As filed with the Securities and Exchange Commission on December 27, 2024

Registration No. 333-274971

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 2

TO

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

FUELCELL ENERGY, INC.

(Exact Name of Registrant as Specified in its Charter)

| |

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

|

06-0853042

(I.R.S. Employer

Identification Number)

|

|

3 Great Pasture Road

Danbury, Connecticut 06810

(203) 825-6000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Jason Few

President and Chief Executive Officer

FuelCell Energy, Inc.

3 Great Pasture Road

Danbury, Connecticut 06810

(203) 825-6000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

With copies to:

| |

Paul D. Broude, Esq.

Megan A. Odroniec, Esq.

Foley & Lardner LLP

111 Huntington Avenue

Boston, Massachusetts 02199

Telephone: (617) 342-4000

|

|

|

Joshua Dolger, Esq.

Executive Vice President, General Counsel and

Corporate Secretary

FuelCell Energy, Inc.

3 Great Pasture Road

Danbury, Connecticut 06810

Telephone: (203) 825-6000

|

|

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ☐

|

|

|

Accelerated filer ☒

|

|

|

Non-accelerated filer ☐

|

|

|

Smaller reporting company ☐

|

|

| |

|

|

|

|

|

|

|

|

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

Post-Effective Amendment No. 1 to the Registration Statement on Form S-3 (File No. 333-274971), or Post-Effective Amendment No. 1, of FuelCell Energy, Inc., or the Company, was filed because the Company expected that it would no longer be a “well-known seasoned issuer” (as such term is defined in Rule 405 of the Securities Act of 1933, as amended) when it filed its Annual Report on Form 10-K for the fiscal year ended October 31, 2024. Accordingly, the Company filed Post-Effective Amendment No. 1 for the purpose of including disclosure required for a registrant other than a well-known seasoned issuer, identifying the securities being registered, registering a specific amount of securities, paying the associated filing fee and making certain other amendments. This Post-Effective Amendment No. 2 to the Registration Statement on Form S-3 (File No. 333-274971), or this Post-Effective Amendment No. 2, of the Company is being filed using EDGAR submission type POS AM to convert the Registration Statement to the appropriate EDGAR submission type for a non-automatic shelf registration statement.

This Post-Effective Amendment No. 2 contains:

•

a base prospectus covering the offering, issuance and sale by the Company of up to $405,000,000 of the securities identified therein from time to time in one or more offerings; and

•

a sales agreement prospectus supplement covering the offering, issuance and sale by the Company of up to a maximum aggregate offering price of $204,922,876.65 of the Company’s common stock that may be issued and sold from time to time under the Open Market Sale AgreementSM as amended (the “sales agreement”) with Jefferies LLC, B. Riley Securities, Inc., Barclays Capital Inc., BMO Capital Markets Corp., BofA Securities, Inc., Canaccord Genuity LLC, Citigroup Global Markets Inc., J.P. Morgan Securities LLC and Loop Capital Markets LLC.

The base prospectus immediately follows this explanatory note. The specific terms of any securities to be offered by the Company pursuant to the base prospectus, other than the shares of common stock under the sales agreement, will be specified in a separately filed prospectus supplement to the base prospectus. The specific terms of the shares of common stock to be issued and sold under the sales agreement are specified in the sales agreement prospectus supplement that immediately follows the base prospectus. The shares of common stock that may be offered, issued and sold under the sales agreement prospectus supplement is included in the $405,000,000 of securities that may be offered, issued and sold by the Company pursuant to the base prospectus. Upon termination of the sales agreement, any portion of the aggregate amount of shares of common stock included in the sales agreement prospectus supplement that is not sold pursuant to the sales agreement will be available for sale in other offerings pursuant to the base prospectus and a corresponding prospectus supplement, and if no shares of common stock are sold under the sales agreement, the full amount of securities may be sold in other offerings by the Company pursuant to the base prospectus and a corresponding prospectus supplement.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated December 27, 2024

PROSPECTUS

FuelCell Energy, Inc.

$405,000,000

Common Stock

Warrants

Units

We may offer and sell from time to time up to $405,000,000 in the aggregate of shares of our common stock and warrants, as well as units that include any combination of the foregoing securities. We may sell any combination of these securities in one or more offerings on the terms to be decided at the time of sale. We will provide specific terms of the offering in supplements to this prospectus. You should read this prospectus and any prospectus supplement carefully before you invest.

Securities may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters or through a combination of these methods. See “Plan of Distribution” in this prospectus for more information. We may also describe the plan of distribution for any particular offering in any applicable prospectus supplement. If any agents, underwriters or dealers are involved in the sale in respect of which this prospectus is being delivered, we will disclose their names and the nature of our arrangements with them in a prospectus supplement. The net proceeds we expect to receive from any such sale will also be included in a prospectus supplement. No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of the offering.

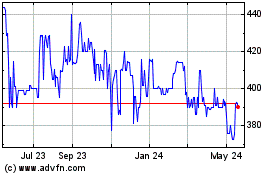

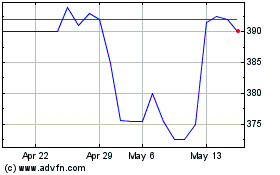

Our common stock is listed on The Nasdaq Global Market under the symbol “FCEL.” On December 26, 2024, the last reported sale price for our common stock was $10.60 per share.

Investing in our securities involves a high degree of risk. See “Risk Factors” on page 3 of this prospectus and any other risk factors included in any accompanying prospectus supplement and in the documents incorporated by reference in this prospectus for a discussion of the factors you should carefully consider before deciding to purchase our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus may not be used to consummate sales of our securities unless, to the extent required by applicable law, it is accompanied by a prospectus supplement.

The date of this prospectus is , 2025.

