2022 Annual Report Driving value

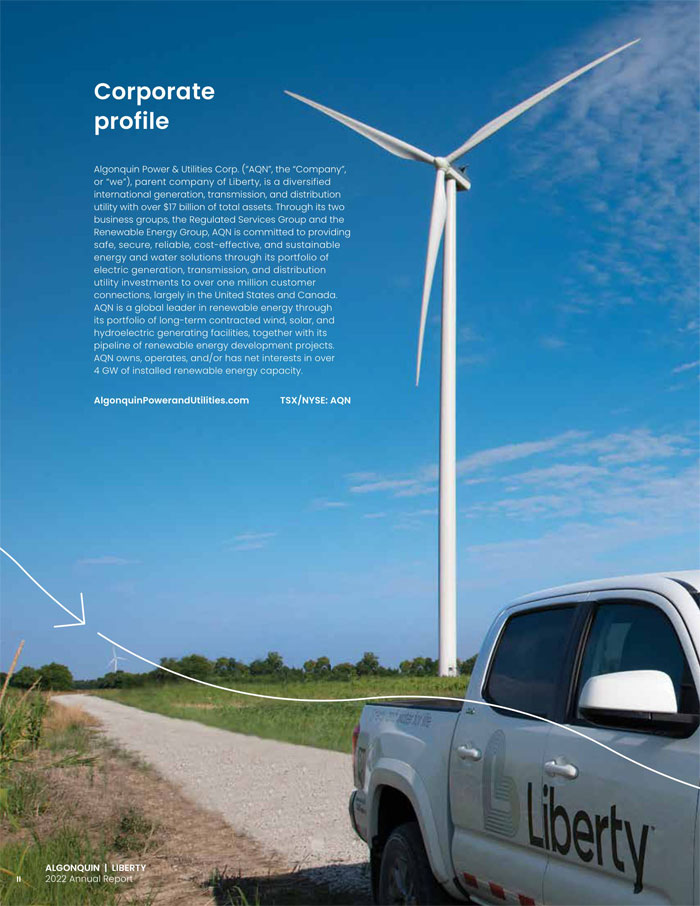

ALGONQUIN | LIBERTY 2022 Annual Report Corporate profile Algonquin Power & Utilities Corp. (“AQN”,

the “Company”, or “we”), parent company of Liberty, is a diversified international generation, transmission, and distribution utility with over $17 billion of total assets. Through its two business groups, the Regulated Services Group and the

Renewable Energy Group, AQN is committed to providing safe, secure, reliable, cost-effective, and sustainable energy and water solutions through its portfolio of electric generation, transmission, and distribution utility investments to over one

million customer connections, largely in the United States and Canada. AQN is a global leader in renewable energy through its portfolio of long-term contracted wind, solar, and hydroelectric generating facilities, together with its pipeline of

renewable energy development projects. AQN owns, operates, and/or has net interests in over 4 GW of installed renewable energy capacity. AlgonquinPowerandUtilities.com TSX/NYSE: AQN ALGONQUIN | LIBERTY II 2022 Annual Report

Forward-looking information This document contains statements that constitute “forward-looking

statements” or “forward-looking information” within the meaning of applicable securities legislation (collectively, “forward-looking information”). The words “aims”, “anticipates”, “expects”, “could”, “intends”, “may”, “plans”, “potential”, “will”,

“would”, “seeks”, “target”, “trends” and similar words and expressions are often intended to identify forward-looking information, although not all forward-looking information contains these identifying words. Specific forward-looking information in

this document includes, but is not limited to: expected future growth, earnings, and operational performance; statements regarding acquisitions, projects, strategies and asset recycling; statements regarding the Company’s use of capital; the expected

generating capacity and completion of the Sandhill RNG project; statements regarding services provided to customers; statements regarding sustainability; statements regarding the Company’s emissions; the Company’s ESG targets, plans and activities,

including its net-zero by 2050 target; and expectations regarding future “greening the fleet” opportunities. Readers are advised that all forward-looking information in this document is provided subject to the “Caution Concerning Forward-Looking

Statements and Forward-Looking Information” section of the Management Discussion & Analysis section of this Annual Report. Algonquin Power & Utilities Corp. 2022 annual report Corporate profile II 2022 stats at a glance IV Renewable Services

Group V Regulated Energy Group V Financial highlights VI Growth Pillar VIII Operational Excellence Pillar XI Sustainability Pillar XII Appendices Management Discussion & Analysis 1 Consolidated Financial Statements 70 Management’s Report 71

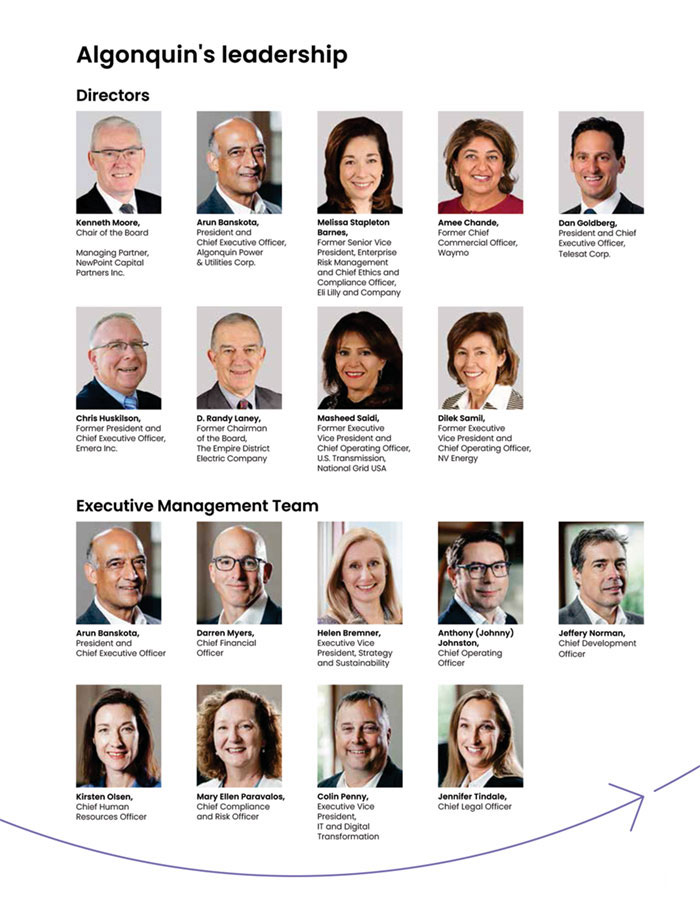

Independent Auditor’s Report 72 Notes to the Consolidated 85 Financial Statements Algonquin’s leadership 153 Corporate info BC III

ALGONQUIN | LIBERTY 2022 Annual Report IV ~309,000 electric customer

connections ~375,000 natural gas customer connections ~560,000 water and wastewater customer connections 1,261 wind turbines 1,520,280 solar panels 53 hydroelectric generators Founded in 1988 3,900+ employees Headquartered

in Greater Toronto Area, Ontario Over $17 billion total assets ~$4.4 billion market cap (NYSE) 8,482 miles of gas distribution lines 13,517 miles of electricity distribution lines 6,941 miles of water distribution mains 1. Data in

this report is provided as of December 31, 2022 unless otherwise stated. Dollar figures herein are presented in U.S. dollars unless otherwise stated. At a glance stats1

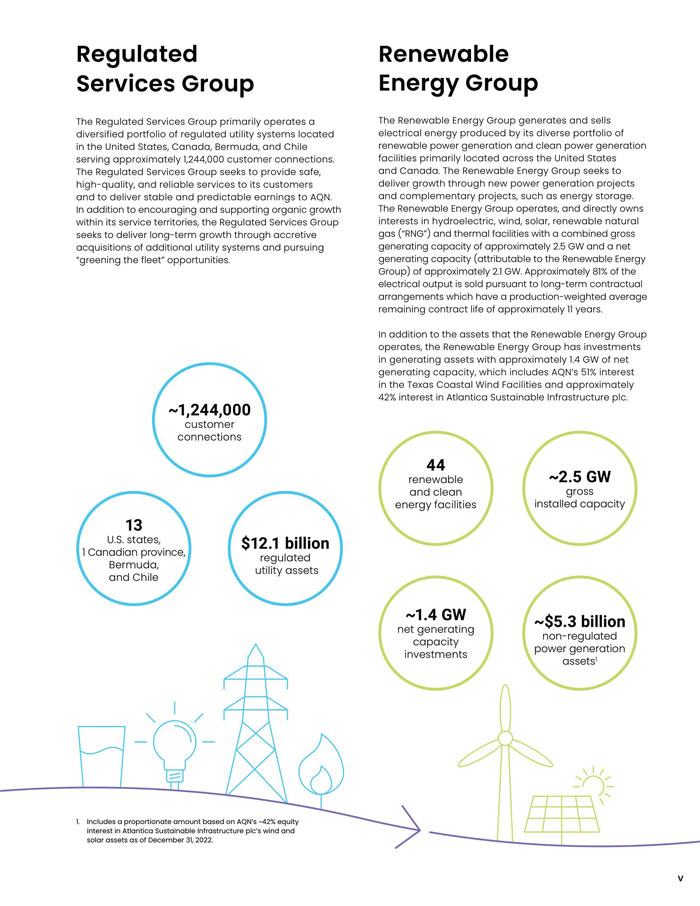

V ~1,244,000 customer connections $12.1 billion regulated utility assets ~2.5 GW gross installed

capacity ~$5.3 billion non-regulated power generation assets1 13 U.S. states, 1 Canadian province, Bermuda, and Chile 44 renewable and clean energy facilities ~1.4 GW net generating capacity investments Regulated Services Group The Regulated Services

