By Costas Paris

Two months after a near complete standstill in China that

rattled global supply chains, the country's ports are again pushing

out thousands of containers that were stranded at the onset of the

coronavirus outbreak.

The massive buildup of boxes at docks in China has left a big

shortfall in cargo at ports in the U.S. and Europe since early

February, and created a shortage of empty containers that Western

exporters need to ship everything from farm products to electronic

parts. As China returns to work, fears are rising that the Western

ports won't be able to handle a flood of imports as seaports and

coastal cities face their own shutdowns and economic

disruption.

"There is a lot of relief that China is waking up after a long

hiatus," said George Lazaridis, head of research at Greece-based

Allied Shipbroking. "But what happens if truck drivers and crane

operators can't work in Hamburg, Rotterdam or Los Angeles and New

York. Who is going to pick up the boxes?"

U.S. and European ports have generally been operating normally,

although many sites have reported sharply reduced business as

global trade has slowed under the pandemic.

Shipping executives said they are taking new precautions to

protect their own workers and that disruptions could come if some

port workers get sick and are quarantined or if authorities impose

blanket public lockdowns for an extended period.

"While the situation is improving in Asia, especially China, new

measures have been taken in some other places to protect the health

of our staff," French container line CMA CGM SA said in a notice

late last week. "As far as France, all staff members will work from

home until further notice."

China government figures show container volumes at the country's

largest eight ports fell 19.8% in February, during the peak of the

lockdowns that Beijing imposed, from the year before.

Container volumes from China into California's three largest

seaports -- Los Angeles, Long Beach and Oakland -- were off 35.2%

in February from a year ago, according to trade data research group

Panjiva. The neighboring ports of Los Angeles and Long Beach, which

together make up the largest U.S. gateway for imports from Asia,

handled 132,564 fewer containers in February than they did the same

month a year ago.

The Port of Seattle closed operations at two of its four

container terminals Friday because of diminished shipping

demand.

The Port of Houston on Thursday said it had suspended operations

at its two main container terminals after a staffer who works at

both sites tested positive for the coronavirus.

Gene Seroka, executive director at the Port of Los Angeles, said

he doesn't expect the same sort of virus disruptions that crippled

Chinese megaports like Shanghai and Ningbo last month.

Thousands of boxes piled up at those ports as truck drivers,

crane operators and other workers couldn't go to work because they

were either sick or quarantined.

"We never saw a port closure in China, and I don't believe we'll

see a port closure here in Los Angeles," Mr. Seroka said. "We have

100,000 people and none work concurrently, or at the same time. I

believe we will have an ample workforce that is healthy and has the

ability to flex based on the needs of cargo flow and personal

health and safety requirements."

Liner operators said they would deploy their biggest ships to

pick up cargo from China, regardless of the situation at Western

entry points.

The 2M Alliance, made up of A.P. Moller-Maersk A/S and

Mediterranean Shipping Co., said last week they are boosting their

capacity of four weekly sailings to Los Angeles and Long Beach.

MSC sent one of its biggest ships -- the MSC Oscar, with

capacity for 23,000 20-foot containers -- into Los Angeles on

Sunday, and three other big vessels are expected to arrive by the

end of March. These giants are normally on the Europe-Asia trade

lanes, and their deployment in the Pacific points to increased

trade activity.

"It's like the roll of a dice to go full steam for China cargo,"

said the chief operations officer of a big Asian shipowner that

charters ships to container lines. "Our sailings take weeks or

months, but the situation with the virus closures changes every

day. If the U,S. closes down, I don't know what will happen with

the cargoes."

"Chinese port call activity returning to 2019 levels supports

reports that efforts to 're-start' the Chinese economy may be

gaining traction," said Clarksons research head Stephen Gordon.

"Given China's role as shipping's biggest market -- 22% of global

imports -- this is encouraging, as are the range of tariff

reductions, stimulus packages and policies being adopted

globally."

Liners canceled more than half of all sailings to China in

February, when infections reached a peak in that country. The virus

outbreak coincided with the Chinese New Year holiday, a period when

industrial output in China usually slows down.

Lars Jensen, chief executive of Copenhagen-based SeaIntelligence

Consulting, said canceled sailings are back to normal levels at

this time of the year but that more disruptions may come as the

coronavirus pandemic rolls across cities in Europe and Asia.

Mr. Jensen compares the hit to shipping companies to the

financial crisis in 2008, when container volumes contracted 10%. A

similar retrenchment now would mean a loss of 17 million containers

for shipping companies.

"It's a massive damage, even if we later get a V-shaped

recovery," he said.

Write to Costas Paris at costas.paris@wsj.com

(END) Dow Jones Newswires

March 19, 2020 16:06 ET (20:06 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

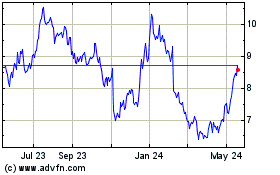

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Dec 2024 to Jan 2025

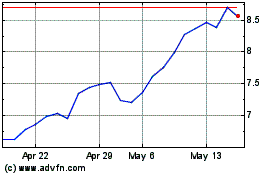

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Jan 2024 to Jan 2025