White Gold Corp. (TSX.V: WGO, OTC – Nasdaq Intl: WHGOF,

FRA: 29W) (the "Company") is pleased to announce positive

RC drill results on its recently acquired VG Deposit located on the

QV Property. The drilling extended known mineralization which

remains open in all directions and shows similarities to the nearby

Golden Saddle deposit. The QV Property was acquired in early 2019

and contains the VG Deposit, which hosts an historic inferred gold

resource of 230,000 oz at 1.65 g/t Au(1) and several highly

prospective undrilled targets in close proximity. The QV Property

is historically underexplored and demonstrates strong similarities

and prospective geology as that found on both the White Gold and JP

Ross properties. Drilling in 2019 was designed to step-out on the

VG deposit along strike to the NE and SW, and to infill gaps in the

deposit’s historic resource model. The Company’s fully-funded $13

million 2019 exploration program, backed by partners Agnico Eagle

Mines Limited (TSX: AEM, NYSE: AEM) and Kinross Gold Corp (TSX: K,

NYSE: KGC), includes diamond drilling on the Vertigo target (JP

Ross property), Golden Saddle & Arc deposits (White Gold

property) as well as soil sampling, prospecting, GT Probe sampling,

trenching and RAB/RC drilling on various other properties across

the Company’s expansive land package located in the prolific White

Gold District, Yukon, Canada.

Highlights Include:

- QV Property was acquired in early 2019 and includes the

VG Deposit which hosts a historic Inferred gold resource of 230,000

oz at 1.65 g/t Au. The property has geologic similarities to both

the newly discovered Vertigo target as well as the Company’s

flagship White Gold property which has a mineral resource of

1,039,600 ounces Indicated at 2.26 g/t Au and 508,700 ounces

Inferred at 1.48 g/t Au. The QV is vastly underexplored and a high

priority for follow-up exploration.

- 2019 activity included 870m of RC drilling across 8

holes, designed to step-out along the strike of the deposit to the

NE and SW, and to infill gaps in the deposit’s historic resource

model. LiDAR was also completed over the southern portion of the

property and a total of 1,466 soil samples were collected.

- Golden Saddle style gold mineralization was intercepted

in every hole at the VG deposit. Results confirmed

continuity of mineralization and extended the current deposit

limits. The VG deposit remains open in both directions along strike

and downdip.

- 2019 Drill highlights include QVVGRC19-005 which

intercepted 50.3m of 2.07 g/t Au, QVVGRC19-007

intercepting 38.10m of 1.97 g/t Au, QVVVGRC19-006 intercepting

36.58m of 1.42 g/t Au, QVVVGRC19-002 intercepting 33.54m of 1.09

g/t Au, and QVVVGRC19-001 intercepting 10.67m of 2.09 g/t

Au.

- Multiple underexplored, high-priority targets exist

surrounding the VG resource on the QV property, including the

Tetra, Shadow and Stewart gold targets, which warrant follow-up

exploration based on exploration performed to date.

Images to accompany this news release can be

found

at http://whitegoldcorp.ca/investors/exploration-highlights/.

“We are very pleased with the results of our

2019 RC drill program on the recently acquired VG Deposit. The

program further expanded the footprint of the deposit, which

continues to remain open along strike and at depth and refined the

geologic model for continued follow up work. Furthermore, the

mineralization, alteration, geochemistry and structural controls of

the VG are remarkably similar to our flagship Golden Saddle deposit

just 10km to the south,” stated David D’Onofrio, Chief Executive

Officer. “This property has seen very limited exploration to date

and we are confident that our team is well positioned to maximize

the value of the VG deposit and the several other highly

prospective and untested new targets on the property through

leveraging our innovative data driven exploration

methodologies.”