Group primarily operates a diversified portfolio of regulated utility systems located in the United States, Canada, Bermuda, and Chile serving approximately 1,244,000 customer connections. The Regulated Services Group seeks to provide safe,

high-quality, and reliable services to its customers and to deliver stable and predictable earnings to AQN. In addition to encouraging and supporting organic growth within its service territories, the Regulated Services Group seeks to deliver

long-term growth through accretive acquisitions of additional utility systems and pursuing “greening the fleet” opportunities. Renewable Energy Group The Renewable Energy Group generates and sells electrical energy produced by its diverse portfolio

of renewable power generation and clean power generation facilities primarily located across the United States and Canada. The Renewable Energy Group seeks to deliver growth through new power generation projects and complementary projects, such as

energy storage. The Renewable Energy Group operates, and directly owns interests in hydroelectric, wind, solar, renewable natural gas (“RNG”) and thermal facilities with a combined gross generating capacity of approximately 2.5 GW and a net

generating capacity (attributable to the Renewable Energy Group) of approximately 2.1 GW. Approximately 81% of the electrical output is sold pursuant to long-term contractual arrangements which have a production-weighted average remaining contract

life of approximately 11 years. In addition to the assets that the Renewable Energy Group operates, the Renewable Energy Group has investments in generating assets with approximately 1.4 GW of net generating capacity, which includes AQN’s 51%

interest in the Texas Coastal Wind Facilities and approximately 42% interest in Atlantica Sustainable Infrastructure plc. 1. Includes a proportionate amount based on AQN’s ~42% equity interest in Atlantica Sustainable Infrastructure plc’s wind and

solar assets as of December 31, 2022.

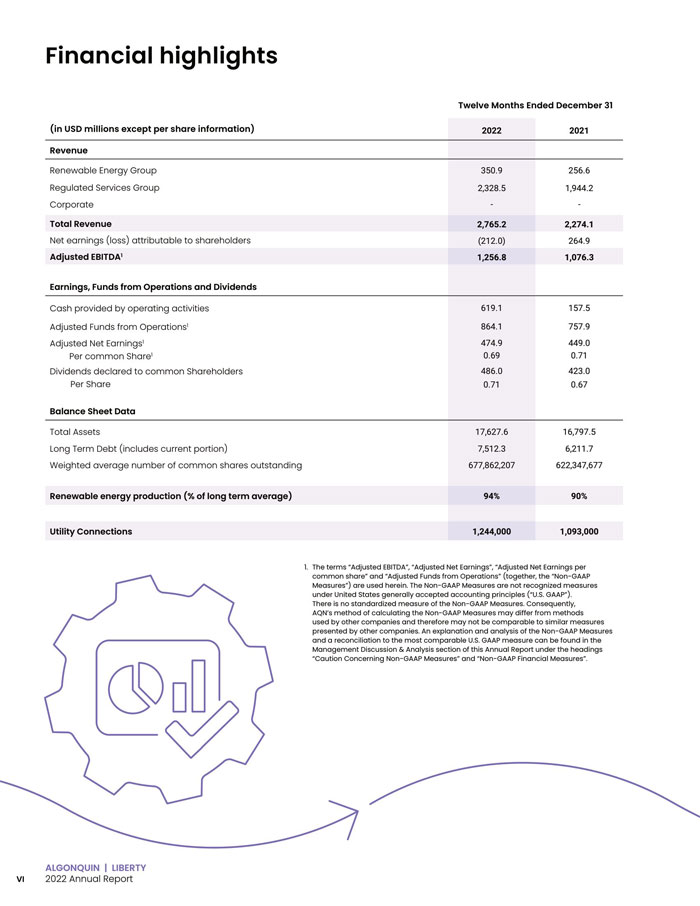

ALGONQUIN | LIBERTY VI 2022 Annual Report Twelve Months Ended December 31 (in USD millions except per

share information) 2022 2021 Revenue Renewable Energy Group 350.9 256.6 Regulated Services Group 2,328.5 1,944.2 Corporate - - Total Revenue 2,765.2 2,274.1 Net earnings (loss) attributable to shareholders (212.0) 264.9 Adjusted EBITDA1 1,256.8

1,076.3 Earnings, Funds from Operations and Dividends Cash provided by operating activities 619.1 157.5 Adjusted Funds from Operations1 864.1 757.9 Adjusted Net Earnings1 474.9 449.0 Per common Share1 0.69 0.71 Dividends declared to common

Shareholders 486.0 423.0 Per Share 0.71 0.67 Balance Sheet Data Total Assets 17,627.6 16,797.5 Long Term Debt (includes current portion) 7,512.3 6,211.7 Weighted average number of common shares outstanding 677,862,207 622,347,677 Renewable energy

production (% of long term average) 94% 90% Utility Connections 1,244,000 1,093,000 1. The terms “Adjusted EBITDA”, “Adjusted Net Earnings”, “Adjusted Net Earnings per common share” and “Adjusted Funds from Operations” (together, the “Non-GAAP

Measures”) are used herein. The Non-GAAP Measures are not recognized measures under United States generally accepted accounting principles (“U.S. GAAP”). There is no standardized measure of the Non-GAAP Measures. Consequently, AQN’s method of

calculating the Non-GAAP Measures may differ from methods used by other companies and therefore may not be comparable to similar measures presented by other companies. An explanation and analysis of the Non-GAAP Measures and a reconciliation to the

most comparable U.S. GAAP measure can be found in the Management Discussion & Analysis section of this Annual Report under the headings “Caution Concerning Non-GAAP Measures” and “Non-GAAP Financial Measures”. Financial highlights

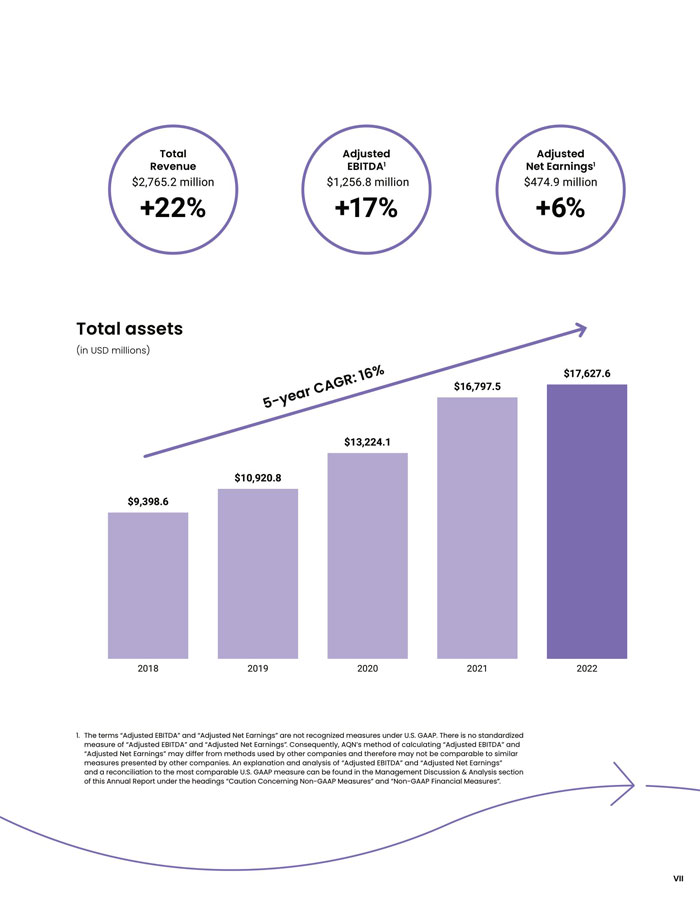

VII +17% Adjusted EBITDA1 $1,256.8 million +6% Adjusted Net Earnings1 $474.9 million +22% Total Revenue

$2,765.2 million Total assets (in USD millions) 2018 $9,398.6 2021 $16,797.5 2020 $13,224.1 2019 $10,920.8 2022 $17,627.6 1. The terms “Adjusted EBITDA” and “Adjusted Net Earnings” are not recognized measures under U.S. GAAP. There is no standardized

measure of “Adjusted EBITDA” and “Adjusted Net Earnings”. Consequently, AQN’s method of calculating “Adjusted EBITDA” and “Adjusted Net Earnings” may differ from methods used by other companies and therefore may not be comparable to similar measures

presented by other companies. An explanation and analysis of “Adjusted EBITDA” and “Adjusted Net Earnings” and a reconciliation to the most comparable U.S. GAAP measure can be found in the Management Discussion & Analysis section of this Annual

Report under the headings “Caution Concerning Non-GAAP Measures” and “Non-GAAP Financial Measures”. 5-year CAGR: 16%

Growth Pillar Pursuing long-term profitable growth Despite our recent commitment to reducing our

capital intensity, long-term profitable growth remains an important component of our strategy. In 2022, we successfully closed the New York Water transaction, and have now fully integrated the business into Liberty operations. Liberty New York Water

is a regulated water and wastewater utility serving approximately 127,000 customer connections across eight counties in southeastern New York state. On the renewable side, the Company completed its acquisition of Sandhill Advanced Biofuels, LLC

(“Sandhill”) in August 2022. Sandhill is a developer of RNG anaerobic digestion projects located on dairy farms with a portfolio of four projects in the state of Wisconsin. Two of the projects achieved commercial operation in August 2022. Once fully

constructed, the portfolio is expected to produce RNG at a rate of approximately 500 million British thermal units per day. The acquisition represents the Company’s first investment in the non-regulated RNG space. In 2022, the Company continued to

execute on its partnerships with commercial and industrial customers to help them achieve their corporate targets for cleaner energy. In the fourth quarter, site preparation commenced at the Carvers Creek Solar project, a 150 MW project in Virginia.

