UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934

(Amendment

No. )

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to Section 240.14a-12 |

AIXIN

LIFE INTERNATIONAL, INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No fee required |

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on the table below per Exchange Act Rules 14a-6(i)(1)

and 0-11 |

AIXIN

LIFE INTERNATIONAL, INC.

Hongxing

International Business Building 2, 14th FL, No. 69 Qingyun South Ave., Jinjiang District

Chengdu

City, Sichuan Province, China

December

20, 2022

Dear

Stockholders:

The

Annual Meeting of Stockholders of AiXin Life International, Inc. will be held on Wednesday, January 25, 2023, at 3:00 p.m. local

time at the offices of of AiXin Life International, Inc., Hongxing International Business Building 2, 14th FL, No. 69 Qingyun

South Ave., Jinjiang District, Chengdu City, Sichuan Province, China. The formal Notice of Annual Meeting and other proxy materials are

enclosed.

The

matters expected to be acted upon at the Annual Meeting are described in the attached Proxy Statement.

It

is important that your views be represented. If you request a proxy card, please mark, sign and date the proxy card when received and

return it promptly in the self-addressed, stamped envelope we will provide. No postage is required if this envelope is mailed in the

United States. You also have the option of voting your proxy via the Internet at www.proxyvote.com or by calling toll free via

a touch-tone phone at 1-800-690-6903. Proxies submitted by telephone or over the Internet must be received by 11:59 p.m. Eastern Time

on January 24, 2023. Although we encourage you to complete and return a proxy prior to the Annual Meeting to ensure that your

vote is counted, you can attend the Annual Meeting and cast your vote in person. If you vote by proxy and also attend the Annual Meeting,

there is no need to vote again at the Annual Meeting unless you wish to change your vote.

We

appreciate your investment in AiXin Life International, Inc. and urge you to cast your vote as soon as possible.

| |

Sincerely, |

| |

|

| |

/s/

Quanzhong Lin |

| |

Chairman,

President and Chief Executive Officer |

AIXIN

LIFE INTERNATIONAL, INC.

Hongxing

International Business Building 2, 14th FL, No. 69 Qingyun South Ave., Jinjiang District

Chengdu

City, Sichuan Province, China

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

The

Annual Meeting of Stockholders of Air Industries Group will be held at the offices of AiXin Life International, Inc. Hongxing International

Business Building 2, 14th FL, No. 69 Qingyun South Ave., Jinjiang District, Chengdu City, Sichuan Province, China on Wednesday, January 25, 2023, beginning at 3:00 p.m. Local Time for the following purposes:

|

1.

|

to

elect four directors;

|

| |

|

|

| |

2. |

to

ratify the appointment of KCCW Accountancy Corp. as our independent registered public accounting firm for the fiscal year ending

December 31, 2022; and |

| |

|

|

| |

3. |

to

transact such other business as may properly come before the Annual Meeting and at any adjournment or postponement thereof. |

The

Board of Directors has fixed the close of business on December 19, 2022 as the record date for determining stockholders entitled

to notice of and to vote at the Annual Meeting.

| |

By

order of the Board of Directors, |

| |

|

| |

/s/

Quanzhong Lin |

| |

Chairman,

President and Chief Executive Officer |

December

20, 2022

Please

mark, sign and date the enclosed proxy card and

return

it promptly in the enclosed self-addressed, stamped envelope.

To

vote via the Internet:

Internet:

http://onlineproxyvote.com/AIXN/

TABLE

OF CONTENTS

Documents Accompanying this Proxy Statement:

Annual

Report on Form 10-K for the Year Ended December 31, 2021

AIXIN

LIFE INTERNATIONAL, INC.

Hongxing

International Business Building 2, 14th FL, No. 69 Qingyun South Ave., Jinjiang District

Chengdu

City, Sichuan Province, China

PROXY

STATEMENT

General

Information

This

Proxy Statement is furnished in connection with the solicitation by the Board of Directors of AiXin Life International, Inc., a Colorado

corporation (the “Company,” “we,” “our” or “us”), of proxies to be voted at our Annual

Meeting of Stockholders (the “Annual Meeting” or the “Meeting”) and at any adjournment or postponement of the

Meeting. The Annual Meeting will take place on Wednesday, January 25, 2023, beginning at 3:00 p.m., local time, at our offices,

Hongxing International Business Building 2, 14th FL, No. 69 Qingyun South Ave., Jinjiang District, Chengdu City, Sichuan Province, China.

This

Proxy Statement, the Notice of Annual Meeting, our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 and accompanying

proxy are being furnished to holders of our common stock, par value $0.00001 per share (“Common Stock”), on or about

December 20, 2022. Web links and addresses contained in this Proxy Statement are provided for convenience only, and the content

on the referenced websites does not constitute a part of this Proxy Statement.

Frequently

Asked Questions About the Annual Meeting and Voting

| 1. |

Who

is entitled to vote at the Annual Meeting? |

Holders

of our Common Stock as of December 19, 2022 (the “Record Date”) are entitled to receive the Notice of Annual Meeting

and to vote their shares at the Meeting. Holders of our Common Stock on the Record Date are entitled to one vote for each share held

of record on the Record Date.

| 2. |

How

many shares of Common Stock are “outstanding”? |

As

of December 19, 2022, there were 49,999,891 shares of Common Stock outstanding and entitled to be voted at the Annual Meeting.

| 3. |

What

is the difference between holding shares as a stockholder of record and as a beneficial owner? |

If

your shares are registered in your name with our transfer agent, Securities Transfer Corporation, you are the “stockholder of record”

of those shares. This Notice of Annual Meeting and Proxy Statement and any accompanying materials have been provided directly to you

by Air Industries Group.

