UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement

Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

[ ] Preliminary Information

Statement

[ ] Confidential, for

Use of the Commission Only (as permitted by Rule 14c-5(d)(2)

[ X] Definitive Information Statement

FBEC WORLDWIDE,

INC.

(Name of Registrant As Specified

In Chapter) Payment of Filing Fee (Check the appropriate box)

[X] No fee required

[ ] Fee computed on table below per Exchange

Act Rules 14c-5(g) and 0-11

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

[ ] Fee

paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Preliminary Copy

FBEC WORLDWIDE, INC.

(a Wyoming corporation)

INFORMATION STATEMENT

Date first mailed to stockholders:

1621

Central Ave.

Cheyenne,

WY 82001

(Principal

Executive Offices)

We are not asking you

for a proxy and you are requested not to send us a proxy.

Item 1. Information Required by Items of Schedule

14A.

This Information Statement has been filed with the

Securities and Exchange Commission and is being mailed or otherwise furnished to the registered stockholders of FBEC Worldwide,

Inc. (“FBEC”) in connection with the prior approval by the board of directors of FBEC, and receipt by the board of

approval by written consent of the holders of a majority of FBEC’s outstanding shares of common stock, of a resolution to,

| 1. | amend the Fourth Article of the Articles of FBEC Worldwide, Inc. by reducing the authorized shares

of common stock from 5,000,000,000 shares to 2,200,000,000 shares of common stock with a par value of $0.001 per share; |

(the “Resolution”).

The Wyoming Business Corporation Act and the By-laws

of FBEC provide that any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting

if stockholders holding at least a majority of the voting power sign a written consent approving the action.

On January 28, 2016, the board of directors of FBEC

approved and recommended the Resolution. Subsequently, the holders of a majority of the voting power signed and delivered to FBEC

written consents approving the Resolution, in lieu of a meeting. Since the holders of the required majority of shares of common

stock have approved the Resolution, no other votes are required or necessary and no proxies are being solicited with this Information

Statement.

FBEC has obtained all necessary corporate approvals

in connection with the Resolution and your consent is not required and is not being solicited in connection with the approval of

the Resolution. This Information Statement is furnished solely for the purpose of informing stockholders in the manner required

under the Securities Exchange Act of 1934 of these corporate actions before they take effect.

The Resolution will not become

effective until (i) 21 days from the date this Information Statement is first mailed to the stockholders, or, (ii) such later date

as approved by the board of directors, in its sole discretion. The Certificate of Amendment will be filed with the Secretary of

State of Wyoming and is expected to become effective on or about March 8, 2016.

This Information Statement is dated

February 12, 2016 and is first being mailed to stockholders on or about February 16, 2016. Only shareholders of record at the

close of business on January 28, 2016 are entitled to notice of the Resolution and to receive this Information Statement.

Reasons for the Amendments to Articles

The amendment to the Articles of Incorporation of FBEC

to decrease the authorized capital is being made, in part, to tighten the capital structure of FBEC, and ease any concerns of material

diluting events.

Potential Anti-takeover Effect

Release No. 34-15230 of the staff of the Securities

and Exchange Commission requires disclosure and discussion of the effects of any shareholder proposal that may be used as an anti-takeover

device. However, as indicated above, the purpose of the decrease in the authorized capital is to tighten FBEC’s capital structure,

and not to construct or enable any anti-takeover defense or mechanism on behalf of FBEC. Although the decrease of the authorized

capital could, under certain circumstances, have an anti-takeover effect, the Resolution is not being undertaken in response to

any effort of which the Board of Directors is aware to accumulate shares of FBEC’s common stock or obtain control of FBEC.

Other than the Resolution, the Board of Directors does

not currently contemplate the adoption of any other amendments to the Articles of Incorporation that could be construed to affect

the ability of third parties to take over or change the control of FBEC. While it is possible that management could use the decrease

in authorized shares to resist or frustrate a third-party transaction providing an above-market premium that is favored by a majority

of the independent stockholders, FBEC currently has no intent or plans or proposals to take advantage of the decrease in authorized

shares as an anti-takeover device or to adopt other provisions or enter into other arrangements that may have anti-takeover ramifications.

Other than the super voting rights of FBEC’s

preferred shares of common stock, FBEC has no anti-takeover mechanisms present in its governing documents or otherwise. FBEC confirms

that there are no plans or proposals to adopt any such additional provisions or mechanisms or to enter into any arrangements that

may have material anti-takeover consequences.