Additional advancements on renewable projects included the delivery and installation of wind turbines at our Deerfield II, Sandy Ridge II, and Shady Oaks II wind projects. We currently have over 600 MW of wind and solar projects in various stages of

construction. Finally, we ended the year with the announcement of our inaugural asset recycling transaction, in which we sold a 49% ownership interest in three operating wind facilities totaling 551 MW in the U.S. and an 80% ownership interest in the

175 MW operating Blue Hill Wind Facility in Saskatchewan to InfraRed Capital Partners. This announcement represents a meaningful step in achieving the asset recycling financing strategy described out at our 2021 Investor Day. ALGONQUIN | LIBERTY VIII

2022 Annual Report

IX

ALGONQUIN | LIBERTY X 2022 Annual Report

Operational Excellence Pillar Achieving next level operational excellence At AQN, our vision of

operational excellence is largely focused on safety, security, and reliability. AQN has and continues to demonstrate ongoing resiliency, while keeping the health, safety and well-being of our employees, customers, and communities a top priority. 2022

was an excellent year for our safety numbers; we had a best-in-class lost time injury rate, top-decile recordable injury rate, and saw a significant drop in motor vehicle accidents year over year. We also received two additional industry awards

recognizing another excellent year: the AGA Leading Indicator Safety Award and the AGA Safety Achievement Award. With increasing inclement weather, emergency preparedness and response are more important than ever, and we are proud that our BELCO

Bermuda electric utility team received the EEI Emergency Response Award for restoration efforts following Hurricane Fiona in Bermuda. Presented to EEI member companies twice a year, the Emergency Response Awards recognize recovery and assistance

efforts of electric companies following service disruptions caused by extreme natural events. XI

Sustainability Pillar Leader in sustainability With more than 30 years of experience developing and

operating renewable and clean energy facilities, sustainability has long been in AQN’s DNA and is part of the Company’s business strategy. We continue to include environmental, social, and governance (“ESG”) activities across our business and as part

of our key metrics. Our 2022 ESG report, published in the fourth quarter of 2022, included a more quantitative-focused approach to ESG across the enterprise. We also continued our journey to operationalizing net-zero by rolling out transition plans

across our top five emitting facilities and advancing work on our Task Force on Climate-Related Financial Disclosures risks for these. Our overall emissions intensity continues to trend downward. We also continue to make progress on our 2023 ESG

targets, including an 8% improvement towards our employee engagement target. We are pleased that our ESG efforts are being recognized, as evidenced by AQN’s inclusion in the Bloomberg Gender Equity Index for the fourth consecutive year and

recognition on the Globe and Mail’s 2022 Report on Business Women Lead Here list, an annual benchmark program that ranks Canadian companies on achieving or nearing gender parity in their executive ranks. Additionally, we were recently awarded the

Sustainable Markets Initiative’s Terra Carta Seal, in recognition of AQN’s commitment and leadership in sustainability. ALGONQUIN | LIBERTY XII 2022 Annual Report

Management Discussion & Analysis

Management of Algonquin Power & Utilities Corp. (“AQN” or the “Company” or the “Corporation”) has prepared the following discussion and analysis to provide

information to assist its shareholders’ understanding of the financial results for the three and twelve months ended December 31, 2022. This Management Discussion & Analysis (“MD&A”) should be read in conjunction with AQN’s annual consolidated

financial statements for the years ended December 31, 2022 and 2021. This material is available on SEDAR at www.sedar.com, on EDGAR at www.sec.gov/edgar, and on the AQN website at www.AlgonquinPowerandUtilities.com. Additional

information about AQN, including the most recent Annual Information Form (“AIF”), can be found on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/edgar.

Unless otherwise indicated, financial information provided for the years ended December 31, 2022 and 2021 has been prepared in accordance with generally accepted

accounting principles in the United States (“U.S. GAAP”). As a result, the Company’s financial information may not be comparable with financial information of other Canadian companies that provide financial information on another basis.

All monetary amounts are in U.S. dollars, except where otherwise noted. We denote any amounts denominated in Canadian dollars with “C$” immediately prior to the stated

amount.

Capitalized terms used herein and not otherwise defined have the meanings assigned to them in the Company’s most recent AIF.

Unless noted otherwise, this MD&A is based on information available to management as of March 16, 2023.

Contents

| Management Discussion & Analysis |

1 |

Caution Concerning Forward-Looking Statements and Forward-Looking

Information

This document may contain statements that constitute “forward-looking information” within the meaning of applicable securities laws in each of the provinces and

territories of Canada and the respective policies, regulations and rules under such laws or “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking information”). The

words “aims”, “anticipates”, “believes”, “budget”, “could”, “estimates”, “expects”, “forecasts”, “intends”, “may”, “might”, “plans”, “projects”, “schedule”, “should”, “will”, “would”, “seeks”, “strives”, “targets” (and grammatical variations of such

terms) and similar expressions are often intended to identify forward-looking information, although not all forward-looking information contains these identifying words. Specific forward-looking information in this document includes, but is not limited

to, statements relating to: expected future growth, earnings (including 2023 Adjusted Net Earnings per common share) and results of operations; liquidity, capital resources and operational requirements; sources of funding, including adequacy and

availability of credit facilities, cash flows from operations, capital markets financing, and asset recycling initiatives (including the 2023 Asset Recycling Plan (as defined herein)); expectations regarding the use of proceeds from financings; ongoing

and planned acquisitions, dispositions, projects, initiatives or other transactions, including expectations regarding timing, costs, financing, results, ownership structures, regulatory matters, in-service dates and completion dates; financing plans,

including the Company’s expectation that it will not undertake any new common equity financing through the end of 2024; expectations regarding future macroeconomic conditions; expectations regarding the anticipated closing of the Kentucky Power

Transaction (as defined herein); expectations regarding the purchase price for the Kentucky Power Transaction; expectations regarding the financial impacts of the flooding that occurred in Kentucky Power’s service territory in late July 2022;

expectations regarding financing of the Kentucky Power Transaction; expectations regarding the Company’s corporate development activities and the results thereof, including the expected business mix between the Regulated Services Group and Renewable

Energy Group; expectations regarding regulatory hearings, motions, filings, appeals and approvals, including rate reviews, and the timing, impacts and outcomes thereof; expected future generation, capacity and production of the Company’s energy

facilities; expectations regarding future capital investments, including expected timing, investment plans, sources of funds and impacts; joint ventures; expectations regarding the outcome of legal claims and disputes; strategy and goals; dividends to

shareholders, including expectations regarding the sustainability thereof and the Company’s ability to achieve its targeted annual dividend payout ratio; expectations regarding future “greening the fleet” initiatives, including with respect to Kentucky

Power; credit ratings and equity credit from rating agencies; expectations regarding debt repayment and refinancing; the future impact on the Company of actual or proposed laws, regulations and rules; the expected impact of changes in customer usage on

the Regulated Services Group’s revenue; accounting estimates; interest rates, including the anticipated effect of an increase thereof; the implementation of new technology systems and infrastructure, including the expected timing thereof; financing

costs; and currency exchange rates. All forward-looking information is given pursuant to the “safe harbour” provisions of applicable securities legislation.

The forecasts and projections that make up the forward-looking information contained herein are based on certain factors or assumptions which include, but are not

limited to: the receipt of applicable regulatory approvals and requested rate decisions; the absence of a material increase in the costs of compliance with environmental laws following the completion of the Kentucky Power Transaction; the absence of

material adverse regulatory decisions being received and the expectation of regulatory stability; the absence of any material equipment breakdown or failure; availability of financing (including tax equity financing and self-monetization transactions

for U.S. federal tax credits) on commercially reasonable terms and the stability of credit ratings of the Corporation and its subsidiaries; the absence of unexpected material liabilities or uninsured losses; the continued availability of commodity

supplies and stability of commodity prices; the absence of interest rate increases or significant currency exchange rate fluctuations; the absence of significant operational, financial or supply chain disruptions or liability, including relating to

import controls and tariffs; the continued ability to maintain systems and facilities to ensure their continued performance; the absence of a severe and prolonged downturn in general economic, credit, social or market conditions; the successful and

timely development and construction of new projects; the closing of pending acquisitions substantially in accordance with the expected timing for such acquisitions; the absence of capital project or financing cost overruns; sufficient liquidity and

capital resources; the continuation of long term weather patterns and trends; the absence of significant counterparty defaults; the continued competitiveness of electricity pricing when compared with alternative sources of energy; the realization of

