UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

November 30, 2015

FBEC WORLDWIDE, INC.

(Exact Name of Registrant as Specified in its

Charter)

| Wyoming |

000-52297 |

47-3855542 |

| (State of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

1621 Central Ave., Cheyenne, WY 82001

(Address of principal executive

offices)

N/A

(Former Name or former address if changed from

last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b)) |

| o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

On November 30, 2015, FBEC Worldwide, Inc., (“FBEC”)

entered into a joint venture agreement (the “JV Agreement”) with DuBe Hemp Beverages Inc. (“DUBE”). Pursuant

to the JV Agreement FBEC and DUBE will form a limited liability company (the “LLC”), which shall be owned as follows:

50.1% by FBEC and 49.9% by DUBE. The LLC shall create a strategic alliance between the brands currently held by the parties, respectively

in an effort to lend support in a multitude of areas and consolidate businesses in the cannabis and hemp industry. FBEC will take

on the role of online digital marketer in a wide variety of online spaces as well as provide fulfilment support for the distribution

of all brands at FBEC’s expense. To the extent set forth in this Agreement, each of the Parties shall own an undivided fractional

part in the LLC. Jason Spatafora and Phil Restifo shall be the managing members of the LLC (the “Managing Members”).

The term of the JV Agreement shall be one year. The JV Agreement

may be terminated by either party in writing with thirty (30) days’ notice.

FBEC, through the operations of LLC, in connection with the products

produced by DUBE, will perform the following tasks:

● Handle all digital and

social media marketing; attempt to increase sales online and via wholesale channels utilising SEO activities and Google Adword

commitment.

● Connect fulfillment centre

to website and coordinate sales GUI for wholesale ordering by sales team members.

● Data collection on retailers,

distributors and wholesalers.

● Identify, list and provide

all free or discounted banner groups available.

● Implement logistical and

distribution manager to handle fulfilment needs by using inventory management software.

● Create a tracking platform

using available technology to maintain accurate records of purchase orders, accounts receivable and all other expenditures related

to day to day business of má products.

● Create marketing strategies

to extend the footprint of all brands associated with the LLC by both traditional marketing means, celebrity endorsement and product

placement with prior approval of strategy and marketing aims in unison with DUBE as brand owners.

● Agree to a funding commitments

for both promotions and conventions.

● Provide its scientific

advisory team to propose ideas to DUBE, test and create new products that DUBE could deem unique and worth pursuing.

● Seek approval from DUBE

in connection with the marketing of any other competing product or proposition, without such approval FBEC would be prohibited

from any further activity in this respect.

● Liaise with DUBE on all

proposed product pricing issues, discounts, promotions, campaigns, PR, social media, advertising and all other marketing issues

with the objective of streamlining má brand and marketing campaigns worldwide.

● Coordinate the payment

to DUBE of its profit distribution, pursuant to the Operating Agreement, within 10 business days of each month end.

● DUBE, through the operations

of the LLC, will:

● Share distribution pipeline

opportunities, marketing, and public relations with FBEC for the purpose of extending DUBE products and FEBEC’s WofShot (“WolfShot”)

brand footprints in the cannabis and hemp space.

● Connect

FBEC with all personnel currently managing and overseeing the production, sales, distribution, packaging, and marketing of DUBE

products.

● Direct

all revenue and product flow related to the DUBE brand in the United States through the LLC and assist FBEC in its preparation

of periodic financial reports as to be filed with the Securities and Exchange Commission.

The parties shall share the net profit realized by the LLC, if any,

within 10 business days of each month end. 30% of all net profits related to DUBE products shall be distributed to FBEC. 70% of

all net profits related to DUBE products shall be distributed to DUBE. 30% of all net profits related to WolfShot products to shall

be distributed to DUBE. 70% of all net profits related to WolfShot products shall be distributed to FBEC. 50% of all net profits

related to co-branded products shall be distributed to both parties. FBEC shall also issue DUBE 6,000,000 shares of restricted

common stock over the coming year.