TABLE OF CONTENTS

| |

|

|

|

|

|

1 |

|

|

| |

|

|

|

|

|

1 |

|

|

| |

|

|

|

|

|

2 |

|

|

| |

|

|

|

|

|

3 |

|

|

| |

|

|

|

|

|

3 |

|

|

| |

|

|

|

|

|

4 |

|

|

| |

|

|

|

|

|

4 |

|

|

| |

|

|

|

|

|

5 |

|

|

| |

|

|

|

|

|

10 |

|

|

| |

|

|

|

|

|

12 |

|

|

| |

|

|

|

|

|

13 |

|

|

| |

|

|

|

|

|

14 |

|

|

| |

|

|

|

|

|

16 |

|

|

| |

|

|

|

|

|

16 |

|

|

| |

|

|

|

|

|

16

|

|

|

Neither we nor the underwriters (if any) have authorized anyone to provide you with any information other than that contained in or incorporated by reference into this prospectus or any amendment or supplement to this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the underwriters (if any) take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus and any accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities described in any applicable prospectus supplement or an offer to sell or the solicitation of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful. You should assume that the information in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate only as of the date on the front of the document and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus, any applicable prospectus supplement or any related free writing prospectus, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed materially since those dates.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that FuelCell Energy, Inc. (“FuelCell Energy,” the “Company,” “we,” “our,” “us” or similar terms) filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, we may from time to time sell shares of our common stock and warrants, as well as units that include any combination of the foregoing securities, in one or more offerings from time to time for an aggregate offering amount of up to $405,000,000. We have provided to you in this prospectus a general description of the securities that we may offer.

Each time we sell securities, we will, to the extent required by law, provide a prospectus supplement that will contain information about the specific terms of the offering. We may also add, update or change in any accompanying prospectus supplement any of the information contained in this prospectus. To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date — for example, a document incorporated by reference in this prospectus or any prospectus supplement — the statement in the document having the later date modifies or supersedes the earlier statement. This prospectus, together with any accompanying prospectus supplement and any other document we may authorize to be delivered to you, includes all material information relating to the offering of our securities.

As permitted by the rules and regulations of the SEC, the registration statement, of which this prospectus forms a part, includes and/or incorporates by reference additional information not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at the SEC’s website as described below under the heading “Where You Can Find Additional Information.”

FORWARD-LOOKING STATEMENTS

This prospectus, any prospectus supplement, the documents incorporated by reference herein and therein and any related free writing prospectuses issued by us may contain forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995 (the “PSLRA”)) about our financial condition, results of operations, plans, objectives, expectations, future performance and business. Statements preceded by, followed by or that include words such as “expects,” “anticipates,” “estimates,” “goals,” “projects,” “intends,” “plans,” “believes,” “predicts,” “should,” “seeks,” “will,” “could,” “would,” “may,” “forecast,” or words or phrases of similar import are intended to identify some of the forward-looking statements and are included, along with this statement, for purposes of complying with the safe harbor provisions of the PSLRA. Forward-looking statements are neither historical facts, nor assurances of future performance. Instead, such statements are based only on our beliefs, expectations and assumptions regarding the future. As such, the realization of matters expressed in forward-looking statements involves inherent risks and uncertainties. Our actual results and future events may differ materially from those set forth in or contemplated by the forward-looking statements due to, among other factors, the risks and uncertainties described in or incorporated by reference into this prospectus, including under the heading “Risk Factors,” as well as any risks or uncertainties described in or incorporated by reference into any prospectus supplement. Any forward-looking statement contained in this prospectus, any prospectus supplement, the documents incorporated by reference herein and therein, and any related free writing prospectuses issued by us speaks only as of the date on which the statement was made, and we undertake no obligation to update publicly or revise any forward-looking statements for any reason, whether as a result of new information, future events or otherwise. New risks emerge from time to time, and we cannot predict all of the risks that may impact our business or the extent to which any particular risk, or combination of risks, may cause actual results to differ materially from those contained in any forward-looking statement.

Market data and industry forecasts and projections used in this prospectus and documents incorporated by reference herein have been obtained from independent industry sources. Forecasts, projections and other forward-looking information obtained from such sources are subject to similar qualifications and uncertainties as other forward-looking statements in this prospectus and documents incorporated by reference herein.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information that we file with it, which means that we can disclose important information to you by referring you to other documents. The information incorporated by reference is an important part of this prospectus. We incorporate by reference the following documents (other than information furnished rather than filed):

•

•

•

•

the description of our common stock set forth in our registration statement on Form 8-A, filed with the SEC on June 6, 2000, including any amendment or reports filed for the purpose of updating such description, and in any other registration statement or report filed by us under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including any amendment or report filed for the purpose of updating such description.

Notwithstanding the foregoing, information furnished under Items 2.02 and 7.01 of any Current Report on Form 8-K, including the related exhibits under Item 9.01, is not incorporated by reference in this prospectus.

All reports and other documents we file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act (other than information furnished rather than filed), (i) on or after the date of filing of the registration statement of which this prospectus is a part and prior to the effectiveness of such registration statement and (ii) on or after the effectiveness of the registration statement until the earlier of the date on which all of the securities registered hereunder have been sold or the registration statement of which this prospectus is a part has been withdrawn, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

We will provide without charge, upon written or oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus and a copy of any or all other contracts or documents which are referred to in this prospectus. You may request a copy of any or all of these documents, which will be provided to you at no cost, by writing or telephoning us using the following contact information:

FuelCell Energy, Inc.

Attention: Corporate Secretary

3 Great Pasture Road

Danbury, Connecticut 06810

Telephone: (203) 825-6000

Our SEC filings are also available to the public on the “Investors” tab of our website at www.fuelcellenergy.com. The information on, or that can be accessed through, our website is not incorporated by reference in this prospectus, and you should not consider it to be a part of this prospectus. Our website address is included as an inactive textual reference only.

OUR COMPANY

FuelCell Energy, Inc.

At FuelCell Energy, our purpose is to enable a world powered by clean energy. We are a global leader in delivering a variety of clean energy solutions to address some of the world’s most critical challenges around energy access, resilience, reliability, affordability, safety and security. Since our inception, FuelCell Energy has been innovating and developing commercial technologies that produce clean electricity, heat, clean hydrogen, and water. We are also proud to be at the forefront of what we believe to be one of the most critical technologies required to achieve the world’s overall emissions objectives: carbon capture. Today, we offer commercial technology that produces clean electricity, heat, clean hydrogen, and water and is also capable of recovering and capturing carbon for utilization and/or sequestration, depending on product configuration and application. We also continue to invest in product development and commercializing technologies that are expected to add new capabilities to our platforms’ abilities to deliver hydrogen and long duration hydrogen-based energy storage through our solid oxide technologies, as well as further enhance our existing platforms’ carbon capture solutions.