If

your shares are held through a broker, bank or other holder of record, you hold your shares in “street name” and you are

considered the “beneficial owner” of those shares. This Notice of Annual Meeting and Proxy Statement and any accompanying

documents have been provided to you by your broker, bank or other holder of record. As the beneficial owner, you have the right to direct

your broker, bank or other holder of record how to vote your shares by using the voting instruction card or by following their instructions

for voting by telephone or on the Internet. Absent instructions from you, under applicable regulatory requirements, your broker may not

vote your shares on the election of directors or any of the other proposals to be voted on at the Annual Meeting.

| 4. |

Why

did I receive a notice of internet availability of proxy materials instead of a full set of proxy materials? |

In

accordance with the rules of the U.S. Securities and Exchange Commission (“SEC”), we are permitted to furnish proxy materials,

including this proxy statement and our annual report, to stockholders by providing access to these documents on the Internet instead

of mailing printed copies. Most stockholders will not receive printed copies of the proxy materials unless they so request. Instead,

the notice provides instructions on how to access and review the proxy materials on the Internet. The notice also provides instructions

on how to submit your proxy and voting instructions via the Internet. If you would like to receive a printed copy or an electronic copy

(via email) of our proxy materials, please follow the instructions for requesting the materials in the notice.

You

may vote using any of the following methods:

By

mail

Complete,

sign and date the accompanying proxy or voting instruction card and return it in the prepaid envelope. If you are a stockholder of record

and return your signed proxy card but do not indicate your voting preferences, the persons named in the proxy card will vote the shares

represented by your proxy card as recommended by the Board of Directors.

By

the Internet

AiXin

Life International, Inc. has established Internet voting procedures for stockholders of record. These procedures are designed to authenticate

your identity, to allow you to give your voting instructions and to confirm that those instructions have been properly recorded. Telephone

and Internet voting facilities for stockholders of record will be available 24 hours a day until 11:59 p.m., Eastern Time, on January 24, 2023.

The

availability of Internet voting for beneficial owners will depend on the voting processes of your broker, bank or other holder of record.

We therefore recommend that you follow the voting instructions in the materials you receive.

If

you vote by Internet, you do not have to return your proxy or voting instruction card.

The

website for Internet voting is http://onlineproxyvote.com/AIXN/. Please have your proxy card handy when you go to the website. You can

confirm that your instructions have been properly recorded. If you vote on the Internet, you also can request electronic delivery of

future proxy materials.

In

person at the Annual Meeting

Stockholders

who attend the Annual Meeting may vote in person at the Meeting. You may also be represented by another person at the Meeting by executing

a proper proxy designating that person. If you are a beneficial owner of shares, you must obtain a legal proxy from your broker, bank

or other holder of record and present it to the inspector of election with your ballot to be able to vote at the Annual Meeting.

Your

vote is important. Please complete your proxy card promptly to ensure that your vote is received timely.

| 6. |

What

can I do if I change my mind after I vote? |

If

you are a stockholder of record, you can revoke your proxy before it is exercised by:

| |

● |

giving

written notice to the Corporate Secretary of the Company; |

| |

|

|

| |

● |

delivering a valid, later-dated proxy, or a later-dated vote by telephone or on the Internet, in a timely manner; or |

| |

|

|

| |

● |

voting by ballot at the Annual Meeting. |

If

you are a beneficial owner of shares, you may submit new voting instructions by contacting your broker, bank or other holder of record.

All shares for which proxies have been properly submitted and not revoked will be voted at the Annual Meeting.

| 7. |

How

will your proxy vote your shares? |

Your

proxy will vote according to your instructions. If you vote by mail and complete, sign, and return the proxy card but do not indicate

your vote, your proxy will vote “FOR” each of the director nominees and “FOR” ratification of the appointment

of KCCW Accountancy Corp. as our independent registered public accounting firm for the fiscal year ending December 31, 2022. The Board

does not intend to bring any other matter for a vote at the Annual Meeting, and neither we nor the Board knows of anyone else who intends

to do so. However, on any other business that properly comes before the Annual Meeting, your proxies are authorized to vote on your behalf

using their best judgment.

| 8. |

Where

can you find the voting results? |

We

intend to announce the preliminary voting results at the Annual Meeting and will publish the final results in a Current Report on Form

8-K, which we will file with the SEC no later than four business days following the Annual Meeting. If the final voting results are unavailable

in time to file a current report on Form 8-K with the SEC within four business days after the Annual Meeting, we intend to file a Form

8-K to disclose the preliminary results and, within four business days after the final results are known, will file an additional current

report on Form 8-K with the SEC to disclose the final voting results.

| 9. |

What

is a broker non-vote? |

If

you are a beneficial owner whose shares are held of record by a broker, you must instruct the broker how to vote your shares. If you

do not provide voting instructions, your shares will not be voted on any proposal on which the broker does not have discretionary authority

to vote. This is called a “broker non-vote.” In these cases, the broker can register your shares as being present at the

Annual Meeting for purposes of determining the presence of a quorum but will not be able to vote on those matters for which specific

authorization is required under the rules of the New York Stock Exchange (“NYSE”).

If

you are a beneficial owner whose shares are held of record by a broker, your broker has discretionary voting authority under NYSE rules

to vote your shares on the ratification of KCCW Accountancy Corp. as our independent registered public accounting firm, even if the broker

does not receive voting instructions from you. However, your broker does not have discretionary authority to vote on the election of

directors, the “say-on-pay” proposals or any other proposal, in which case a broker non-vote will occur and your shares will

not be voted on these matters.

| 10. |

What

is a quorum for the Annual Meeting? |

The

presence of the holders of shares of common stock representing 24,999,946 votes, a majority of the Common Stock issued and outstanding

and entitled to vote at the Annual Meeting, in person or represented by proxy, is necessary to constitute a quorum. Abstentions and broker

non-votes are counted as present and entitled to vote for purposes of determining a quorum.

| 11. |

What

are the voting requirements to elect the directors and to approve each of the proposals discussed in this Proxy Statement? |

Election

of Directors

Directors

are elected by a plurality of the votes cast at the Annual Meeting. This means that the seven persons receiving the highest number of

affirmative “for” votes at the Annual Meeting will be elected. Abstentions and broker non-votes are not counted as votes

“for” or “against” a director nominee.

