equipment

solutions including sales, rentals, and financing and has an

integrated network of 35 locations across North America that the

Company entered into in 2019.

- Expected increased spending on

infrastructure in North America, particularly in the USA as a

result of the US Infrastructure Bill passed in late 2021.

- The anticipated addition of new and

innovative products to its product lines that will support the

infrastructure, telecommunications and oil and gas industries.

- The Company’s commitment to

continuous improvement of its hydrovac truck design which in the

Company’s view will result in compelling advantages over other

hydrovac trucks currently offered in the market.

- The Company has secured key

manufacturing components, including chassis for customers, into

future years through strategic relationships.

- The Company has strengthened its

dealer relationships in both Canada and US to meet the expected

demand increase.

- Expanded North American coverage

for maintenance warranty and repair to better serve customers.

- Increased sales pricing to

customers to reflect changes in material and labour costs.

Limiting factors on the Company’s ability to

meet increased demand include: (i) the possibility of chassis

supply chain interruption due to chip shortages at the chassis

manufacturer level and other supply chain issues related to other

key hydrovac components exacerbated by the COVID pandemic, Russia’s

invasion of Ukraine and USA China tensions, Canada China relations,

and China Taiwan tensions; and (ii) general inflationary increases

in components and labour. However, management believes that it will

be able to manage these supply chain issues as a result of

strategic decisions made by the Company.

About Tornado Global Hydrovacs

Ltd.

Tornado is a pioneer and leader in the vacuum

truck industry and has been a choice of utility and oilfield

professionals with over 1,200 hydrovacs sold since 2005. The

Company designs and manufactures hydrovac trucks as well as

provides heavy duty truck maintenance operations in central

Alberta. It sells hydrovac trucks to excavation service providers

in the infrastructure and industrial construction and oil and gas

markets. Hydrovac trucks use high pressure water and vacuum to

safely penetrate and cut soil to expose critical infrastructure for

repair and installation without damage. Hydrovac excavation methods

are quickly becoming a standard in the North America to safely

excavate in urban areas and around critical infrastructure greatly

reducing infrastructure damage and related fatalities. In China,

the Company’s subsidiary is used principally to source certain

parts to the Company’s North America operations.

For more information about Tornado Global

Hydrovacs Ltd., visit www.tornadotrucks.com or contact:

|

Brett Newton |

Investor Relations Contact |

| President and Chief Executive

Officer |

Jeff Walker, VP |

| Phone: (587) 802-5070 |

The Howard Group Inc. |

| Email: bnewton@tghl.ca |

Phone: (403) 221-0915 |

| |

Email:

jeff@howardgroupinc.com |

Advisory

Certain statements contained in this news

release constitute forward-looking statements. These statements

relate to future events. All statements other than statements of

historical fact are forward-looking statements. The use of the

words “anticipates”, “should”, ‘‘may”, “expected”, “expects”,

“believes” and other words of a similar nature are intended to

identify forward-looking statements. These statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements. Although Tornado

believes these statements to be reasonable, no assurance can be

given that these expectations will prove to be correct and such

forward-looking statements included in this news release should not

be unduly relied upon. Such statements include those with respect

to:

- the expectation that the Company’s

production and sales of hydrovac trucks in North America in 2023

will continue to grow;

- the expectation of a positive

impact from the Supply Contract with Ditch Witch and receipt of an

anticipated total $3 Million USD cash proceeds in 2023 upon meeting

certain milestones related to the transfer of certain intellectual

property rights relating to the proprietary hydrovac trucks;

- management’s belief in the

increasing revenues and benefits from the exclusive sales agreement

with its US strategic partner;

- the Company’s estimate of aggregate

gross revenue in the amount of $44 million USD from the Supply

Contract;

- the anticipated development and

supply of the customized hydrovac trucks to be delivered by the

Company over a four-year period commencing in fiscal year 2022 and

ending in fiscal year 2025;

- the expectation that the Company

will be able to capitalize on the increased capacity of the Red

Deer facility over the long term;

- the expectation that the US

Infrastructure Bill will lead to an increase in infrastructure

spending;

- the Company’s outlook for the 2023

fiscal year generally;

- the expectation that the improving

economic environment is expected to continue through 2023;

- the expectation of adding new and

innovative products to its product lines that will support the

infrastructure, telecommunications and oil and gas industries;

- management’s belief that the

Company’s commitment to continuous improvement of its hydrovac

truck design will continue to provide compelling advantages over

other hydrovac trucks currently offered in the market;

- management’s belief in the positive

impact of securing key manufacturing components, including chassis,

for customers into future years through strategic

relationships;

- management’s belief in the positive

impact of strengthened dealer relationships in both Canada and

US;

- management’s belief in the positive

impact of expanded North American coverage for maintenance warranty

and repair;

- management’s belief in the positive

impact of increased sales pricing to customers to reflect changes

in material and labour costs; and

- the Company’s ability to meet

increased demand may be limited by factors including (i) the

possibility of chassis supply chain interruption due to chip

shortages at the chassis manufacturer level and other supply chain

issues related to other key components exacerbated by the COVID

pandemic, Russia’s invasion of Ukraine and USA China tensions,

Canada China relations, and China Taiwan tensions; and (ii) general

inflationary increases in components and labour. Management’s

belief that it will be able to manage these supply chain issues as

a result of strategic decisions made by the Company.

These statements involve known and unknown

risks, uncertainties and other factors that may cause actual

results or events to differ materially from those anticipated in

such forward-looking statements. Actual results could differ

materially from those anticipated in these forward-looking

statements as a result of prevailing economic conditions, and other

factors, many of which are beyond the control of Tornado. Although

Tornado believes these statements to be reasonable, no assurance

can be given that these expectations will prove to be correct and

such forward-looking statements included in this news release

should not be unduly relied upon. The forward-looking statements

contained in this news release represent Tornado’s expectations as

of the date hereof and are subject to change after such date.

Tornado disclaims any intention or obligation to update or revise

any forward-looking statements whether as a result of new

information, future events or otherwise, except as may be required

by applicable securities regulations.

Neither the Exchange nor its Regulation

Service Provider (as that term is defined in policies of the

Exchange) accepts responsibility for the adequacy or accuracy of

this news release.

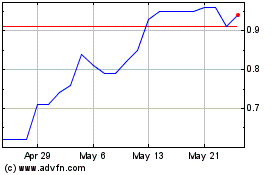

Tornado Infrastructure E... (TSXV:TGH)

Historical Stock Chart

From Nov 2024 to Dec 2024

Tornado Infrastructure E... (TSXV:TGH)

Historical Stock Chart

From Dec 2023 to Dec 2024