We target a range of markets and applications with our products, including utilities and independent power producers, data centers, wastewater treatment, commercial and hospitality, food and beverage, and microgrids, among others. We market our products primarily in the United States, Europe and Korea, and we are also pursuing opportunities in other countries around the world. We target for expansion and development markets and geographic regions that benefit from and value clean distributed generation; are located where there are high energy costs, poor grid reliability, and/or challenged transmission and distribution lines; can leverage the multiple value streams delivered by our platforms (electricity, hydrogen, thermal, water, and carbon recovery); are aligned with regulatory frameworks that harmonize energy, economic and environmental policies; and are committed to reducing their Scope 1 and Scope 2 emissions.

FuelCell Energy, headquartered in Danbury, Connecticut, was founded in 1969 as a New York corporation to provide applied research and development services on a contract basis. We completed our initial public offering in 1992 and reincorporated in Delaware in 1999. We began selling stationary fuel cell power plants commercially in 2003.

Corporate Information

Our principal executive offices are located at 3 Great Pasture Road, Danbury, Connecticut 06810. Our telephone number is (203) 825-6000. We maintain a website at www.fuelcellenergy.com. The information on, or that can be accessed through, our website is not incorporated by reference in this prospectus, and you should not consider it to be a part of this prospectus. Our website address is included as an inactive textual reference only.

In this prospectus, unless otherwise stated or the context otherwise requires, references to “FuelCell Energy,” the “Company,” “we,” “us” and “our” and similar references refer to FuelCell Energy, Inc. and our consolidated subsidiaries.

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the risk factors incorporated herein by reference to our most recent Annual Report on Form 10-K and the other information contained in this prospectus, as updated by our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other subsequent filings under the Exchange Act and the risk factors and other information contained or incorporated by reference in the applicable prospectus supplement before acquiring any of our securities.

USE OF PROCEEDS

Unless otherwise provided in the applicable prospectus supplement, we currently intend to use the net proceeds from our sale of securities under this prospectus for general corporate purposes, which may include future investments in businesses, products, services and/or technologies, including strategic growth and acquisition opportunities, the repayment, redemption or refinancing of indebtedness, research with respect to and the development and commercialization of our products, working capital, capital expenditures, and acquisitions and repurchases of our securities. We may set forth additional information regarding the use of proceeds from the sale of the securities we offer under this prospectus in a prospectus supplement relating to the specific offering. We have not determined the amount of net proceeds to be used specifically for the foregoing purposes. As a result, our management will have broad discretion in the allocation of the net proceeds.

THE SECURITIES WE MAY OFFER

We may sell common stock and warrants, as well as units that include any combination of the foregoing securities, in one or more offerings from time to time under this prospectus at prices and on terms to be determined at the time of any offering. This prospectus provides you with a general description of the securities we may offer. Each time we offer a type or series of securities under this prospectus, we will provide a prospectus supplement or free writing prospectus, or both, that will describe the specific amounts, prices and other important terms of the securities being offered.

DESCRIPTION OF CAPITAL STOCK

General

The following description of our capital stock is a summary and does not purport to be complete. It is subject to, and qualified in its entirety by reference to, our Certificate of Incorporation, as amended (the “Certificate of Incorporation”), including the Amended Certificate of Designation for the 5% Series B Cumulative Convertible Perpetual Preferred Stock (the “Series B Certificate of Designation”), and our Third Amended and Restated By-laws (the “By-laws”), each of which is incorporated by reference as an exhibit to the registration statement of which this prospectus is a part. We encourage you to read our Certificate of Incorporation (including the Series B Certificate of Designation), our By-laws and the applicable provisions of the Delaware General Corporation Law (“DGCL”) for additional information.

On November 8, 2024, we effectuated a 1-for-30 reverse stock split of our issued and outstanding shares of common stock (the “Reverse Stock Split”). The Reverse Stock Split did not change the total number of shares, or par value, of common stock or preferred stock authorized for issuance by the Company. Certain share numbers and per share prices, conversion rates and conversion prices herein have been adjusted to reflect the Reverse Stock Split. However, common stock share and per share amounts, conversion rates and conversion prices in certain of the documents incorporated by reference herein have not been adjusted to give effect to the Reverse Stock Split.

Authorized and Outstanding Capital Stock

Under our Certificate of Incorporation, we are authorized to issue 1,000,000,000 shares of common stock, par value $0.0001 per share, and 250,000 shares of preferred stock, par value $0.01 per share, in one or more series designated by our board of directors, of which 105,875 shares of our preferred stock have been designated as 5% Series B Cumulative Convertible Perpetual Preferred Stock (“Series B Preferred Stock”).

As of December 23, 2024, 20,449,715 shares of our common stock were issued and outstanding and 64,020 shares of our Series B Preferred Stock were issued and outstanding. No other shares of our preferred stock were issued and outstanding.

As of December 23, 2024, we were obligated, if and when the holders exercise their conversion rights, to issue approximately 1,261 shares of our common stock upon conversion of all of the issued and outstanding Series B Preferred Stock.

As of December 23, 2024, there were outstanding options to purchase 574 shares of our common stock under our equity incentive plan; 241,194 shares of our common stock were reserved for issuance upon time-based vesting of outstanding restricted stock units granted under our equity incentive plan; 134,463 shares of our common stock were reserved, at the target performance level, for potential issuance in connection with the settlement of performance-based restricted stock units granted under our equity incentive plan; 134,463 shares of our common stock were reserved, for performance above the target level up to 200% maximum performance, for potential issuance in connection with the settlement of performance-based restricted stock units granted under our equity incentive plan; 638,198 shares of our common stock were available for future grants of awards under our equity incentive plan; and 11,562 shares of our common stock were reserved for future issuance under our employee stock purchase plan.

As of December 23, 2024, there were 20 holders of record of our common stock.

Common Stock

Voting Rights. The holders of our common stock have one vote per share. Holders of our common stock are not entitled to vote cumulatively for the election of directors. Generally, matters to be voted on by stockholders (including the election of directors in uncontested elections) must be approved by a majority of the votes properly cast on the matter at a meeting at which a quorum is present, subject to any voting rights granted to holders of any then-outstanding preferred stock. (The voting rights of the outstanding Series B Preferred Stock are described below under the heading “Series B Preferred Stock”). A plurality voting standard applies in contested director elections (i.e., when the number of nominees for election as directors exceeds the number of directors to be elected at such meeting).

Dividends. Holders of our common stock will share ratably in any dividends declared by our board of directors, subject to the preferential rights of any of our preferred stock then outstanding. (The dividend rights of the outstanding Series B Preferred Stock are described below under the heading “Series B Preferred Stock”). Dividends consisting of shares of our common stock may be paid to holders of shares of our common stock. We have never paid a cash dividend on our common stock and do not anticipate paying any cash dividends on our common stock in the foreseeable future.