The VG Deposit The historic

Inferred Mineral Resource estimate for the VG deposit is 230,000

ounces of gold (4,390,000 tonnes at an average gold grade of 1.65

g/t), as of June 3rd, 2014. The Mineral Resource estimate was

prepared for Comstock Metals Ltd. by Lions Gate Geological

Consulting Inc. and reported in its press release dated July 8th,

2014, and is based on Comstock data (including collar, survey,

lithology and assay data), using the Inverse Distance Squared (ID2)

method with appropriate estimation parameters in accordance with

industry standards. The estimate needs to be verified by the

Company by conducting detailed data and QA/QC validation, including

location, geological, density and assay data. More recent drilling

data will be incorporated into a future resource update. A

qualified person for the Company has not done sufficient work to

classify the historical estimate at QV as current Mineral

Resources, therefore the Company is not treating the historical

estimate as current Mineral Resources and the historical resource

should not be relied upon.

(1) See Comstock Metals Ltd.

Technical report titled “NI 43-101 TECHNICAL REPORT on the QV

PROJECT”, dated August 19, 2014, available on SEDAR.

2019 Exploration SummaryA total

of 870.2m of RC drilling over 8 holes was completed on the VG Zone.

The holes were designed to step-out on the deposit along strike to

the NE and SW, evaluate gaps in the historic resource model, and

twin historic diamond holes for QA/QC purposes. Individual assay

results for the 2019 program ranged from trace to 11.9 g/t Au with

additional detail provided below.

The results from 2019 activities, in addition to

the 2017 historic drilling performed after the historic resource

calculation was completed, prove that the VG deposit is open along

strike to the NE, continues to be open at depth, and has great

potential to expand and upgrade the current resource area with

future activity. The QV also hosts several highly prospective new

targets which remain underexplored further adding to the property’s

potential for new discoveries.

The mineralization on the VG deposit is hosted

along a NE trending, gently south dipping structural zone that has

been traced for over 700m at surface and consists of disseminated

to vein-controlled pyrite with brecciation, stockwork

quartz-carbonate veining, and sericite alteration.

Mineralization on the VG consists of a several

tabular, NE trending, shallowly N dipping bodies of mineralization

associated with strong quartz-sericite-illite alteration with

brecciation and stockwork to lode style quartz veining and

disseminated to fracture controlled pyrite and rare visible gold.

The mineralization is coincident with anomalous Mo (+/-Pb) and

strongly resembles mineralization on the Golden Saddle Deposit;

approximately 10km to the south and is open along strike and at

depth. The mineralization occurs adjacent to the Telegraph Fault, a

NE trending, subvertical normal fault that has locally offset the

mineralization.

A summary of significant assay results is

presented in Table 1 and a description of the holes is below.

QVVGRC19-001 is a 50m step out

located on the southeastern margin of the VG deposit on the VG

South body. The hole returned 10.67m of 2.09 g/t Au from 4.57m

depth; including 1.52m of 7.83 g/t Au from 10.67m depth. The

intercept confirms mineralization on the VG continues along strike

to the east of the historic resource area and is still open along

strike.

QVVGRC19-002 is a 110m step-out

to the northeast of the VG deposit and returned 7.62m of 4.03 g/t

Au from 86.87m depth; including 3.04m of 7.80 g/t Au from 89.92m

depth. This intercept occurs within a broader envelope of anomalous

mineralization (>0.1 g/t Au) and the overall interval averages

1.09 g/t Au over 33.54m from 65.53m depth. The intercept confirms

mineralization on the VG continues along strike to the NE of the

historic resource area and is still open along strike and down

dip.

QVVGRC19-003 is located 205m

west of QVVGRC19-002 and was drilled to test along the western edge

of the historic resource pit. The hole returned 13.71m of 0.67 g/t

Au from 36.58m depth, with individual 1.52m sample values up to

2.41 g/t Au.

QVVGRC19-004 is located 135m

W-NW of QVVGRC19-002 and outside the historic resource pit. The

hole was terminated prior to target depth due to poor ground

conditions.

QVVGRC19-005 was drilled as a

twin of historic hole QV12-006 for QA/QC purposes. The hole

returned 50.3m of 2.07 g/t Au from 70.1m depth; including 3.05m of

7.88 g/t Au from 76.2m depth, 12.19m of 3.29 g/t Au from 102.11m

depth and 4.57m of 5.46 g/t Au from 103.63m depth. This compares

favorably with the intercept of 41.43m of 2.00 g/t in historic hole

QV12-006

QVVGRC19-006 infilled a 95m gap

between historic holes QV12-006/008 & QV12-001/002/004. The

hole returned 36.58m of 1.42 g/t Au from 80.77m depth; including

9.14m of 2.71 g/t Au from 86.87m depth. This result confirms grade

continuity and compares favourably with grades from surrounding

historic drill holes.

