-- Year-to-Date Net Loans Increase 13% --

Farmers & Merchants Bank of Long Beach (OTCBB:FMBL) today

reported financial results for the third quarter ended September

30, 2013.

“We achieved continued growth in the third quarter in key

metrics, including loans and deposits, reflecting the strength of

our brand and the F&M team in a highly competitive landscape,”

said Henry Walker, president of Farmers & Merchants Bank of

Long Beach. “During the quarter, F&M demonstrated its

commitment to maintaining its leadership in the region by expanding

our executive management team with the appointment of Melissa

Lanfre as the Bank’s chief operating officer.”

Income Statement

For the 2013 third quarter, interest income amounted to $40.9

million, compared with $41.5 million earned in the 2012 third

quarter, reflecting the protracted low interest rate environment.

Interest income for the nine-month period ended September 30, 2013

was $119.7 million, compared with $130.7 million reported for the

same period in 2012.

Interest expense for the 2013 third quarter declined to $1.6

million from $1.7 million in last year’s third quarter. Interest

expense for the nine-month period ended September 30, 2013 declined

to $4.6 million from $5.4 million reported for the same period last

year.

Net interest income for the 2013 third quarter was $39.3

million, compared with $39.8 million for the third quarter of 2012,

and $115.1 million for the first nine months of 2013, versus $125.3

million for the same period in 2012.

Farmers & Merchants’ net interest margin was 3.28% for the

2013 third quarter, compared with 3.51% for the 2012 third quarter.

Net interest margin was 3.25% for the first nine months of 2013,

compared with 3.76% for the same period in 2012.

The Bank did not have a provision for loan losses in the first

nine months of 2013, nor in the same period a year ago, amid

continued strength in the quality of its loan portfolio. The Bank’s

allowance for loan losses as a percentage of loans outstanding was

2.32% at September 30, 2013, compared with 2.57% at December 31,

2012.

Non-interest income increased to $10.5 million for the 2013

third quarter from $9.5 million in the third quarter a year ago.

Non-interest income was $30.6 million for the nine-month period

ended September 30, 2013, compared with $20.4 million for the same

period in 2012.

Non-interest expense for the 2013 third quarter was $27.9

million, versus $28.1 million for the same period last year.

Non-interest expense for the first nine months of 2013 was $77.0

million, compared with $72.2 million last year.

Net income for the 2013 third quarter increased to $15.1

million, or $114.95 per diluted share, from $14.9 million, or

$113.68 per diluted share, in the year-ago period. The Bank’s net

income for the first nine months of 2013 was $47.2 million, or

$360.39 per diluted share, compared with $50.1 million, or $383.02

per diluted share, for the same period in 2012.

Balance Sheet

At September 30, 2013, net loans totaled $2.18 billion, compared

with $1.93 billion at December 31, 2012. The Bank’s deposits

totaled $3.84 billion at the end of the 2013 third quarter,

compared with $3.69 billion at December 31, 2012. Non-interest

bearing deposits represented 40.4% of total deposits at September

30, 2013, versus 40.0% of total deposits at December 31, 2012.

Total assets increased to $5.15 billion at the close of the 2013

third quarter, compared with $4.99 billion at the close of the

prior year.

At September 30, 2013, Farmers & Merchants Bank remained

“well-capitalized” under all regulatory categories, with a total

risk-based capital ratio of 28.72%, a Tier 1 risk-based capital

ratio of 27.46%, and a Tier 1 leverage ratio of 14.43%. The minimum

ratios for capital adequacy for a well-capitalized bank are 10.00%,

6.00% and 5.00%, respectively.

“Results for the third quarter demonstrate F&M’s sound and

stable reputation, which continues to pervade throughout Southern

California,” said Daniel Walker, chief executive officer and

chairman of the board. “Additionally, the strength of our balance

sheet positions us well, as we embark on the next phase of growth

and development for the Bank.”

About Farmers & Merchants Bank

Founded in Long Beach in 1907 by C.J. Walker, Farmers &

Merchants Bank has 21 branches in L.A. and Orange Counties. The

Bank specializes in commercial and small business banking along

with business loan programs. Farmers & Merchants Bank of Long

Beach is a California state chartered bank with deposits insured by

the Federal Deposit Insurance Corporation (Member FDIC) and an

Equal Housing Lender. For more information about F&M, please

visit www.fmb.com.

FARMERS & MERCHANTS BANK OF LONG BEACH Income

Statements (Unaudited) (In thousands except per share

data) Three Months Ended Sept.