the anticipated benefits of the Corporation’s acquisitions and joint ventures; the absence of a change in applicable laws, political conditions, public policies and directions by governments, materially negatively affecting the Corporation; the ability

to obtain and maintain licenses and permits; maintenance of adequate insurance coverage; the absence of material fluctuations in market energy prices; the absence of material disputes with taxation authorities or changes to applicable tax laws;

continued maintenance of information technology infrastructure and the absence of a material breach of cybersecurity; the successful implementation of new information technology systems and infrastructure; favourable relations with external

stakeholders; favourable labour relations; the realization of the anticipated benefits of the Kentucky Power Transaction, including that it will be accretive to the Corporation’s Adjusted Net Earnings per common share; that the Corporation will be able

to successfully integrate newly acquired entities, and the absence of any material adverse changes to such entities prior to closing; the successful transfer of operational control over the Mitchell Plant (as defined herein) to Wheeling Power

| 2 |

ALGONQUIN | LIBERTY

2022 Annual Report

|

Company; the Mitchell Plant being transferred or retired in accordance with the Corporation’s expectations; the absence of undisclosed liabilities of entities being

acquired; that such entities will maintain constructive regulatory relationships with state regulatory authorities; the ability of the Corporation to retain key personnel of acquired entities and the value of such employees; no adverse developments in

the business and affairs of the sellers during the period when transitional services are provided to the Corporation in connection with any acquisition; the ability of the Corporation to satisfy its liabilities and meet its debt service obligations

following completion of any acquisition; the absence of any reputational harm to the Corporation as a result of any acquisition; and the ability of the Corporation to successfully execute future “greening the fleet” initiatives.

The forward-looking information contained herein is subject to risks, uncertainties and other factors that could cause actual results to differ materially from

historical results or results anticipated by the forward-looking information. Factors which could cause results or events to differ materially from current expectations include, but are not limited to: changes in general economic, credit, social or

market conditions; changes in customer energy usage patterns and energy demand; reductions in the liquidity of energy markets; global climate change; the incurrence of environmental liabilities; natural disasters, diseases, pandemics, public health

emergencies and other force majeure events; critical equipment breakdown or failure; supply chain disruptions; the imposition of import controls or tariffs; the failure of information technology infrastructure and other cybersecurity measures to

protect against data, privacy and cybersecurity breaches; failure to successfully implement, and cost overruns and delays in connection with, new information technology systems and infrastructure; physical security breach; the loss of key personnel

and/or labour disruptions; seasonal fluctuations and variability in weather conditions and natural resource availability; reductions in demand for electricity, natural gas and water due to developments in technology; reliance on transmission systems

owned and operated by third parties; issues arising with respect to land use rights and access to the Corporation’s facilities; terrorist attacks; fluctuations in commodity and energy prices; capital expenditures; reliance on subsidiaries; the

incurrence of an uninsured loss; a credit rating downgrade; an increase in financing costs or limits on access to credit and capital markets; significant inflation; increases and fluctuations in interest rates and failure to manage exposure to credit

and financial instrument risk; currency exchange rate fluctuations; restricted financial flexibility due to covenants in existing credit agreements; an inability to refinance maturing debt on favourable terms; disputes with taxation authorities or

changes to applicable tax laws; failure to identify, acquire, develop or timely place in service projects to maximize the value of tax credits; requirement for greater than expected contributions to post-employment benefit plans; default by a

counterparty; inaccurate assumptions, judgments and/or estimates with respect to asset retirement obligations; failure to maintain required regulatory authorizations; changes in, or failure to comply with, applicable laws and regulations; failure of

compliance programs; failure to identify attractive acquisition or development candidates necessary to pursue the Corporation’s growth strategy; failure to dispose of assets (at all or at a competitive price) to fund the Company’s operations and growth

plans; delays and cost overruns in the design and construction of projects, including as a result of COVID-19; loss of key customers; failure to complete or realize the anticipated benefits of acquisitions or joint ventures; Atlantica (as defined

herein) or a third party joint venture partner acting in a manner contrary to the Corporation’s interests; a drop in the market value of Atlantica’s ordinary shares; facilities being condemned or otherwise taken by governmental entities; increased

external stakeholder activism adverse to the Corporation’s interests; fluctuations in the price and liquidity of the Corporation’s common shares and the Corporation’s other securities; the severity and duration of the COVID-19 pandemic, including the

potential resurgence of COVID-19 and/ or new strains of COVID-19, and collateral consequences thereof, including the disruption of economic activity, volatility in capital and credit markets and legislative and regulatory responses; impact of

significant demands placed on the Corporation as a result of pending acquisitions or growth strategies; potential undisclosed liabilities of any entities being acquired by the Corporation; uncertainty regarding the length of time required to complete

pending acquisitions; the failure to implement the Corporation’s strategic objectives or achieve expected benefits relating to acquisitions; Kentucky Power’s failure to receive regulatory approval for the construction of new renewable generation

facilities; indebtedness of any entity being acquired by the Corporation; reputational harm and increased costs of compliance with environmental laws as a result of announced or completed acquisitions; unanticipated expenses and/or cash payments as a

result of change of control and/or termination for convenience provisions in agreements to which any entity being acquired is a party; and the reliance on third parties for certain transitional services following the completion of an acquisition.

Although the Corporation has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or

results not to be as anticipated, estimated or intended. Some of these and other factors are discussed in more detail under the heading Enterprise Risk Management in this MD&A and under the heading Enterprise Risk Factors in the Corporation’s most

recent AIF.

Forward-looking information contained herein (including any financial outlook) is provided for the purposes of assisting the reader in understanding the Corporation

and its business, operations, risks, financial performance, financial position and cash flows as at and for the periods indicated and to present information about management’s current expectations and plans relating to the future, and the reader is

cautioned that such information may not be appropriate for other purposes. Forward-looking information contained herein is made as of the date of this document and based on the plans, beliefs, estimates, projections, expectations, opinions and

assumptions of management on the date hereof. There can be no

| Management Discussion & Analysis |

3 |

assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such

forward-looking information. Accordingly, readers should not place undue reliance on forward-looking information. While subsequent events and developments may cause the Corporation’s views to change, the Corporation disclaims any obligation to update

any forward-looking information or to explain any material difference between subsequent actual events and such forward-looking information, except to the extent required by applicable law. All forward-looking information contained herein is qualified

by these cautionary statements.

Caution Concerning Non-GAAP Measures

AQN uses a number of financial measures to assess the performance of its business lines. Some measures are calculated in accordance with U.S. GAAP, while other

measures do not have a standardized meaning under U.S. GAAP. These non-GAAP measures include non-GAAP financial measures and non-GAAP ratios, each as defined in Canadian National Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure.

AQN’s method of calculating these measures may differ from methods used by other companies and therefore may not be comparable to similar measures presented by other companies.

The terms “Adjusted Net Earnings”, “Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization” (“Adjusted EBITDA”), “Adjusted Funds from Operations”,

“Net Energy Sales”, “Net Utility Sales” and “Divisional Operating Profit”, which are used throughout this MD&A, are non-GAAP financial measures. An explanation of each of these non-GAAP financial measures is set out below and a reconciliation to

the most directly comparable U.S. GAAP measure, in each case, can be found in this MD&A. In addition, “Adjusted Net Earnings” is presented throughout this MD&A on a per common share basis. Adjusted Net Earnings per common share is a non-GAAP

ratio and is calculated by dividing Adjusted Net Earnings by the weighted average number of common shares outstanding during the applicable period.

AQN does not provide reconciliations for forward-looking non-GAAP financial measures as AQN is unable to provide a meaningful or accurate calculation or estimation of

reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing or amount of various events that have not yet occurred, are out of AQN’s control and/or cannot be

reasonably predicted, and that would impact the most directly comparable forward-looking U.S. GAAP financial measure. For these same reasons, AQN is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP

financial measures may vary materially from the corresponding U.S. GAAP financial measures.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure used by many investors to compare companies on the basis of ability to generate cash from operations. AQN uses these

calculations to monitor the amount of cash generated by AQN. AQN uses Adjusted EBITDA to assess the operating performance of AQN without the effects of (as applicable): depreciation and amortization expense, income tax expense or recoveries,

acquisition and transition costs, certain litigation expenses, interest expense, gain or loss on derivative financial instruments, write down of intangibles and property, plant and equipment, earnings attributable to non-controlling interests,

non-service pension and post-employment costs, cost related to tax equity financing, costs related to management succession and executive retirement, costs related to prior period adjustments due to changes in tax law, costs related to condemnation

proceedings, financial impacts on the Company’s Senate Wind Facility from the significantly elevated pricing that persisted in the Electric Reliability Council of Texas (“ERCOT”) market over several days (the “Market Disruption Event”) as a result of

the February 2021 extreme winter storm conditions experienced in Texas and parts of the central U.S. (the “Midwest Extreme Weather Event”), gain or loss on foreign exchange, earnings or loss from discontinued operations, changes in value of investments

carried at fair value, and other typically non-recurring or unusual items. AQN adjusts for these factors as they may be non-cash, unusual in nature and are not factors used by management for evaluating the operating performance of the Company. AQN

believes that presentation of this measure will enhance an investor’s understanding of AQN’s operating performance. Adjusted EBITDA is not intended to be representative of cash provided by operating activities or results of operations determined in

accordance with U.S. GAAP, and can be impacted positively or negatively by these items. For a reconciliation of Adjusted EBITDA to net earnings, see Non-GAAP Financial Measures starting on page 36 of this MD&A.

