0001113313

false

0001113313

2024-04-29

2024-04-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): April

29, 2024

ARVANA

INC.

(Exact

name of registrant as specified in its charter)

Nevada

(State

or other jurisdiction of incorporation) |

000-30695

(Commission

File Number) |

87-0618509

(IRS

Employer Identification No.) |

299

Main Street, 13th

Floor, Salt

Lake City, Utah

84111

(Address

of principal executive offices) (Zip code)

Registrant’s

telephone number, including area code: (801)

232-7395

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| n/a |

n/a |

n/a |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.45

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check number if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01

Entry into a Material Definitive Agreement.

On April 29, 2024, Arvana Inc. (“Company”)

entered into a Consulting Services Agreement (“Agreement”) with Social4orce, Inc. (“Social4orce”) to assist in

the development of its business.

Social4orce offers expertise in generating a business

development strategy, overseeing project management, interpreting market awareness, and accessing capital markets.

The Company engaged Social4orce for an initial

fee of $50,000 with a commitment to paying mutually agreeable future amounts, determined on a month-to-month basis, as required to accomplish

the objectives of the Agreement.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Arvana

Inc. |

Date |

| |

|

| By:

/s/ Ruairidh Campbell |

May 7,

2024 |

| Name:

Ruairidh Campbell |

|

| Title:

Chief Executive Officer and a Director |

|

CONSULTING

SERVICES AGREEMENT

THIS

AGREEMENT is made as of the 15th day of April, 2024 (the “Effective Date”)

BETWEEN:

Arvana

Inc., corporation incorporated under the laws of Nevada whose principal address is 299 Main Street, 13th Floor, Salt Lake

City, Utah, 84111 (“AVNI” or the "Company");

-

and -

Social4orce

Inc., a corporation incorporated under the laws of Ontario, Canada, having an office located at 2 Campbell Drive, Suite 820, Uxbridge,

Ontario, Canada L9P 0A4 (“S4” or the “Consultant”)

RECITALS:

| (a) | | The

Consultant offers expertise in global capital markets for emerging small cap public companies

listed in Canada, Europe and the USA. The Consultant further offers expertise in technology-based

startup companies with respect to developing and implementing strategy and tactics, operations,

project management, business development, market awareness and capital markets. The Consultant

also provides strategic consulting on marketing, sales, distribution, technology, direct

to consumer sales, wholesale and retail distribution, pricing models, technology, and ecommerce.

Specifically, strategy for consumer- packaged good product management, influencer marketing,

social media strategies, content creation and engagement. |

| (b) | | Company

desires to retain the Consultant to undertake the Consultant duties and responsibilities

hereinafter set out and the Consultant has agreed to provide such services on the terms set

out in this Agreement. |

| (c) | | The

Consultant agrees to strictly adhere to the Market Awareness Promotions Policy stated in

Schedule D if this Agreement. |

| (d) | | The

Consultant will not engage with any media companies or social media influencers that have

been backlisted by the Company as stated in Appendix E to Schedule D. |

NOW

THEREFORE, in consideration of the premises and mutual covenants contained herein and other good and valuable consideration (the receipt

and sufficiency whereof, is hereby acknowledged), the parties agree as follows:

1.

Engagement

Upon

the terms and conditions set out in this Agreement, Company hereby agrees to engage the Consultant to perform the services specified

herein (the “Services”) and the Consultant hereby accept such engagement.

2.

Services

Services

to be provided under this Agreement are as follows:

| i. | | Acting

as Business Development and Marketing Consultant, will report to the CEO of the Company and

work with the management team and Board of Directors. |

| ii. | | Work

with the CEO and Chairman of the Board on communication strategy and ensure that the implementation

of this strategy occurs. Weekly meeting to discuss tactical execution, monthly planning of

budgets, strategy, and overall quarterly reporting. |

| iii. | | Directly

assist management and other employees of the Company on all strategic matters as they relate

to overseeing the growth of the Company’s Brand and expansion into additional Brands

the Company intends to create. |

| iv. | | Capital

markets support such as guiding advice on IR contracts, and development of investment banking

