Current Report Filing (8-k)

January 10 2022 - 1:54PM

Edgar (US Regulatory)

0001533030

false

0001533030

2022-01-10

2022-01-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported) January

10, 2022

Cryomass Technologies Inc

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-56155

|

|

82-5051728

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of incorporation)

|

|

|

|

Identification No.)

|

|

1001 Bannock St Suite

612, Denver CO

|

|

80204

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code 303-416-7208

(Andina Gold Corp.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol

|

|

Name of each Exchange on which Registered

|

|

None

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b -2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07. Submission of Matters to a Vote of Security Holders.

On

January 10, 2022, Cryomass Technologies Inc (the “Company”) held its Annual Meeting of Stockholders (the “Annual Meeting”).

As of the close of business on November 22, 2021, the record date for the Annual Meeting, 196,650,634 common shares of the Company were

outstanding and entitled to vote at the Annual Meeting. At the Annual Meeting,116,299,053 or approximately 59.1% of the outstanding common

shares entitled to vote, were represented in person or by proxy and, therefore, a quorum was present pursuant to the Company’s Bylaws,

which require 1% of the outstanding common shares entitled to vote to be present in order to meet quorum requirements.

.

The stockholders of the Company voted on the following

items at the Annual Meeting:

|

|

1.

|

A proposal to elect four directors, namely Messrs. Delon Human, Christian Noel, Mark Radke and Mario Gobbo

to serve until the next 2022 annual meeting of stockholders and until their respective successors are duly elected and qualified;

|

|

|

2.

|

A proposal to ratify the appointment of BF Borgers, CPA PC as the Company’s independent registered

public accounting firm for the fiscal year ending December 31, 2021;

|

|

|

3.

|

A proposal to approve and adopt the 2022 Stock Incentive Plan;

|

|

|

4.

|

A proposal to grant the Board of Directors the discretionary authority to amend the Company’s articles

of incorporation to effect a reverse stock split (the “Reverse Split Proposal”) of the Company’s common stock (the “Common

Stock”);

|

For more information about the foregoing proposals,

see the Company’s definitive proxy statement filed on November 30, 2021.

Set forth below are the voting results with respect

to the foregoing proposals.

|

|

1.

|

Proposal to elect four directors, namely Messrs. Delon Human, Christian Noel, Mark Radke and Mario

Gobbo to serve until the next 2022 annual meeting of stockholders and until their respective successors are duly elected and qualified.

|

FOR: 95,750,871

shares

AGAINST: 79,525

shares

ABSTAIN: 276,811shares

Based on the votes set forth above, the director

nominees were duly elected.

|

|

2.

|

Proposal to ratify the appointment of BF Borgers, CPA PC as the Company’s independent registered

public accounting firm for the fiscal year ending December 31, 2021.

|

FOR: 102,448,477

shares

AGAINST: 348,546

shares

ABSTAIN: 131,174

shares

Based on the votes set forth above, the appointment

of BF Borgers, CPA PC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021,

was duly ratified.

|

|

3.

|

Proposal to approve and adopt the 2022 Stock Incentive Plan.

|

FOR: 115,528,733

shares

AGAINST: 602,471

shares

ABSTAIN: 167,849

shares

Based on the votes set forth above, the 2022 Stock

Incentive Plan was duly approved and adopted.

|

|

4.

|

Proposal to grant the Board of Directors the discretionary authority to amend the Company’s articles

of incorporation to effect a reverse stock split (the “Reverse Split Proposal”) of the Company’s common stock (the “Common

Stock”).

|

FOR: 97,459,718

shares

AGAINST: 5,461,779

shares

ABSTAIN: 6,700

shares

Based on the votes set forth above, the Board

of Directors was duly granted the discretionary authority to amend the Company’s articles of incorporation to effect the Reverse

Split Proposal of the Common Stock.

Item 7.01. Regulation FD Disclosure.

On January 10, 2022, during the Annual Meeting

of the Stockholders of the Company, the Chief Executive Officer of the Company, Mr. Christian Noël, provided verbal remarks. A transcript

of his remarks is furnished as Exhibit 99.1 to this report and incorporated herein by reference.

The information in Item 7.01 of this Current Report

and Exhibit 99.1 is being furnished, not filed, pursuant to Items 7.01 and 9.01 of Form 8-K. Accordingly, the information in Items 7.01

and 9.01 of this Current Report, including Exhibit 99.1, will not be subject to liability under Section 18 of the Securities and Exchange

Act of 1934, as amended (the “Exchange Act”), and will not be incorporated by reference into any registration statement or

other document filed by the Company under the Securities Act of 1933, as amended, or the Exchange Act, unless specifically identified

therein as being incorporated by reference. The furnishing of information in this Current Report, including Exhibit 99.1, is not intended

to, and does not, constitute a determination or admission by the Company that the information in this Current Report, including Exhibit

99.1, is material or complete, or that investors should consider this information before making an investment decision with respect to

any security of the Company or any of its affiliates.

Item 9.01. Financial Statements and Exhibits.

NOTE REGARDING FORWARD LOOKING STATEMENTS

Any statements in this Current Report on Form

8-K or any exhibit hereto about future expectations, plans, and prospects for the Company, including statements about Company’s

future expectations, beliefs, goals, plans, or prospects, constitute “forward-looking statements” within the meaning of Section

27A of the Securities Act and Section 21E of the Exchange Act. In some cases you can identify forward-looking statements because they

contain words such as “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “might,” “likely,” “plan,” “potential,”

“predict,” “project,” “seek,” “should,” “target,” “will,” “would,”

or similar expressions and the negatives of those terms.

These forward-looking statements involve risks,

uncertainties, and assumptions that could cause actual performance or results to differ materially from those expressed or suggested by

the forward-looking statements. If any of these risks or uncertainties materialize, or if any of Company’s assumptions prove incorrect,

its actual results could differ materially from the results expressed or implied by these forward-looking statements. These risks and

uncertainties include risks associated with: Company’s ability to achieve or maintain profitability, and to effectively manage its

anticipated growth; and the risks described in the other filings Company makes with the Securities and Exchange Commission from time to

time, including the risks described under the heading “Risk Factors” in Company’s Annual Report on Form 10-K for the

year ended December 31, 2020 and subsequent quarterly reports on Form 10-Q, and which should be read in conjunction with its financial

results and forward-looking statements. All forward-looking statements in this Current Report on Form 8-K or any exhibit hereto are based

on information available to Company as of the date hereof, and it does not assume any obligation to update the forward-looking statements

provided to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Cryomass Technologies Inc

|

/s/ Christian Noël

|

|

|

Christian Noël

|

|

|

CEO

|

|

|

|

|

|

Date: January 10, 2022

|

|

4

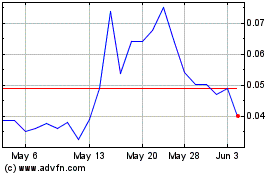

CryoMass Technologies (QB) (USOTC:CRYM)

Historical Stock Chart

From Dec 2024 to Jan 2025

CryoMass Technologies (QB) (USOTC:CRYM)

Historical Stock Chart

From Jan 2024 to Jan 2025