Ratification

of KCCW Accountancy Corp. as our independent registered public accounting firm

The

votes cast “for” must exceed the votes cast “against” to approve the ratification of KCCW Accountancy Corp. as

our independent registered public accounting firm. Abstentions are not counted as votes “for” or “against” this

proposal.

| 12. |

How

will my shares be voted at the Annual Meeting? |

At

the Meeting, the persons named in the proxy card or, if applicable, their substitutes, will vote your shares as you instruct. If you

sign your proxy card and return it without indicating how you would like to vote your shares, your shares will be voted as the Board

of Directors recommends, which is:

| |

● |

FOR the election of each of the director nominees named

in this Proxy Statement; and |

| |

|

|

| |

● |

FOR ratification of the appointment of KCCW Accountancy

Corp.as our independent registered public accounting firm for the fiscal year ending December 31, 2022; |

| 13. |

Could

other matters be decided at the Annual Meeting? |

As

of the date of this Proxy Statement, we did not know of any matters to be presented at the Annual Meeting, other than those referred

to in this Proxy Statement.

If

you return your signed and completed proxy card or vote by telephone or on the Internet and other matters are properly presented at the

Annual Meeting for consideration, the individuals named as proxies on the enclosed proxy card will have the discretion to vote on your

behalf.

| 14. |

Who

will pay for the cost of the Annual Meeting and this proxy solicitation? |

The

Company will pay the costs associated with the Annual Meeting and solicitation of proxies, including the costs of transmitting the proxy

materials. In addition to solicitation by mail, our directors, officers and regular employees (who will not be specifically compensated

for such services) may solicit proxies by telephone or otherwise. Arrangements will be made with brokerage houses and other custodians,

nominees and fiduciaries to forward proxies and proxy materials to their principals, and we will reimburse them for their expenses. We

have retained Securities Transfer Corporation, to assist in the mailing, collection and administration of proxies. We have not retained

a soliciting agent to assist in the solicitation of proxies.

MATTERS

TO COME BEFORE THE ANNUAL MEETING

PROPOSAL

ONE:

Election

of Directors

Nominees

At

the Annual Meeting, four directors, who have been nominated by the Nominating Committee of the Board of Directors, are to be elected,

each to hold office (subject to our By-Laws) until the next annual meeting and until his successor has been elected and qualified. All

of the nominees for director currently serve as directors.

Each

nominee has consented to being named as a nominee in this proxy statement and to serve if elected. If any nominee listed in the table

below should become unavailable for any reason, which the Board of Directors does not anticipate, the proxy will be voted for any substitute

nominee or nominees who may be selected by the Board of Directors prior to or at the Annual Meeting, or, if no substitute is selected

by the Board of Directors prior to or at the Annual Meeting, for a motion to reduce the membership of the Board of Directors to the number

of nominees available. The seven nominees receiving the highest number of affirmative “for” votes at the Annual Meeting will

be elected. The information concerning the nominees and their security holdings has been furnished by them to us.

Directors

are nominated by our Board of Directors, based on the recommendations of the Nominating Committee. As discussed elsewhere in this proxy

statement, in evaluating director nominees, the Nominating Committee considers characteristics that include, among others, integrity,

business experience, financial acumen, leadership abilities, familiarity with our businesses and businesses similar or analogous to ours,

and the extent to which a candidate’s knowledge, skills, background and experience are already represented by other members of

our Board of Directors. Listed below are our director nominees with their biographies.

| Name |

|

Age |

|

Director

Since |

| Quanzhong

Lin |

|

44 |

|

February

2017 |

| Yao-Te

Wang |

|

45 |

|

December

2017 |

Christopher

Lee

Jiao

Huiliang |

|

51

50 |

|

February

2021

December

2022 |

Quanzhong

Lin has served as a director, President and Chief Executive Officer of our company since February 2017. Mr. Lin is a highly

active entrepreneur in China, and currently serves as Chairman of AiXin Company Group, a diversified company which he founded in

2008. In addition to AiXin Company Group, Mr. Lin has founded a number of companies located in Chengdu City, Sichuan Province,

China, engaged in various types of business, including pharmacies, retail outlets, hotel management services and global tourism. In

2009, Mr. Lin founded QingBaiJiangJinWanXiang Daily Necessities store, predecessor to AixinZhonghong Biotechnology Co., Ltd. From

2010 to 2013, Mr. Lin opened branches in Xindu and Xinjin district, officially entering the Chengdu market. In September 2013, Mr.

Lin founded Chengdu Aixin E-Commerce Company Ltd., which in the following twelve months opened branches in Huayuan and Wenjiang

districts, and Mianyang and Jianyang city. In April, 2015, Aixin E-commerce Co., Ltd. changed its name to Chengdu AixinZhonghong

Biotechnology Co., Ltd., whose shares became listed on the Shanghai Stock Exchange (Ticker Symbol: 207448) in October 2015; and

during 2015, AixinZhonghong opened branches in Dujiangyan City, and Chongzhou City. In June 2014, Mr. Lin founded Chengdu Aixin

Investment Co., Ltd. From January through March, 2016, Mr. Lin founded Chengdu Aixin International Travel Service Co., Ltd.,

Hongkong Aixin International Group Co., Ltd., and Chengdu Aixintang Pharmacy; and during 2016, AixinZhonghong opened branches in

Huayang Township, Ziyang City, Guizhou Province, and Hubei Province. Mr. Lin’s extensive experience as an entrepreneur

qualifies him to serve as a director.

Yao-Te

Wang has served as a director of our company since December 2017. Mr. Wang has been the Chief Executive Officer of Ivy Service Group

(China), which is a transnational consultant company in China, since 2015. From January 2016 to June 2016, Mr. Wang participated in the

overall operation planning for Chongqing Cultural Assets and Equity Exchange. From June 2015 to January 2016, Mr. Wang helped with the

overall brand strategy development for Swire Group, who merged the biggest baking brand in Southwest China within more than 150 million

RMB. From September 2014 to February 2015, Mr. Wang was the chairman special assistant for JECUI Health Science Company. From July 2012

to August 2014, Mr. Wang was the Chief Executive Officer of Ivy Service Group (Taipei). From August 2007 to June 2012, Mr. Wang was an

instructor of National Defense University (Taipei), taught International Politics and Economic Analysis. Mr. Wang’s extensive experience

as an advisor to our company and other companies in China qualifies him to serve as a director.