relations, analyst coverage, capital raising and market awareness. |

| v. | | Provide

status and progress reporting on the strategy implementation which includes content surveillance

and monitoring for compliance. |

| vi. | | Make

introductions to potential institutional investors. |

| vii. | | Assist

in the development and execution of the media strategy for market awareness, creative content

generation and monitoring of engagement. This includes the development of digital content

and acquiring placement on media outlets, influencer marketing engagements, Ad placement

in social media and on other media sites. |

| viii. | | Assist

in capital raising, government grant and loan proposals. |

| ix. | | Assist

in overall strategic advisory capacity on all aspects of the business. |

| x. | | Provide

investor and shareholder feedback accumulated from social media, financial media and direct

phone calls. |

| xi. | | Provide

individual intelligence and recommend strategies for retention of existing shareholders and

originating new shareholders. |

3.

Performance by the Consultant

The

Consultant will perform the Services in a timely effective manner, honestly and in good faith, with a view to the best interests of the

Company. The Consultant must strictly adhere to the Market Awareness Promotion Policy stated in Schedule D and has agreed herein through

the execution of this Agreement.

4.

Non-exclusivity of the Consultant

The

Consultant will at all times use its best efforts to comply with any reasonable request made by the Company pursuant to the terms of

this Agreement. Nothing in this Agreement will obligate the Consultant to accept any particular engagement, the performance of which

is beyond the Consultant’s available skills and resources. The Company acknowledges other business activities of the Consultant

and confirms that the Consultant may continue to pursue such activities, subject to the Consultant’s obligations under this Agreement

relating to maintaining confidentiality and refraining from any and all potential conflicts of interest unless disclosed to and accepted

by the Company.

5.

Commencement of Engagement

The

Consultant’s engagement hereunder will commence on April 15, 2024, and will continue unless terminated by either party on 30 days’

prior written notice.

6.

Compensation

| 6.1. | | The

Company shall pay to the Consultant the sums and amounts as are more particularly set out

in the attached Schedule A to this agreement where such amounts include consulting fees,

marketing costs, paid publishing and distribution costs for the content to be initiated in

the target markets internationally. |

| 6.2. | | Payment

for work will be paid in accordance with Schedule A so capacity can be scheduled and committed. |

| 6.3. | | Option

to renew is on a month-by-month basis. Approval to proceed for an additional month must occur

before the 20th of the current month in order to schedule distribution capacity

for the next month. Payment received by the 25th of the current month. |

i.

Paid distribution of PR content through international media sites and social media

ii.

Overall content management and creation working with the Company's management team.

iii.

Overall market management advising market makers, traders, and investors.

iv.

Media planning and communication strategy.

The

Consultant will render an invoice on the effective date of this Agreement and on the 20th of each month for subsequent months.

Payment for subsequent months must be received by the 25th of each month. All applicable taxes shall be billed in addition

to the Compensation.

7.

Out-of-Pocket Expenses

The

Company shall reimburse the Consultant for all expenses actually and properly incurred by it in connection with the performance of the

Services hereunder, provided that such expenses are within the budget for such expenses as established by the Company from time to time.

Such expenses shall include but are not limited to charges for long distance telecommunications, travel and mileage charges at the applicable

rate established from time to time, meals and entertainment. For all such expenses, the Consultant shall furnish to the Company statements

and vouchers as and when reasonably required by it.

8.

Termination Provisions

This

Agreement in whole or in part may be terminated by the non-insolvent or non- defaulting party forthwith by notice given to the other

party if the other party:

| (a) | | is

adjudged bankrupt or files a voluntary petition in bankruptcy or similar legislation for

the relief of debtors or makes an assignment for the benefit of its creditors generally or

if any proceedings for dissolution or winding- up are commenced (other than by way of voluntary

winding-up or dissolution for the purposes of amalgamation or reconstruction) or a receiver

or receiver-manager is appointed in respect of its undertaking or all or part of its assets,

which matter is not vacated or discharged within 30 days; |

| (b) | | fails

to perform or otherwise breaches any of its obligations under this Agreement and the failure

or breach is not remedied within 30 days after notice is given specifying the breach and

the reasonable remedial action required; or |

The term

“Cause” as used herein means:

I.

gross negligence;

II.

gross insubordination;

III.

chronic culpable absenteeism or lateness (other than for a disability under the Human Rights Code); and

IV.

other conduct incompatible with continued services.