Adjusted Net Earnings

Adjusted Net Earnings is a non-GAAP financial measure used by many investors to compare net earnings from operations without the effects of certain volatile primarily

non-cash items that generally have no current economic impact or items such as acquisition expenses or certain litigation expenses that are viewed as not directly related to a company’s operating performance. AQN uses Adjusted Net Earnings to assess

its performance without the effects of (as applicable): gains or losses on foreign exchange, foreign exchange forward contracts, interest rate swaps, acquisition and transition costs, one-time costs of arranging tax equity financing, certain litigation

expenses and write down of intangibles and property, plant and equipment, earnings or loss from discontinued operations (excluding sale of assets in the course of normal operations), unrealized mark-to-market revaluation impacts (other than those

realized in connection with the sales of development assets), costs related to management succession and executive retirement, costs related to prior period adjustments due to changes in tax law, costs related to condemnation proceedings, financial

impacts from the Market Disruption Event on the

| 4 |

ALGONQUIN | LIBERTY

2022 Annual Report

|

Company’s Senate Wind Facility, changes in value of investments carried at fair value, and other typically non-recurring or unusual items as these are not reflective

of the performance of the underlying business of AQN. AQN believes that analysis and presentation of net earnings or loss on this basis will enhance an investor’s understanding of the operating performance of its businesses. Adjusted Net Earnings is

not intended to be representative of net earnings or loss determined in accordance with U.S. GAAP, and can be impacted positively or negatively by these items. For a reconciliation of Adjusted Net Earnings to net earnings, see Non-GAAP Financial

Measures starting on page 37 of this MD&A.

Adjusted Funds from Operations

Adjusted Funds from Operations is a non-GAAP financial measure used by investors to compare cash provided by operating activities without the effects of certain

volatile items that generally have no current economic impact or items such as acquisition expenses that are viewed as not directly related to a company’s operating performance. AQN uses Adjusted Funds from Operations to assess its performance without

the effects of (as applicable): changes in working capital balances, acquisition and transition costs, certain litigation expenses, cash provided by or used in discontinued operations, financial impacts from the Market Disruption Event on the Company’s

Senate Wind Facility, and other typically non- recurring items affecting cash from operations as these are not reflective of the long-term performance of the underlying businesses of AQN. AQN believes that analysis and presentation of funds from

operations on this basis will enhance an investor’s understanding of the operating performance of its businesses. Adjusted Funds from Operations is not intended to be representative of cash provided by operating activities as determined in accordance

with U.S. GAAP, and can be impacted positively or negatively by these items. For a reconciliation of Adjusted Funds from Operations to cash provided by operating activities, see Non-GAAP Financial Measures starting on page 38 of this MD&A.

Net Energy Sales

Net Energy Sales is a non-GAAP financial measure used by investors to identify revenue after commodity costs used to generate revenue where such revenue generally

increases or decreases in response to increases or decreases in the cost of the commodity used to produce that revenue. AQN uses Net Energy Sales to assess its revenues without the effects of fluctuating commodity costs as such costs are predominantly

passed through either directly or indirectly in the rates that are charged to customers. AQN believes that analysis and presentation of Net Energy Sales on this basis will enhance an investor’s understanding of the revenue generation of the Renewable

Energy Group. It is not intended to be representative of revenue as determined in accordance with U.S. GAAP. For a reconciliation of Net Energy Sales to revenue, see Renewable Energy Group - 2022 Renewable Energy Group Operating Results on page

31 of this MD&A.

Net Utility Sales

Net Utility Sales is a non-GAAP financial measure used by investors to identify utility revenue after commodity costs, either natural gas or electricity, where these

commodity costs are generally included as a pass through in rates to its utility customers. AQN uses Net Utility Sales to assess its utility revenues without the effects of fluctuating commodity costs as such costs are predominantly passed through and

paid for by utility customers. AQN believes that analysis and presentation of Net Utility Sales on this basis will enhance an investor’s understanding of the revenue generation of the Regulated Services Group. It is not intended to be representative of

revenue as determined in accordance with U.S. GAAP. For a reconciliation of Net Utility Sales to revenue, see Regulated Services Group - 2022 Regulated Services Group Operating Results on page 21 of this MD&A.

Divisional Operating Profit

Divisional Operating Profit is a non-GAAP financial measure. AQN uses Divisional Operating Profit to assess the operating performance of its business groups without

the effects of (as applicable): depreciation and amortization expense, corporate administrative expenses, income tax expense or recoveries, acquisition costs, certain litigation expenses, interest expense, gain or loss on derivative financial

instruments, write down of intangibles and property, plant and equipment, gain or loss on foreign exchange, earnings or loss from discontinued operations (excluding the sale of assets in the course of normal operations), non-service pension and

post-employment costs, financial impacts from the Market Disruption Event on the Company’s Senate Wind Facility, and other typically non-recurring or unusual items. AQN adjusts for these factors as they may be non-cash, unusual in nature and are not

factors used by management for evaluating the operating performance of the divisional units. Divisional Operating Profit is calculated inclusive of interest, dividend and equity income earned from indirect investments, and Hypothetical Liquidation at

Book Value (“HLBV”) income, which represents the value of net tax attributes earned in the period from electricity generated by certain of its U.S. wind power and U.S. solar generation facilities. AQN believes that presentation of this measure will

enhance an investor’s understanding of AQN’s divisional operating performance. Divisional Operating Profit is not intended to be representative of cash provided by operating activities or results of operations determined in accordance with U.S. GAAP,

and can be impacted positively or negatively by these items. For a reconciliation of Divisional Operating Profit to revenue for AQN’s main business units, see Regulated Services Group - 2022 Regulated Services Group Operating Results on page

21 and Renewable Energy Group - 2022 Renewable Energy Group Operating Results on page 31 of this MD&A.

| Management Discussion & Analysis |

5 |

Overview and Business Strategy

AQN is incorporated under the Canada Business Corporations Act. AQN owns and operates a diversified portfolio of regulated and non-regulated generation, distribution,

and transmission assets which are expected to deliver predictable earnings and cash flows. AQN seeks to maximize total shareholder value through new investments in renewable power generating facilities, regulated utilities and other complementary

infrastructure projects, supported by the Company’s focus on operational excellence and sustainability. Through these activities, the Company aims to drive growth in earnings and cash flows to support a sustainable dividend and share price

appreciation. AQN strives to achieve these results while also seeking to maintain a business risk profile consistent with its BBB flat investment grade credit ratings and a strong focus on Environmental, Social and Governance factors.

In light of the current macroenvironment, including elevated interest and inflation rates, as well as Company specific challenges and the Company’s desire to

effectively allocate capital and drive value creation for shareholders, the Company has reset the quarterly dividend to shareholders to $0.1085 per common share, or $0.4340 per common share on an annualized basis. AQN believes that, on a long-term

basis, its targeted annual dividend payout will allow for both a return on investment for shareholders and retention of cash within AQN to partially fund growth opportunities. Changes in the level of dividends paid by AQN are at the discretion of AQN’s

Board of Directors (the “Board”), with dividend levels being reviewed periodically by the Board in the context of AQN’s financial performance and growth prospects.

In addition, the Company has announced that it is targeting approximately $1 billion of asset sales (the “2023 Asset Recycling Plan”) and that no new common equity

financings are expected through the end of 2024.

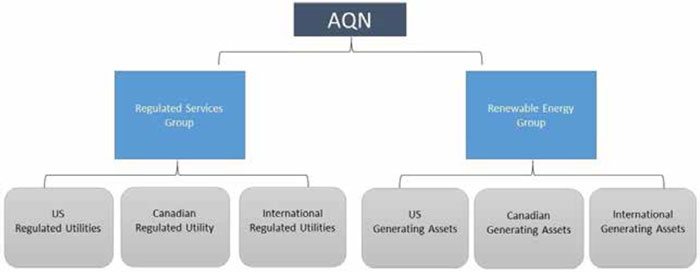

AQN’s operations are organized across two primary business units consisting of: the Regulated Services Group, which primarily owns and operates a portfolio of

regulated assets in the United States, Canada, Bermuda and Chile; and the Renewable Energy Group, which primarily operates a diversified portfolio of owned renewable generation assets.

AQN pursues investment opportunities with an objective of maintaining the current business mix between its Regulated Services Group and Renewable Energy Group and with

leverage consistent with its current credit ratings.1 The business mix target may from time to time require AQN to grow its Regulated Services Group or implement other

strategies in order to pursue investment opportunities within its Renewable Energy Group.

The Company also undertakes business development activities for both business units, primarily in North America, working to identify, develop, acquire, invest in, or

divest of renewable energy facilities, regulated utilities and other complementary infrastructure projects.

Summary Structure of the Business

The following chart depicts, in summary form, AQN’s key businesses. A more detailed description of AQN’s organizational structure can be found in the most recent AIF.