Liquidation Rights. In the event of our liquidation, dissolution or winding up, after payment of liabilities and liquidation preferences on any of our preferred stock then outstanding, the holders of shares of our common stock are entitled to share ratably in all assets available for distribution. (The liquidation and other rights of the outstanding Series B Preferred Stock are described below under the heading “Series B Preferred Stock”).

Other Rights. Holders of shares of our common stock (solely in their capacity as holders of shares of our common stock) have no preemptive rights or rights to convert their shares of our common stock into any other securities. There are no redemption or sinking fund provisions applicable to our common stock.

Listing on The Nasdaq Global Market. Our common stock is listed on The Nasdaq Global Market under the symbol “FCEL.”

Transfer Agent and Registrar. The transfer agent and registrar for our common stock is Equiniti Trust Company, LLC.

Series B Preferred Stock

Ranking. Shares of our Series B Preferred Stock rank with respect to dividend rights and rights upon our liquidation, winding up or dissolution:

•

senior to shares of our common stock;

•

junior to our debt obligations; and

•

effectively junior to our subsidiaries’ (i) existing and future liabilities and (ii) capital stock held by others.

Dividends. The Series B Preferred Stock pays cumulative annual dividends of $50.00 per share, which are payable quarterly in arrears on February 15, May 15, August 15 and November 15. Dividends accumulate and are cumulative from the date of original issuance. Unpaid accumulated dividends do not bear interest.

The dividend rate is subject to upward adjustment as set forth in the Series B Certificate of Designation if we fail to pay, or to set apart funds to pay, any quarterly dividend on the Series B Preferred Stock.

No dividends or other distributions may be paid or set apart for payment on our common stock (other than a dividend payable solely in shares of a like or junior ranking), nor may any stock junior to or on parity with the Series B Preferred Stock be redeemed, purchased or otherwise acquired for any consideration (or any money paid to or made available for a sinking fund for such stock) by us or on our behalf (except by conversion into or exchange for shares of a like or junior ranking), unless all accumulated and unpaid dividends on the Series B Preferred Stock have been paid or funds or shares of common stock have been set aside for payment of such accumulated and unpaid dividends.

The dividends on the Series B Preferred Stock will be paid in cash, unless a registered holder elects (pursuant to the procedures set forth in the Series B Certificate of Designation) to receive such dividends in shares of our common stock. Any such shares of common stock paid in lieu of cash dividends will be treated as restricted securities and will not be transferable by the recipient thereof except pursuant to an effective registration statement or pursuant to an exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”).

Liquidation. The holders of Series B Preferred Stock are entitled to receive, in the event that the Company is liquidated, dissolved or wound up, whether voluntarily or involuntarily, $1,000.00 per share plus all accumulated and unpaid dividends up to but excluding the date of such liquidation, dissolution, or winding up (the “Liquidation Preference”). Until the holders of Series B Preferred Stock receive the

Liquidation Preference with respect to their shares of Series B Preferred Stock in full, no payment will be made on any junior shares, including shares of our common stock. After the Liquidation Preference is paid in full, holders of the Series B Preferred Stock will not be entitled to receive any further distribution of our assets. (For the avoidance of doubt, neither the voluntary sale of all or substantially all of our assets, nor a merger involving the Company, shall be deemed to be a voluntary or involuntary liquidation, dissolution or winding up of the Company.) As of October 31, 2024, the issued and outstanding shares of Series B Preferred Stock had an aggregate Liquidation Preference of $64.0 million.

Conversion Rights. Each share of Series B Preferred Stock may be converted at any time, at the option of the holder, into .0197 shares of our common stock (which is equivalent to a conversion price of $50,760.00 per share) plus cash in lieu of fractional shares. The conversion rate is subject to adjustment upon the occurrence of certain events, as described in the Series B Certificate of Designation. The conversion rate is not adjusted for accumulated and unpaid dividends. If converted, holders of Series B Preferred Stock do not receive a cash payment for all accumulated and unpaid dividends; rather, all accumulated and unpaid dividends are canceled.

We may, at our option, cause shares of Series B Preferred Stock to be automatically converted into that number of shares of our common stock that are issuable at the then-prevailing conversion rate. We may exercise our conversion right only if the closing price of our common stock exceeds 150% of the then-prevailing conversion price ($50,760.00 per share as of October 31, 2024) for 20 trading days during any consecutive 30 trading day period, as described in the Series B Certificate of Designation.

If the holders of Series B Preferred Stock elect to convert their shares in connection with certain “fundamental changes” (as defined in the Series B Certificate of Designation and described below), we will in certain circumstances increase the conversion rate by a number of additional shares of common stock upon conversion or, in lieu thereof, we may in certain circumstances elect to adjust the conversion rate and related conversion obligation so that shares of Series B Preferred Stock are converted into shares of the acquiring or surviving company, in each case as described in the Series B Certificate of Designation.

The adjustment of the conversion price is to prevent dilution of the interests of the holders of the Series B Preferred Stock from certain dilutive transactions with holders of our common stock.

Redemption. We do not have the option to redeem the Series B Preferred Stock. However, holders of the Series B Preferred Stock can require us to redeem all or a portion of their shares of Series B Preferred Stock at a redemption price equal to the Liquidation Preference of the shares to be redeemed in the case of a “fundamental change” (as further described in the Series B Certificate of Designation). A fundamental change will be deemed to have occurred if any of the following occurs:

•

any “person” or “group” is or becomes the beneficial owner, directly or indirectly, of 50% or more of the total voting power of all classes of our capital stock then outstanding and normally entitled to vote in the election of directors;

•

during any period of two consecutive years, individuals who at the beginning of such period constituted the board of directors of the Company (together with any new directors whose election to our board of directors or whose nomination for election by the stockholders was approved by a vote of 662∕3% of our directors then still in office who were either directors at the beginning of such period or whose election or nomination for election was previously so approved) cease for any reason to constitute a majority of the directors of the Company then in office;

•

the termination of trading of our common stock on The Nasdaq Stock Market and our common stock is not approved for trading or quoted on any other U.S. securities exchange or established over-the-counter trading market in the U.S.; or

•

we (i) consolidate with or merge with or into another person or another person merges with or into our Company or (ii) sell, assign, transfer, lease, convey or otherwise dispose of all or substantially all of the assets of the Company and certain of its subsidiaries, taken as a whole, to another person and, in the case of any such merger or consolidation described in clause (i), the securities that are outstanding immediately prior to such transaction (and which represent 100% of the aggregate voting power of our voting stock) are changed into or exchanged for cash, securities or property, unless pursuant to the transaction such securities are changed into or exchanged for securities of the

surviving person that represent, immediately after such transaction, at least a majority of the aggregate voting power of the voting stock of the surviving person.