QVVGRC19-007 was drilled as a

twin of historic hole QV12-002 for QA/QC purposes. The hole

returned 38.10m of 1.97 g/t Au from 21.34m depth; including 9.14m

of 3.70 g/t Au from 28.96m depth and 3.05m of 3.68 g/t Au from

48.77m depth. The hole also intercepted a 9.14m zone of 0.99 g/t Au

from 68.58m depth. These results are both slightly higher than the

results from QV12-002 which were 40.40 m of 1.64 g/t Au and 8.40m

of 0.68 g/t Au from the two zones respectively.

QV Drill Highlights:Individual

assays for the reported results ranged from trace to 11.9 g/t Au.

The most significant results for drilling on QV included in this

release are summarized in the table below. True thickness is

estimated to be between 90 – 95% of the reported intercepts:

|

Hole ID |

From |

To |

Length |

Au g/t |

|

QVVVGRC19-001 |

4.57 |

15.24 |

10.67 |

2.09 |

|

Incl. |

10.67 |

12.19 |

1.52 |

7.83 |

|

QVVVGRC19-002 |

86.87 |

94.49 |

7.62 |

4.03 |

|

Incl. |

89.92 |

92.96 |

3.04 |

7.80 |

|

Within |

65.53 |

97.54 |

33.54 |

1.09 |

|

QVVVGRC19-003 |

36.58 |

50.29 |

13.71 |

0.67 |

|

Incl. |

39.62 |

41.15 |

1.53 |

2.47 |

|

QVVVGRC19-005 |

70.10 |

120.40 |

50.30 |

2.04 |

|

Incl. |

76.20 |

79.25 |

3.05 |

7.88 |

|

Incl. |

102.11 |

114.30 |

12.19 |

3.29 |

|

Incl. |

103.63 |

108.20 |

4.57 |

5.46 |

|

QVVVGRC19-006 |

80.77 |

117.35 |

36.58 |

1.42 |

|

Incl. |

86.87 |

96.01 |

9.14 |

2.71 |

|

QVVVGRC19-007 |

21.34 |

59.44 |

38.10 |

1.97 |

|

Incl. |

28.96 |

38.10 |

9.14 |

3.70 |

|

Incl. |

48.77 |

51.82 |

3.05 |

3.68 |

|

And |

68.58 |

77.72 |

9.14 |

0.99 |

The 2019 drilling program successfully confirmed

historic results, continuity of mineralization and extended the

current deposit limits. The VG deposit remains open in both

directions along strike and downdip.

Historical work on the VG

DepositThe most recent historic work on the property prior

to its acquisition by the Company in 2019 occurred in 2017 and

included six diamond drill holes on the VG which expanded the

footprint of known mineralization beyond the limits of the prior

historic resource calculation. Significant results from the 2017

program included 1.42 g/t gold over 45.5m from 67.5m down hole in

hole QV17-018, which expanded the mineralization 125 metres down

dip from previous drilling and 1.48 g/t gold over 51.2m from 98m

down hole in hole QV17-019, which expanded the mineralization 45m

west of previous drilling.

Additional work on the QV Property has included

soil sampling, GT Probe sampling, trenching, IP-Resistivity

surveys, airborne magnetic-radiometric surveys, geological

mapping/prospecting and minor RAB drilling. This work has defined

other priority targets with similarities to the Company’s Golden

Saddle deposit and recently discovered Vertigo zone warranting

follow up exploration including the Stewart, Tetra and Shadow

targets.

QV PropertyThe QV property

covers 16,335 hectares (40,000 acres) and is 10km north of the

Company's White Gold property which hosts its Golden Saddle &

Arc deposits, 20 km southwest of the Company’s Vertigo discovery on

its JP Ross property, and 44 kilometres northwest of Newmont

Goldcorp's Coffee project. At least 3 other high priority targets

are currently recognized on the property including the Stewart,

Tetra, and Shadow zones. Additionally, large portions of the QV

property are historically underexplored and are open for potential

new gold discoveries. Strong geological similarities have been

noted between the QV property and the Company’s adjacent White Gold

and JP Ross properties.

