Maersk Fourth-Quarter Earnings Surged as Outlook Disappoints -- Update

February 10 2021 - 12:45PM

Dow Jones News

By Costas Paris and Dominic Chopping

Shipping giant A.P. Moller-Maersk A/S swung to a $1.3 billion

profit in the fourth quarter, but its outlook fell short of analyst

expectations as pandemic-driven supply-chain disruptions continue

to trigger sharp changes in trade demand and freight rates.

The Copenhagen-based parent of Maersk Line, the world's biggest

ocean container line by capacity, said its profit before interest,

tax, depreciation and amortization reached $8.2 billion last year

from $5.7 billion in 2019. It expects its earnings this year to be

between $8.5 billion and $10.5 billion.

The outlook was short of market expectations of around $10.8

billion in earnings this year, according to Clarksons Platou

Securities. Some analysts expect significant headwinds this year,

saying that freight rates that soared in the second half of 2020

have likely peaked, putting a lid on future earnings growth.

"Although the company is known to be conservative in their

guidance, the message is clear and this report is therefore likely

to be viewed as negative," Clarksons Platou said.

Maersk Chief Executive Søren Skou said freight rates could slip

to more normal levels this year, depending on how the world reopens

from the Covid-19 pandemic.

"Whether demand stays strong once the world is reopening remains

to be seen," Mr. Skou said.

Maersk's shares slumped nearly 7% on the Nasdaq Copenhagen to

12,495 Danish kroner. Maersk shares gained 42% in 2020, the best

performance for the stock since 2005. The stock hit a record high

late last month, but has since lost steam on expectations of lower

freight rates.

The company said its fourth quarter net profit hit $1.3 billion,

compared with a loss of $72 million a year earlier, and below

analyst expectations of $1.39 billion, according to FactSet.

"The tailwinds in the fourth quarter have continued in the first

quarter, " Mr. Skou said.

Maersk and other container lines have been benefiting from a

surge in shipping demand as big retailers like Walmart Inc. and

Amazon.com Inc. restock inventories depleted in the early weeks of

the pandemic last year. Container Trades Statistics, a London-based

industry data firm, said global shipping volumes rose 4.3% in the

second half of last year, including a 5.7% surge in the fourth

quarter, after falling 6.6% in the first half of 2020.

At Maersk, fourth-quarter revenue rose 16% to $11.26 billion.

Maersk's shipping volumes rose 3.2% in the quarter from the same

period the year before, while average freight rates surged 18% and

fuel costs fell 14% on the year.

Maersk expects 3% to 5% volume growth in 2021, with most of it

coming in the first half of the year.

Mr. Skou said shipping volumes will remain high in the first

quarter as companies clear bottlenecks in supply chains driven by

the high demand and tight capacity for ocean transport and in port

cargo-handling operations.

"None of us were ready for the pandemic," Mr. Skou said. "Demand

is driven by consumer spending, which we expect will continue in

the U.S. with more stimulus measures coming. But the intense

inventory restocking cycle will stop."

Write to Costas Paris at costas.paris@wsj.com and Dominic

Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

February 10, 2021 13:30 ET (18:30 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

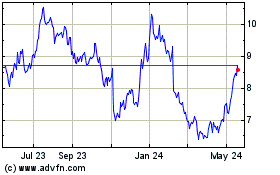

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Dec 2024 to Jan 2025

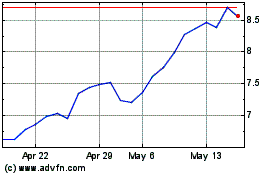

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Jan 2024 to Jan 2025