Notwithstanding the foregoing, holders of shares of Series B Preferred Stock will not have the right to require us to redeem their shares if:

•

the last reported sale price of shares of our common stock for any five trading days within the 10 consecutive trading days ending immediately before the later of the fundamental change or its announcement equaled or exceeded 105% of the conversion price of the Series B Preferred Stock immediately before the fundamental change or announcement;

•

at least 90% of the consideration (excluding cash payments for fractional shares and in respect of dissenters’ appraisal rights) in the transaction or transactions constituting the fundamental change consists of shares of capital stock traded on a U.S. national securities exchange or quoted on The Nasdaq Stock Market, or which will be so traded or quoted when issued or exchanged in connection with a fundamental change, and as a result of the transaction or transactions, shares of Series B Preferred Stock become convertible into such publicly traded securities; or

•

in the case of a merger or consolidation constituting a fundamental change (as described in the fourth bullet above), the transaction is affected solely to change our jurisdiction of incorporation.

Moreover, we will not be required to redeem any Series B Preferred Stock upon the occurrence of a fundamental change if a third party makes an offer to purchase the Series B Preferred Stock in the manner, at the price, at the times and otherwise in compliance with the requirements set forth above and such third party purchases all shares of Series B Preferred Stock validly tendered and not withdrawn.

We may, at our option, elect to pay the redemption price in cash, in shares of our common stock valued at a discount of 5% from the market price of shares of our common stock, or in any combination thereof. Notwithstanding the foregoing, we may only pay such redemption price in shares of our common stock that are registered under the Securities Act and eligible for immediate sale in the public market by non-affiliates of our Company.

Voting Rights. Holders of Series B Preferred Stock currently have no voting rights; however, holders may receive certain voting rights, as described in the Series B Certificate of Designation, if (a) dividends on any shares of Series B Preferred Stock, or any other class or series of stock ranking on parity with the Series B Preferred Stock with respect to the payment of dividends, shall be in arrears for dividend periods, whether or not consecutive, containing in the aggregate a number of days equivalent to six calendar quarters or (b) we fail to pay the redemption price, plus accrued and unpaid dividends, if any, on the redemption date for shares of Series B Preferred Stock following a fundamental change. In each such event, the holders of Series B Preferred Stock (voting separately as a class with all other classes or series of stock ranking on parity with the Series B Preferred Stock with respect to the payment of dividends and upon which like voting rights have been conferred and are exercisable) will be entitled to elect two directors to the Company’s board of directors in addition to those directors already serving on the Company’s board of directors at such time (the “Series B Directors”), at the next annual meeting of the Company’s stockholders (or at a special meeting of the Company’s stockholders called for such purpose, whichever is earlier). The right to elect the Series B Directors will continue for each subsequent annual meeting of the Company’s stockholders until all dividends accumulated on the shares of Series B Preferred Stock have been fully paid or set aside for payment or the Company pays in full or sets aside for payment such redemption price, plus accrued but unpaid dividends, if any, on the redemption date for the shares of Series B Preferred Stock following a fundamental change. The term of office of any Series B Directors will terminate immediately upon the termination of the right of holders of Series B Preferred Stock to elect such Series B Directors, as described in this paragraph. Each holder of Series B Preferred Stock will have one vote for each share of Series B Preferred Stock held in the election of Series B Directors. We previously failed to make timely payment of the accrued dividends on the Series B Preferred Stock with respect to the May 15, 2019 and August 15, 2019 dividend payment dates. Such amounts were fully paid on or about November 15, 2019.

So long as any shares of Series B Preferred Stock remain outstanding, we will not, without the consent of the holders of at least two-thirds of the shares of Series B Preferred Stock outstanding at the time (voting separately as a class with all other series of preferred stock, if any, on parity with our Series B Preferred

Stock upon which like voting rights have been conferred and are exercisable) issue or increase the authorized amount of any class or series of shares ranking senior to the outstanding shares of the Series B Preferred Stock as to dividends or upon liquidation. In addition, we will not, subject to certain conditions, amend, alter or repeal provisions of our Certificate of Incorporation, including the Series B Certificate of Designation, whether by merger, consolidation or otherwise, so as to adversely amend, alter or affect any power, preference or special right of the outstanding shares of Series B Preferred Stock or the holders thereof without the affirmative vote of not less than two-thirds of the issued and outstanding shares of Series B Preferred Stock.

CERTAIN PROVISIONS OF DELAWARE LAW, OUR CERTIFICATE OF INCORPORATION, AND BY-LAWS

The following description of certain provisions of Delaware law is only a summary. For a complete description, we refer you to the DGCL and to our Certificate of Incorporation and our By-laws, the forms of which are filed as exhibits to the registration statement of which this prospectus forms a part.

Anti-Takeover Provisions

Provisions of our Certificate of Incorporation and By-laws. A number of provisions of our Certificate of Incorporation and By-laws concern matters of corporate governance and the rights of stockholders. Some of these provisions, including, but not limited to, the inability of stockholders to take action by unanimous written consent, certain advance notice requirements for stockholder proposals and director nominations, supermajority voting provisions requiring the affirmative vote of eighty percent of the votes entitled to be cast by the stockholders to amend or repeal voting rights provisions (e.g., provisions giving holders of our common stock one vote per share, provisions prohibiting stockholders from taking action without a meeting, and the supermajority voting provisions), the filling of vacancies on the board of directors by the affirmative vote of a majority of the remaining directors, and the ability of the board of directors to issue shares of preferred stock and to set the voting rights, preferences and other terms thereof without further stockholder action, may be deemed to have an anti-takeover effect and may discourage takeover attempts not first approved by the board of directors, including takeovers which stockholders may deem to be in their best interests. If takeover attempts are discouraged, temporary fluctuations in the market price of shares of our common stock, which may result from actual or rumored takeover attempts, may be inhibited. These provisions, together with the ability of the board of directors to issue preferred stock without further stockholder action, could also delay or frustrate the removal of incumbent directors or the assumption of control by our stockholders, even if the removal or assumption would be beneficial to our stockholders. These provisions could also discourage or inhibit a merger, tender offer or proxy contest, even if favorable to the interests of stockholders, and could depress the market price of our common stock. The board of directors believes these provisions are appropriate to protect our interests and the interests of our stockholders. The board of directors has no present plans to adopt any further measures or devices which may be deemed to have an “anti-takeover effect.”

