As filed with the Securities and Exchange Commission

on February 20, 2024

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

ASTRAZENECA PLC

(Exact name of registrant as specified in its charter)

England and Wales

(State or other jurisdiction of

incorporation or organization) |

|

Not Applicable

(I.R.S. Employer

Identification No.) |

1 Francis Crick Avenue

Cambridge Biomedical Campus

Cambridge CB2 0AA

England

(Address of principal executive offices)

ASTRAZENECA GLOBAL RESTRICTED STOCK PLAN

(Full title of the plan)

CT Corporation System

28 Liberty Street

New York, NY 10005

Tel: +1-212-894-8940

(Name, address and telephone

number of agent for service)

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging

growth company” in Rule 12b-2 of the Exchange Act. (Check one)

| x Large accelerated filer |

¨ Accelerated filer |

¨ Non-accelerated filer |

¨ Smaller reporting company |

| |

|

|

|

| |

|

|

¨ Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

EXPLANATORY NOTE

This Registration Statement on Form S-8 (this

“Registration Statement”) registers an additional 20,000,000 Ordinary Shares, par value $0.25 each (“Ordinary

Shares”), of AstraZeneca PLC (the “Company”), represented by an additional 40,000,000 American Depositary

Shares, each representing one half of one Ordinary Share (“ADSs”), that may be offered or sold pursuant to an increase

in the number of Ordinary Shares that may be awarded under the AstraZeneca Global Restricted Stock Plan (the “GRSP”),

as amended by the Remuneration Committee of the Company’s Board of Directors on December 13, 2023. The GRSP provides that Ordinary

Shares or ADSs will be purchased by the trustee of the GRSP for the accounts of the participants on the open market. The GRSP does not

provide for Ordinary Shares to be issued by the Company out of its authorized and unissued Ordinary Shares. The additional securities

are of the same class as other securities relating to the GRSP for which the Company’s Registration Statement on Form S-8 (File

No. 333-240298) filed on August 3, 2020 (the “Prior Registration Statement”) is effective. The information

contained in the Prior Registration Statement is hereby incorporated by reference pursuant to General Instruction E to Form S-8.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 5. Interests of Named Experts and Counsel.

Not applicable. Because no original issuance securities are to be registered

hereunder, no opinion of counsel regarding the legality of the securities being registered hereunder is required pursuant to Item 8(a)(i) of

Form S-8.

Item 8. Exhibits.

* Filed herewith

SIGNATURES

Pursuant to the requirements of the Securities

Act, AstraZeneca PLC certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8

and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized in London on

February 20, 2024.

| |

ASTRAZENECA PLC |

| |

|

|

| |

By |

/s/ Adrian Kemp |

| |

|

Name: |

Adrian Kemp |

| |

|

Title: |

Company Secretary |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS that each person

whose signature appears below hereby constitutes and appoints Adrian Kemp and Matthew Bowden (with full power to each of them to act alone),

as such person’s true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for such person

and in such person’s name, place and stead, in any and all capacities, to sign and file with the Securities and Exchange Commission

any and all amendments and post-effective amendments to this Registration Statement, with exhibits thereto and any and all other documents

that may be required in connection therewith, granting unto each said attorney-in-fact and agent full power and authority to do and perform

each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as might

or could do in person, hereby ratifying and confirming all that each said attorney-in-fact and agent, or any substitutes therefor, may

lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act of 1933, this Registration Statement has been signed below by the following persons in the capacities and on the dates indicated.

| Name |

|

Title |

|

Date |

|

/s/ Pascal Soriot |

|

Executive Director and Chief Executive Officer |

|

February 20, 2024 |

| Pascal Soriot |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/

Aradhana Sarin |

|

Executive Director and Chief Financial Officer |

|

February 20, 2024 |

| Aradhana Sarin |

|

(Principal Financial Officer) |

|

|

| |

|

|

|

|

| /s/

Mani Sharma |

|

SVP, Group Financial Controller |

|

February 20, 2024 |

| Mani Sharma |

|

(Principal Accounting Officer) |

|

|

| |

|

|

|

|

| /s/

Michael Demaré |

|

Non-Executive Chairman of the Board |

|

February 20, 2024 |

| Michael Demaré |

|

|

|

|

| |

|

|

|

|

| /s/

Philip Broadley |

|

Senior Independent Non-Executive Director |

|

February 20, 2024 |

| Philip Broadley |

|

|

|

|

| |

|

|

|

|

| /s/

Euan Ashley |

|

Non-Executive Director |

|

February 20, 2024 |

| Euan Ashley |

|

|

|

|

| |

|

|

|

|

| /s/

Deborah DiSanzo |

|

Non-Executive Director |

|

February 20, 2024 |

| Deborah DiSanzo |

|

|

|

|

| |

|

|

|

|

| /s/

Diana Layfield |

|

Non-Executive Director |

|

February 20, 2024 |

| Diana Layfield |

|

|

|

|

| |

|

|

|

|

| /s/

Anna Manz |

|

Non-Executive Director |

|

February 20, 2024 |

| Anna Manz |

|

|

|

|

| |

|

|

|

|

| /s/

Sheri McCoy |

|

Non-Executive Director |

|

February 20, 2024 |

| Sheri McCoy |

|

|

|

|

| |

|

|

|

|

| /s/

Tony Mok |

|

Non-Executive Director |

|

February 20, 2024 |

| Tony Mok |

|

|

|

|

| |

|

|

|

|

| /s/

Nazneen Rahman |

|

Non-Executive Director |

|

February 20, 2024 |

| Nazneen Rahman |

|

|

|

|

| |

|

|

|

|

| /s/

Andreas Rummelt |

|

Non-Executive Director |

|

February 20, 2024 |

| Andreas Rummelt |

|

|

|

|

| |

|

|

|

|

| /s/

Marcus Wallenberg |

|

Non-Executive Director |

|

February 20, 2024 |

| Marcus Wallenberg |

|

|

|

|

| Authorized Representative |

|

|

|

|

| |

|

|

|

|

| /s/ Mariam Koohdary |

|

|

|

February 20, 2024 |

| Mariam Koohdary, as duly authorized representative of AstraZeneca PLC in the United States |