1 See Treasury Risk Management

-Downgrade in the Company’s Credit Rating Risk.

| 6 |

ALGONQUIN | LIBERTY

2022 Annual Report

|

Regulated Services Group

The Regulated Services Group operates a diversified portfolio of regulated utility systems located in the United States, Canada, Bermuda and Chile serving

approximately 1,244,000 customer connections as at December 31, 2022 (using an average of 2.5 customers per connection, this translates into approximately 3,110,000 customers). The Regulated Services Group seeks to provide safe, high quality, and

reliable services to its customers and to deliver stable and predictable earnings to AQN. In addition to encouraging and supporting organic growth within its service territories, the Regulated Services Group seeks to deliver long-term growth through

accretive acquisitions of additional utility systems and pursuing “greening the fleet” opportunities.

The Regulated Services Group’s regulated electrical distribution utility systems and related generation assets are located in the U.S. States of California, New

Hampshire, Missouri, Kansas, Oklahoma, and Arkansas, as well as in Bermuda, which together served approximately 309,000 electric customer connections as at December 31, 2022. The group also owns and operates generating assets with a gross capacity of

approximately 2.0 GW and has investments in generating assets with approximately 0.3 GW of net generation capacity.

The Regulated Services Group’s regulated water distribution and wastewater collection utility systems are located in the U.S. States of Arizona, Arkansas, California,

Illinois, Missouri, New York, and Texas as well as in Chile which together served approximately 560,000 customer connections as at December 31, 2022.

The Regulated Services Group’s regulated natural gas distribution utility systems are located in the U.S. States of Georgia, Illinois, Iowa, Massachusetts, New

Hampshire, Missouri, and New York, and in the Canadian Province of New Brunswick, which together served approximately 375,000 natural gas customer connections as at December 31, 2022.

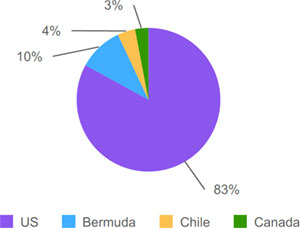

Below is a breakdown of the Regulated Services Group’s Revenue by geographic area for the twelve months ended December 31, 2022.

Regulated Revenue by Geographic Area

| Management Discussion & Analysis |

7 |

Renewable Energy Group

The Renewable Energy Group generates and sells electrical energy produced by its diverse portfolio of renewable power generation and clean power generation facilities

primarily located across the United States and Canada. The Renewable Energy Group seeks to deliver growth through new power generation projects and complementary projects, such as energy storage.

The Renewable Energy Group operates, and directly owns interests in hydroelectric, wind, solar, renewable natural gas (“RNG”) and thermal facilities with a combined

gross generating capacity of approximately 2.5 GW and a net generating capacity (attributable to the Renewable Energy Group) of approximately 2.1 GW. Approximately 81% of the electrical output is sold pursuant to long term contractual arrangements

which as of December 31, 2022 had a production-weighted average remaining contract life of approximately 11 years (see Market Price Risk).

In addition to the assets that the Renewable Energy Group operates, the Renewable Energy Group has investments in generating assets with approximately 1.4 GW of net

generating capacity, which includes the Company’s 51% interest in the Texas Coastal Wind Facilities (as defined herein) and approximately 42% interest in Atlantica Sustainable Infrastructure plc (“Atlantica”). Atlantica owns and operates a portfolio of

international clean energy and water infrastructure assets under long term contracts with a Cash Available for Distribution weighted average remaining contract life of approximately 14 years as of December 31, 2022.

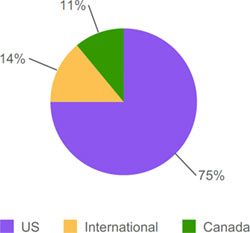

Below is a breakdown of the Renewable Energy Group’s generating capacity by geographic area as of December 31, 2022, which was comprised of net generating capacity of

facilities owned and operated and net generating capacity of investments, including the Company’s 51% interest in the Texas Coastal Wind Facilities and approximately 42% interest in Atlantica.

Renewable Generation by Geographic Area

| 8 |

ALGONQUIN | LIBERTY

2022 Annual Report

|

Significant Updates

Operating Results

AQN operating results relative to the same period last year are as follows:

| |

Three months ended |

Twelve months ended |

| |

December 31 |

December 31 |

| (all dollar amounts in $ millions except per share

information) |

2022 |

2021 |

Change |

2022 |

2021 |

Change |

| Net earnings (loss) attributable to shareholders |

$(74.4) |

$175.6 |

(142)% |

$(212.0) |

$264.9 |

(180)% |

| Adjusted Net Earnings1 |

$151.0 |

$137.0 |

10% |

$474.9 |

$449.0 |

6% |

| Adjusted EBITDA1 |

$358.3 |

$298.3 |

20% |

$1,256.8 |

$1,076.3 |

17% |

| Net earnings (loss) per common share |

$(0.11) |

$0.27 |

(141)% |

$(0.33) |

$0.41 |

(180)% |

| Adjusted Net Earnings per common share1 |

$0.22 |

$0.21 |

5% |

$0.69 |

$0.71 |

(3)% |

| 1 |

See Caution Concerning Non-GAAP Measures. |

Declaration of 2023 First Quarter Dividend of $0.1085 (C$0.1495) per Common Share

AQN currently targets annual growth in dividends payable to shareholders

underpinned by increases in earnings and cash flow.

The Board has declared a first quarter 2023 dividend of $0.1085 per common

share payable on April 14, 2023 to shareholders of record on March 31, 2023.

The Canadian dollar equivalent for the first quarter 2023 dividend is C$0.1495 per common share.

The previous four quarter U.S. and Canadian dollar equivalent dividends per common share have been

as follows:

| |

|

Q2 2022 |

|

Q3 2022 |

|

Q4 2022 |

|

Q1 2023 |

Total |

| U.S. dollar dividend |

$ |

0.1808 |

$ |

0.1808 |

$ |

0.1808 |

$ |

0.1085 |

$0.6509 |

| Canadian dollar equivalent |

$ |

0.2345 |

$ |

0.2312 |

$ |

0.2438 |

$ |

0.1495 |

$0.8590 |

Pending Acquisition of Kentucky Power Company and AEP Kentucky Transmission Company, Inc.

On October 26, 2021, Liberty Utilities Co. (“Liberty Utilities”), an indirect

subsidiary of AQN, entered into an agreement (“the Kentucky Acquisition Agreement”) with American Electric Power Company, Inc. (“AEP”) and AEP Transmission Company, LLC (“AEP Transmission”) to acquire Kentucky Power Company (“Kentucky Power”) and AEP

Kentucky Transmission Company, Inc. (“Kentucky TransCo”) for a total purchase price of approximately $2.846 billion, including the assumption of approximately $1.221 billion in debt (the “Kentucky Power Transaction”). On September 29, 2022, the

parties entered into an amendment to the Kentucky Acquisition Agreement that, among other things, reduces the purchase price by $200 million to approximately $2.646 billion, including the assumption of approximately $1.221 billion in debt.

Kentucky Power is a state rate-regulated electricity generation, distribution

and transmission utility serving customers in 20 eastern Kentucky counties and operating under a cost of service framework. Kentucky TransCo is an electricity transmission business operating in the Kentucky portion of the transmission infrastructure

that is part of the Pennsylvania – New Jersey – Maryland regional transmission organization, PJM Interconnection, L.L.C. Kentucky Power and Kentucky TransCo are both regulated by the U.S. Federal Energy Regulatory Commission (“FERC”).

Closing of the Kentucky Power Transaction remains subject to the satisfaction

or waiver of certain conditions precedent, which include the approval of the Kentucky Power Transaction by FERC and clearance pursuant to the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (as the clearance received previously has now lapsed).

On December 15, 2022, FERC issued an order denying, without prejudice, authorization for the proposed transaction. On February 14, 2023, a new application was filed with FERC for approval of the Kentucky Power Transaction. If the Kentucky Power

Transaction has not closed by April 26, 2023, either party may, if certain requirements are met, terminate the Kentucky Acquisition Agreement in accordance with its terms.

Inaugural Asset Recycling Transaction

On December 29, 2022, the Company closed the previously-announced sale of

ownership interests in a portfolio of operating wind facilities in the United States and Canada to InfraRed Capital Partners, an international infrastructure investment manager that is part of SLC Management, the institutional alternatives and

traditional asset management business of Sun Life Financial Inc. (the “Disposition Transaction”). The Disposition Transaction consisted of the sale of (1) a 49% ownership interest in three operating wind facilities in the United States totaling 551

MW of installed capacity: the Odell Wind Facility in Minnesota, the Deerfield Wind Facility in Michigan, and the Sugar Creek Wind Facility in Illinois; and

| Management Discussion & Analysis |

9 |

(2) an 80% ownership interest in the operating 175 MW Blue Hill Wind Facility

in Saskatchewan. Total cash proceeds to the Company were approximately $277.5 million for the U.S. facilities and approximately C$108.6 million for the Blue Hill Wind Facility (subject to certain potential future post-closing adjustments). A gain on

disposition of $62.8 million was recognized and included in gain on sale of renewable assets on the Company’s consolidated statement of operations. The Company will continue to oversee day-to-day operations and provide management services to the

facilities.

