ETHEMA

HEALTH CORPORATION

950

Evernia Street

West

Palm Beach, Florida 33401

561-

500-0020

www.ethemahealth.com

UP TO 4,166,666,660

SHARES OF COMMON STOCK THROUGH 416,666,666 UNITS OF 100 SHARES OF COMMON STOCK PER UNIT

Ethema

Health Corporation, a Colorado corporation (the “Company,” “Ethema,” “we,” “us,” and

“our”), is offering up to 4,166,666,660 shares (“Shares”) of its common stock, par value of $0.01 per share (“Common

Stock”) sold in Units of 100 Shares of Common Stock (“Units”) on a “best efforts” basis without any minimum

offering amount pursuant to Regulation A promulgated under the Securities Act of 1933, as amended (the “Securities Act”),

for Tier 2 offerings (the “Offering”). We expect that the fixed initial public offering price per Unit will be $0.12 (equivalent

of per share of Common Stock will be $0.0012) upon qualification of the Offering Statement of which this Offering Circular is a part

by the United States Securities and Exchange Commission (“SEC”). We expect to commence the sale of the Units within two calendar

days of the date on which the Offering Statement of which this Offering Circular is a part is declared qualified by the SEC. The Offering

is expected to expire on the earlier of (i) the date on which all of the Units offered are sold; or (ii) the date on which this Offering

is earlier terminated by us in our sole discretion. For avoidance of doubt, potential investors will only be able to purchase Shares

in Units. There will be no fractional Units sold.

We

have engaged DealMaker Securities LLC (the “Broker”), a broker-dealer registered with the U.S. Securities and Exchange Commission

(the “SEC”) and a member of Financial Industry Regulatory Authority (“FINRA”), to perform certain administrative

and compliance related functions in connection with this Offering, but not for underwriting or placement agent services. Potential investors

may at any time make revocable offers to subscribe to purchase Units with each containing 100 shares of our Common Stock. Such revocable

offers will become irrevocable when both the Offering Statement is qualified by the SEC and we accept your subscription. We may close

on investments on a “rolling” basis (so not all investors will receive their Shares on the same date). Funds will be promptly

refunded without interest, for sales that are not consummated. Upon closing under the terms as set out in this Offering Circular, funds

will be immediately available to us (where the funds will be available for use in our operations in a manner consistent with the “Use

of Proceeds” in this Offering Circular) and the Shares for such closing will be issued to investors. See “Plan

of Distribution” of this Offering Circular for more information.

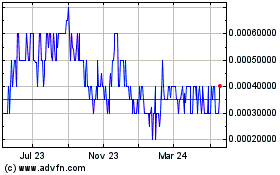

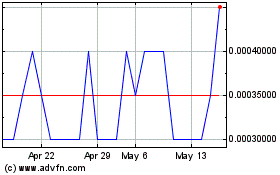

Our

Common Stock currently trades on the OTC Pink Open Market under the symbol “GRST” and the closing price of our Common

Stock on April 6, 2023 was $0.0004. Our Common Stock currently trades on a sporadic and limited basis.

An

investment in the Units (each containing 100 Shares) is subject to certain risks and should be made only by persons or entities able

to bear the risk of and to withstand the total loss of their investment. Prospective investors should carefully consider and review the “Risk

Factors” beginning on page 8.

| |

|

Price to Public |

|

Dealer Commissions & Fees (2) |

|

Proceeds to the Company (3) |

| Per Unit |

|

$ |

0.0012 |

|

|

$ |

0.00012 |

|

|

$ |

0.00108 |

|

| Maximum Offering (1) |

|

$ |

5,000,000 |

|

|

$ |

480,000 |

|

|

$ |

4,520,000 |

|

(1)

Reflects the proceeds to be received by the Company pursuant to the sale of Units under the subscription agreement. There is no minimum

Offering amount. See “Risk Factors” at page 8.

(2)

DealMaker Securities LLC, referred to herein as the Broker, is engaged to provide administrative and compliance related services in connection

with this Offering, but not for underwriting or placement agent services. Broker will receive a cash commission equal to one percent

(1%) of the amount raised in the Offering. Additionally, the Broker and its affiliates will receive certain other fees. The cash commissions

and certain other fees in aggregate shall not exceed a maximum compensation limit for this offering of nine percent (9%).

(3) Does

not include expenses of the Offering, including without limitation, legal, accounting, escrow

agent, transfer agent, other professional, printing, advertising, travel, marketing, and other expenses of this Offering.