Delaware Anti-Takeover Provisions. We are subject to Section 203 of the DGCL, which prohibits a publicly-held Delaware corporation from engaging in a “business combination,” except under certain circumstances, with an “interested stockholder” for a period of three years following the date such person became an “interested stockholder” unless:

•

before such person became an interested stockholder, the board of directors of the corporation approved either the business combination or the transaction that resulted in the interested stockholder becoming an interested stockholder;

•

upon the consummation of the transaction that resulted in the interested stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding shares held by directors who are also officers of the corporation and shares held by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

•

at or following the time such person became an interested stockholder, the business combination is approved by the board of directors of the corporation and authorized at an annual or special meeting of stockholders (and not by written consent) by the affirmative vote of the holders of at least 662∕3% of the outstanding voting stock of the corporation which is not owned by the interested stockholder.

The term “interested stockholder” generally is defined as a person who, together with affiliates and associates, owns, or, within the three years prior to the determination of interested stockholder status, owned, 15% or more of a corporation’s outstanding voting stock. The term “business combination” includes mergers, asset or stock sales and other similar transactions resulting in a financial benefit to an interested stockholder. Section 203 makes it more difficult for an “interested stockholder” to effect various business combinations with a corporation for a three-year period. The existence of this provision would be expected to

have an anti-takeover effect with respect to transactions not approved in advance by the board of directors, including discouraging attempts that might result in a premium over the market price for the shares of our common stock held by stockholders. A Delaware corporation may “opt out” of Section 203 with an express provision in its original certificate of incorporation or any amendment thereto. Our Certificate of Incorporation does not contain any such exclusion.

Exclusive Forum

Our By-laws provide that unless we consent in writing to an alternative forum, a state court located within the State of Delaware (or, if no state court located within the State of Delaware has jurisdiction, the federal district court for the District of Delaware) will be the sole and exclusive forum for: (i) any derivative action or proceeding brought on behalf of the Company; (ii) any action asserting a claim of breach of a fiduciary duty owed by any of the Company’s directors or officers or other employees to the Company or our stockholders; (iii) any action asserting a claim against the Company or any of our directors or officers or other employees arising pursuant to any provision of the DGCL or our Certificate of Incorporation or our By-laws (as either may be amended from time to time); or (iv) any action asserting a claim against the Company or any of our directors or officers or other employees which claim is governed by the internal affairs doctrine.

Limitations of Directors’ Liability

Our Certificate of Incorporation provides that none of our directors will be personally liable to the Company or our stockholders for monetary damages for breach of fiduciary duty as a director, except for liability:

•

for any breach of the director’s duty of loyalty to the Company or our stockholders;

•

for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law;

•

under Section 174 of the DGCL; or

•

for any transaction from which the director derived an improper personal benefit.

The effect of these provisions is to eliminate our rights and the rights of our stockholders (through stockholders’ derivatives suits on behalf of us) to recover monetary damages against a director for breach of fiduciary duty as a director (including breaches resulting from grossly negligent behavior), except in the situations described above. These provisions do not limit the liability of directors under federal securities laws and do not affect the availability of equitable remedies such as an injunction or rescission based upon a director’s breach of his duty of care.

Disclosure of Commission Position on Indemnification for Securities Act Liabilities

Our Certificate of Incorporation provides that none of our directors will be personally liable to the Company or our stockholders for monetary damages for breach of fiduciary duty as a director, except to the extent described above. Our By-laws provide for indemnification of our officers and directors to the fullest extent permitted by applicable law. Insofar as indemnification for liabilities under the Securities Act may be permitted to directors, officers or controlling persons of the Company pursuant to our Certificate of Incorporation, our By-laws, applicable law, or otherwise, we have been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

DESCRIPTION OF WARRANTS

We may issue warrants in the future for the purchase of common stock. Warrants may be issued independently or together with common stock as units offered by any prospectus supplement and/or other offering material and may be attached to or separate from any such offered securities. Each series of warrants will be issued under a separate warrant agreement to be entered into between us and a bank or trust company, as warrant agent, provided that we may also act as warrant agent and enter into warrant agreements directly with the purchasers of securities offered pursuant to this prospectus. In each case, the terms of the warrants will be set forth in a prospectus supplement and/or other offering material relating to the particular issue of warrants. The warrant agent, if any, will act solely as our agent in connection with the warrants and will not assume any obligation or relationship of agency or trust for or with any holders of warrants or beneficial owners of warrants.

The following summary of certain provisions of the warrants we may issue in the future does not purport to be complete and is subject to, and is qualified in its entirety by reference to, all provisions of the warrant agreements.

Reference is made to the prospectus supplement and/or other offering material relating to the particular issue of warrants for the terms of and information relating to such warrants, including, where applicable:

•

the number of shares of common stock purchasable upon the exercise of warrants and the price at which such number of shares of common stock may be purchased upon such exercise;

•

the designation and number of units of other securities purchasable upon the exercise of warrants to purchase other securities and the price at which such number of units of such other securities may be purchased upon such exercise;

•

the date on which the right to exercise such warrants shall commence and the date on which such right shall expire;

•

certain material U.S. federal income tax considerations applicable to such warrants;

•

the amount of warrants outstanding as of the most recent practicable date; and

•

any other terms of such warrants.

Warrants will be issued in registered form only. The exercise price for warrants will be subject to adjustment in accordance with the applicable prospectus supplement and/or other offering material.

Each warrant will entitle the holder thereof to purchase such number of shares of common stock or other securities at such exercise price as shall in each case be set forth in, or calculable from, the prospectus supplement and/or other offering material relating to the warrants, which exercise price may be subject to adjustment upon the occurrence of certain events as set forth in such prospectus supplement and/or other offering material. After the close of business on the expiration date, or such later date to which such expiration date may be extended by us, unexercised warrants will become void. The place or places where, and the manner in which, warrants may be exercised shall be specified in the prospectus supplement and/or other offering material relating to such warrants.

Prior to the exercise of any warrants, holders of such warrants will not have any of the rights of holders of the underlying securities, as the case may be, purchasable upon such exercise, including the right to receive payments of dividends, if any, on the common stock purchasable upon such exercise, or to exercise any applicable right to vote.