Christopher

Lee was appointed a Member of our Board of Directors in February 2021. Mr. Lee has served as Chief Financial Officer of Semileds

Corporation since September 2015. Mr. Lee joined Semileds Corporation in September 2014 and from November 2014 until his appointment

as Chief Financial Officer, Mr. Lee was the interim Chief Financial Officer of Semileds Corporation. Semileds develops, manufactures

and sells high performance light emitting diodes and is currently listed on The Nasdaq Stock Market. Mr. Lee has over 20 years of experience

in accounting and finance, including US GAAP, PCAOB standards and SEC rules and regulations. Mr. Lee was a partner of KEDP CPA Group

from August 2009 to June 2011 and a self-employed accountant from July 2011 to August 2014. Mr. Lee holds a BS degree in accounting from

Ohio State University and a MS degree in business taxation from Golden Gate University and is licensed as a Certified Public Accountant

(CPA) in the United States. Mr. Lee’s knowledge of accounting practices and service as a Chief Financial Officer of a publicly

traded company qualifies him to serve as a director.

Jiao

Huiliang was added to the Board of Directors of our Company. Mr. Huiliang, age 47, received his degree from China Pharmaceutical

University in 1997 where he majored in Pharmacy. Mr. Huiliang joined Yunnan Runcangsheng Technology Co., Ltd. in April 2020, most recently

serving as Chief Executive Officer. Mr. Huiliang served as the general manager of Yunnan Shengshengyuan Technology Co., Ltd. from June

2016 until he joined Runcangsheng. From January 2007 until May 2016, Mr. Huiliang was the general manager of Yunnan Shengcaofeng Biotechnology

Co., Ltd. Throughout his career Mr. Huiliang has been involved in the research and development of new products intended to improve individuals’

health and well-being, with an emphasis on functional products comprised of natural plants, foods and supplements intended to address

obesity and other chronic conditions. He was named as an inventor on more than forty patents relating to the composition and manufacture

of health foods. In addition to the development of health foods, Mr. Huiliang has participated in the design and maintenance of production

systems intended to meet the latest manufacturing standards.There

are no family relationships among any of our directors. Mr. Huiliang’s knowledge of health products and the manufacture and production

of such products qualifies him to serve as a director.

Directors

hold office until the next annual meeting of shareholders and until their successors have been duly elected and qualified.

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE FOR

THE

ELECTION OF EACH NOMINEE UNDER PROPOSAL ONE

Information

Concerning the Board of Directors

Board

Meetings; Leadership Structure and Risk Oversight

The

Board does not have a policy requiring separation of the roles of Chief Executive Officer and Chairman of the Board. The Board has determined

that having Mr. Lin serve as Chairman is in the best interests of our stockholders at this time because of his in-depth knowledge of

our businesses and his familiarity with our customers and clients.

The

Board of Directors as a whole is responsible for consideration and oversight of the risks we face and is responsible for ensuring that

material risks are identified and managed appropriately. Certain risks are overseen by committees of the Board of Directors and these

committees make reports to the full Board of Directors, including reports on noteworthy risk-management issues. Members of the Company’s

senior management team regularly report to the full Board about their areas of responsibility and a component of these reports is the

risks within their areas of responsibility and the steps management has taken to monitor and control such exposures. Additional review

or reporting on risks is conducted as needed or as requested by the Board or one of its committees.

Compensation

of Directors

The

following table sets forth certain information regarding the compensation paid to, earned by or accrued for, our directors during the

fiscal year ended December 31, 2021.

| DIRECTOR COMPENSATION |

| |

| Name | |

Fees Earned

or Paid In Cash

($) | | |

Stock

Awards

($) | | |

Option

Awards

($) | | |

Non-Equity

Incentive Plan

Compensation

($) | | |

Non-Qualified

Deferred

Compensation

Earnings ($) | | |

All Other

Compensation

($) | | |

Total ($) | |

| Yao-Te Wang | |

$ | 24,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

$ | 24,000 | |

| Quanzhong Lin | |

$ | 24,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

$ | 24,000 | |

| Christopher Lee | |

$ | 9,600 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

$ | 9,600 | |

| Chang-Ping Lin | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

Independent

Directors

Our

Board of Directors has determined that Yao-Te Wang, Christopher Lee and Jiao Huiliang are “independent directors”

within the meaning of NASDAQ Marketplace Rule 5605(a)(2).

Board

Meetings; Committees and Membership

Our

Board of Directors did not meet in formal session during 2021, though it regularly took action by written consent after the directors

consulted with each other as to the actions to be taken.

We

maintain the following committees of the Board of Directors: the Audit Committee, the Compensation Committee and the Nominating and Corporate

Governance Committee. Each committee is comprised entirely of directors who are “independent” within the meaning of NASDAQ

Marketplace Rule 5605(a)(2). Each committee acts pursuant to a separate written charter, and each such charter has been adopted and approved

by the Board of Directors. Copies of the committee charters were filed as Exhibits to our Report on Form 8-K filed on September 25, 2020.

Audit

Committee

Our

Audit Committee consists of Messrs. Lee, Huiliang and Wang, each of whom is independent. The Audit Committee assists the Board of Directors

oversight of (i) the integrity of financial statements, (ii) our compliance with legal and regulatory requirements, (iii) the independent

auditor’s qualifications and independence, and (iv) the performance of our internal audit function and independent auditor and

prepares the report that the SEC requires to be included in our annual proxy statement. The audit committee operates under a written

charter. Mr. Lee is the Chairman of our audit committee.

The

Board of Directors determined that Mr. Lee possesses accounting or related financial management experience that qualifies him as financially

sophisticated within the meaning of Rule 4350(d)(2)(A) of the Nasdaq Marketplace Rules and that he is an “audit committee financial

expert” as defined by the rules and regulations of the SEC.