V.

Non-compliance with the Market Awareness Promotion Policy attached herein in Schedule D including engagement with a Blacklisted Media

Company or Social Media Influencer.

| (d) | | with

written notice of termination before the monthly renewal, no later than the 20th of

each month. |

Termination

will be without prejudice to any legal rights of the party delivering the notice of termination.

9.

No Conflicts of Interest

During

the term of this Agreement the Consultant will not engage in any business or other transaction or have any financial or other interest,

direct or indirect, anywhere in the world which is incompatible with the performance by the Consultant of his duties and services under

this Agreement, unless the prior written consent of the Company is obtained, which consent will not be unreasonably withheld or delayed.

10.

Confidentiality and Indemnification

The

Consultant acknowledges that it has executed, delivered to the Company and shall be bound by a counterpart of the Confidentiality Agreement,

attached hereto as Schedule A, and the Indemnification Agreement in Schedule B and that such Confidentiality and Indemnification Agreement

shall survive any termination or invalidity of this Consulting Services Agreement.

11.

Mutual Representations and Warranties

Each

party represents and warrants to the other that:

| (a) | | it

has good and sufficient power, authority and right to enter into this Agreement; and |

| (b) | | the

entering into of this Agreement will not result in a material violation of: |

(i)

any agreement or other instrument to which it is a party or by which it is bound, or

(ii)

any applicable law or regulation.

12.

Entire Agreement

This

Agreement and its Schedules constitute the entire agreement between the parties with respect to the subject matter hereof and supersedes

all prior negotiations and agreements. This Agreement can only be modified by a writing signed by authorized representatives of both

parties.

13.

Assignment

Neither

party may assign or delegate this Agreement or any of its rights or duties under this Agreement, whether by operation of law or otherwise,

without the prior written consent of the other party, except to a person or entity into which it has merged or which has otherwise succeeded

to all or substantially all of its business and assets to which this Agreement pertains, by merger, reorganization or otherwise, and

which has assumed in writing or by operation of law its obligations under this Agreement. In addition, any permitted assignment by the

Consultant will be subject to the Consultant’s permitted assignee or transferee agreeing in writing to comply with all the terms

and restrictions contained in this Agreement. Any attempted assignment in violation of the provisions of this paragraph will be void.

Subject to the foregoing, this Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors

and assigns.

14.

Severability

In

the event any of the provisions of this Agreement shall be held invalid by a tribunal or competent jurisdiction, the remaining provisions

shall nevertheless remain in full force and effect.

15.

Waiver

The

waiver of a breach of any term hereof shall in no way be construed as a waiver of any other term or breach hereof. One or more waivers

of any right, obligation or default shall not be construed as a waiver of any subsequent right, obligation or default.

16.

Interpretation

Headings

are included in this Agreement for convenience of reference only and are not to affect its construction or interpretation.

Words importing

the singular include the plural and vice versa, and words importing gender include all genders.

Unless

otherwise noted, all amounts stated in this agreement are in the lawful currency of Canada.

This Agreement

shall be governed by the laws in force in the state of Nevada applicable therein.

17.

Execution in Counterparts

This

Agreement may be executed and delivered by the parties in one or more counterparts, each of which when so executed and delivered will

be an original, and those counterparts will together constitute one and the same instrument.

18.

Notices

Any

notice or communication to be given or made under this Agreement, including a notice to effect a change in a party's address for notice,

must be in writing and addressed as follows:

(a)

If to:

the

Company:

Arvana

Inc.

Address:

299 Main Street, 13th Floor, Salt Lake City, Utah, 84111

Attention:

Ruairidh Campbell, Chief Executive Officer

Email:

ruairidh@arvana.us

(b)

If to the: Consultant: Social4orce Inc.