|

|

|

|

Exhibit 4.4

Plan Rules of

the AstraZeneca Global Restricted Stock Plan

Adopted by

RemCo on 1 March 2010 and restated on 22 October 2019

and amended on 25 September 2020, 27 April 2022

and 13 December 2023.

Plan terminates on 22 October 2029

French Appendix terminates on

22 February 2026

AstraZeneca Global Restricted Stock Plan

What is an ‘award’ and when do you get shares?

An award under the Plan is a contingent right

to receive shares in AstraZeneca PLC. When your award ‘vests’ you receive shares.

Your award will normally vest a specified number

of years after grant. After your award vests, you will receive a net number of shares after withholdings for tax have been made. Your

shares will be transferred into a nominee or custodian arrangement for you.

What happens if you leave?

Awards will generally only vest if you are employed.

If you leave AZ within the specified number of years after grant, your unvested awards will normally lapse.

However, if you end employment for one of the following reasons:

| (b) | ill-health, injury or disability (in each case evidenced to the satisfaction of your employer), |

| (c) | redundancy (within the terms of the Employment Rights Act 1996), |

| (d) | circumstances determined by RemCo to be retirement, or |

| (e) | the company or business in which you are employed ceasing to be a member of the AZ group, |

your award will not lapse and it will normally

vest on the date you cease employment, pro- rated for the time you were in employment.

Change of control of AstraZeneca

If there is a change in control of AZ, your award

will vest pro-rata (subject to achievement of any performance targets).

Dividends

On vesting, you will receive cash or additional

shares to reflect any dividends that would have been paid to you had you held the shares that vest on any dividend record dates during

the Vesting Period (dividend equivalents).

General

Awards are personal to you and may not be transferred

or charged until they vest. The awards do not form part of your terms and conditions of employment and are not pensionable.

You may be required to acknowledge the grant of your award and agree

to certain terms.

This summary does not form part of the Rules of

the GRSP. The Rules of the GRSP are set out in the following pages and will govern how your awards are treated. Definitions

and interpretation provisions are at Appendix 1. If you are resident in a country outside of the UK, your award may be subject to special

terms.

Rules of the AstraZeneca Global Restricted

Stock Plan

RemCo may approve the grant of Awards

to Eligible Employees, subject to the limits in Rule 10. Awards will not be granted during a Closed Period.

| 2.1 | Vesting of your Award is subject to such terms and conditions as RemCo considers appropriate before grant. |

| 2.2 | Unless your Award vests early under Rules 3 or 7, your Award will vest on the Vesting Date to the extent that any

terms and conditions imposed under Rule 2.1 have been met. |

| 3.1 | If you end Employment before the Vesting Date other than in any of the circumstances set out in Rule 3.2, your Award will

lapse unless RemCo in its absolute discretion decides otherwise, in which case RemCo has discretion to decide when and to what extent

your Award may vest. |

| 3.2 | If you end Employment before the Vesting Date for one of the following reasons: |

| 3.2.2 | ill-health, injury or disability (in each case evidenced to the satisfaction of your employing company); |

| 3.2.3 | redundancy within the terms of the Employment Rights Act 1996; |

| 3.2.4 | circumstances determined by RemCo, or anyone authorised by RemCo, to be retirement; or |

| 3.2.5 | the company by which you are employed ceasing to be a member of the AZ Group, or the part of the business in which you are employed

being transferred to a person outside the AZ Group, |

your Award will vest on the date you

end Employment, and will be reduced pro- rata to the proportion of the Vesting Period that has elapsed up to the end of Employment, unless

RemCo decides not to pro-rate or to pro-rate on some other basis.

| 3.3 | For the purposes of this Rule 3, if you are on statutory family-related leave, you will not end Employment until the earlier

of the date on which you notify your employer of your intention not to return to work or the date on which you cease to have statutory

or contractual rights to return to work. |

| 3.4 | If you are resident in China and you end Employment as a result

of your death, if a delay in providing the necessary documentation will result in a breach of the Chinese State Administration of Foreign

Exchange requirements, your Award shall not be satisfied by the issue or transfer of Shares but will be satisfied by the payment of

a cash sum equal to the value of the Shares in respect of which your Award vested under Rule 3.2 (converted into your relevant

payroll currency at an appropriate spot rate) less deductions for Tax Liabilities. |

| 4.1 | Notwithstanding any other provision of these Rules, your Award will lapse: |

| 4.1.1 | if you are declared bankrupt or are unable to hold your Award by operation of law, or you attempt to transfer, assign, charge or dispose

of your Award contrary to Rule 12.3; |

| 4.1.2 | to the extent that: (i) the Award does not vest in full

under Rules 3 or 7; or (ii) the number of Shares which are subject to the Award is reduced under Rule 8. |

| 5. | Consequences of Vesting of an Award |

| 5.1 | After vesting of your Award, the number of Shares in respect of which it has vested will, subject to Rule 6, be transferred