Nominating

and Corporate Governance Committee

The

purpose of the Nominating and Corporate Governance Committee is to assist the Board of Directors in identifying qualified individuals

to become members of our Board of Directors, in determining the composition of the Board of Directors and in monitoring the process to

assess Board effectiveness. Each of Messrs. Lee, Huiliang and Wang are members of the Nominating and Corporate Governance Committee.

Mr. Wang serves as Chairman of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee operates

under a written charter.

| |

● |

Our

Nominating and Corporate Governance Committee has, among the others, the following authority and responsibilities: |

| |

|

|

| |

● |

To

determine and recommend to the Board, the criteria to be considered in selecting nominees for the director; |

| |

|

|

| |

● |

To

identify and screen candidate consistent with such criteria and consider any candidates recommended by our stockholders pursuant

to the procedures described in our proxy statement or in accordance with applicable laws, rules and regulations and provisions of

our charter documents. |

| |

|

|

| |

● |

To

select and approve the nominees for director to be submitted to a stockholder vote at the annual meeting of stockholders. |

Compensation

Committee

The

Compensation Committee is responsible for overseeing and, as appropriate, making recommendations to the Board of Directors regarding

the annual salaries and other compensation of our executive officers and general employees and other policies, and for providing assistance

and recommendations with respect to our compensation policies and practices. Each of Messrs. Lee, Huiliang and Wang are members of the

Compensation Committee. The Compensation Committee operates under a written charter. Mr. Huiliang is the Chairman of Compensation Committee.

Our

Compensation Committee has, among the others, the following responsibilities and authority.

| |

● |

The

compensation committee shall be directly responsible for the appointment, compensation and oversight of the work of any compensation

consultant, legal counsel and other adviser retained by the compensation committee or said group. |

| |

|

|

| |

● |

The

Company must provide for appropriate funding, as determined by the compensation committee, for payment of reasonable compensation to

a compensation consultant, legal counsel or any other adviser retained by the compensation committee or said group. |

| |

|

|

| |

● |

The

compensation committee may select, or receive advice from, a compensation consultant, legal counsel or other adviser to the compensation

committee or said group, other than in-house legal counsel, only after conducting an independence assessment with respect to the adviser

as provided for in the Exchange Act. |

Code

of Ethics

Our

board of directors has adopted a Code of Business Ethics and Conflicts of Interest (“Code of Ethics”) applicable to all employees,

including the Company’s chief executive officer and chief financial officer. A copy of the Code of Ethics and Business Conduct

was filed as an Exhibit to our report on Form 8-K filed on September 25, 2020, and is available on the SEC’s website, www.sec.gov.

Delinquent

Section 16(a) Reports

Section

16(a) of the Securities Exchange Act of 1934 requires our Directors, Executive Officers and beneficial owners of more than 10% of our

common stock to file with the SEC reports of their holdings of, and transactions in, our common stock. Based solely upon our review of

copies of such reports we believe that our officers, directors and 10% stockholders complied with these reporting requirements with respect

to 2021.

Shareholders

Communications

Shareholders

may communicate with the board of directors and individual directors by submitting their communications in writing to the Company’s

Corporate Secretary at Hongxing International Business Building 2, 14th FL, No. 69 Qingyun South Ave., Jinjiang District,

Chengdu City, Sichuan Province, China. Any communications received that are directed to the board of directors will be processed by the

Corporate Secretary and distributed promptly to the board of directors or individual directors, as appropriate. If it is unclear from

the communication received whether it was intended or appropriate for the Board, the Corporate Secretary will (subject to any applicable

regulatory requirements) use his business judgment to determine whether such communications should be conveyed to the board of directors.

Information

Concerning Executive Officers

Our

Executive Officers are set forth in the table below along with their ages and positions.

| Name |

|

Age |

|

Position |

| Quanzhong

Lin |

|

44 |

|

Chairman,

President and Chief Executive Officer |

| Tianfeng

Li |

|

35 |

|

Chief

Financial Officer |

Quanzhong

Lin has served as President and Chief Executive Officer of our company since February 2017. See Proposal One for additional information

concerning Mr. Lin.

Tianfeng

Li became our Chief Financial Officer in December 2022. Ms. Li has held various positions,

most recently, Finance Manager, within the Finance Department of our subsidiary, Chengdu Aixin Pharmacy Co., Ltd., which she joined in

May 2019. While serving at Aixin Pharmacy Ms. Li has helped build the company’s finance team and established the development of

its financial reporting and risk management systems. In addition, she has presided over the preparation of the company’s financial

statements, the completion of its annual audit, daily cash management, the preparation of the annual budget and the integration of newly

acquired pharmacies. From May 2013 until joining Aixin Pharmacy in May 2019, Ms. Li served as the Finance Manager of Sichuan Jinxin Clean

Energy Equipment Co., Ltd., where she was responsible for developing the company’s financial systems, preparing its budget and

all aspects of cash management. At Sichuan Jinxin Clean Energy Equipment Co., Ms. Li supervised a staff of five assistants. Ms. Li received

a bachelors degree from The Open University of China in 2017, and has received a Certificate of Honor as an Intermediate Accountant.

Officers

are elected by the board of directors and hold office until the earliest of their death, resignation or removal from office.

Executive

Compensation

The

following table sets forth information concerning compensation awarded to, earned by or paid to each individual who served as our chief

executive officer or chief financial officer for services rendered in all capacities during 2021 and 2020. No other executive officer

of our company received total annual salary and bonus compensation in excess of $100,000 for 2021 and 2020.

Summary

Compensation Table

| Name

and Principal Position | |

Year | | |

Salary

($) | | |

Bonus

($) | | |

Total

($) | |

| Quanzhong

Lin, President(1) | |

| 2021 | | |

$ | 24,000 | | |

$ | | | |

$ | 24,000 | |

| | |

| 2020 | | |

$ | 34,285 | | |

$ | | | |

$ | 34,285 | |

| Guolu

Li, Chief Financial Officer(2) | |

| 2021 | | |

$ | 18750 | | |

$ | | | |

$ | 18,750 | |

| | |

| 2020 | | |

$ | 18,000 | | |

$ | | | |

$ | 18,000 | |

(1)

Amounts attributed to Mr. Lin represent amounts paid for serving as a director and as President and CEO of

AiXinZhonghong.