Prior to the date of the JV Agreement, the

parties thereto had no interaction other than the negotiation of the JV Agreement.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

10.1

|

Joint Venture Agreement, by and between FBEC Worldwide,

Inc. and DuBe Hemp Beverages Inc., dated November 30, 2015.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly

caused this report to be signed on its behalf by the undersigned, hereunto duly

authorized.

| |

FBEC Worldwide, Inc. |

| |

|

| |

By: |

/s/ Jason Spatafora |

| |

|

Jason Spatafora

Chief Executive Officer |

Date: November 30, 2015

EXHIBIT INDEX

| Exhibit No. |

|

Document Description |

|

| |

|

|

|

|

10.1

|

|

Joint Venture Agreement, by and between FBEC Worldwide, Inc. and

DuBe Hemp Beverages Inc., dated November 30, 2015.

|

|

| |

|

|

|

Exhibit 10.1

Joint

Venture Agreement

This AGREEMENT is made on this date November

30, 2015

duly signed and totally binding on all parties mentioned hereunder.

as “ First Party”

FBEC Worldwide, Inc.

1621 Central Ave.

Cheyenne, WY 82001

And as “Second Party”

DuBe Hemp Beverages Inc.

8101 w. Rosada Way

Las Vegas, NV 89149

Hereinafter also referred to collectively as the “Parties”

and individually as the “Party”.

WHEREAS:

The Parties identified herein, for the

purpose of consolidating power/footprint in the cannabis and hemp industry through this Joint Venture Agreement (“Agreement”)

by and between the Parties identified herein through the formation of a Florida limited liability company (the “LLC”);

and

The Parties agree that this Agreement shall

also be binding on affiliates and related companies in the widest meaning of this definition. This agreement is a partnership in

any transaction between either buyers, sellers, distributors or other service providers that either of the parties has introduced.

The Parties agree to do nothing to circumvent or avoid their obligations under this Agreement or to avoid their obligations to

the other Party; and

The Parties wish to enter into an Agreement

to define their respective roles and responsibilities and thus successfully satisfy the objectives of these transactions; and

To perform certain functions, and thereby

binding all the Parties to the terms and conditions of this Agreement.

IT IS NOW,

THEREFORE, AGREED by the undersigned parties to this Agreement that the various promises, covenants, warranties and

undertakings set forth herein shall constitute good and valuable consideration, the receipt and adequacy of which the Parties acknowledge

by signing below. The Parties hereto agree to work together in good faith, using their best efforts and resources as set forth

below:

| 1. | | THE PURPOSE OF THIS AGREEMENT |

This Agreement is drawn for the express

purpose of forming the LLC, which shall be owned as follows: 50.1% by the First Party and 49.9% by the Second Party. The LLC shall

create a strategic alliance between the brands currently held by the Parties, respectively in an effort to lend support in a multitude

of areas and consolidate businesses in the cannabis and hemp industry. The First Party will take on the role of online digital

marketer in a wide variety of online spaces as well as provide fulfilment support for the distribution of all brands at the First

party’s expense. To the extent set forth in this Agreement, each of the Parties shall own an undivided fractional part in

the LLC. The LLC shall not engage in any other business or activity without the written consent of the Parties. In addition to

this Agreement, the purpose and operations of the LLC will be detailed in the applicable operating agreement of the LLC (the “Operating

Agreement”). Jason Spatafora and Phil Restifo shall be the managing members of the LLC (the “Managing Members”)

This Agreement shall become effective upon

execution and shall continue to be in effect for a period of one (1) year, or until the obligations of each of the parties are

fulfilled as set forth herein, including any roll-overs, extensions, additions, renewals or revisits to this Agreement, or until

discharge or termination as set forth elsewhere herein. This Agreement shall be binding upon the Parties, their Principals, Heirs,

Successors, Assigns, Subsidiaries, Attorneys, Agents or any other party deriving or claiming to derive benefit here from, or becomes

involved with it, or it's subject matter in any way. The Agreement may be terminated by either Party in writing with thirty

(30) days notice, as long as all financial obligations generated herein are completed to their fruition. All terms in the Confidentiality,

Non-Circumvention and Non-Disclosure Agreement Section of this agreement shall survive any termination noted herein.

The transactions intended by the Parties

hereto, and the duties of the various parties with respect to such transactions, are described as follows:

3.1 Duties of the First Party, through

the operations of LLC, in connection with the products produced by the Second Party:

● Handle

all digital & social media marketing; increase sales online and via wholesale channels utilising SEO activities and Google

Adword commitment for the Second Party domain www.dube-elevates.com.