After

the qualification by the SEC of the Offering Statement, this Offering will be conducted through our website at invest.ethemahealth.com,

whereby investors will receive, review, executed, and deliver subscription agreements electronically. Payment of the purchase price will

be made through a third-party processor by ACH debit transfer or wire transfer or credit card to an account designated by the Company.

We estimate total maximum fees related to this Offering would be approximately $450,000 assuming a fully subscribed offering. See “Use

of Proceeds” and “Plan of Distribution” for more details.

The Broker is not

participating as an underwriter or placement agent in this offering and will not solicit any investments, recommend our securities, provide

investment advice to any prospective investor, or distribute this Offering Circular or other offering materials to potential investors.

All inquiries regarding this offering should be made directly to the Company.

GENERALLY, NO

SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME

OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION

THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR

GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

THE UNITED

STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF

THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES

ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION

THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

This Offering Circular

follows the disclosure format prescribed by Part II of Form 1-A.

TABLE OF CONTENTS[1]

| Summary |

6 |

| Risk Factors |

7 |

| Dilution |

13 |

| Plan of Distribution

and Selling Shareholders |

14 |

| Use of Proceeds to Issuer |

19 |

| The Company’s

Business |

20 |

| The Company’s

Property |

34 |

| Management’s Discussion

and Analysis of Financial Condition and Results of Operations |

35 |

| Directors, Executive

Officers and Significant Employees |

43 |

| Compensation of Directors

and Officers |

44 |

| Security Ownership of

Management and Certain Shareholders |

44 |

| Interest of Management

and Others in Certain Transactions |

44 |

| Securities Being Offered |

45 |

| Financial Statements |

F-1 |

In this Offering

Circular, the term “Ethema”, “we”, “us”, “our”, or “the company” refers to

Ethema Health Corporation. and our subsidiaries on a consolidated basis.

THIS OFFERING CIRCULAR

MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND

STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY

AVAILABLE TO OUR MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,”

“ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING

STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE

EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE OUR ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE

FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY

AS OF THE DATE ON WHICH THEY ARE MADE. WE DO NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT

EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

You should not place

undue reliance on forward looking statements. The cautionary statements set forth in this Offering Circular, including in “Risk

Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements.

These factors include, among other things:

| |

· |

Our ability to effectively

execute our business plan, including without limitation our ability to respond to the highly competitive and rapidly evolving marketplace

and health and regulatory environments in which we intend to operate; |

| |

· |

Our ability to manage our

expansion, growth, and operating expenses; |

| |

· |

Our ability to evaluate

and measure our business, prospects and performance metrics, and our ability to differentiate our business model and service offerings; |

| |

· |

Our ability to compete,

directly and indirectly, and succeed in the highly competitive and evolving addiction treatment market; and |

| |

· |

Our ability to respond

and adapt to changes in technology, treatment techniques, and customer behavior. |

STATEMENTS REGARDING

FORWARD-LOOKING STATEMENTS

______

This Offering Circular

contains various "forward-looking statements." You can identify forward-looking statements by the use of forward-looking terminology

such as "believes," "expects," "may," "would," "could," “should," "seeks,"

"approximately," "intends," "plans," "projects," "estimates" or "anticipates"

or the negative of these words and phrases or similar words or phrases. You can also identify forward-looking statements by discussions

of strategy, plans or intentions. These statements may be impacted by a number of risks and uncertainties.

Although the forward-looking

statements in this Offering Circular are based on our beliefs, assumptions and expectations, taking into account all information currently

available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to

any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them

will not be material and adverse. We undertake no obligation, other than as may be required by law, to re-issue this Offering Circular

or otherwise make public statements updating our forward-looking statements.

IMPORTANT

INFORMATION ABOUT THIS OFFERING CIRCULAR

Please carefully

read the information in this offering circular and any accompanying offering circular supplements, which we refer to collectively as

the offering circular. You should rely only on the information contained in this Offering Circular. We have not authorized anyone to

provide you with different information. This offering circular may only be used where it is legal to sell these securities. You should

not assume that the information contained in this offering circular is accurate as of any date later than the date hereof or such other

dates as are stated herein or as of the respective dates of any documents or other information incorporated herein by reference.