to you as soon as practicable. Your Shares may be transferred into any nominee or other custodian arrangement as AZ shall determine is

appropriate (Shareholding Arrangement) and will be held on your behalf on the terms notified to you from time to time. |

| 5.2 | In the event that you end Employment, unless your Shares are required by AZ to be retained in the Shareholding Arrangement, you will

be required to remove your Shares from such Shareholding Arrangement within six months of the date you end Employment. If your Shares

remain in the Shareholding Arrangement at the end of that six month period, AZ will have the right, at any time, to sell or direct the

sale of your Shares on your behalf at the prevailing market rate and will remit the cash proceeds to you or to an account with a nominee

or custodian on your behalf. For the avoidance of doubt, Shares in this Rule 5.2 shall refer to Shares acquired on vesting

of your Award, including pursuant to Rule 5.4, and any additional Shares that are acquired by you as a result of your holding

of such Shares, for example by way of reinvestment of dividends paid on such Shares. |

| 5.3 | You will have no voting, dividend or other rights in the Shares under your Award before the Vesting Date. Shares that you acquire

under the Plan will not have the benefit of any rights that attach to those Shares by reference to a record date that is earlier than

the date when you acquired them. |

| 5.4 | To the extent that your Award vests you may receive an additional amount as “dividend equivalents”. Unless RemCo decides

otherwise, your dividend equivalents will be calculated by reference to the dividends paid or which are payable on the number of Shares

that vest, as if those dividends had been reinvested in Shares on the relevant dividend record dates during the Vesting Period, or if

your Award vests early, until the date of such vesting. This payment will be made in cash or Shares, subject to deductions for Tax Liabilities,

after your Award has vested, but no later than 15 March after the calendar year in which your Award has vested. |

| 5.5 | Notwithstanding any other provision, RemCo may, at any time, determine that your Award shall not be satisfied by the issue or transfer

of Shares but will be satisfied by the payment to you of a cash sum equal to the value of the Shares in respect of which your Award vests

on the day of vesting (converted into your relevant payroll currency at an appropriate spot rate) less deductions for Tax Liabilities. |

By accepting the Award, you indemnify

AZ and your employer against any Tax Liabilities that may arise in connection with the benefits delivered under the Plan. AZ or your employer

may withhold any amount and make any arrangements it considers necessary to meet any Tax Liabilities, which may include the sale on your

behalf of any Shares acquired by you under the Plan.

| 7. | Change of Control of AZ |

| 7.1 | If before the Vesting Date of an Award: |

| 7.1.1 | an offeror (alone or with any party acting in concert with the offeror) obtains Control of AZ by making an offer to acquire the whole

of the issued ordinary share capital of AZ (or any part of it which is not owned by the offeror and any party acting in concert with the

offeror); |

| 7.1.2 | the Court sanctions a compromise or arrangement affecting the Shares under section 899 of the Companies Act 2006; or |

| 7.1.3 | a resolution is passed for the voluntary winding up of AZ, |

unless Rule 7.4 applies,

your Award will vest on the date of that event, to the extent decided by RemCo under Rule 7.2.

| 7.2 | Where Rule 7.1 applies or is likely to apply, an Award will vest pro-rata to the time which has elapsed between the Date

of Grant of the Award and the date of the relevant event (subject to achievement of any applicable performance targets, in the opinion

of RemCo, at the time of the relevant event or most practicable earlier date). However, RemCo may decide to take into account any other

factors it believes to be relevant in determining the extent to which an Award will vest in circumstances it considers exceptional. |

| 7.3 | RemCo will confirm the extent (if any) to which an Award will vest under Rule 7.2. Confirmation may be before, but conditional

on, the relevant event in Rule 7.1. |

| 7.4 | If a company obtains Control of AZ, but the shareholders of the acquiring company immediately after it has obtained Control of AZ

are substantially the same as the shareholders of AZ immediately before that event, and if the acquiring company consents to this Rule 7.4

applying, then your Award will not vest under Rule 7.1. Instead, it will be exchanged for a new award in respect of shares

having a total Market Value being equal to the Market Value of the Shares that are subject to your Award immediately before the exchange.

The new award will be governed by the Rules, except that references to Shares shall refer to shares in the acquiring company, and references

to AZ shall refer to the acquiring company. |

Notwithstanding any other provision,

Awards are subject to the Malus and Clawback Global Standard and by accepting an Award, you agree to be bound by the terms of the Malus

and Clawback Global Standard.

| 9. | Amending the Plan and Awards |

| 9.1 | If there is a Variation in the equity share capital of AZ, the number and/or the nominal value of the Shares over which your Award

is granted will be adjusted as RemCo decides. You will be notified of any adjustment under Rule 9.1. |

| 9.2 | AZ can amend these Rules at any time. |

| 9.3 | AZ can adopt additional sections of these Rules applicable in any jurisdiction under which Awards may be subject to additional

and/or modified terms and conditions, taking into account any securities, exchange control or taxation laws, which may apply to you, AZ,

or any member of the AZ Group. Any additional sections must conform to the basic principles of the Plan and must not exceed the limits

set out in these Rules. |

| 10. | Limit on the number of Shares which can be issued |

| 10.1 | Any Shares you receive on vesting will be Shares that are purchased by the Trustee in the market, and will not be Shares that are

treasury shares or are newly issued to you or the Trustee. |

| 10.2 | Unless RemCo decides otherwise, the maximum Market Value of Shares (determined at the Date of Grant) which may be subject to any Award

in respect of any Eligible Employee in any financial year of AZ will be 500% of the Eligible Employee's basic salary. |