(2)

Amounts attributed to Mr. Li represent amounts paid as CFO of AiXinZhonghong. Mr. Li was dismissed from his position in December, 2022.

Neither

Mr. Lin nor Tianfeng Li has an employment agreement with the Company and each serves on an at-willl basis.

Outstanding

Equity Awards at Fiscal Year-End

None

of our executive officers was granted any options or equity awards during 2021 or held any options or other equity awards at December

31, 2021.

Transactions

with Related Persons

The

following includes a summary of transactions since January 1, 2021, or any currently proposed transaction, in which we were or are to

be a participant and the amount involved exceeded or exceeds the lesser of $120,000 or one percent of the average of our total assets

at year-end for the last two completed fiscal years, and in which any related person had or will have a direct or indirect material interest

(other than compensation described under “Executive Compensation”). We believe the terms obtained or consideration that we

paid or received, as applicable, in connection with the transactions described below were comparable to terms available or the amounts

that would be paid or received, as applicable, in arm’s-length transactions.

Advance to/from related parties

At

December 31, 2021, the Company had advances from a shareholders and affiliates of shareholders of $1,947,154. At December 31, 2021, the

Company had advances to affiliates of our major shareholder of $19,055. The advances are payable on demand, and bear no interest.

Acquisitions

from a Major Shareholder

In

September 2021, we completed the acquisition of nine pharmacies located in Chengdu by acquiring the

entities which owned the pharmacies for an aggregate purchase price of RMB 34,635,845, or approximately US$5.31 million (“Transfer

Price”). Our Chairman, Quanzhong Lin, was the principal shareholder of the entity which owned the pharmacies we acquired.

In

July we completed the acquisition of Aixin Shangyan Hotel. Shangyan

Hotel Company which owns and operates a hotel located in the Jinniu District, Chengdu City. The hotel covers more than 8,000 square meters

and has a large restaurant that can accommodate 600 people, 6 luxury dining rooms, a 200 square meter music tea house, 13 private tea

rooms, 108 guest rooms and other supporting facilities. We acquired the hotel through an acquisition

of the outstanding equity of Aixin Shangyan Hotel of which Mr. Lin was the principal shareholder, for a purchase price of RMB

7,598,887, or approximately $1.16 million (“Transfer Price”).

In

connection with the acquisitions of the pharmacies and hotel we made payments to Mr Lin in the aggregate amount of $4.50 million.

Forgiveness

of Loan

On

December 31, 2021, Mr. Lin forgave a loan previously made to the Company in the amount of $6,912,513. This was treated as a contribution

to capital.

Office

Lease from a Major Shareholder

In

May 2014, we entered a lease with Mr. Lin for use of an office. We renewed the lease until May 28, 2023, with monthly rent of RMB 5,000

($766), payable quarterly.

Other

than the foregoing, none of the directors or executive officers of the Company, nor any person who owned of record or was known to own

beneficially more than 5% of the Company’s outstanding shares of its Common Stock, nor any associate or affiliate of such persons

or companies, had any material interest, direct or indirect, in any transaction that occurred since January 1, 2019, or in any proposed

transaction, which has materially affected or will affect the Company.

As

of the date hereof, we do not have in place any policies with respect to whether we will enter into agreements with related persons in

the future.

Independent

Directors

Each

of Yao-Te Wang, Christopher Lee and Jiao Huiliang is an independent director as the term “independent” is defined by Nasdaq

Marketplace Rule 5605(a)(2).

Security

Ownership of Certain Beneficial Owners and Management

The following table sets forth information concerning beneficial ownership of our common stock as of December 19, 2022, by (i)

any person or group with more than 5% of our common stock, (ii) each director, (iii) our chief executive officer and each other executive

officer whose cash compensation for the most recent fiscal year exceeded $100,000 and (iv) all such executive officers and directors

as a group.

Beneficial

ownership is determined in accordance with the rules of the SEC and includes voting and investment power with respect to the securities.

Subject to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all

shares of common stock shown as beneficially owned by them. In addition, shares of common stock issuable upon exercise of options, warrants

and other convertible securities anticipated to be exercisable or convertible at or within 60 days of December 19, 2022, are deemed

outstanding for the purpose of computing the percentage ownership of the person holding those securities, and the group as a whole, but

are not deemed outstanding for computing the percentage ownership of any other person. As December 19, 2022, we had outstanding

49,999,891 shares of common stock.

To

our knowledge, the persons named in the table have sole voting and investment power with respect to all shares of securities shown as

beneficially owned by them.

| Name of Shareholder | |

Amount and

Nature of

Beneficial

Ownership | | |

Percent of

Common Stock | |

| Directors and Executive Officers: | |

| | | |

| | |

| | |

| | | |

| | |

Quanzhong Lin, Chairman and CEO

9 An Rong Lu Jingniu, Bldg 4 Unit 163

Chengdu, Sichuan Province, China | |

| 29,069,353 | | |

| 58.14 | % |

| | |

| | | |

| | |

Yao-Te Wang, Director

704 No.9, Lane 14, Shijian St.

Tainan City, Taiwan, R.O.C. | |

| 3,768,673 | | |

| 7.54 | % |

| | |

| | | |

| | |

| All directors and executive officers as a group (5 persons) | |

| 32,838,026 | | |

| 65.68 | % |

Audit

Committee Report to Stockholders

Pursuant

to rules adopted by the SEC designed to improve disclosures related to the functioning of corporate audit committees and to enhance the

reliability and credibility of financial statements of public companies, the Audit Committee of our Board of Directors submits the following

report:

The

Audit Committee of the Board of Directors is responsible for providing independent, objective oversight of the Company’s accounting

functions and internal controls. The Audit Committee is composed of three directors, each of whom is independent within the meaning of

NASDAQ Marketplace Rule 5605(a)(2). The Audit Committee operates under a written charter approved by the Board of Directors.