In 2019, airborne LiDAR was completed over the

southern portion of the property and a total of 1,466 soil samples

were collected over two grids on the QV property. The most

significant results were from a previously unsampled area in the

central portion of the QV property and included samples ranging

from trace to 106.2 ppb Au. This includes expansion of the Tetra

zone approximately 500m to the west, and the Tetra target now

covers a 1,500m x 600m area and is associated with an E-W trending

magnetic low interpreted as a potentially mineralized

structure.

Follow up work on the Tetra and other targets

across the QV property will be a priority for future exploration

campaigns. Further detail on the high priority targets is outlined

below.

Stewart Target: Located 5km

N-NW of the VG and consists of a 1.5km, E-W, trending gold in soil

anomaly, with values from trace to 274.1 ppb Au and anomalous

Bi-Ag-Te-Mo. The target occurs adjacent to a Jurassic intrusive

that may be associated with mineralization in the area.

Tetra Target: Located 8km N of

the VG and consists of a 1.5km, E-W, trending gold in soil anomaly,

with values from trace to 151.5 ppb Au. The target occurs along an

interpreted E-W oriented fault based on magnetic data for the area

and is open and unexplored to the west.

Shadow Target: Located 12 km

north of the VG zone and consists of multiple gold in soil

anomalies, ranging from trace to 514ppb Au and up to 2.7km long,

associated with a series of NW and ENE trending structures.

Strongly anomalous Ag-Pb-Bi+/-As+/-Mo also occur in the area, and

the overall geochemical and structural setting is similar to the

Company’s Vertigo discovery 23km to the east.

QA/QCThe analytical work for

the 2019 drilling program was performed by ALS Canada Ltd. an

internationally recognized analytical services provider, at its

Vancouver, British Columbia laboratory. Sample preparation

was carried out at its Whitehorse, Yukon facility. All RC chip and

diamond core samples were be prepared using procedure PREP-31H

(crush 90% less than 2mm, riffle split off 500g, pulverize split to

better than 85% passing 75 microns) and analyzed by method Au-AA23

(30g fire assay with AAS finish) and ME-ICP41 (0.5g, aqua regia

digestion and ICP-AES analysis). Samples containing >10 g/t Au

will be reanalyzed using method Au-GRAV21 (30g Fire Assay with

gravimetric finish).

The reported work was completed using industry

standard procedures, including a quality assurance/quality control

(“QA/QC”) program consisting of the insertion of certified

standard, blanks and duplicates into the sample stream.

About White Gold Corp.The

Company owns a portfolio of 22,040 quartz claims across 35

properties covering over 439,000 hectares representing over 40% of

the Yukon’s White Gold District. The Company’s flagship White Gold

property has a mineral resource of 1,039,600 ounces Indicated at

2.26 g/t Au and 508,700 ounces Inferred at 1.48 g/t Au.

Mineralization on the Golden Saddle and Arc is also known to extend

beyond the limits of the current resource estimate. Regional

exploration work has also produced several other prospective

targets on the Company’s claim packages which border sizable gold

discoveries including the Coffee project owned by Newmont Goldcorp

Corporation with a M&I gold resource(2) of 3.4M oz and Western

Copper and Gold Corporation’s Casino project which has P&P gold

reserves(2) of 8.9M oz Au and 4.5B lb Cu. For more information

visit www.whitegoldcorp.ca.

(2) Noted mineralization is as disclosed

by the owner of each property respectively and is not necessarily

indicative of the mineralization hosted on the Company’s

property.

Qualified PersonJodie Gibson,

P.Geo., Technical Advisor, and Andrew Hamilton, P.Geo., Exploration

Manager, for the Company are each a “qualified person” as defined

under National Instrument 43-101 Standards of Disclosure for

Mineral Projects, and each has reviewed and approved the content of

this news release.