| 11.1 | The Plan will be administered by RemCo which will interpret and construe any provision of the Plan and may adopt any regulations for

administering the Plan and any documents it thinks appropriate. The decision of RemCo on any matter concerning the Plan will be final

and binding. |

| 11.2 | Any communication in connection with the Plan (including any award documentation) can be given electronically by e-mail or on an online

portal designed for the purpose or by personal delivery or post, (in the case of a company, to its registered office and in the case of

an individual to the individual's last known address) or by any other means which AZ and you use to communicate with each other. |

| 11.3 | Any notice under the Plan will be given: (i) if delivered personally, at the time of delivery; (ii) if posted, at 10.00

a.m. on the third business day after it was put into the post; or (iii) if sent by e-mail or any other form of electronic delivery

system, at the time of despatch. |

| 12.1 | You can reject an Award in writing within thirty (30) days after the Date of Grant. If you do not reject your Award, you will be deemed

to have accepted it and its terms. If you reject your Award it will be taken never to have been granted. |

| 12.2 | You may be required to acknowledge the grant of your Award and its terms, in which case AZ will notify you of this requirement. If

you fail to acknowledge any Award, RemCo shall have the discretion to apply any additional conditions to the vesting of your Award or

Shares received on vesting of your Award as it may determine. |

| 12.3 | Your Award may not be sold, transferred, assigned, charged or otherwise encumbered or disposed of to any person, other than to your

personal representatives on your death. |

| 12.4 | Participation in the Plan is not pensionable and does not form part of your employment contract. Nothing in the Plan or any document

under it will give any person any right to participate in the Plan and the grant of an Award does not create any right or expectation

to the grant of an Award in the future. Your rights and obligations under the terms of your office or Employment will not be affected

by your participation in the Plan or any right which you may have to participate under it. |

| 12.5 | By accepting and not rejecting an Award under the Plan, you waive all and any rights to compensation or damages under the Plan in

consequence of any loss of rights under the Plan as a result of: (i) termination of your office or Employment with a member of the

AZ Group for any reason; or (ii) the way in which RemCo or any person to whom RemCo has delegated authority, exercises or does not

exercise any discretion under the Plan. Nothing in the Plan or in any document executed under it will give you any right to continue in

Employment or will affect the right of any member of the AZ Group to terminate your Employment without liability at any time with or without

cause. |

| 12.6 | The invalidity or non-enforceability of one or more provisions of the Plan will not affect the validity or enforceability of the other

provisions of the Plan, which will remain in full force and effect. |

| 12.7 | The Plan was adopted by RemCo on 1 March 2010 and restated on 22 October 2019 and amended on 25 September 2020, 27

April 2022 and 13 December 2023. The Plan will terminate on 22 October 2029 or at any earlier time AZ decides. Termination

of the Plan will not affect your Awards. |

| 12.8 | Nothing in this Plan confers any benefit, right or expectation on a person who is not an Eligible Employee or member of the AZ Group,

and no third party has any rights under the Contracts (Rights of Third Parties) Act 1999 to enforce any term of this Plan. This does not

affect any other right or remedy of a third party which may exist. |

| 12.9 | These Rules will be governed by and construed in accordance with the law of England. You, AZ and any member of the AZ Group submit

to the jurisdiction of the English courts in relation to anything arising under the Plan. RemCo may determine that another law will apply

to the operation of the Plan outside the United Kingdom. |

Appendix 1

Definitions and Interpretation

ADS means an American Depository Share

representing Shares;

Award means a contingent right to acquire

Shares granted or proposed to be granted under Rule 1;

AZ means AstraZeneca PLC (registered number 2723534);

AZ Group means AZ and any subsidiary, holding

company or subsidiary of a holding company of AZ (as each term is defined in section 1159 Companies Act 2006);

Closed Period means a period when you are

prohibited from dealing in Shares under the UK Market Abuse Regulation, the Criminal Justice Act 1993, or under any other statute, regulation

or similar code to which AZ is subject or other share dealing code adopted by AZ from time to time;

Control shall have the meaning given in section 995 Income Tax

Act 2007;

Date of Grant means with respect to an Award, the date on which

the Award is granted;

Dealing Day means a day on which the London

Stock Exchange plc is open for the transaction of business;

Eligible Employee means any person who

at a Date of Grant is an employee of any member of the AZ Group but not an executive director of AZ;

Employment means employment as an employee of any member of

the AZ Group;

Malus and Clawback Global Standard means

the malus and clawback global standard approved by RemCo and which came into effect on 1 December 2023, as amended from time to time;

Market Value means, in relation to a Share

on any day, an amount equal to the average of the middle market closing prices of a Share (as derived from the Daily Official List of

the London Stock Exchange plc) on the three consecutive Dealing Days preceding that day (or such other Dealing Day or Dealing Days as

RemCo may decide) or, in the case of an ADS, by reference to the average of the equivalent price of an ADS as derived from NASDAQ on trading

days as close as possible to those Dealing Days. In the event that the Shares cease to be traded on the Main Market of the London Stock

Exchange and are admitted to trading on a replacement market, references to the Daily Official List of the London Stock Exchange plc shall

be construed as references to the equivalent of such replacement market. In the event that ADSs cease to be traded on NASDAQ and are admitted

to trading on a replacement market, references to NASDAQ shall be construed as references to such replacement market;

Plan means the AstraZeneca Global Restricted Stock Plan constituted

by these Rules;

RemCo means the duly authorised remuneration

committee of the board of directors of AZ;

Share means a fully paid ordinary share

in the capital of AZ or, where the context requires it, an equivalent number of ADSs;