Management

is responsible for the Company’s internal controls over financial reporting, disclosure controls and procedures and the financial

reporting process. The independent registered public accounting firm is responsible for performing an independent audit of the Company’s

consolidated financial statements in accordance with Public Company Accounting Oversight Board (PCAOB) standards and to issue reports

thereon. The Audit Committee’s responsibility is to monitor and oversee these processes. The Audit Committee Charter establishes

a mechanism to receive complaints on auditing, accounting and internal control issues, including the confidential, anonymous submission

by employees, vendors, customers and others of concerns on questionable accounting and auditing matters.

In

connection with these responsibilities, Members of the Audit Committee met with management and the independent registered public accounting

firm to review and discuss the December 31, 2021 audited consolidated financial statements. The Members also discussed with the

independent registered public accounting firm the matters required by Statement on Auditing Standards Update No. 61, as amended (AICPA,

Professional Standards, Vol. 1, AU section 380), as adopted by the PCAOB in Rule 3200T. In addition, they received the written disclosures

from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountant’s

communications with the Audit Committee concerning independence, and the Audit Committee has discussed the independent registered public

accounting firm’s independence from the Company and its management.

Based

upon the Audit Committee’s discussions with management and the independent registered public accounting firm, and the Audit Committee’s

review of the representations of management and the independent registered public accounting firm, the Audit Committee recommended that

the Board of Directors include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for fiscal

2021 filed with the SEC.

The

Audit Committee also has appointed, subject to stockholder ratification, KCCW Accountancy Corp as the Company’s independent registered

public accounting firm for the fiscal year ending December 31, 2022.

| |

Respectfully

submitted, |

| |

|

| |

THE

AUDIT COMMITTEE |

| |

|

| |

Christopher

Lee, Chairman

Jiao

Huiliang

Yao-Te

Wang |

The

Report of the Audit Committee should not be deemed filed or incorporated by reference into any other filing of the Company under the

Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates the Report

of the Audit Committee therein by reference.

PROPOSAL

TWO:

Independent

Registered Public Accounting Firm

The

Audit Committee has appointed KCCW Accountancy Corp. to serve as our independent registered public accounting firm and to audit our consolidated

financial statements for the fiscal year ending December 31, 2022. KCCW Accountancy Corp. does not expect to have a representative present

at the Annual Meeting.

We

are asking our stockholders to ratify the selection of KCCW Accountancy Corp. as our independent registered public accounting firm for

the fiscal year ending December 31, 2022. Although ratification is not required by our By-laws or otherwise, the Board is submitting

the selection of KCCW Accountancy Corp. to our stockholders for ratification because we value our stockholders’ views on our independent

registered public accounting firm and as a matter of good corporate practice. In the event that our stockholders fail to ratify the selection,

it will be considered as a direction to the Board of Directors and the Audit Committee to consider the selection of a different firm.

Even if the selection is ratified, the Audit Committee in its discretion may select a different independent registered public accounting

firm at any time during the year if it determines that such a change would be in our best interests and the best interests of our stockholders.

Audit

Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

As

required by our Audit Committee charter, our Audit Committee pre-approved the engagement of KCCW Accountancy Corp. for all audit and

permissible non-audit services. The Audit Committee annually reviews the audit and permissible non-audit services performed by our principal

accounting firm and reviews and approves the fees charged by our principal accounting firm. The Audit Committee has considered the role

of KCCW Accountancy Corp. in providing tax and audit services and other permissible non-audit services to us and has concluded that the

provision of such services, if any, was compatible with the maintenance of such firm’s independence in the conduct of its auditing

functions.

The

following is a summary of the fees billed to us for professional services rendered by our registered independent public accountants for

the fiscal years ended December 31, 2021 and December 31, 2020:

| | |

Fiscal year ended December 31, | |

| | |

2021 | | |

2020 | |

| | |

| | |

| |

| Audit Fees | |

$ | 220,000 | | |

$ | 180,000 | |

| Audit Related Fees | |

| - | | |

| - | |

| Tax Fees | |

| - | | |

| - | |

| All Other Fees | |

| - | | |

| - | |

| | |

$ | 220,000 | | |

$ | 180,000 | |

Audit

Fees. Consists of fees billed for professional services rendered for the audit of our financial statements and review of interim financial

statements included in quarterly reports and services that are normally provided in connection with statutory and regulatory filings

or engagements.

Audit

Related Fees. Consists of fees billed for assurance and related services that are reasonably related to the performance of the audit

or review of our financial statements and are not reported under “Audit Fees”.

Tax

Fees. Consists of fees billed for professional services for tax compliance, tax advice and tax planning. These services include preparation

of federal and state income tax returns.

All

Other Fees. Consists of fees for product and services other than the services reported above.

The

proposal to ratify the Audit Committee’s selection of KCCW Accountancy Corp. as our independent registered public accounting firm

will require the affirmative vote of the holders of a majority of the outstanding shares of common stock cast in person or by proxy.

THE

BOARD OF DIRECTORS RECOMMENDS

A

VOTE FOR THE ADOPTION OF PROPOSAL TWO

STOCKHOLDER

PROPOSALS

Stockholders

wishing to include proposals in the proxy materials in relation to our 2023 Annual Meeting of Stockholders must submit the same in writing,

by mail, first-class postage pre-paid, to AiXin Life International, Inc., Hongxing International Business Building 2, 14th FL, No. 69

Qingyun South Ave., Jinjiang District, Chengdu City, Sichuan Province, China, Attention: Corporate Secretary, which must be received

at our executive office on or before August 21, 2023 (unless we hold our annual meeting more than 30 days earlier next year, in which

case the deadline will be a reasonable period of time prior to the date we begin to print and send our proxy materials for the annual

meeting). Our Board of Directors will review any stockholder proposals that are filed as required and, with the assistance of our Corporate

Secretary, will determine whether such proposals meet the criteria prescribed by Rule 14a-8 under the Exchange Act for inclusion in our

2023 proxy solicitation materials or consideration at the 2023 Annual Meeting. If the stockholder does not also comply with the requirements

of Rule 14a-4(c) under the Exchange Act, we may exercise discretionary voting authority under proxies we solicit to vote in accordance

with our best judgment on any such stockholder proposal or nomination.