Issuance of approximately $1.1 Billion of Subordinated Notes

On January 18, 2022, the Company closed (i) an underwritten public offering in

the United States (the “U.S. Note Offering”) of $750 million aggregate principal amount of 4.75% fixed-to-fixed reset rate junior subordinated notes series 2022-B due January 18, 2082 (the “U.S. Notes”); and (ii) an underwritten public offering in

Canada (the “Canadian Note Offering” and, together with the U.S. Note Offering, the “Note Offerings”) of C$400 million aggregate principal amount of 5.25% fixed-to-fixed reset rate junior subordinated notes series 2022-A due January 18, 2082 (the

“Canadian Notes” and, together with the U.S. Notes, the “Notes”). The Company intends to use the net proceeds of the Note Offerings to partially finance the Kentucky Power Transaction, provided that, in the short-term, prior to closing of the

Kentucky Power Transaction, the Company has used such net proceeds to repay certain indebtedness of the Corporation and its subsidiaries. As a result, the Company expects to draw from the credit facilities of the Company and certain of its

subsidiaries in connection with the closing of the Kentucky Power Transaction. Concurrent with the pricing of the Note Offerings, the Company entered into a cross currency interest rate swap, to convert the Canadian dollar denominated proceeds from

the Canadian Note Offering into U.S. dollars and a forward starting swap to fix the interest rate for the second five year term of the U.S. Notes, resulting in an anticipated effective interest rate to the Company of approximately 4.95% throughout

the first ten year period of the Notes.

Acquisition of Liberty NY Water (formerly New York American Water Company, Inc.)

Effective January 1, 2022, Liberty Utilities (Eastern Water Holdings) Corp., a

wholly-owned subsidiary of Liberty Utilities, closed the acquisition of Liberty Utilities (New York Water) Corp. (formerly New York American Water Company Inc.) (“Liberty NY Water”) from American Water Works Company, Inc. for a purchase price of

approximately $609 million. Headquartered in Merrick, NY, Liberty NY Water is a regulated water and wastewater utility serving approximately 127,000 customer connections across eight counties in southeastern New York. Liberty NY Water’s operations

include approximately 1,270 miles of water mains and distribution lines, with 98% of customers located in Nassau County on Long Island. The Company has incorporated the operations of Liberty NY Water into its East Region.

Outlook

The following discussion should be read in conjunction with the Caution

Concerning Forward-Looking Statements and Forward-Looking Information section in this MD&A. Actual results may differ materially from the estimates below. Accordingly, investors are cautioned not to place undue reliance on these estimates.

Estimated 2023 Adjusted Net Earnings Per Common Share

The Company estimates that its Adjusted Net Earnings per common share for the

2023 fiscal year will be within a range of $0.55-$0.61 (see Caution Concerning Non-GAAP Measures). Estimated 2023 Adjusted Net Earnings per common share is calculated excluding the impact of gains and losses from asset dispositions, but is otherwise

calculated in a manner consistent with the description set out under Caution Concerning Non-GAAP Measures - Adjusted Net Earnings.

The Company’s 2023 Adjusted Net Earnings per common share estimate is based on

the following key assumptions, as well as those set out under Caution Concerning Forward-Looking Statements and Forward-Looking Information:

|

● |

normalized weather patterns in the geographical areas in which the Company operates or has projects; |

|

● |

renewable energy production consistent with long-term average and realized pricing in line with expectations; |

|

● |

capital projects, including renewable energy generation projects, being completed on time and

substantially in line with budgeted costs; |

|

● |

the absence of significant changes in the macroeconomic environment, including with respect to

interest rates and inflation; |

|

● |

rate decisions in line with expectations; |

|

● |

closing of the Kentucky Power Transaction in late April 2023; |

|

● |

a Canadian dollar/U.S. dollar exchange rate and a Chilean Peso/U.S. dollar exchange rate in line with expectations; |

|

● |

operating expense savings in line with expectations; |

|

● |

a low single-digit percent effective tax rate, including tax credits and excluding an expected

one-time 2017 tax reform adjustment related primarily to the Kentucky Power Transaction; and |

|

● |

timing of the close of the 2023 Asset Recycling Plan in line with expectations. |

Capital Investment Expectations

Assuming closing of the $2.646 billion Kentucky Power Transaction, the Company

anticipates making capital investments of approximately $3.6 billion in 2023. See Summary of Property, Plant and Equipment Expenditures for a more detailed discussion of the Company’s 2023 capital investment estimates.

In light of the current macroenvironment, including elevated interest and

inflation rates, as well as Company specific challenges and the Company’s desire to effectively allocate capital, the Company expects reduced capital intensity from the Company’s previously-disclosed expectation of $12.4 billion in capital

investments for the period from 2022 through the end of 2026.

| Management Discussion & Analysis |

11 |

2022 Fourth Quarter Results From Operations

| Key Financial Information |

|

Three months ended December 31 |

|

| (all dollar amounts in $ millions except per share information) |

|

2022 |

|

|

2021 |

|

| Revenue |

|

$ |

748.0 |

|

|

$ |

592.0 |

|

| Net earnings (loss) attributable to shareholders |

|

|

(74.4 |

) |

|

|

175.6 |

|

| Cash provided by operating activities |

|

|

214.6 |

|

|

|

126.5 |

|

| Adjusted Net Earnings1 |

|

|

151.0 |

|

|

|

137.0 |

|

| Adjusted EBITDA1 |

|

|

358.3 |

|

|

|

298.3 |

|

| Adjusted Funds from Operations1 |

|

|

258.4 |

|

|

|

221.2 |

|

| Dividends declared to common shareholders |

|

|

123.7 |

|

|

|

115.5 |

|

| Weighted average number of common shares outstanding |

|

|

683,281,170 |

|

|

|

653,728,621 |

|

| Per share |

|

|

|

|

|

|

|

|

| Basic net earnings (loss) |

|

$ |

(0.11 |

) |

|

$ |

0.27 |

|

| Diluted net earnings (loss) |

|

$ |

(0.11 |

) |

|

$ |

0.26 |

|

| Adjusted Net Earnings1 |

|

$ |

0.22 |

|

|

$ |

0.21 |

|

| Dividends declared to common shareholders |

|

$ |

0.18 |

|

|

$ |

0.17 |

|

| 1 |

See Caution Concerning Non-GAAP Measures. |

For the three months ended December 31, 2022, AQN reported a basic net loss

per common share of $0.11 as compared to basic net earnings per common share of $0.27 during the same period in 2021, a decrease of $0.38. This loss was primarily driven by the change in value of investments carried at fair value of $75.7 million

primarily related to the Company’s investment in Atlantica, and non-cash losses on asset impairment charges of $159.6 million, mainly on the Senate Wind Facility (which began commercial operations in 2012) due to declining forecasted energy prices in

ERCOT, and an impairment of $75.9 million on the equity-method investment in the Texas Coastal Wind Facilities primarily as a result of continued challenges with congestion at the facilities (collectively the “2022 Impairment”).

For the three months ended December 31, 2022, AQN reported Adjusted Net

Earnings per common share of $0.22 as compared to $0.21 per common share during the same period in 2021, an increase of $0.01 (see Caution Concerning Non-GAAP Measures). Adjusted Net Earnings increased by $14.0 million year over year. The

Company grew year over year Adjusted EBITDA by $60.0 million (see Caution Concerning Non-GAAP Measures), primarily as a result of increased gains on asset sales of $33.7 million in the Renewable Energy Group, and the acquisition of Liberty NY

Water, and implementation of new rates at the Empire, Bermuda and Granite State Electric Systems in the Regulated Services Group which contributed $10.1 million and $14.7 million of Adjusted EBITDA, respectively. This growth was partially offset by

increased depreciation of $4.0 million, increased interest of $27.9 million, driven by higher interest rates as well as increased borrowings to support growth initiatives, lower recognition of investment tax credits (“ITCs”) and production tax

credits (“PTCs”) of $9.4 million, and an increase in the weighted average number of common shares outstanding.

For the three months ended December 31, 2022, AQN experienced an average

exchange rate of Canadian to U.S. dollars of approximately 0.7364 as compared to 0.7937 in the same period in 2021, and an average exchange rate of Chilean pesos to U.S. dollars of approximately 0.0011 for the three months ended December 31, 2022 as

compared to 0.0012 for the same period in 2021. As such, any year over year variance in revenue or expenses, in local currency, at any of AQN’s Canadian and Chilean entities is affected by a change in the average exchange rate upon conversion to

AQN’s reporting currency.

