TOKYO—An 83-year-old convenience-store pioneer who built a

Tokyo-based 7-Eleven empire said Thursday he would step down after

losing a boardroom clash that pitted him against U.S. hedge-fund

operator Daniel Loeb.

The resignation of Toshifumi Suzuki, chief executive of

7-Eleven's parent company Seven & i Holdings, was a milestone

for the budding activist-shareholder movement in Japan, which has

drawn strength from Prime Minister Shinzo Abe's

corporate-governance overhaul. Mr. Suzuki has effectively

controlled his company for decades and is one of Japan's most

prominent executives.

The battle between Mr. Suzuki and Mr. Loeb centered on

succession and corporate strategy. Under Mr. Suzuki, Seven & i

Holdings has aggressively acquired other retailers including

department stores and a baby-goods chain, while retaining the

money-losing chain of big-box stores called Ito-Yokado that

originally formed the company's core.

Mr. Loeb said the company should shed those businesses and focus

on convenience stores globally. And he praised the head of the

convenience-store business in Japan, Ryuichi Isaka, calling Mr.

Isaka a natural candidate to replace Mr. Suzuki as the parent's

CEO.

The dispute came to a climax on Thursday morning, when the Seven

& i Holdings board met to consider a proposal backed by Mr.

Suzuki to oust Mr. Isaka from his job. The vote was as close as it

could be: 7-6 in favor, with two abstentions. The motion failed

because it needed a majority of the 15-member board.

Hours later, at a sometimes-emotional news conference, Mr.

Suzuki said he was stepping down. He described a lengthy effort to

get Mr. Isaka to quit that ultimately failed. Mr. Suzuki said that

in light of the turmoil, he no longer felt worthy of continuing in

the CEO role.

No new CEO was immediately named. Mr. Suzuki said the board

would have to consider that as part of a broader management revamp.

A company spokeswoman said Mr. Isaka wasn't available to

comment.

In a call with reporters in March, Mr. Loeb said he would be

concerned if Mr. Suzuki's son, who serves as chief information

officer of Seven & i Holdings, received an edge in the choice

of a successor. "This is not a dynasty. This is a corporation," Mr.

Loeb said. He said in a March 27 letter to Seven & i Holdings'

directors: "Mr. Isaka should be rewarded—not demoted—for his

performance and commitment to delivering results for

shareholders."

The elder Mr. Suzuki denied that he wanted his son as a

successor. "I have never said it at the company and I have never

said it to my son either," he told the news conference.

Shares of Seven & i Holdings fell more than 8% at one point

Thursday but recovered to finish down 1.6% after news of the elder

Mr. Suzuki's planned resignation emerged.

In Japan, convenience stores are ubiquitous, selling a wide

variety of products such as rice balls and toiletries. They have

expanded into services, allowing customers to pay utility bills and

buy tickets to concerts. Mr. Suzuki helped develop the concept of

flooding urban areas with small stores, typically open 24 hours,

and carefully managing inventory of the 2,000 or 3,000 items people

are most likely to need.

The clash between Mr. Suzuki and Mr. Loeb reflects broader

changes in corporate governance roiling Japanese business.

A corporate-governance code pushed by the Abe government took

effect in June 2015, calling on companies to appoint outside

directors and pay more heed to shareholder concerns. One outside

director at Seven & i Holdings, Kunio Ito, led a government

panel that produced the 2014 "Ito Report" calling for a stronger

focus on shareholder returns.

Akira Kiyota, chief executive of the company that runs the Tokyo

Stock Exchange, said in an interview that the Seven & i

Holdings board's vote was an example of outside directors' growing

influence, an idea the exchange has helped promote in Japan.

"Governance is working," he said.

Mr. Loeb has said that his fund, Third Point LLC, owns hundreds

of millions of dollars in common shares of Seven & i Holdings.

The investor has made a name for himself in recent years by

challenging Sony Corp. to restructure unprofitable units and urging

industrial-robot maker Fanuc Corp. to raise dividends—with some

success in both cases.

The company now called Seven & i Holdings was long centered

around the big-box Ito-Yokado stores, which founder Masatoshi Ito

built on a U.S. model selling groceries, clothes and household

items.

In 1991, the Japanese company acquired the U.S. operator of

7-Eleven stores. Today, the global 7-Eleven business is fully owned

by the Tokyo-based company and it has more than 58,000 convenience

stores in Japan, North America, China and elsewhere.

Seven & i Holdings released results Thursday for the year

ending in February 2016 that showed how the convenience-store

business has come to dominate its profits while the big-box stores

are struggling—a point stressed by Mr. Loeb. 7-Eleven Japan

reported operating income of slightly more than $2 billion, while

Ito-Yokado posted an operating loss.

Founder Mr. Ito, 91, remains honorary chairman of Seven & i

Holdings, although he is no longer on the board. In a twist, Mr.

Suzuki's camp said it sought the founder's approval for Thursday's

board motion, but Mr. Ito refused to give it for reasons that

weren't clear. A spokeswoman said he wasn't available to

comment.

Mr. Suzuki appeared saddened by the rebuff from his longtime

patron. "He had never disagreed with whatever I proposed," Mr.

Suzuki said.

Write to Megumi Fujikawa at megumi.fujikawa@wsj.com and Kosaku

Narioka at kosaku.narioka@wsj.com

(END) Dow Jones Newswires

April 07, 2016 08:25 ET (12:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

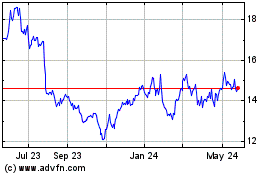

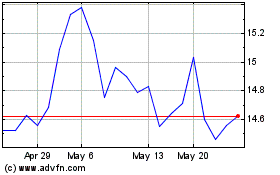

Fanuc (PK) (USOTC:FANUY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Fanuc (PK) (USOTC:FANUY)

Historical Stock Chart

From Feb 2024 to Feb 2025