2

Campbell Drive, Suite 820

Uxbridge,

Ontario, Canada, L9P 0A3

Attention:

Gary Bartholomew, CEO, President

Email:

gary@social4orce.com

And will

be deemed to have been duly given or made on the earliest of the following:

(i)

actual delivery;

(ii)

72 hours after being sent by commercial courier service; and

(iii)

the day following which any electronic mail or facsimile message is sent.

The parties

have executed this Agreement, intending to be legally bound as of the day and date above first written.

| ARVANA

INC. |

|

SOCIAL4ORCE

INC. |

| |

|

|

| Per:

/s/ Ruairidh Campbell |

|

Per:

/s/ Gary Bartholomew |

| Name:

Ruairidh Campbell |

|

Name:

Gary Bartholomew |

| (CEO

& President) |

|

(President) |

Schedule

A Schedule of Payments

Pursuant

to the Consulting Agreement dated April 15, 2024, between Social4orce Inc. and Arvana Inc. the following schedule of payments further

defines the obligations set out in the Agreement and forms a part thereof. The payments can only be made in cash if used for public company

promotion and marketing to the investment community:

| • | | First

Payment: Startup costs - Strategy development, messaging and content development. Included

cap table, calls to major free trading shareholders, competitor analysis and market sentiment

analysis on industry. Also included is web development and social media set up with correct

content. Cost: $50,000 USD. Due at execution of this Agreement. |

| • | | Second

Payment: the Launch Campaign of up to $250,000 USD due upon agreement to start the Launch

Campaign. External marketing will begin within two weeks of receipt of Funds. Further campaign

funding will be assessed on a week-to-week basis and funded by the Company as agreed. |

| • | | Budgets

can range from $25,000 per month to $250,000 depending on upcoming events. Budgets can be

discussed on a month-to-month basis, confirmed by the 20th of the then current

month for the following month’s activities. |

Schedule

B

Confidentiality

and Proprietary Rights Agreement

In

consideration of the engagement of SOCIAL4ORCE INC. (the “Consultant”) by Arvana Inc. (the “Company”),

the Consultant acknowledges and agrees with the Company as follows:

Part

I Confidential Information

1.

Protection of Confidential Information. The Consultant hereby acknowledges, understands and agrees that, whether it is

developed by the Consultant or by others employed or engaged by or associated with the Company, all Confidential Information (as defined

in paragraph 2 below) is the exclusive and confidential property of the Company and shall at all times be regarded, treated and protected

as such as provided in this Agreement. Failure to mark any written material as confidential shall not affect the confidential nature

of such written material or the information contained therein.

2.

Definition of Confidential Information. “Confidential Information” shall mean information, whether or

not originated by the Consultant, which is used in the Company’s business and is proprietary to, about or created by the Company.

Such Confidential Information includes, but is not limited to, the following types of information and other information of a similar

nature (whether or not reduced to writing or designated as confidential):

| (a) | | work

product resulting from or related to work or projects performed or to be performed by the

Company, including but not limited to the interim and final lines of inquiry, hypotheses,

research and conclusions related thereto and the methods, processes, procedures, analysis,

techniques and audits used in connection therewith; |

| (b) | | computer

software of any type or form and in any stage of actual or anticipated development, including

but not limited to programs and program modules, routines and subroutines, procedures, algorithms,

design concepts, design specifications (design notes, annotations, documentation, flowcharts,

coding sheets, and the like), source code, object code and load modules, programming, program

patches and system designs; |

| (c) | | information

relating to Proprietary Items (as defined in paragraph 6 below) prior to any public disclosure

thereof, including but not limited to the nature of the Proprietary Items, production data,

technical and engineering data, test data and test results, the status and details of research

and development of products and services, and information regarding acquiring, protecting,

enforcing and licensing proprietary rights (including patents, copyrights and trade secrets); |

| (d) | | internal

the Company personnel and financial information, vendor names and other vendor information,

purchasing and internal cost information, internal; service and operational manuals, and

the manner and method of conducting the Company’s business; |

| (e) | | marketing

and development plans, price and cost data, price and fee amounts, pricing and billing polices,

quoting procedures, marketing techniques and methods of obtaining business, forecasts and

forecast assumptions and volumes, and future plans and potential strategies of the Company

which have been or are being discussed; and |

| (f) | | contracts

and their contents, Company services, data provided by Company and the type, quantity and

specifications of products and services purchased, leased, licensed or received by Company

of the Company. |

| (g) | | material

non-public Company information. |

3.