DESCRIPTION OF UNITS

As specified in the applicable prospectus supplement, we may issue units consisting of one or more shares of common stock and warrants. The applicable prospectus supplement will specify the following terms of the units:

•

the terms of the underlying securities comprising the units, including whether and under what circumstances the underlying securities may be traded separately;

•

a description of the terms of any unit agreement governing the units (if any);

•

if appropriate, a discussion of certain material U.S. federal income tax considerations applicable to such units; and

•

a description of the provisions for the payment, settlement, transfer or exchange of the units.

PLAN OF DISTRIBUTION

The securities may be sold:

•

to or through underwriting syndicates represented by managing underwriters;

•

through one or more underwriters without a syndicate for them to offer and sell to the public;

•

through dealers or agents;

•

in “at the market offerings” to or through a market maker or into an existing trading market, or a securities exchange or otherwise;

•

to investors directly in negotiated sales or in competitively bid transactions; or

•

as otherwise described in a prospectus supplement, including through a combination of any of these methods of sale.

We will describe the plan of distribution for any particular offering in the applicable prospectus supplement, in accordance with applicable law. The prospectus supplement will set forth the terms of the offering, including the following:

•

the name or names of any underwriters, dealers or agents;

•

the purchase price, the proceeds from that sale and the expected use of such proceeds;

•

any options under which underwriters may purchase additional securities from us;

•

any underwriting discounts and other items constituting underwriters’ compensation;

•

any initial public offering price and any discounts or concessions allowed or reallowed or paid to underwriters, dealers or agents; and

•

any securities exchanges on which the securities may be listed.

The securities may be distributed from time to time in one or more transactions, at negotiated prices, at a fixed price or fixed prices (that may be subject to change), at market prices prevailing at the time of sale, at various prices determined at the time of sale or at prices related to prevailing market prices.

Underwriters

If underwriters are used in the sale, we will execute an underwriting agreement with the underwriters relating to the securities that we will offer. Unless otherwise set forth in the prospectus supplement, the obligations of the underwriters to purchase these securities will be subject to conditions. The underwriters will be obligated to purchase all of the offered securities if any are purchased.

The securities subject to the underwriting agreement will be acquired by the underwriters for their own account and may be resold by them from time to time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined at the time of sale. Underwriters may be deemed to have received compensation from us in the form of underwriting discounts or commissions and may also receive commissions from the purchasers of these securities for whom they may act as agent. Underwriters may sell these securities to or through dealers. These dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters and/or commissions from the purchasers for whom they may act as agent. Any initial public offering price and any discounts or concessions allowed or reallowed or paid to dealers may be changed from time to time.

We also may sell the securities in connection with a remarketing upon their purchase, in connection with a redemption or repayment, by a remarketing firm acting as principal for its own account or as our agent. Remarketing firms may be deemed to be underwriters in connection with the securities that they remarket.

We may authorize underwriters to solicit offers by institutions to purchase the securities subject to the underwriting agreement from us, at the public offering price stated in the prospectus supplement under delayed delivery contracts providing for payment and delivery on a specified date in the future. If we sell

securities under these delayed delivery contracts, the prospectus supplement will state that as well as the conditions to which these delayed delivery contracts will be subject and the commissions payable for that solicitation.

Any dealers and agents participating in the distribution of securities may be deemed to be underwriters, and compensation received by them on resale of the securities may be deemed to be underwriting discounts.

Agents

We may also sell any of the securities through agents designated by us from time to time. We will name any agent involved in the offer or sale of these securities and will list commissions payable by us to any such agents in the prospectus supplement. These agents will be acting on a best efforts basis to solicit purchases for the period of their appointment, unless we state otherwise in the prospectus supplement.

Direct Sales

We may sell any of the securities directly to purchasers. In this case, we will not engage underwriters or agents in the offer and sale of these securities.

Indemnification

We may indemnify underwriters, dealers or agents who participate in the distribution of securities against certain liabilities, including liabilities under the Securities Act and agree to contribute to payments which these underwriters, dealers or agents may be required to make. The terms and conditions of any indemnification or contribution will be described in the applicable prospectus supplement.

LEGAL MATTERS

The validity of the securities covered by this prospectus will be passed upon for us by Foley & Lardner LLP. The validity of the securities covered by this prospectus will be passed upon for any underwriters or agents by counsel named in the applicable prospectus supplement. The opinions of Foley & Lardner LLP and counsel for any underwriters or agents may be conditioned upon and may be subject to assumptions regarding future action required to be taken by us and any underwriters, dealers or agents in connection with the issuance of any securities. The opinions of Foley & Lardner LLP and counsel for any underwriters or agents may be subject to other conditions and assumptions, as indicated in the applicable prospectus supplement.

EXPERTS

The consolidated financial statements of FuelCell Energy, Inc. as of October 31, 2024 and 2023, and for each of the years in the three-year period ended October 31, 2024, and management’s assessment of the effectiveness of internal control over financial reporting as of October 31, 2024 have been incorporated by reference herein and in the registration statement in reliance upon the report of KPMG LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public at the SEC’s website at http://www.sec.gov.

This prospectus is part of a registration statement that we have filed with the SEC relating to the securities to be offered. This prospectus does not contain all of the information we have included in the registration statement and the accompanying exhibits and schedules in accordance with the rules and regulations of the SEC, and we refer you to the omitted information. The statements this prospectus makes pertaining to the content of any contract, agreement or other document that is an exhibit to the registration statement necessarily are summaries of their material provisions and do not describe all provisions, exceptions and qualifications contained in those contracts, agreements or documents. You should read those contracts, agreements or documents for information that may be important to you. The registration statement, exhibits and schedules are available at the SEC’s website at http://www.sec.gov.

Neither we nor the underwriters (if any) have authorized anyone to provide you with any information other than that contained in or incorporated by reference into this prospectus or any amendment or supplement to this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the underwriters (if any) take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front of those documents or that any document incorporated by reference is accurate as of any date other than its filing date. You should not consider this prospectus to be an offer or solicitation relating to the securities in any jurisdiction in which such an offer or solicitation relating to the securities is not authorized. Furthermore, you should not consider this prospectus to be an offer or solicitation relating to the securities if the person making the offer or solicitation is not qualified to do so, or if it is unlawful for you to receive such an offer or solicitation.