This offering circular

is part of an offering statement that we filed with the SEC, using a continuous offering process. Periodically, as we have material developments,

we will provide an offering circular supplement that may add, update or change information contained in this offering circular. Any statement

that we make in this offering circular will be modified or superseded by any inconsistent statement made by us in a subsequent offering

circular supplement. The offering statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters

discussed in this offering circular. You should read this offering circular and the related exhibits filed with the SEC and any offering

circular supplement, together with additional information contained in our annual reports, semi-annual reports and other reports and

information statements that we will file periodically with the SEC. See the section entitled “Additional Information” below

for more details.

We, and if applicable,

those selling Common Stock on our behalf in this offering, will be permitted to make a determination that the purchasers of Common Stock

in this offering are “qualified purchasers” in reliance on the information and representations provided by the purchaser

regarding the purchaser’s financial situation. Before making any representation that your investment does not exceed applicable

thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A (“Regulation A”) under the Securities Act of

1933, as amended (the “Securities Act”). For general information on investing, we encourage you to refer to www.investor.gov.

STATE LAW EXEMPTION

AND PURCHASE RESTRICTIONS

Our Common Stock

is being offered and sold only to “qualified purchaser” (as defined in Regulation A). As a Tier 2 offering pursuant to Regulation

A, this offering will be exempt from state law “Blue Sky” review, subject to meeting certain state filing requirements and

complying with certain anti-fraud provisions, to the extent that our Common Stock offered hereby is offered and sold only to “qualified

purchasers” or at a time when our Common Stock is listed on a national securities exchange. “Qualified purchasers”

include: (i) “accredited investors” under Rule 501(a) of Regulation D under the Securities Act (“Regulation D”)

and (ii) all other investors so long as their investment in our Common Stock does not represent more than 10% of the greater of their

annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural

persons).

To determine whether

a potential investor is an “accredited investor” for purposes of satisfying one of the tests in the “qualified purchaser”

definition, the investor must be a natural person who has:

| |

1. |

an individual net worth,

or joint net worth with the person’s spouse, that exceeds $1,000,000 at the time of the purchase, excluding the value of the

primary residence of such person; or |

| |

2. |

earned income exceeding

$200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation

of the same income level in the current year. |

If the investor is

not a natural person, different standards apply. See Rule 501 of Regulation D for more details.

For purposes of determining

whether a potential investor is a “qualified purchaser,” annual income and net worth should be calculated as provided in

the “accredited investor” definition under Rule 501 of Regulation D. In particular, net worth in all cases should be calculated

excluding the value of an investor’s home, home furnishings and automobiles.

SUMMARY

This

summary highlights information contained elsewhere in this Offering Circular. This summary is not complete and does not contain all of

the information that you should consider before deciding to invest in our Common Stock. You should read this entire Offering Circular

carefully, including the risks associated with an investment in us discussed in the “Risk Factors” section of this Offering

Circular, before making an investment decision.

Summary

Ethema Health Corporation

aims to develop world class centers of excellence in addiction treatment for adults. We specialize in the treatment of substance use

disorders. By working with doctors and researchers, we strive to develop better assessment and treatment modalities for the industry.

We operate the Addiction Recovery Institute of America, a 41-bed addiction treatment facility located in West Palm Beach, Florida. This

facility is a three-story building with unfinished commercial space on the first floor and two floors of mixed commercial and residential

space where clients are treated and sleep. The first-floor space is being completed at which time it will allow the center to expand

to 52 beds by moving existing treatment space from the 2nd floor to the 1st Floor.

Through this Offering,

we are looking to expand our operations through acquisition of, and partnership with, other treatment facilities. By integrating operations

and reducing redundancies, we can offer an efficient and effective treatment plan to service the unique and varying needs of our patients.

The Offering

The offering is for

Common Stock of Ethema Health Corporation The rights of the Common Stock are described more fully in “Securities Being Offered.”

| Securities offered |

|

Maximum of 4,166,666,660

shares of Common Stock, through the sale of 416,666,666 Units of 100 shares of Common Stock per Unit (1) |

| |

|

|

| Shares of Common Stock outstanding before the offering

(2) |

|

3,729,053,805 shares |

| |

|

|

| Shares of Common Stock outstanding after the offering

(1) |

|

7,895,720,471 shares |

| |

|

|

| Delivery of the Shares |

|

Shares will be delivered by book entry. |

| |

|

|

| Use of proceeds |

|

The net proceeds of this

offering will be used primarily for acquisitions and to cover other ancillary marketing costs and operating expenses. The details

of our plans are set forth in our “Use of Proceeds” section. |

| |

|

|

| |

|

(1) This

represents the shares available to be offered as of the date of this Offering Circular, based upon this Offering being for up

to $5 million. The rolling 12-month maximum offering amount for Tier 2 offering issuers is $75 million. We have not made any

other offerings pursuant to Regulation A in the past twelve (12) months.