Exclusions from Confidential Information. “Confidential Information” shall not include information publicly

known that is generally used by the Company, and the general skills and experience gained during the Consultant’s engagement by

the Company which the Consultant could reasonably have been expected to acquire in similar engagement by other companies. The phrase

“publicly known” shall mean readily accessible to the public in written publications. The burden of proving that information

or skills and experience are not Confidential Information shall be on the party asserting such exclusion.

4.

Covenants Respecting Confidential Information. As a consequence of the Consultant’s acquisition of Confidential

Information, the Consultant will occupy a position of trust and confidence with respect to the Company’s affairs and business.

In view of the foregoing and of the consideration to be provided to the Consultant by the Company, the Consultant agrees that it is reasonable

and necessary for it to make the following covenants regarding its conduct during and subsequent to its engagement by the Company. the

Consultant hereby agrees as follows:

| (a) | | During

and after its engagement by the Company, the Consultant will not disclose Confidential Information

to any person or entity other than as necessary in carrying out the Consultant’s duties

on behalf of the Company, without first obtaining the Company’s consent, and will take

all reasonable precautions to prevent inadvertent disclosure of such Confidential Information.

This prohibition against disclosure of Confidential Information includes, but is not limited

to, disclosing the fact that any similarity exists between the Confidential Information and

information independently developed by another person or entity, and the Consultant understands

that such similarity does not excuse it from abiding by its covenants and other obligations

under this Agreement. |

| (b) | | During

and after its engagement by the Company, the Consultant will not use, copy or transfer any

Confidential Information other than as necessary in carrying out its duties on behalf of

the Company, without first obtaining the Company’s consent, and will take all reasonable

precautions to prevent inadvertent use, copying or transfer of any Confidential Information.

This prohibition against the use, copying or transfer of Confidential Information includes,

but is not limited to, licensing or otherwise exploiting, directly or indirectly, any products

or services (including software in any form) which embody or are derived from Confidential

Information, or exercising judgment or performing analysis based upon knowledge of Confidential

Information. |

| (c) | | During

and after its engagement by the Company, Consultant will not trade in the Company’s

securities while in possession of material non-public information or communicate such information

to others who might trade on material non-public information. Consultant agrees to comply

with all applicable securities laws and regulations, including the Securities Exchange Act

of 1934, as amended, and the rules promulgated thereunder regarding insider trading. Consultant

further agrees to take all necessary precautions to prevent unauthorized disclosure or use

of material non-public information. |

| (d) | | For

a period of one year from the date of termination of its engagement by the Company, the Consultant

will not serve, directly or indirectly, in any capacity for any person or entity which competes

with the Company, if the loyal and complete fulfillment of the Consultant’s duties

to such person or entity would inherently require that it use, copy or transfer Confidential

Information. |

Part

II Proprietary Items

5.

The Company Ownership of Proprietary Items. The Consultant hereby acknowledges, understands and agrees that all

Proprietary Items (as defined in paragraph 6 below) are and shall be the property of the Company.

6.

Definition of Proprietary Items. “Proprietary Items” shall mean all legally recognized rights which

result from or are derived from the Consultant’s work product made for the Company or with knowledge, use or incorporation of Confidential

Information. Proprietary Items include, but are not limited to, developments, inventions, designs, works of authorship, improvements

and ideas, whether or not patentable or copyrightable, conceived or made by the Consultant or its employees (solely or in cooperation

with others) during its engagement by the Company or which result from or are derived from the Company resources or which are reasonably

related to the business operations or the actual or demonstrably anticipated research and development of the Company.

7.

Exclusions from Proprietary Items. “Proprietary Items” shall not include inventions for which no equipment,

supplies, facility or trade secret information of the Company is used and which are developed by the Consultant entirely with its own

resources, and (1) which do not relate to the business of the Company or the Company’s actual or demonstrably anticipated research

and development, or (2) which do not result from any work performed by the Consultant for the Company.