Shareholding Arrangement means the nominee or custodian arrangement

referred to in Rule 5.1;

Tax Liabilities means any income tax, employee’s

national insurance contributions, social security charges or similar taxes or charges imposed in any jurisdiction for which AZ or any

member of the AZ Group is required to account;

Trustee means the trustee for the time

being of an employee benefit trust established by AZ;

Variation means a capitalisation issue,

rights issue, subdivision, consolidation, reduction, or any other variation in the capital of AZ;

Vesting Date means in relation to an Award

the date specified at the Date of Grant, save that if such date falls within a Closed Period, unless RemCo has made a determination under

Rule 5.5, the Vesting Date will be the first Dealing Day following the end of that Closed Period;

Vesting Period means in relation to an

Award, the period between the Date of Grant of the Award and the Vesting Date; and

you means any Eligible Employee to whom

an Award has been granted, or (where the context requires) that Eligible Employee's personal representatives, and “your”

shall be construed accordingly.

Interpretation

Headings are for convenience only. Words in the

singular include the plural and vice versa and words importing gender include both genders. Reference to statutory provisions include

amendments, extensions or re-enactments and equivalent legislation in any country other than England, and include any regulations or subordinate

legislation made under them.

Appendix 2

Schedule for US Participants

The provisions of sections 1 to 5 of this Schedule modify the Rules of

the Plan in respect of any Awards granted under it to Eligible Employees who are resident in the United States.

| 1. | The following shall be inserted as new Rule 2.3: |

"You may be required, as a condition

of the vesting of your Award, to represent and agree that, in relation to Shares you acquire under the Plan:

| (a) | you understand that such Shares are deemed to be restricted securities within the meaning of Rule 144 under the United States

Securities Act of 1933 (the “Securities Act”), which may not be resold in the United States or to a U.S. person except pursuant

to an effective registration statement under the Securities Act or an exemption from the registration requirements of the Securities Act; |

| (b) | you are acquiring such Shares for investment and not with a view to distribution; and |

| (c) | you will not resell such Shares at any time, except to non-U.S. persons in transactions effected in accordance with Rule 904

of Regulation S under the Securities Act (or any successor section thereto) and only after the expiration of any holding period RemCo

may require. |

AZ may endorse on certificates representing

Shares issued or transferred upon the vesting of an Award such legend referring to the foregoing representations or restrictions or any

other applicable restrictions on resale as AZ, in its discretion, shall deem appropriate.”

| 2. | In the definition of “AZ Group”, “subsidiary” shall be defined as any company in which AZ owns, directly or

indirectly, a majority of the voting rights. |

| 3. | In Rule 3.2.3, the words "redundancy within the terms of the Employment Rights Act 1996" shall be deleted and

replaced by "Redundancy”. |

| 4. | In Rule 3.2.4, the words "circumstances determined by RemCo, or anyone authorised by RemCo, to be retirement"

shall be deleted and replaced by "Retirement". |

| 5. | In Appendix 1 (Definitions) the following definitions shall be inserted: |

“Redundancy means a qualifying

involuntary termination without cause (but excluding a termination by mutual agreement or mutual consent) entitling you to a severance

payment under a severance program adopted by your U.S. employing company. Vesting under these Rules following your redundancy termination

is subject always to your having met all the requirements of such severance program, including having executed a valid release of all

and any claims against the AZ Group;”

“Retirement means:

| (a) | termination without cause after having attained age 62 with 5 years of service; |

| (b) | termination without cause after having attained age 65 with 3 years of service; or |

| (c) | any other meaning as may be notified to you in writing at the time of grant of your Award;”. |

The remaining provisions of this Schedule modify

the Rules of the Plan in respect of any Awards granted under it to Eligible Employees who are US taxpayers (whether or not they are

also resident in the United States).

| 6. | Rule 2.2 shall be deleted and replaced with the following: |

“Subject to Rules 3, 7

and 8, your Award will vest on the Vesting Date, to the extent that any terms and conditions imposed under Rule 2.1

have been met. For the avoidance of doubt, you shall have no rights in respect of the Shares the subject of an Award until the Award

has vested. If vesting of an Award would be prohibited by a Closed Period, the day on which the Award vests will be the first Dealing

Day on which such prohibition ceases to apply or, if later, the first day on which you are able to trade in the Shares after the Closed

Period ceases. In any event, the latest day by which the Shares subject to an Award will be delivered to you is the US Taxpayer Payment

Deadline (as defined in Rule 5.1 (as inserted by paragraph 7 of this Appendix 2)).”

| 7. | Rule 5.1 shall be deleted and replaced with the following: |

“After vesting of your Award,

the Shares subject to such an Award in respect to which it has vested will, subject to Rule 6, be delivered to you as soon

as practicable following the vesting of the Award, but in no event later than the end of the year in which the applicable vesting date

occurs, or, if later, by the 15th day of the third month following the applicable vesting date (collectively, the “US Taxpayer

Payment Deadline”). You will not be permitted, either directly or indirectly, to designate the year of payment. In the event

that an Award vests by reason of Redundancy and your termination of Employment occurs in the calendar year preceding the deadline for

you to execute and submit a valid release of claims (if any) required by the applicable severance program, then the year of payment will

be the year of the release deadline regardless of whether you earlier submit the release.”