(2) As

of September 27, 2023. |

This Offering is

being made on a “best efforts” basis through the use of DealMaker Securities LLC (“Broker”) as the Broker, which

will be acting as broker-dealer for the Offering. Novation Solutions, Inc. (o/a DealMaker (“DealMaker”), an affiliate of

Broker, is providing the platform and related services being used to obtain subscriptions.

See “Plan of

Distribution” for more information. As there is no minimum Offering, upon the approval of any subscription to this Offering Circular,

the Company shall immediately deposit said proceeds, after deducting applicable Offering commissions, fees and expenses, into the bank

account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds.

Risks Related

to Our Business and Strategy

Our

ability to successfully operate our business is subject to numerous risks, including those that are generally associated with operating

in the addiction treatment industry. Any of the factors set forth under “Risk Factors”

below may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth

in this Offering Circular and, in particular, you should evaluate the specific factors set forth under “Risk

Factors” below in deciding whether to invest in our Common Stock. Risks relating to our business and our ability to execute

our business strategy include:

| |

· |

we may not effectively manage our growth; |

| |

· |

we operate in a highly competitive industry and our

failure to compete effectively could adversely affect our market share, revenues and growth prospects; |

| |

· |

unfavorable publicity or consumer perception of our

services could adversely affect our reputation and the demand for our services; |

| |

· |

if the services we provide do not comply with applicable

regulatory and legislative requirements, we may be required to suspend our services; |

| |

· |

if we do not meet certain provider credentialing or

service metrics, we may lose relationships with insurance providers and limit our ability to offer services to certain patients;

and |

| |

· |

changes in our management team could adversely affect

our business strategy and adversely impact our performance. |

RISK FACTORS

The SEC requires

the company to identify risks that are specific to its business and its financial condition. The company is still subject to all the

same risks that all companies in its business, and all companies in the economy, are exposed to. These include risks relating to economic

downturns, political and economic events and technological developments (such as hacking and the ability to prevent hacking). Additionally,

early-stage companies are inherently more risky than more developed companies. You should consider general risks as well as specific

risks when deciding whether to invest.

Risk Factors Related

to the Company and its Business

Our financials

were prepared on a “going concern” basis.

Our

unaudited condensed consolidated financial statements have been prepared in accordance with US GAAP applicable to a going concern, which

assumes that we will be able to meet our obligations and continue its operations in the normal course of business. As of September 30,

2021, the Company has a working capital deficiency of approximately $15,440,821 and accumulated deficit of approximately $45,978,688.

Management believes that current available resources will not be sufficient to fund our planned expenditures over the next 12 months.

Accordingly, we will be dependent upon the raising of additional capital through placement of common shares, and/or debt financing in

order to implement its business plan, and generating sufficient revenue in excess of costs. If we raise additional capital through the

issuance of equity securities or securities convertible into equity, stockholders will experience dilution, and such securities may have

rights, preferences or privileges senior to those of the holders of common stock or convertible senior notes. If we raise additional

funds by issuing debt, we may be subject to limitations on its operations, through

debt covenants or other restrictions. If we obtain additional funds through arrangements with collaborators or strategic partners, we

may be required to relinquish its rights to certain geographical areas, or techniques that it might otherwise seek to retain. There is

no assurance that we will be successful with future financing ventures, and the inability to secure such financing may have a material

adverse effect on our financial condition. These factors create substantial doubt about our ability to continue as a going

concern. These unaudited condensed consolidated financial statements do not include any adjustments relating to the recoverability or

classification of recorded assets and liabilities or other adjustments that may be necessary should we not be able to continue as a going

concern.

Any valuation

of the Company at this stage is difficult to assess.

We established the

valuation for the Offering. Unlike actively-traded companies that are valued publicly through market-driven stock prices, the valuation

of limited trading companies, especially startups, is difficult to assess and you may risk overpaying for your investment. This is especially

true with companies engaging in new product offerings.

We operate

in a regulatory environment that is evolving and uncertain.