8.

Covenants Respecting Proprietary Items. The Consultant agrees to grant to the Company, without further compensation,

all my right, title and interest in and to all Proprietary Items. The Consultant further agrees that the authorship by it or its employees

of any such Proprietary Items which are copyrightable are hereby assigned to the Company without further compensation. The Consultant

will secure from each of its employees a waiver of any and all moral rights to which he or she may be entitled under copyright legislation

in respect of such copyrightable Proprietary Items. In order to permit the Company to claim, perfect and enforce its rights in and to

Proprietary Items, the Consultant agrees:

| (a) | | to

disclose promptly to the Company in confidence and in writing all Proprietary Items conceived

or made by the Consultant or any of its employees (solely or jointly with others) during

the term of its engagement by the Company; |

| (b) | | for

one year after the term of its engagement by the Company, to disclose promptly to the Company

in confidence and in writing all items which relate to or are derived (in whole or in part)

from Proprietary Items conceived or made by the Consultant or any of its employees (solely

or jointly with others); |

| (c) | | to

comply with all of the Company’s reasonable instructions and to execute and procure

all documents respecting Proprietary Items reasonably requested by the Company for the purpose

of vesting, confirming, securing and assigning the Company’s or its nominee's right,

title and interest therein and thereto, including patents and copyrights relating to Canada

and other countries; and |

| (d) | | to

keep complete, accurate and authentic notes, reference materials, data and records of all

Proprietary Items in the manner and form requested by the Company (which materials and all

copies thereof are hereby agreed to be the property of the Company), to mark all such items

as "confidential" and to surrender all such items to the Company at its request. |

Part

III General

9.

The Consultant’s Staff Members. As a condition of giving access to any Confidential Information to any member of

his staff, the Consultant will require that such staff member sign an agreement to the same tenor as this Agreement, in such form as

may be specified by the Company. The Consultant will furnish to the Company a signed copy of each such agreement.

10.

Binding Effect. This Agreement shall be binding on the Consultant and its successors.

11.

Governing Laws. This Agreement shall be governed by the laws in force in the state of Nevada.

12.

Other Agreements. This Agreement is supplemental to and separate from any agreement under which the Consultant is

engaged by the Company. However, if there is any conflict or inconsistency between the provisions of such other agreement and this Agreement,

the provisions of this Agreement will govern and prevail.

The

Consultant has executed this Agreement intending to be legally bound, as evidenced by their signatures below and as of April 15, 2024:

SOCIAL4ORCE

INC.

/s/

Gary Bartholomew

Name:

Gary Bartholomew

Title:

President

SCHEDULE

C

INDEMNITY

AGREEMENT

In

connection with the engagement of Social4orce inc. (“Consultant ”) to perform services in accordance with the Agreement of

which this Schedule C forms an integral part, Arvana Inc. (hereinafter called the “Company”) hereby agrees to indemnify

and hold harmless the Consultant , its affiliates, the respective shareholders, directors, officers, partners, agents and employees of

the Consultant and its affiliates (collectively, the “Indemnified Parties” and individually, an “Indemnified

Party”), to the full extent lawful, from and against all losses, (other than loss of profit) claims, damages, liabilities and

expenses (including reasonable fees and disbursements of counsel on a solicitor / client basis) which are related to or arise out of

actions taken or omitted to be taken (including any untrue statements made or any statements omitted to be made) by the Company in the

context of the Agreement, and the Company will reimburse any Indemnified Party for all expenses (including reasonable fees and disbursements

of counsel on a solicitor / client basis) as they are incurred by the Consultant or such other Indemnified Party in connection with investigating,

preparing or defending any such action or claim in connection with pending or threatened litigation in which any Indemnified Party is

a party. The Company will not be responsible, however, for any losses, claims, damages, liabilities or expenses which are finally judicially

determined to have resulted primarily from the bad faith, negligence, misconduct or failure to comply with applicable laws or regulations

of any Indemnified Party or the person seeking indemnification hereunder.