For the three months ended December 31, 2022, AQN reported total revenue of

$748.0 million as compared to $592.0 million during the same period in 2021, an increase of $156.0 million or 26.4%. The major factors impacting AQN’s revenue in the three months ended December 31, 2022 as compared to the same period in 2021 are set

out as follows:

| |

|

Three months ended |

| (all dollar amounts in $ millions) |

|

December 31 |

| Comparative Prior Period Revenue |

|

$ |

592.0 |

|

| REGULATED SERVICES GROUP |

|

|

|

|

| Existing Facilities |

|

|

|

|

| Electricity: Increase is primarily due to higher pass through costs at the Empire and Granite State Electric Systems and favourable weather versus prior year at the Empire Electric

System. |

|

|

52.6 |

|

| Natural Gas: Increase is primarily due to higher pass through commodity costs. |

|

|

46.0 |

|

| Water: Increase is primarily due to the inflationary rate increase mechanism at the ESSAL Water System and the tuck-in addition of the Bolivar Water System. |

|

|

3.3 |

|

| Other: Increase is primarily due to an increase in projects at Ft. Benning. |

|

|

0.9 |

|

| |

|

|

102.8 |

|

| New Facilities |

|

|

|

|

| Water: Acquisition of Liberty NY Water (January 2022). |

|

|

30.8 |

|

| |

|

|

30.8 |

|

| Rate Reviews |

|

|

|

|

| Electricity: Increase is primarily due to implementation of new rates at the Empire, Bermuda and Granite State Electric Systems. |

|

|

11.5 |

|

| Natural Gas: Increase is primarily due to implementation of new rates at the EnergyNorth and Peach State Gas Systems. |

|

|

3.2 |

|

| |

|

|

14.7 |

|

| Foreign Exchange |

|

|

(2.1 |

) |

| RENEWABLE ENERGY GROUP |

|

|

|

|

| Existing Facilities |

|

|

|

|

| Hydro: Increase is primarily due to higher production. |

|

|

0.5 |

|

| Wind Canada: Increase is primarily due to higher production at the St. Damase and Amherst Island Wind Facilities. |

|

|

1.2 |

|

| Wind U.S.: Increase is primarily due to favourable renewable energy certificate (“REC”) revenue, favourable energy market pricing, as well as higher availability revenue at the

Maverick and Sugar Creek Wind Facilities. |

|

|

7.5 |

|

| Solar: Decrease is primarily due to unfavourable weather conditions at the Great Bay I, Great Bay II, and Altavista Solar Facilities. |

|

|

(1.7 |

) |

| Thermal: Decrease is primarily driven by lower production at the Sanger Thermal Facility as it had reached the annual target limit of run hours. |

|

|

(0.9 |

) |

| Other: Increase is primarily due to higher Congestion Revenue Rights (“CRRs”) revenue at the Texas Coastal Wind Facilities. |

|

|

4.7 |

|

| |

|

|

11.3 |

|

| New Facilities |

|

|

|

|

| Solar: Increase is due to the Croton Solar Facility (full commercial operations (“COD”) in December 2021). |

|

|

0.2 |

|

| Other: |

|

|

0.1 |

|

| |

|

|

0.3 |

|

| Foreign Exchange |

|

|

(1.8 |

) |

| Current Period Revenue |

|

$ |

748.0 |

|

| Management Discussion & Analysis |

13 |

2022 Annual Results From Operations

| Key Financial Information |

|

Twelve months ended December 31 |

|

| (all dollar amounts in $ millions except per share information) |

|

2022 |

|

|

2021 |

|

|

2020 |

|

| Revenue |

|

$ |

2,765.2 |

|

|

$ |

2,274.1 |

|

|

$ |

1,677.0 |

|

| Net earnings (loss) attributable to shareholders |

|

|

(212.0 |

) |

|

|

264.9 |

|

|

|

782.5 |

|

| Cash provided by operating activities |

|

|

619.1 |

|

|

|

157.5 |

|

|

|

505.2 |

|

| Adjusted Net Earnings1 |

|

|

474.9 |

|

|

|

449.0 |

|

|

|

365.8 |

|

| Adjusted EBITDA1 |

|

|

1,256.8 |

|

|

|

1,076.3 |

|

|

|

869.5 |

|

| Adjusted Funds from Operations1 |

|

|

864.1 |

|

|

|

757.9 |

|

|

|

600.2 |

|

| Dividends declared to common shareholders |

|

|

486.0 |

|

|

|

423.0 |

|

|

|

344.4 |

|

| Weighted average number of common shares outstanding |

|

|

677,862,207 |

|

|

|

622,347,677 |

|

|

|

559,633,275 |

|

| Per share |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net earnings (loss) |

|

$ |

(0.33 |

) |

|

$ |

0.41 |

|

|

$ |

1.38 |

|

| Diluted net earnings (loss) |

|

$ |

(0.33 |

) |

|

$ |

0.41 |

|

|

$ |

1.37 |

|

| Adjusted Net Earnings1 |

|

$ |

0.69 |

|

|

$ |

0.71 |

|

|

$ |

0.64 |

|

| Dividends declared to common shareholders |

|

$ |

0.71 |

|

|

$ |

0.67 |

|

|

$ |

0.61 |

|

| Total assets |

|

|

17,627.6 |

|

|

|

16,797.5 |

|

|

|

13,224.1 |

|

| Long term debt2 |

|

|

7,512.3 |

|

|

|

6,211.7 |

|

|

|

4,538.8 |

|

| 1 |

See Caution Concerning Non-GAAP Measures. |

| 2 |

Includes current and long-term portion of debt and convertible debentures per the annual consolidated financial statements. |

For the twelve months ended December 31, 2022, AQN reported a basic net loss

per common share of $0.33 as compared to net earnings per common share of $0.41 during the same period in 2021, a decrease of $0.74. This loss was primarily driven by the change in value of investments carried at fair value of $376.7 million

primarily related to the Company’s investment in Atlantica, and the 2022 Impairment. These impaired assets operate within the ERCOT market, and the 2022 Impairment recorded is primarily due to declining forecasted energy prices in ERCOT for the

Senate Wind Facility (which began commercial operations in 2012) and continued challenges with congestion at the Texas Costal Wind Facilities.

For the twelve months ended December 31, 2022, AQN reported Adjusted Net

Earnings per common share of $0.69 as compared to $0.71 per share during the same period in 2021, a decrease of $0.02 (see Caution Concerning Non-GAAP Measures). Adjusted Net Earnings increased by $25.9 million year over year. The Company grew

year over year Adjusted EBITDA by $180.5 million,(see Caution Concerning Non-GAAP Measures), primarily as a result of increased gains on asset sales of $34.9 million and $45.0 million in additional contributions from existing facilities in

the Renewable Energy Group mainly driven by increased production, and the acquisition of Liberty NY Water and implementation of new rates at the Empire, Bermuda and Granite State Electric Systems in the Regulated Services Group which contributed

$37.4 million and $42.3 million of Adjusted EBITDA, respectively. This growth was offset by increased depreciation of $52.5 million, increased interest expense of $69.0 million, driven by higher interest rates and higher borrowings to support growth

initiatives, lower recognition of ITCs and PTCs of $31.0 million, and an increase in the weighted average number of common shares outstanding.

For the twelve months ended December 31, 2022, AQN experienced an average

exchange rate of Canadian to U.S. dollars of approximately 0.7682 as compared to 0.7976 in the same period in 2021, and an average exchange rate of Chilean pesos to U.S. dollars of approximately 0.0011 for the twelve months ended December 31, 2022 as

compared to 0.0014 for the same period in 2021. As such, any year-over-year variance in revenue or expenses, in local currency, at any of AQN’s Canadian and Chilean entities is affected by a change in the average exchange rate upon conversion to

AQN’s reporting currency.

For the twelve months ended December 31, 2022, AQN reported total revenue of

$2,765.2 million as compared to $2,274.1 million during the same period in 2021, an increase of $491.1 million or 21.6%. The major factors resulting in the increase in AQN revenue for the twelve months ended December 31, 2022 as compared to the same

period in 2021 are as follows:

| |

|

Twelve months |

|

| (all dollar amounts in $ millions) |

|

ended December 31 |

|

| Comparative Prior Period Revenue |

|

$ |

2,274.1 |

|

| REGULATED SERVICES GROUP |

|

|

|

|

| Existing Facilities |

|

|

|

|

| Electricity: Increase is primarily due to higher pass through costs at the Empire, Granite State and Bermuda Electric Systems and favourable weather at the Empire Electric System. |

|

|

61.4 |

|

| Natural Gas: Increase is primarily due to higher pass through commodity costs. |

|

|

152.8 |

|

| Water: Increase is primarily due to the inflationary rate increase mechanism at the ESSAL Water System. |

|

|

15.2 |

|

| Other: Increase is primarily due to an increase in projects at Ft. Benning. |

|

|

1.1 |

|

| |

|

|

230.5 |

|

| New Facilities |

|

|

|

|

| Water: Acquisition of Liberty NY Water (January 2022). |

|

|

125.6 |

|

| |

|

|

125.6 |

|

| Rate Reviews |

|

|

|

|

| Electricity: Increase is primarily due to implementation of new rates at the Empire, Bermuda and Granite State Electric Systems. |

|

|

33.2 |

|

| Natural Gas: Increase is primarily due to implementation of new rates at the EnergyNorth and Peach State Gas Systems. |

|

|

7.3 |

|

| Water: Increase is due to the implementation of new rates at the Park Water System. |

|

|

1.8 |

|

| |

|

|

42.3 |

|

| Foreign Exchange |

|

|

(11.7 |

) |

| |

|

|

|

|

| RENEWABLE ENERGY GROUP |

|

|

|

|

| Existing Facilities |

|

|

|

|

| Hydro: Increase is primarily due to higher overall production as well as favourable pricing at one of the Company’s hydro facilities. |

|

|

7.5 |

|

| Wind Canada: Increase is primarily due to higher overall production. |

|

|

5.0 |

|

| Wind U.S.: Increase is primarily due to the non-recurring impact of the Market Disruption Event, higher production, favourable energy market pricing and favourable REC revenue across the U.S. wind

facilities. |

|

|

71.0 |

|

| Solar: Increase is primarily due to favourable REC revenue at the Great Bay I Solar Facility and favourable energy market pricing at the Great Bay II Solar Facility. |

|

|

2.7 |

|

| Thermal: Increase is primarily due to favourable overall energy market pricing and favourable REC revenue at the Windsor Locks Thermal Facility. |

|

|

11.9 |

|