The information in this prospectus supplement is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus supplement is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-274971

Subject to Completion, dated December 27, 2024

PROSPECTUS SUPPLEMENT

Up to $204,922,876.65

FuelCell Energy, Inc.

Common Stock

We previously entered into an Open Market Sale AgreementSM (as amended, the “sales agreement”) with Jefferies LLC, B. Riley Securities, Inc., Barclays Capital Inc., BMO Capital Markets Corp., BofA Securities, Inc., Canaccord Genuity LLC, Citigroup Global Markets Inc., J.P. Morgan Securities LLC and Loop Capital Markets LLC, as sales agents (the “sales agents”), relating to the sale of up to $300,000,000 of shares of our common stock, $0.0001 par value per share (“common stock”), offered by our prospectus supplement dated April 10, 2024. As of the date of filing of this prospectus supplement, we have issued and sold $95,077,123.35 of our common stock pursuant to the sales agreement. Accordingly, we may offer and sell shares of our common stock having an aggregate offering amount of up to $204,922,876.65 from time to time through the sales agents, acting as our sales agents, or directly to the sales agents, acting as principals.

Our common stock is listed on The Nasdaq Global Market under the symbol “FCEL.” On December 26, 2024, the last reported sale price for our common stock was $10.60 per share.

Sales of our common stock, if any, under this prospectus supplement and the accompanying prospectus may be made by any method that is deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended (the “Securities Act”).

The sales agents are not required to sell any specific number or dollar amount of shares, but will act as our sales agents using commercially reasonable efforts consistent with their respective normal trading and sales practices, on mutually agreed terms between the sales agents and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement. Sales of our common stock under the sales agreement and this prospectus supplement will be made through only one sales agent on any particular trading day.

We will pay each sales agent a commission equal to 2.0% of the gross proceeds from each sale of shares of our common stock made through or to such sales agent from time to time under the sales agreement. The amount of proceeds we will receive from this offering, if any, will depend upon the actual number of shares of our common stock sold and the market price at which such shares are sold. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time.

In connection with the sale of common stock on our behalf, each sales agent may be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of the sales agents may be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to the sales agents with respect to certain civil liabilities, including liabilities under the Securities Act. See “Plan of Distribution” on page S-9 for more information.

Investing in our common stock involves a high degree of risk. You should read this prospectus supplement and the accompanying prospectus carefully before you make your investment decision. See “Risk Factors” beginning on page S-6 of this prospectus supplement, as well as the documents we file with the Securities and Exchange Commission that are incorporated by reference in this prospectus supplement and in the accompanying prospectus, including our most recent Annual Report on Form 10-K and any subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, for more information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

Jefferies

|

|

|

B. Riley Securities

|

|

|

Barclays

|

|

|

BMO Capital

Markets

|

|

|

BofA Securities

|

|

| |

Canaccord

Genuity

|

|

|

Citigroup

|

|

|

|

|

|

J.P. Morgan

|

|

|

Loop Capital

Markets

|

|

The date of this prospectus supplement is , 2025.

TABLE OF CONTENTS

Prospectus Supplement

| |

|

|

|

|

|

S-ii |

|

|

| |

|

|

|

|

|

S-1 |

|

|

| |

|

|

|

|

|

S-3 |

|

|

| |

|

|

|

|

|

S-4 |

|

|

| |

|

|

|

|

|

S-6 |

|

|

| |

|

|

|

|

|

S-8 |

|

|

| |

|

|

|

|

|

S-9 |

|

|

| |

|

|

|

|

|

S-11 |

|

|

| |

|

|

|

|

|

S-11 |

|

|

| |

|

|

|

|

|

S-11

|

|

|

We are offering to sell, and are seeking offers to buy, the securities only in jurisdictions where such offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the securities in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about and observe any restrictions relating to the offering of the securities and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus to or by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

ABOUT THIS PROSPECTUS SUPPLEMENT AND PROSPECTUS

This prospectus supplement is part of a registration statement that FuelCell Energy, Inc. filed with the Securities and Exchange Commission using a “shelf” registration process. This document consists of two parts. The first part is the accompanying prospectus, which gives more general information, some of which may not apply to this offering. The second part is this prospectus supplement, which describes the specific terms of the securities we are offering. This prospectus supplement and the information incorporated by reference in this prospectus supplement may add to, update and change information contained in, or incorporated by reference into, the accompanying prospectus. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, or in any document incorporated by reference herein that was filed with the Securities and Exchange Commission (“SEC”) before the date of this prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date, for example, a document incorporated by reference in this prospectus supplement or the accompanying prospectus, the statement in the document having the later date modifies or supersedes the earlier statement.

The accompanying prospectus is also part of a registration statement that we filed with the SEC using a shelf registration process. Under the shelf registration process, from time to time, we may offer and sell any of the securities described in the accompanying prospectus separately or together with other securities described therein. You should read this prospectus supplement along with the accompanying prospectus, the documents incorporated by reference in this prospectus supplement and the accompanying prospectus and any related free writing prospectus that we authorized to be distributed to you carefully before you invest. These documents contain important information you should consider when making your investment decision. You should also read and consider the information in the documents to which we have referred you under the heading “Where You Can Find Additional Information” on page S-11 of this prospectus supplement and on page 16 of the accompanying prospectus and under the heading “Incorporation by Reference” on page 2 of the accompanying prospectus.

Neither we nor the sales agents have authorized anyone to provide you with any information other than the information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus and any related free writing prospectus that we authorized to be distributed to you or to which we have referred you. If anyone provides you with different or additional information, you should not rely on it. Neither we nor the sales agents take any responsibility for, or can provide any assurance as to the reliability of, any other information that others may give you.

Neither we, nor the sales agents, nor anyone acting on our behalf is making an offer to sell these shares of common stock in any jurisdiction where the offer or sale is not permitted, and you should not consider this prospectus supplement or the accompanying prospectus to be an offer or solicitation relating to the securities in any jurisdiction in which such an offer or solicitation relating to the securities is not authorized. You should assume that the information contained in this prospectus supplement, the accompanying prospectus, any related free writing prospectus that we have authorized to be delivered to you and the documents incorporated by reference herein and therein is accurate only as of their respective dates, regardless of the time of delivery of such documents or of any sale of securities. Our business, financial condition, results of operations and prospects may have changed since those dates. Furthermore, you should not consider this prospectus supplement or the accompanying prospectus to be an offer or solicitation relating to the securities if the person making the offer or solicitation is not qualified to do so, or if it is unlawful for you to receive such an offer or solicitation.