“Your Shares may be transferred

into any nominee or other custodian arrangement as AZ shall determine is appropriate (Shareholding Arrangement) and will be held

on your behalf on the terms notified to you from time to time.”

| 8. | Rule 5.4 shall be deleted and replaced with the following: |

“To the extent that your Award

vests, you may, at the discretion of RemCo, receive an amount equivalent to the total dividends paid or which are payable on the number of

Shares that vest, by reference to dividend record dates during the Vesting Period, or if your Award vests early, until the date of such

vesting. This payment will be made in cash or Shares, subject to deductions for Tax Liabilities, after your Award has vested, but in

no event later than the US Taxpayer Payment Deadline (as defined in Rule 5.1 (as inserted by paragraph 7 of this Appendix

2)).”

| 9. | The following shall be inserted as a new Rule 7.5: |

“If an Award vests pursuant to

this Rule 7, and the event described in Rule 7 also constitutes a “change in control event” under

Section 409A of the US Internal Revenue Code of 1986, as it may be amended from time to time, and all regulations, interpretations

and administrative guidance issued thereunder (the “Code”), then the Shares subject to it in respect of which it has vested

will, subject to Rule 6, be transferred to you as soon as practicable following the vesting of an Award, but in no event later

than the US Taxpayer Payment Deadline. If such event does not constitute a “change in control event” under Section 409A

of the Code, then the Award will vest on the occurrence of such event described in Rule 7, but shall not be delivered to you

until the earlier of the Vesting Date or the date on which your Award vests under Rule 3. For the avoidance of doubt, an Award

shall only become payable upon the earlier of the Vesting Date or the date upon which your Award vests under Rule 3 or Rule 7.”

| 10. | The following shall be inserted as a new Rule 13: “13. Section 409A of the Code. |

| 13.1 | The compensation and benefits under the Plan are intended to comply with the requirements of Section 409A of the Code, and the

Plan will be interpreted and administered in a manner consistent with that intent. The preceding provision, however, shall not be construed

as a guarantee by AZ of any particular tax effect to you under an Award. Payment may only be accelerated or delayed if and to the extent

that such accelerated or delayed payment is permitted under Section 409A of the Code. |

| 13.2 | References to “end of Employment”, “cessation of Employment”, “termination of Employment” and

similar terms used in the Plan mean, to the extent necessary to comply with Section 409A of the Code, the date that you first incur

a “separation from service” within the meaning of Section 409A of the Code. |

| 13.3 | Notwithstanding anything in the Plan to the contrary, if at the time of your separation from service with AZ you are a “specified

employee” as defined in Section 409A of the Code, and any payment payable under the Plan as a result of such separation from

service is required to be delayed by six months pursuant to Section 409A of the Code, then AZ will make such payment on the date

that is six months following your separation from service with AZ. The amount of such payment will equal the sum of the payments that

would have been paid to you during the six-month period immediately following your separation from service had the payment commenced as

of such date and will not include interest. |

| 13.4 | No Shares issued or payments made in respect of such an Award shall be funded with any assets set aside in a trust or other arrangement

in violation of Section 409A(b)(1) of the Code. To the extent any trust is utilized in administration of the Plan, Awards granted

to Eligible Employees who are US taxpayers need not be settled by Shares held in such a trust and such Awards do not form the basis for

any claims or rights with respect to such a trust’s assets. |

| 13.5 | In the first taxable year in which you become a US taxpayer by reason of becoming a resident alien for US federal income tax purposes,

the Plan may be amended solely with respect to you such that the compensation and benefits under the Plan are compliant with or exempt

from Section 409A of the Code. Such amendment must be effective not later than the end of the first year in which you become a resident

alien and shall only be effective with respect to amounts that were not vested prior to the date that you became a resident alien. For

any year after the first year in which you are classified as a resident alien, this clause shall not apply, provided that a year may again

be treated as the first year in which you are classified as a resident alien if you are classified as a resident alien in that year and

have not been classified as a resident alien for the three consecutive years immediately preceding that year. This clause will be interpreted

consistent with the requirements of Section 409A of the Code, including Sections 1.409A-2(c) and 1.409A-3(h) of the US

Treasury Regulations, as well as any subsequent guidance under Section 409A of the Code. |

| 13.6 | Awards under the Plan that become vested while you are not subject to US federal income taxation but that are paid at a time when

you subsequently have become subject to US federal income taxation are intended to be exempt from Section 409A of the Code. This

clause will be interpreted consistent with the requirements of Section 409A of the Code, including Section 1.409A-1(b)(8)(ii) of

the US Treasury Regulations, as well as any subsequent guidance under Section 409A of the Code.” |

| 11. | Rule 3.3 shall be deleted and replaced with the following: |

“For the purposes of this Rule 3,

if you are on an authorized leave of absence pursuant to an AZ policy or a legal entitlement, you will not end Employment until the earlier

of the date on which you notify your employer of your intention not to return to work or the date on which you cease to have statutory

or contractual rights to return to work.”

| 12. | The following sentence shall be appended to the end of the existing Rule 8: |

“Notwithstanding anything to the

contrary, this Rule 8 shall not apply in any jurisdiction where its enforcement would be prohibited by applicable law.”

Appendix 3

France

| 1. | This Appendix 3 governs the grant of Awards to French Participants |

This Appendix 3 modifies the

Rules of the Plan in respect of any Awards granted to participants who are French Participants.

This Appendix 3 has been drafted

in order to allow Awards to benefit from the tax incentive as implemented under articles L.225-197-1 to L.225-197-3, L.22-10-59 and L.22-10-60

of the French Commercial Code, articles 80 quaterdecies of the French Tax Code and articles L.137-13 and L.242-1 of the French

Social Security Code. The current provisions of this Appendix 3 include the regulations currently applicable in France. AZ may

however have to amend the provisions of this Appendix 3 to take into account any new regulations that could arise in the future.