Cautionary Note Regarding Forward

Looking InformationThis news release contains

"forward-looking information" and "forward-looking statements"

(collectively, "forward-looking statements") within the meaning of

the applicable Canadian securities legislation. All statements,

other than statements of historical fact, are forward-looking

statements and are based on expectations, estimates and projections

as at the date of this news release. Any statement that involves

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives, assumptions, future events or

performance (often but not always using phrases such as "expects",

or "does not expect", "is expected", "anticipates" or "does not

anticipate", "plans", “proposed”, "budget", "scheduled",

"forecasts", "estimates", "believes" or "intends" or variations of

such words and phrases or stating that certain actions, events or

results "may" or "could", "would", "might" or "will" be taken to

occur or be achieved) are not statements of historical fact and may

be forward-looking statements. In this news release,

forward-looking statements relate, among other things, the

Company’s objectives, goals and exploration activities conducted

and proposed to be conducted at the Company’s properties; future

growth potential of the Company, including whether any proposed

exploration programs at any of the Company’s properties will be

successful; exploration results; and future exploration plans and

costs and financing availability.

These forward-looking statements are based on

reasonable assumptions and estimates of management of the Company

at the time such statements were made. Actual future results may

differ materially as forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to

materially differ from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors, among other things, include: expected

benefits to the Company relating to exploration conducted and

proposed to be conducted at the Company’s properties; failure to

identify any additional mineral resources or significant

mineralization; the preliminary nature of metallurgical test

results; uncertainties relating to the availability and costs of

financing needed in the future, including to fund any exploration

programs on the Company’s properties; business integration risks;

fluctuations in general macroeconomic conditions; fluctuations in

securities markets; fluctuations in spot and forward prices of

gold, silver, base metals or certain other commodities;

fluctuations in currency markets (such as the Canadian dollar to

United States dollar exchange rate); change in national and local

government, legislation, taxation, controls, regulations and

political or economic developments; risks and hazards associated

with the business of mineral exploration, development and mining

(including environmental hazards, industrial accidents, unusual or

unexpected formations pressures, cave-ins and flooding); inability

to obtain adequate insurance to cover risks and hazards; the

presence of laws and regulations that may impose restrictions on

mining and mineral exploration; employee relations; relationships

with and claims by local communities and indigenous populations;

availability of increasing costs associated with mining inputs and

labour; the speculative nature of mineral exploration and

development (including the risks of obtaining necessary licenses,

permits and approvals from government authorities); the

unlikelihood that properties that are explored are ultimately

developed into producing mines; geological factors; actual results

of current and future exploration; changes in project parameters as

plans continue to be evaluated; soil sampling results being

preliminary in nature and are not conclusive evidence of the

likelihood of a mineral deposit; title to properties; and those

factors described in the most recently filed management’s

discussion and analysis of the Company. Although the

forward-looking statements contained in this news release are based

upon what management of the Company believes, or believed at the

time, to be reasonable assumptions, the Company cannot assure

shareholders that actual results will be consistent with such

forward-looking statements, as there may be other factors that

cause results not to be as anticipated, estimated or intended.

Accordingly, readers should not place undue reliance on

forward-looking statements and information. There can be no

assurance that forward-looking information, or the material factors

or assumptions used to develop such forward-looking information,

will prove to be accurate. The Company does not undertake to

release publicly any revisions for updating any voluntary

forward-looking statements, except as required by applicable

securities law.

Neither the TSX Venture Exchange (the

“Exchange”) nor its Regulation Services Provider (as that term is

defined in the policies of the Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

Contact Information:David

D’Onofrio Chief Executive Officer White Gold Corp. (647) 930-1880

ir@whitegoldcorp.ca

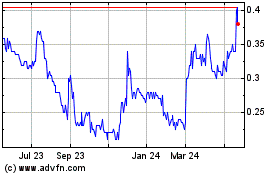

White Gold (TSXV:WGO)

Historical Stock Chart

From Nov 2024 to Dec 2024

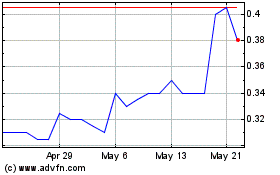

White Gold (TSXV:WGO)

Historical Stock Chart

From Dec 2023 to Dec 2024