● Connect

fulfilment centre to website and coordinate sales GUI for wholesale ordering by sales team members.

● Data collection

on retailers, distributors and wholesalers.

● Identify,

list and provide all free or discounted banner groups available.

● Implement

logistical and distribution manager to handle fulfilment needs by using inventory management software.

● Create

a tracking platform using available technology to maintain accurate records of purchase orders, accounts receivable and all other

expenditures related to day to day business of the Second Party products.

● Create

marketing strategies to extend the footprint of all brands associated with this joint venture by both traditional marketing means,

celebrity endorsement and product placement with prior approval of strategy and marketing aims in unison with the Second Party

as brand owners.

● Agree to

a funding commitment for the Second Party operations and marketing.

● Provide

its scientific advisory team to make proposals to the Second Party, and to test and create new products that the Second Party deems

unique and worth pursuing.

● Seek approval

from the Second Party in connection with the marketing of any other competing product or proposition, without such approval the

First Party would be prohibited from any further activity in this respect.

● Liaise

with the Second Party on all proposed product pricing issues, discounts, promotions, campaigns, PR, social media, advertising and

all other marketing issues with the objective of streamlining the Second Party brand and marketing campaigns worldwide.

● Coordinate

the payment to the Second Party of its profit distribution, pursuant to the Operating Agreement, within 10 business days of each

month end.

3.2 Duties of the Second Party, through

the operations of the LLC:

● Share distribution

pipeline opportunities, marketing, and public relations network with the First Party for the purpose of extending Dube and WolfShot

brand footprints in the expanding cannabis & hemp space.

● Connect

the First Party with all personnel currently managing and overseeing the production, sales, distribution, packaging, and marketing

of Dube products.

● Direct

all revenue and product flow related to the Dube brand in the United States through the LLC and assist the First Party in its preparation

of periodic financial reports as to be filed with the Securities and Exchange Commission.

| 4. | | PROFITS, COSTS & DISTRIBUTION OF PROFITS |

The Parties in this Agreement agree to

act in joint efforts in completion of the formation of the LLC and the undertaking of the purpose of this Agreement and the LL.

The Parties shall share the Net Profit realized by the LLC, if any, within 10 business days of each month end, in accordance with

the terms of the Operating Agreement. “Net Profit” as used herein, shall mean, for each month, an amount equal to the

Licensor's taxable income, if any, for such month, determined in accordance with section 703(a) of the Internal Revenue Code of

1986, as amended from time to time (for this purpose, all items of income, gain, loss or deduction required to be stated separately

pursuant to section 703(a)(1) of the Code shall be included in taxable income, as applicable). All Net Profit is to be disbursed

as follows:

30% (Thirty percent)

of all Net Profits related to Dube products to First Party.

70%

(Seventy percent) of all Net Profits related to Dube products Second Party.

30% (Thirty percent)

of all Net Profits related to WolfShot products to Second Party

70%

(Seventy percent) of all Net Profits related to WolfShot products to First Party.

50%

(Fifty percent) of all Net Profits related to co-branded products to both Parties.

| 5. | | BANKING and BANKING COORDINATES |

Banking information for the Parties to

this Agreement will be provided and shall provide the coordinates necessary for wire transfers of Net Profit.

| 6.1. | | Confidentiality, Non-Circumvention, Non-Disclosure and Non-Solicitation Agreement. |

All Parties agree that all information

received from any other Party shall be used for the collective good of the transaction between the Parties and is not to be used

in any way to:

| 6.1.1. | | circumvent, eliminate, reduce or in any way diminish the role of the another Party; |

| 6.1.2. | | capitalize on, leverage, or in any way benefit individually and separately over the

another Party from or by the use of said information outside of the spirit and purpose of this joint venture between the Parties; |

| 6.1.3. | | compete directly or indirectly with another Party. The intent is that recipient by

receiving confidential information including investor names, customer lists, etc. from the disclosing Party will not use this

information to compete with or circumvent the disclosing Party; |

| 6.1.4. | | disclose any current, past and future transaction to any third party; |

| 6.1.5. | | disclose any and all internal discussion, disputes or conversations to any third unrelated

party; |

| 6.1.6. | | solicit nor accept any business from sources, nor their affiliates, that are made

available by the other Party to this Agreement, at any time or in any manner, for a period beginning on the date hereof and ending

one (1) year from the termination of this Agreement, without the express written permission of the Party who made the source available;

and |

| 6.1.7. | | solicit for employment and employees of the other Party for a period beginning on

the date hereof and ending one (1) year from the termination of this Agreement, without the express written permission of the