30, Nine Months Ended Sept. 30,

2013 2012 2013

2012 Interest income:

Loans $ 26,002 $ 26,741 $ 76,813 $ 86,097 Securities

available-for-sale 1,980 2,639 6,289 8,430 Securities

held-to-maturity 12,800 11,848 36,117 35,392 Deposits with banks

105 294 457 764 Total interest income 40,887 41,522 119,676 130,683

Interest expense: Deposits 1,268 1,433 3,753

4,512 Securities sold under repurchase agreements 283 305 839 854

Total interest expense 1,551 1,738 4,592 5,366 Net interest

income 39,336 39,784 115,084 125,317

Provision for loan

losses - - - - Net interest income after provision for

loan losses 39,336 39,784 115,084 125,317

Non-interest

income: Service charges on deposit accounts 1,135 1,110

3,403 3,462 Gains on sale of securities - - 1,048 42 Other real

estate owned income 3,275 2,504 3,275 2,504 Merchant bankcard

income 2,448 3,418 7,010 6,644 Other income 3,623 2,477 15,894

7,780 Total non-interest income 10,481 9,509 30,630 20,432

Non-interest expense: Salaries and employee benefits

13,536 11,695 40,260 35,259 FDIC and other insurance expense 1,303

1,634 4,702 4,813 Occupancy expense 2,340 2,032 5,044 4,768

Equipment expense 1,619 1,366 4,592 4,082 Other real estate owned

expense 712 2,905 243 3,443 Amortization of public welfare

investments 2,020 1,866 6,061 5,897 Merchant bankcard expense 1,904

2,902 5,564 5,072 Legal and professional services 970 883 2,719

1,929 Marketing expense 1,573 1,313 2,980 2,425 Other expense 1,939

1,455 4,860 4,477 Total non-interest expense 27,916 28,051 77,025

72,165 Income before income tax expense 21,901 21,242 68,689

73,584

Income tax expense 6,851 6,359 21,504 23,436

Net income $ 15,050 $

14,883 $ 47,185 $ 50,148

Basic and diluted earnings per common share $ 114.95 $ 113.68 $

360.39 $ 383.02

FARMERS & MERCHANTS BANK OF

LONG BEACH Balance Sheets (Unaudited) (In thousands

except share and per share data)

Sept. 30, 2013 Dec. 31,

2012 Assets Cash and due from banks:

Noninterest-bearing balances $ 65,017 $ 60,914 Interest-bearing

balances 34,059 253,087 Securities available-for-sale 492,346

630,055 Securities held-to-maturity 2,219,970 1,942,085 Loan held

for sale 1,663 2,365 Gross loans 2,228,103 1,982,075 Less allowance

for loan losses (51,621 ) (50,994 ) Less unamortized deferred loan

fees, net (708 ) (364 ) Net loans 2,175,774 1,930,718

Other real estate owned, net 14,298 17,696 Public welfare

investments 29,743 35,804 Bank premises and equipment, net 65,911

60,504 Net deferred tax assets 24,452 26,060 Other assets 22,154

29,674

Total assets $

5,145,387 $ 4,988,961

Liabilities and Stockholders' Equity

Liabilities: Deposits: Demand, non-interest bearing $

1,549,200 $ 1,474,215 Demand, interest bearing 379,142 346,991

Savings and money market savings 1,070,754 1,011,029 Time deposits

837,239 853,631 Total deposits 3,836,335 3,685,866

Securities sold under repurchase agreements 527,728 551,293

Other liabilities 30,135 34,543

Total

liabilities 4,394,198 4,271,702

Stockholders' Equity:

Common Stock, par value $20; authorized

250,000shares; issued and outstanding 130,928 shares

2,619 2,619 Additional paid-in capital 12,044 12,044 Retained

earnings 733,713 695,169 Other comprehensive income 2,813

7,427

Total stockholders' equity

751,189 717,259 Total

liabilities and stockholders' equity $ 5,145,387

$ 4,988,961

Farmers & Merchants BankJohn HinrichsExecutive Vice

President562-437-0011, ext. 5035orPondelWilkinson Inc.Evan

PondelInvestor Relations310-279-5980investor@pondel.com

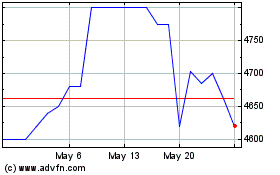

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Jan 2024 to Jan 2025