The

Company also agrees that no Indemnified Party shall have any liability to the Company (whether direct or indirect, in contract, in tort

or otherwise) for or in connection with the Agreement except for such liability for losses (other than loss of profit), claims, damages,

liabilities or expenses incurred by the Company which is finally judicially determined to have resulted primarily from such Indemnified

Party's bad faith, negligence, misconduct, breach of the terms of the engagement, or failure to comply with applicable laws or regulations.

The

Company will assume the defence of any litigation or proceeding in respect of which indemnity may be sought hereunder, including the

employment of counsel satisfactory to such Indemnified Party, acting reasonably, and the payment of the fees and disbursements of such

counsel. In any such litigation or proceeding the defence of which the Company shall have assumed, any Indemnified Party shall have the

right to participate in such litigation or proceeding and to retain its own counsel, but the fees and disbursements of such counsel shall

be at the expense of such Indemnified Party unless the named parties to any such litigation or proceeding including one or more of the

Company and the Indemnified Party and the representation of both parties by the same counsel in the written opinion of the Indemnified

Party's counsel would be inappropriate due to actual or potential differing interests between them and provided, however, that the Company

shall only be obligated to pay for one set of counsel for all Indemnified Parties (in addition to counsel retained by the Company). The

Company shall not be liable for any settlement of any litigation or proceeding effected without its written consent, such consent not

to be unreasonably withheld. If the Company assumes the defence of any litigation or proceeding, the Company will not, without the prior

written consent of the Indemnified Party, such consent not to be unreasonably withheld, settle or compromise or consent to the entry

of any judgement in any pending or threatened claim, action, suit or proceeding in respect of which indemnification may be sought hereunder

unless such settlement, compromise or consent includes an unconditional release of each Indemnified Party hereunder from all liability

arising out of such claim, action, suit or proceeding.

The

foregoing shall be in addition to any rights that any Indemnified Party may have at common law or otherwise, including, but not limited

to, any right to contribution. The Company hereby agrees to submit to the non-exclusive jurisdiction of the Courts in the State of Nevada

in respect of any claim made by an Indemnified Party pursuant hereto.

Agreed

and accepted this 15th day of April, 2024.

| ARVANA

INC. |

|

SOCIAL4ORCE

INC. |

| |

|

|

| Per:

/s/ Ruairidh Campbell |

|

Per:

/s/ Gary Bartholomew |

| Name:

Ruairidh Campbell |

|

Name:

Gary Bartholomew |

| (CEO

& President) |

|

(President) |

SCHEDULE

D

MARKET

AWARNESS PROMOTIONS POLICY

Overview:

Arvana

Inc. has adopted the highest standards of compliance and governance among the Board of Directors, Management and Employees. The Policies

adopted to date include Board Mandates, Delegation Authority and Controls, Quarterly Reporting on Compliance, Audit and Timely Disclosure.

This

document extends the compliance and code of conduct to the marketing, promotions, and public relations as it related to communication

with Investors, potential Investors and Commercial markets (buyers of our products).

The

Company has adopted the Best Practices for Issuers Policy issued by OTC Markets and referenced as Appendix A to Schedule D.

In

addition, Appendix B to Schedule D references the OTC Markets Group Policy on Stock Promotion.

Appendix

C to Schedule D is the petition to the SEC regarding SEC action to Protect the Investing Public from Unlawful and Deceptive Securities

Promotions

Appendix

D to Schedule D are examples of non-compliant promotional material developed without editorial controls in place by the Consultant and

upon execution of this Consulting Agreement represent a breach of this agreement and subject to immediate termination.

Appendix

E to Schedule D is the media companies and social media influencers that are backlisted from participating in any form of communication

on behalf of the Company. This list may be updated as non-compliant activates are supported by such media firms or influencers.

Best

Practices Summary:

1.