It is anticipated that Awards will be

eligible for favourable tax and social security treatment in France. In the case where Awards would not benefit from the favourable tax

and social security treatment in France, the French Participants are informed that they may have to bear the cost of any additional income

tax arising as a result of the Award and, if requested by their employer, to reimburse their employer for any employee share of social

security contributions, but not the employer social security contributions, (and any assimilated charges such as, but not limited to,

the Contribution Sociale Généralisée).

The provisions of this Appendix 3

may be subsequently amended, if Awards appear not to be eligible for the favourable tax and social security treatment in France.

This Appendix 3 applies to Awards

granted as from 1 January 2010 and, as amended, to Awards granted as from 3 February 2014 and, as further amended, to Awards

granted as from 24 July 2017.

| 2. | Adoption of French Qualified Part |

The Plan and authority to adopt Appendix

3 was approved by the Board on 1 March 2010 and restated by RemCo on 22 October 2019, in compliance with the law under which

AZ is incorporated. This Appendix 3 was adopted by RemCo on 1 March 2010 and restated on 22 October 2019.

In Rule 1 of the Plan, the

following words shall be inserted:

“No Award shall be granted under

Appendix 3: (i) more than seventy-six months after the date on which this Appendix 3 was restated by RemCo.”

The following limits shall apply in

respect of Awards granted under the Rules of the Plan to French Participants:

| (i) | an Eligible Employee may not own more than 10% of the ordinary share capital of AZ at the date an Award is granted; and |

| (ii) | an Eligible Employee may not own, as a result of the grant of an Award, more than 10% of the ordinary share capital of AZ. |

| 4. | Early vesting of an Award |

Rules 3.1 and 3.2 of the Plan shall be

deleted and replaced by the following:

"If a French Participant ceases to be in Employment before the Vesting Date:

| (a) | as an Eligible Leaver, his Award(s) will vest on the date

the Employment ceases, pro-rated to take into account the period elapsed between the Date of Grant and the date of cessation of

Employment relative to the Vesting Period, unless RemCo decides not to pro-rate or to pro-rate on some other basis; and |

| (b) | other than as an Eligible Leaver, the Award will lapse on the date of cessation, unless RemCo, in its absolute discretion, decides

otherwise, in which case RemCo has discretion to decide when and to what extent the Award may vest. |

If a French Participant dies, the Shares

will be transferred to the French Participant's personal representatives, provided that AZ has received written confirmation that the

personal representatives are legally authorised to deal with the deceased French Participant's affairs, within 6 months after the death

of the relevant French Participant. The terms under which the Shares would be transferred to the personal representatives and the ability

for the personal representatives to dispose of the Shares will be determined according to the law and regulation applicable at the date

of grant of the Award.

If an Award vests before the Vesting

Date for any reason pursuant to the Plan, the French Participant may freely dispose of the Shares subject to it and in respect of which

it has vested. However, in such circumstances, unless an Award vests following a French Participant ceasing Employment due to death, injury

or disability corresponding to the second and third category as described under article L.341-4 of the French Social Security Code, the

French Participant shall bear the cost of any additional income tax arising as a result of the early vesting of the Award and, if requested

by their employer, will reimburse their employer for any employee share of social security contributions (and any assimilated charges

such as, but not limited to, the Contribution Sociale Généralisée)."

| 5. | Payments on account of dividends |

Rule 5.4 of the Plan shall

be deleted. No amounts shall be paid to French Participants or Directors in respect of dividends that would have been paid on the Shares

that are subject to the Award during the Vesting Period.

Rule 7.4 shall apply to

French Participants. If there is an exchange of Awards for other awards upon a merger or a demerger realised in accordance with the applicable

legislation during the Vesting Period, the preferential tax and social regime would continue to apply provided that the French Participant

retains the shares received until the end of the Vesting Period.

In any other cases of an exchange of

Awards, the French Participant shall bear the cost of any additional income tax arising as a result of the exchange of Awards and, if

requested by their employer, will reimburse their employer for any employee share of social security contributions (and any assimilated

charges such as, but not limited to, the Contribution Sociale Généralisée).

| 7. | Limit on the number of shares which can be issued |

If the Plan is amended at any time to

permit Awards to be satisfied using newly issued Shares, no Award may be granted to French Participants or Directors if the number of

Shares issued or capable of being issued pursuant to Awards granted under the Plan, when aggregated with the number of shares issued or

capable of being issued pursuant to awards made or options granted under any other employees’ share scheme, would exceed 10 per

cent of the ordinary issued share capital of AZ from time to time.

This 10 per cent limit does not include:

| (i) | any Shares that have not been effectively awarded at the end of the Vesting Period; or |

| (ii) | any Shares that are no longer subject to a Vesting Period. |

After the Vesting Date, a French Participant

or Director who is an employee of a Participating Company cannot transfer the Shares:

| (i) | Within the thirty (30) calendar days before the announcement of an interim financial report or a year-end report that AZ is required

to make public. |

| (ii) | At any time when the French Participant or Director is in possession of Privileged Information. |

| (iii) | And in any case before the end of the Holding Period (if any). |

For the purpose of this Appendix

3, the following definitions will apply instead of the definitions in Appendix 1:

Director means any Président

du Conseil d'Administration, Directeur Général, Directeur Général Délégué or Membre du

Directoire of a Participating Company.

Eligible Employee means any person

who at a Date of Grant is in Employment with a Participating Company.

