Current Report Filing (8-k)

June 01 2018 - 3:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of

Report (date of earliest event reported):

May 22, 2018

|

OCEAN THERMAL

ENERGY CORPORATION

|

|

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

Nevada

|

|

033-19411-C

|

|

20-5081381

|

|

(State

or other jurisdiction of

|

|

(Commission

File Number)

|

|

(IRS

Employer

|

|

incorporation

or organization)

|

|

|

|

Identification

No.)

|

|

|

|

|

|

|

|

800 South Queen Street

|

|

|

|

Lancaster, PA

|

|

17603

|

|

(Address

of principal executive offices)

|

|

(Zip

code)

|

|

|

|

|

|

Registrant’s

telephone number, including area code:

|

|

(717) 299-1344

|

|

|

|

|

|

n/a

|

|

(Former

name or former address, if changed since last report)

|

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

|

|

|

|

|

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (Section

230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (Section 240.12b-2 of this chapter).

|

|

|

Emerging

growth company [ ]

|

|

|

|

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act.

[ ]

|

ITEM 1.01—ENTRY INTO A MATERIAL DEFINITIVE

AGREEMENT

On May

22, 2018, we entered into a Securities Purchase Agreement,

Convertible Note, and Security Agreement with Collier Investments,

LLC, a California limited liability company. The Securities

Purchase Agreement provides for Collier’s purchase of the

convertible note in the aggregate amount of $281,250 for the

purchase price of $250,000 (an original issue discount of 8.9%). On

May 22, 2018, we received proceeds of $195,581.20, net of $5,000

for the investor’s legal fees and $49,418.80 for other fees

and expenses paid on our behalf. In addition to issuing the

convertible note, we issued 400,000 shares of our common stock to

Colliers as an initial commitment fee. Subsection 1(a) of the

Securities Purchase Agreement provides a mechanism for calculating

the number of additional commitment shares that we may have to

issue based on the market price of our common stock on the day that

is 30 trading days following the six-month anniversary of the

issuance date of the convertible note. The convertible note accrues

interest at the rate of 12%, matures on the earlier of seven months

after the issuance date or the date of qualified financing (as

defined in the note), and converts at the conversion price equal to

the lesser of: (i) 80% of the of the price per share paid by

investors in the qualified financing; or (ii) $0.20, subject to

adjustment as provide in the convertible note.

Prompt

payment and performance of the Securities Purchase Agreement and

Convertible Note are secured by the terms of the Security

Agreement. Under the Security Agreement, we granted to Colliers a

first-lien security interest in the collateral listed on Exhibit A

to the agreement, including all of our accounts receivable, deposit

accounts, inventory and equipment, documents of title to property,

intellectual property, and future accounts and

proceeds.

These

securities were issued in reliance on the exemption from

registration provided in Section 4(a)(2) of the Securities Act of

1933, as amended, for transactions not involving any public

offering. Collier Investments, LLC, is an “accredited

investor” as defined in Rule 501(a) of Regulation D and

confirmed the foregoing and acknowledged, in writing, that the

securities were acquired and will be held for investment. No

underwriter participated in the offer and sale of these securities

and no commissions or other remuneration was paid or given directly

or indirectly in connection therewith.

ITEM 2.03—CREATION OF A DIRECT FINANCIAL OBLIGATION OR

AN

OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A

REGISTRANT

The

information set forth in Item 1.01 is incorporated by reference in

this Item 2.03.

ITEM 3.02—UNREGISTERED SALES OF EQUITY

SECURITIES

The

information set forth in Item 1.01 is incorporated by reference in

this Item 2.03.

ITEM 9.01—FINANCIAL STATEMENTS AND EXHIBITS

The

following are filed as exhibits to this report:

|

Exhibit

Number*

|

|

Title of Document

|

|

Location

|

|

|

|

|

|

|

|

Item 10

|

|

Material Contracts

|

|

|

|

|

|

Securities

Purchase Agreement

|

|

Attached

|

|

|

|

|

|

|

|

|

|

Convertible

Note

|

|

Attached

|

|

|

|

|

|

|

|

|

|

Security

Agreement

|

|

Attached

|

*

All exhibits are

numbered with the number preceding the decimal indicating the

applicable SEC reference number in Item 601 and the number

following the decimal indicating the sequence of the particular

document. Omitted numbers in the sequence refer to documents

previously filed as an exhibit.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

OCEAN THERMAL ENERGY CORPORATION

|

|

|

|

|

|

Company

Name

|

|

|

|

|

|

|

|

Date: June 1, 2018

|

By:

|

/s/ Jeremy P. Feakins

|

|

|

|

|

Jeremy P. Feakins

|

|

|

|

|

Chief Executive Officer

|

|

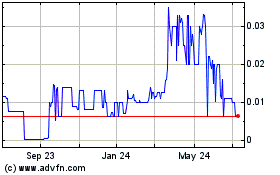

Ocean Thermal Energy (CE) (USOTC:CPWR)

Historical Stock Chart

From Feb 2025 to Mar 2025

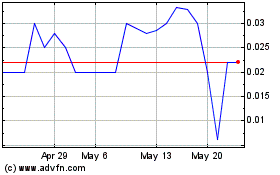

Ocean Thermal Energy (CE) (USOTC:CPWR)

Historical Stock Chart

From Mar 2024 to Mar 2025