Other provisions of FBEC’s Articles of Incorporation

and Bylaws may have anti-takeover effects, making it more difficult for or preventing a third party from acquiring control of FBEC

or changing its Board of Directors and management. According to FBEC’s Articles of Incorporation and Bylaws, the holders

of FBEC’s common stock do not have cumulative voting rights in the election of FBEC’s directors. The combination of

the present ownership by a stockholder of all of the super voting preferred shares and lack of cumulative voting makes it more

difficult for other stockholders to replace FBEC’s Board of Directors or for a third party to obtain control of FBEC by replacing

its Board of Directors.

| b. | Dissenters’ Right of

Appraisal. |

Neither the Articles and By-laws of FBEC nor the Wyoming

Business Corporation Act provide for dissenters’ rights of appraisal in connection with the Resolution.

| c. | Voting Securities and Principal

Holders Thereof |

As of January 29, 2016, there were 261,847,598 outstanding

shares of common stock of FBEC, each of which was entitled to one vote for the purpose of approving the Resolution. Also as of

January 29, 2016, there were 1,000 outstanding shares of preferred stock, voting 66.7% of the outstanding voting rights, held by

Vinyl Groove Productions, Inc. Stockholders of record at the close of business on January 28, 2016 (the date of the stockholders’

written consent) were furnished copies of this Information Statement.

FBEC has $1,284,274 of outstanding convertible promissory

notes that are convertible into approximately 1,148,657,148 shares of common stock, based on the market price on January 29, 2016.

| (i) | Security Ownership of Certain Beneficial Owners (more than 5%) |

To the best knowledge of FBEC, the following table

sets forth all persons beneficially owning more than 5% of the common stock of FBEC as at January 29, 2016. Unless otherwise indicated,

each of the following persons may be deemed to have sole voting and dispositive power with respect to such shares.

| (1) |

(2) |

(3) |

(4) |

| Title of Class |

Name and Address of

Beneficial Owner |

Amount and

Nature of

Beneficial

Owner |

Percent of

Class1 |

| Shares of common stock |

Robert Sand

11801 Skipper Ct.

Penn Valley, CA 959462

|

201,006,528 |

76.8% |

1

Based on 261,847,598 shares of common stock issued and outstanding as of January 29, 2016.

2 51,006,258 of the 201,006,528

shares of common stock are held by S&L Capital, LLC, of which Robert Sand is the President and Managing Member.

| (ii) | Security Ownership of Management |

| (1) |

(2) |

(3) |

(4) |

| Title of Class |

Name and Address of

Beneficial Owner |

Amount and

Nature of

Beneficial

Owner |

Percent of

Class |

| Shares of common stock |

Jason Spatafora

535 NE 17th Way

Fort Lauderdale, FL 33301

|

0 |

0% |

| |

|

|

|

| Shares of common stock |

Directors and Officers

as a group (1 person)

|

0 |

0% |

FBEC is not aware of any arrangement that may result

in a change in control of FBEC.

Item 2. Statement That Proxies Are Not

Solicited.

We are not asking you for a proxy and you

are requested not to send us a proxy.

Item 3. Interest of Certain Persons in or

Opposition to Matters to Be Acted Upon.

Vinyl Groove Productions, Inc., the holder of a majority

of FBEC’s voting interest approved the Resolution on January 28, 2016. At that time and as of the date of this Information

Statement, Jason Spatafora has no beneficial ownership in any shares of common stock in the capital of FBEC.

Management has not received any notice of opposition

to the Resolution.

Item 4. Proposals by Security Holders.

Not applicable as no proposals submitted.

| |

BY ORDER OF THE BOARD OF DIRECTORS |

| |

|

| |

|

|

/s/ Jason Spatafora |

| Dated: February 12, 2016 |

Jason Spatafora, Chief Executive Officer |

| |

|

| |

|

| |

|

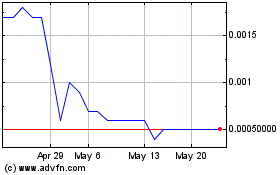

FBEC Worldwide (CE) (USOTC:FBEC)

Historical Stock Chart

From Jan 2025 to Feb 2025

FBEC Worldwide (CE) (USOTC:FBEC)

Historical Stock Chart

From Feb 2024 to Feb 2025