Eligible Leaver means a French

Participant who ceases to be in Employment as a result of death, injury or disability corresponding to the second and third category as

described under article L.341-4 of the French Social Security Code, ill-health, redundancy (provided that, in the case of ill-health or

redundancy, the Participant's employing company does not dispute that these are the reasons for the cessation), retirement with the agreement

of his employing company, his employing company ceasing to be a member of the AZ Group or the business in which he is employed being transferred

out of the AZ Group.

Employment means employment as

an employee or Director of a Participating Company, though a Participating Company may decide on a case by case basis to include or exclude

Directors from this Appendix 3.

French Participant means a participant

in the Plan who is in Employment at a Participating Company and/or an Eligible Employee as defined in the main Rules of the Plan

who is a French tax resident and/or is subject to French social security regulation.

Holding Period means in relation

to an Award that vests less than two years after the Date of Grant, the period specified on the Date of Grant starting on the Vesting

Date and ending at the earliest on the second anniversary of the Date of Grant. Notwithstanding the foregoing, unless RemCo has made a

determination under Rule 5.5, if the last day of the Holding Period falls within a Closed Period, the last day of the Holding

Period will be the first Dealing Day following the end of that Closed Period.

Participating Company means any

French subsidiary of AZ within the meaning of section I of Article L225-197-2° of the French Commercial Code; provided, for the

avoidance of doubt, that a company shall be a French subsidiary only if AZ holds, directly or indirectly, at least 10 per cent. of its

share capital or voting rights.

Privileged Information means

privileged information within the meaning of Article 7 of Regulation (EU) No. 596/2014 of the European Parliament and of the

Council of 16 April 2014 on market abuse (Market Abuse Regulation) which has not been made public.

Vesting Date means in relation

to an Award the date specified at the Date of Grant and determined by RemCo so that the Vesting Period shall be at least one year, save

that if such date falls within a Closed Period, unless RemCo has made a determination under Rule 5.5, the Vesting Date will

be the first Dealing Day following the end of that Closed Period.

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We hereby consent to the incorporation by reference in this Registration

Statement on Form S-8 of AstraZeneca PLC of our report dated 8 February 2024 relating to the financial statements and the effectiveness

of internal control over financial reporting, which appears in AstraZeneca PLC’s Annual Report on Form 20-F for the year ended

31 December 2023.

/s/ PricewaterhouseCoopers LLP

London, United Kingdom

20 February 2024

PricewaterhouseCoopers LLP, 1 Embankment Place, London WC2N

6RH

T:

+44 (0) 2075 835 000, F: +44 (0) 2072 124 652, www.pwc.co.uk

PricewaterhouseCoopers LLP is a limited

liability partnership registered in England with registered number OC303525. The registered office of PricewaterhouseCoopers LLP is 1

Embankment Place, London WC2N 6RH.PricewaterhouseCoopers LLP is authorised and regulated by the Financial Conduct Authority for designated

investment business and by the Solicitors Regulation Authority for regulated legal activities.

Exhibit 107

Calculation of Filing Fee Table

Form S-8

(Form Type)

ASTRAZENECA PLC

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward

Securities

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Security

Type |

|

Security

Class

Title |

|

Fee

Calculation

Rule |

|

Amount

Registered(1) |

|

Proposed

Maximum

Offering

Price Per

Unit(2) |

|

Maximum

Aggregate

Offering

Price |

|

Fee

Rate |

|

Amount of

Registration

Fee |

| |

| Newly Registered Securities |

| |

|

|

|

|

|

|

|

| Equity |

|

Ordinary Shares, par value $0.25 each, represented by American Depositary Shares, to be awarded under the AstraZeneca PLC Global Restricted Stock Plan(3) |

|

Rule 457(h) |

|

20,000,000 |

|

$121.92 |

|

$2,438,400,000 |

|

0.0001476 |

|

$359,907.84 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

| Total Offering Amounts |

|

|

|

$2,438,400,000 |

|

|

|

$359,907.84 |

| |

|

|

|

|

| Total Fee Offsets |

|

|

|

|

|

|

|

— |

| |

|

|

|

|

| Net Fee Due |

|

|

|

|

|

|

|

$359,907.84 |

| (1) |

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement covers any additional ordinary shares, par value $0.25 each, of AstraZeneca PLC (“Ordinary Shares”), represented by American Depositary Shares, each representing one half of one Ordinary Share (“ADSs”), that may be offered or sold under the terms of the AstraZeneca PLC Global Restricted Stock Plan by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the Registrant’s receipt of consideration which results in an increase in the number of the outstanding Ordinary Shares, represented by ADSs. |

| (2) |

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and Rule 457(h) under the Securities Act, based on the average of the high and low prices per ADS as reported on the Nasdaq Global Select Market on February 12, 2024, of $60.96, multiplied by two (the ratio of ADSs to Ordinary Shares). |

| (3) |

The Ordinary Shares shall be represented by ADSs. The ADSs issuable upon deposit of the Ordinary Shares registered hereby have been registered under separate registration statements on Form F-6 (File No. 333-258002 and File No. 333-236014). |

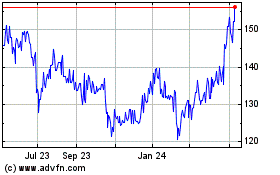

AstraZeneca (PK) (USOTC:AZNCF)

Historical Stock Chart

From Dec 2024 to Jan 2025

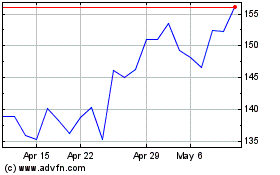

AstraZeneca (PK) (USOTC:AZNCF)

Historical Stock Chart

From Jan 2024 to Jan 2025