Timely Disclosure: Materiality requires dissemination on a national newswire service covering both the USA and Canada. As a development

stage company, in transition to growth stage, material can be as follows:

| a. | | Execution

of a critical distribution or sales contract leading to revenue generation of greater than

$500,000 on an annualized basis |

| b. | | Execution

of a financial obligation greater than $500,000 on an annualized basis, vendors, leases,

capital equipment, purchase obligations |

| c. | | All

transactions involving the issuance of securities or assumption of debt financing. |

| d. | | Changes

in the Board of Directors, Officer or Executive Management |

| e. | | Substantial

change in business direction and strategy |

| f. | | Corporate

updates that represent development and execution of the business plan will be press released

through a recognized national wire service. Such content will go through an internal approval

process within the Company before distribution. |

2.

Due Diligence on Consultants: Company will be required to perform KYC and AML on any Consulting engagement and may include, but limited

too:

| a. | | Standard

KYC and AML requirements including articles of incorporation, bylaws, officers and director

KYC, shareholder register certified |

| b. | | Past

client references that are relevant to this engagement |

| c. | | Disclosure

of any disciplinary action by any regulatory board |

| d. | | Sample

content creation written for past clients representative of this engagement |

| e. | | Full

execution of this Consulting Contract by two such officers of the Consultant. |

3.

Dispel Rumors through a press release: In the event of unusual market activity or information that has not been sanctioned by the Company,

a press release will be distributing dispelling such rumors or addressing unusual market activity.

4.

Fraudulent Promotional Campaigns: Under no circumstances will the Company partake in a fraudulent or misleading campaign. All marketing

companies contracted by the Company will disseminate only information provided in a formally distributed press release. There will be

no mention of future speculative stock, no assumptions of stock price potential. Past stock charts and trading may be referenced by source

but may never lead a marketing campaign. Any content created must never start with reference to the stock and may only start with the

description of the business as reference in the current and past press releases.

5.

External Funding of Stock Promotion: Under no circumstances will the Consultant accept marketing funds from a third party. All activity

will be fully funded by the Company, approved by the Company and content screened by the Company before it is posted.

6.

Blacklisting Media Companies: In the event any marketing or media company, influencer or individual is found to be non-Compliant and

upon 30 notices of non-compliance if failure to comply will result in Blacklisting. The Consultant will ensure sure such Blacklisted

media company shall not be engaged or promote the Company. If failure to comply the Consultants contract will be terminated immediately

for cause.

7.

Investor Funded Promotion: Under no circumstances will the Company endorse, or support Investor funded promotion and the Consultant shall

decline any such requests and report immediately the investor name to the Company. If the Consultant obtains knowledge of any promotion

being funded by an Investor, it must be reported immediately to the Company and appropriate regulatory action will commence.

8.

Know your client: It is the responsibility of the Consultant to perform due diligence on the independent companies and individuals that

are being engaged by the Consultant. The Consultant should follow KYC policies that are internationally recognized.

9.

Campaign Disclosure: The Consultant shall enforce disclosure of paid for promotion and all content created by media companies and influencers

must reference this content as sponsored by the Company.

Appendix

A to Schedule D

OTC

Markets - Best Practice for Issuers Stock Promotion

[Policy

follows this page]

Appendix

B to Schedule D

OTC

Markets Group Policy on Stock Promotion.

[Policy

follows this page]

Appendix

C to Schedule D

OTC

Markets Petition for Unlawful Securities Promotions

[Policy

follows this page]

Appendix

D to Schedule D

Examples

of non-compliant promotional material

[Example

follows this page]

Appendix

E to Schedule D

Blacklist

- Media companies and social media influencers

| Blacklist

Name |

Description |

| |

|

| 1.

Beat Penny Stocks |

www.beatpennystocks.com |

| 2.

Legends Media |

And

all their affiliate sites |

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

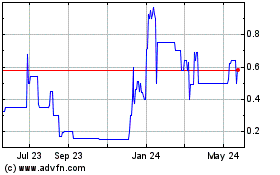

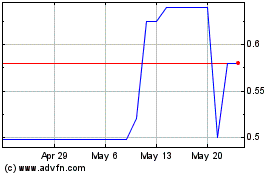

Arvana (PK) (USOTC:AVNI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Arvana (PK) (USOTC:AVNI)

Historical Stock Chart

From Feb 2024 to Feb 2025