Party who employs such employee. |

| 6.2. | | Exclusivity. This relationship between the Parties is exclusive, which means

that each Party is under an obligation to submit opportunities related to the Dube brand to the LLC. |

| 6.3. | | Obligations of the Parties. The Parties agree to work together to accomplish

the objectives of the transaction by performing timely, professionally and ethically and the Parties agree to carry out their

responsibilities as set forth in this Agreement. Each Party is responsible for meeting its committed cost share and tax liabilities

throughout the term of this Agreement. No Party is responsible for the costs or tax liabilities of any other Party. It is understood,

timing is a key factor in this market place where the parties are operating, therefore, each party shall act as time is of the

essence on each transaction. |

| 6.4. | | Indemnity. Each Party shall defend, indemnify, and hold the other Party and

their directors, officers, employees, and representatives harmless from and against any and all liabilities, losses, damages,

and costs, including reasonable attorney's fees, resulting from, arising out of, or in any way connected with: |

| 6.4.1. | | Any breach by them of any warranty, representation, or agreement contained in this

Agreement, |

| 6.4.2. | | The performance of the Party’s duties and obligations under this Agreement. |

| 6.5. | | Liability. Each Party acknowledges that it shall be responsible for any loss,

cost, damage, claim, or other charge that arises out of or is caused by the actions of that Party or its employees or agents.

No Party shall be liable for any loss, cost, damage, claim, or other charge that arises out of or is caused by the actions of

any other Party or its employees or agents. The Parties agree that consequential or punitive damages may be applicable or awarded

with respect to any dispute that may arise between or among the Parties in connection with this Agreement. |

| 6.6. | | Termination. The Agreement may be terminated by either Party in writing. Written

notice must be provided and a confirmation of receipt sought and shall take effect 30 business days following confirmation of

receipt of notice. In addition, the Parties agree that; |

| 6.7.1. | | All website URL’s in connection with the Dube brand shall revert and remain

under the sole ownership and control of the Second Party; |

| 6.7.2. | | All social media and developed content shall revert and remain under the sole ownership

and control of the Second Party; |

| 6.7.3. | | All fulfilment centre activities, installed sales software and relationships in connection

with the Dube brand and the sale of Dube products will revert to the sole control of the Second Party; |

| 6.7.4. | | All sales leads and customer information generated from all marketing, social media

and any other type of promotional activities will continue to be made available to the Second Party by the First Party. |

| 6.7. | | Survival. All terms in the Confidentiality, Non-Circumvention and Non-Disclosure

Agreement Section of this agreement shall survive any termination noted herein. |

| 6.8. | | Governing Law. This Agreement shall be governed by and interpreted in accordance

with the Laws the State of New York. |

| 6.9. | | Disputes. In the event of disputes, the Parties agree to use their reasonable

best effort to settle all disputes amicably. However, when an impasse is reached and a dispute cannot be otherwise settled, then,

all disputes arising in connection with the present contract shall be settled under the rules of the State of New York and arbitration

within the State of New York. |

| 6.10. | | Language: English version it would be the only accepted as legitime text between

the parties even if it contains grammatical mistakes. |

| 6.11. | | Best Effort. The Parties will use their best effort in completing the transaction.