The healthcare and

addiction treatment market is subject to various and changing regulatory schemes both federally and at the state level. These regulatory

schemes are politically influenced with changes of control of our government and the composition of our state and local governments.

In 2020, the United States experienced federal elections that resulted in a change in the control of both the executive and legislative

branches of the federal government and some of the state governments of states in which we may look to operate. As these changes have

just occurred, it is unclear what regulatory changes, if any, will be made by the new administration running the executive branch of

the federal government.

We operate in a highly regulated

industry.

We are subject to

extensive regulation and failure to comply with such regulation could have an adverse effect on our business. Of significant note, we

are subject to numerous patient privacy laws and regulations. These include federal regulations like the Health Insurance Portability

and Accountability Act (HIPAA) and 42 CFR Part 2. Among other things, these regulations govern circumstances

where information about a patient can be disclosed and protects all records relating to a patient’s identity, diagnosis, prognosis

or treatment in a substance abuse program related or linked to the federal government. Failure to follow these regulations can result

in significant fines and other penalties that may make it impossible to operate and provide our services. In addition, some of

the restrictions and rules applicable to our subsidiaries could adversely affect and limit some of our business plans.

We have an

evolving business model.

Our business model

is one of innovation, including continuously working to expand our patient capacity and treatment techniques; see the “The

Company’s Business.” It is unclear whether our expansion plans will be successful. Further, we continuously try to

adapt new methods and techniques to treat our patients, and we cannot offer any assurance that any of them will be successful. We cannot

offer any assurance that any of the expansion plans or any other modifications to our footprint and treatment techniques will be successful

or will not result in harm to the business. We may not be able to manage growth effectively, which could damage our reputation, limit

our growth, and negatively affect our operating results.

We are reliant

on one main type of service.

All of

current services are variants on one type of service — providing addiction treatment for adults. Our growth and future financial

performance will depend on its ability to demonstrate to prospective buyers and users the value of our services. There can be no assurance

that we will be successful in this effort. Furthermore, competing alternatives may be seen to have, or may actually have, certain advantages

over our services.

We depend on

key personnel and face challenges recruiting needed personnel.

Our future success

depends on the efforts of a small number of key personnel, including our CEO, CFO, and Chairman Shawn Leon. In addition, due to our limited

financial resources and the specialized expertise required, we may not be able to recruit the individuals needed for our business needs.

There can be no assurance that we will be successful in attracting and retaining the personnel we require to operate and meet the needs

of our patients.

Our revenues and profits are subject

to fluctuations.

It is

difficult to accurately forecast our revenues and operating results, and these could fluctuate in the future due to a number of factors.

These factors may include adverse changes in: number of investors and amount of investors’ dollars, the success of securities markets,

general economic conditions, our ability to market our services to patients and other service providers, headcount and other operating

costs, and general industry and regulatory conditions and requirements. Our operating results may fluctuate from year to year due to

the factors listed above and others not listed. At times, these fluctuations may be significant and could impact our ability to operate

our business. Our revenue model is new and evolving, and it cannot be certain that it will be successful. The potential profitability

of its business model is unproven and there can be no assurance that we can achieve profitable operations. Our ability to generate revenues

depends, among other things, on its ability to generate revenues relating to helping customers engage cleaner living in an ecological

community. Accordingly, we cannot assure investors that its business model will be successful or that it can sustain revenue growth,

or achieve or sustain profitability.

If we cannot

raise sufficient funds, we will not succeed.

To date, we have

experienced a continuing need for capital to execute our business model. We are offering securities in the amount of up to $5 million

in this offering, and may close on any investments that are made. The amount we can raise in any 12-month period pursuant to Regulation

A is limited to $75 million. Even if the maximum amount is raised (in this 12-month period or in subsequent periods), we are likely to

need additional funds in the future in order to grow, and if we cannot raise those funds for whatever reason, including reasons relating

to us or to the broader economy, we may not survive. If we manage to raise only a portion of funds sought, we will have to find other

sources of funding for some of the plans outlined in “Use of Proceeds.” We

do not have any alternative sources of funds committed.

There is no

minimum amount set as a condition to closing this offering.

Because this is a

“best effort” offering with no minimum, we will have access to any funds tendered. This might mean that any investment made

could be the only investment in this offering, leaving us without adequate capital to pursue our business plan or even to cover the expenses

of this offering.

Natural disasters

and other events beyond our control could materially adversely affect us.