OTHER

MATTERS

Our

Board of Directors does not know of any matter to be brought before the Annual Meeting other than the matters set forth in the Notice

of Annual Meeting of Stockholders and matters incident to the conduct of the Annual Meeting. If any other matter should properly come

before the Annual Meeting, the persons named in the enclosed proxy card will have discretionary authority to vote all proxies with respect

thereto in accordance with their best judgment.

ANNUAL

REPORT

A

copy of our Annual Report on Form 10-K for the year ended December 31, 2021 (the “2021 Form 10-K”), is enclosed

with this Proxy Statement and is available on our website (http://www. Proxyvote.com/AIXN). We will provide copies of the exhibits

to the 2021 Form 10-K upon payment of a nominal fee to cover the reasonable expenses of providing those exhibits. Requests should be

directed to our Corporate Secretary by phone at 86-313-6732526 or by mail to AiXin Life International, Inc., Hongxing International Business

Building 2, 14th FL, No. 69 Qingyun South Ave., Jinjiang District, Chengdu City, Sichuan Province, China. The 2021 Form 10-K and the

exhibits thereto also are available free of charge from the SEC’s website (http:// www.sec.gov.). The Annual Report is not

to be considered as proxy solicitation material.

| |

By

Order of the Board of Directors, |

| |

|

| December

20, 2022 |

/s/

Quanzhong Lin |

| |

Chairman,

President and Chief Executive Officer |

AIXIN LIFE INTERNATIONAL, INC.

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD December 30, 2022

Annual Meeting Proxy Card

This Proxy is Solicited on Behalf of the Board of

Directors

The undersigned stockholder of

AiXin Life International, Inc., a Colorado corporation (the “Company”), acknowledges receipt of the Notice of Annual Meeting

of Stockholders and Proxy Statement with respect to the meeting to be held on Wednesday, January 25, 2023, and hereby constitutes

and appoints Mr. Quanzhong Lin, the Company’s Chairman, President and Chief Executive Officer, and Mr. Yao-Te Wang, a director

of the company, or either of them acting singly in the absence of the other, with full power of substitution in either of them, the proxies

of the undersigned to vote with the same force and effect as the undersigned all shares of the Company’s Common Stock which the

undersigned is entitled to vote at the Annual Meeting of Stockholders to be held on Wednesday, January 25, 2023 (the “Annual Meeting”),

and at any adjournment or adjournments thereof, hereby revoking any proxy or proxies heretofore given and ratifying and confirming all

that said proxies may do or cause to be done by virtue thereof with respect to the following matters:

The undersigned hereby instructs

said proxies or their substitutes:

The Board of Directors recommends that you vote FOR the following:

| |

1. |

Elect as Directors the nominees listed below: |

| 01 Quanzhong Lin |

FOR [_] |

AGAINST [_] |

ABSTAIN [_] |

| 02 Yao-Te Wang |

FOR [_] |

AGAINST [_] |

ABSTAIN [_] |

| 03 Jiao Huiliang |

FOR [_] |

AGAINST [_] |

ABSTAIN [_] |

| 04 Christopher Lee |

FOR [_] |

AGAINST [_] |

ABSTAIN [_] |

The Board of Directors recommends that you vote

FOR the following:

| |

2. |

Ratify the selection of KCCW Accountancy Corp., as the Company’s independent registered public accounting firm for fiscal year ending December

31, 2022. |

| |

FOR

[_] |

AGAINST

[_] |

ABSTAIN

[_] |

NOTE: In their discretion, the proxies are

authorized to vote upon such other business as may properly come before the Annual Meeting, and any adjournment or adjournments thereof.

IF THIS PROXY IS PROPERLY EXECUTED, THE SHARES

OF COMMON STOCK COVERED HEREBY WILL BE VOTED AS SPECIFIED HEREIN. IF NO SPECIFICATION IS MADE, SUCH SHARES WILL BE VOTED “FOR”

THE ELECTION OF ALL NOMINATED DIRECTORS (PROPOSAL 1) AND “FOR” THE RATIFICATION OF THE APPOINTMENT OF KCCW ACCOUNTANCY

CORP. AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2022 (PROPOSAL 2).

IN THEIR DISCRETION, THE PROXIES ARE ALSO AUTHORIZED TO VOTE UPON SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE ANNUAL MEETING AND

ANY ADJOURNMENT OR ADJOURNMENTS THEREOF.

If you are voting by mail, please sign, date and

mail this proxy immediately in the enclosed envelope. You are also permitted and encouraged to vote online by following the instructions

on the Notice of Internet Availability of Proxy Materials that was separately mailed to you.

| |

Name |

| |

|

| |

|

| |

Name

(if joint) |

| |

|

| |

|

| |

Date ,

2023 |

| |

|

| |

Please

sign your name exactly as it appears hereon. When signing as attorney, executor, administrator, trustee or guardian, please give

your full title as it appears hereon. When signing as joint tenants, all parties in the joint tenancy must sign. When a proxy is

given by a corporation, it should be signed by an authorized officer and the corporate seal affixed. No postage is required if returned

in the enclosed envelope, if mailed in the United States. |

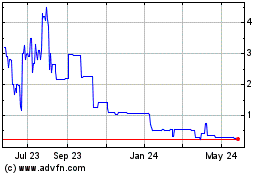

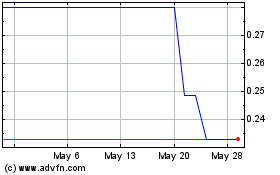

AiXin Life (QB) (USOTC:AIXN)

Historical Stock Chart

From Oct 2024 to Nov 2024

AiXin Life (QB) (USOTC:AIXN)

Historical Stock Chart

From Nov 2023 to Nov 2024