Each transaction has it’s inherit risk. |

| 6.12. | | Headings. Article and section headings contained in this Agreement are included

for convenience only and form no part of the Agreement among the Parties. |

| 6.13. | | Severability. If any provision of this Agreement is declared invalid by any

court or government agency, all other provisions shall remain in full force and effect. |

| 6.14. | | Use of Names. No Party shall use in any correspondence, advertising, promotional,

or sales literature the name of any other Party without prior signed written consent of the other Party. |

| 6.15. | | Waivers. Waiver by any Party of any breach or failure to comply with any provision

of this Agreement by another Party shall not be construed as, or constitute, a continuing waiver of such provision or a waiver

of any other breach of or failure to comply with any other provision of this Agreement. |

| 6.16. | | Relationships, Taxation and Money Laundering. It is understood and agreed by

the Parties that this Agreement in and of itself does not create an employer-employee relationship, a partnership for tax purposes

or for any other reason. The Parties confirm that they will observe the laws of their respective jurisdictions. Each Party will

be fully responsible for their own taxation and declare that they will not use these said funds for any illicit or illegal activities

covering any existing law associated with money laundering or evasion associated with international laws governing the transfer

of monies for the avoidance of debt. No Party of this Agreement shall be liable for any taxation payments required by any and

all governing authorities for any other participating Party. |

| 6.17. | | Expenses of LLC. All losses and disbursements in acquiring, holding and protecting

the business interest of the LLC and the Net Profits shall, during the term of this Agreement, be paid by the equally by the Parties.

The Parties will review and agree on all costs and expenditures that are allocated to the Net Profit calculation. Furthermore,

revenues may be drawn upon to finance further stock inventory with 24 hours’ notice by the Second Party for approval by

the First Party, such approval not to be unreasonably withheld. |

| 6.18. | | Restricted Stock Issuance. The First Party shall issue the Second Party a minimum

of 6,000,000 shares of its common stock, $.001 par value per shares (the “Shares”). The Shares shall be issued in

tranches monthly or quarterly, as to be reasonably agreed to by the Parties. |

| 6.19. | | Halt. In the event that the trading of First Party’s common stock on

the open market is halted, this Agreement shall terminate upon written notice from the Second Party. The LLC will still manage

all day to day business until a reasonable contingency plan is carried out. The First Party will bear all costs and expenses following

termination in this event. |

| 6.20. | | Board of Directors. The Second Party shall have the right to appoint one director

to the Board of Directors of the First Party, thereby giving the Board two members. This right will cease upon termination of

this Agreement. |

| 7.1. | | Any notices required hereof shall be in writing and delivered by Courier, Certified

Mail or by telefax, email fax to the other part's address provided elsewhere herein. The Parties acknowledge and agree that such

copies are legally acceptable and considered original documents. |

| 7.2. | | Changes or deletion of any part of this Agreement shall have no effect unless agreed

in writing by all Parties hereto. |

| 7.3. | | The Parties hereto accept liability for taxes, imposts, levies, duties, charges and

any other Institutional costs applicable to the execution of their part in this Agreement. |

| 7.4. | | All statements, undertakings and representations are made without omission of any

material fact, with personal, corporate and legal responsibility, under Penalty of Perjury. |

| 7.5. | | Each signatory to this Agreement confirms and declares that he is empowered, legally

qualified and authorised to execute and deliver this Agreement and to be bound by its Terms and Conditions. |

| 7.6. | | This Agreement commences and becomes valid when authorised Parties have affixed their

signatures to this page and have initialled all other pages thereof. This Agreement shall remain valid without respect to invalidity,

failure or the inability to enforce any part hereof. |

| 7.7. | | All electronic transmissions (ie facsimile, email, etc) of this Agreement, or any

other associated document(s) to this transaction shall be considered as legal, binding and enforceable instruments, treated as

original copy. |

THIS JOINT VENTURE AGREEMENT

is now, therefore, executed this November 30, 2015

for and on behalf of

Mr. Jason Spatafora /s/

Jason Spatafora

FBEC Worldwide, Inc.

Mr. Phil Restifo /s/

Phil Restifo

DuBe Hemp Beverages Inc.

8101 W. Rosada Way

Las Vegas, NV 89149

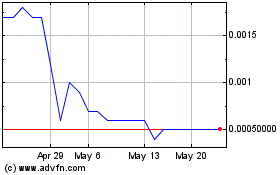

FBEC Worldwide (CE) (USOTC:FBEC)

Historical Stock Chart

From Jan 2025 to Feb 2025

FBEC Worldwide (CE) (USOTC:FBEC)

Historical Stock Chart

From Feb 2024 to Feb 2025