Natural disasters

or other catastrophic events may cause damage or disruption to our operations, commerce and the global economy, and thus could have a

strong negative effect on us. Our business operations are subject to interruption by natural disasters, fire, power shortages, pandemics

and other events beyond our control. Although we maintain crisis management and disaster response plans, such events could make it difficult

or impossible for us to deliver our services to our customers and could decrease demand for our services. In the spring of 2020, large

segments of the U.S. and global economies were impacted by COVID-19, a significant portion of the U.S. population are subject to “stay

at home” or similar requirements. The extent of the impact of COVID-19 and any subsequent “breakouts” of COVID-19,

on our operational and financial performance will depend on certain developments, including the duration and spread of the outbreak,

impact on our customers, impact on our customer, employee or industry events, and effect on our vendors, all of which are uncertain and

cannot be predicted. At this point, the extent to which COVID-19 may impact our financial condition or results of operations is uncertain.

To the extent COVID-19 continues to wreak havoc on the economy and the ability to remain open may have a significant impact on our results

and operations.

We a short

operating history and limited working capital.

We have

a limited relevant operating history upon which investors can evaluate performance and prospects and is not certain that it will maintain

sustained profitability. Our business is subject to all of the risks inherent in the establishment of a new business enterprise, including,

but not limited to, limited capital, need to expand its workforce, unanticipated costs, uncertain markets, adverse changes in technology

and the absence of a significant operating history. We will need to maintain significant revenues to achieve and maintain profitability

and we may not be able to do so. Even if we do achieve profitability, we may not be able to sustain or increase profitability in the

future. If our revenues grow more slowly than we anticipate or if its operating expenses exceed expectations, our financial performance

will be adversely affected. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered

by companies in their early stages of development. We cannot assure investors that it will be successful in addressing the risks it may

encounter, and its failure to do so could have a material adverse effect on its business, prospects, financial condition and results

of operations. Failure to meet our objectives would have a material adverse effect on our operations. In particular, insufficient market

demand would have a material adverse effect on our business, financial condition and results of operations.

Growth

strategy

Our business

model may require an effective execution of its growth strategy over a short period of time in order to scale operations quickly and

establish market presence. Achieving our growth strategy may be critical in order for its business to achieve profitability. If we are

unable to effectively implement its growth strategy ahead of its competition, our business, financial condition or results of operation

could be materially and adversely affected.

Competition

Our market space

is competitive. If we are unable to successfully compete with competitors (including both existing and new companies that enter this

market space), our business, financial condition or results of operations could be materially and adversely affected. The market for

our products and services is rapidly changing. Competitors may develop products and/or services that are better, less expensive or otherwise

more attractive than those offered by us.

We

may be unable to maintain its relationships.

We cannot

assure investors that it will be successful in maintaining relationships with its customers and counterparties. Our inability to maintain

these relationships could have a material adverse effect on its business, results of operations and financial condition.

Damage

to our reputation could damage its businesses.

Maintaining

a positive reputation is critical to us attracting and maintaining customers, counterparties, investors and employees. Damage to its

reputation can therefore cause significant harm to our business and prospects. Harm to our reputation could arise from numerous sources,

including, among others, employee misconduct, litigation or regulatory outcomes, compliance failures, unethical behavior and the activities

of customers and counterparties. Further, negative publicity regarding us, whether or not true, may also result in harm to its prospects.

Market

changes.

Our success

may be dependent upon our ability to develop our market and change our business model as may be necessary to react to changing market

conditions. Our ability to modify or change its business model to fit the needs of a changing marketplace may be critical to our success,

and our inability to do so could have a material adverse effect on our business, liquidity and financial condition.

Risk

Factors Related to the Offering

There is uncertainty

as to the amount of time it will take for us to deliver securities to investors under this offering.

The process for issuance

of Common Stock is set out in “Plan of Distribution.” There may be a delay

between the time you execute your subscription agreement and tender funds and the time securities are delivered to you. Although investors

who provide the information required by the subscription agreement and give accurate instructions for the payment of the subscription

price typically should receive their securities promptly after a complete submission, we cannot guarantee that you will receive your

securities by a specific date or within a specific timeframe.

The exclusive

forum provision in the subscription agreements may have the effect of limiting an investor’s ability to bring legal action against

us and could limit an investor’s ability to obtain a favorable judicial forum for disputes.

Section 6 in

each of the subscription agreements for this offering includes a forum selection provision that requires any claims against

us based on the subscription agreement be brought in a court of competent jurisdiction in the State of Florida. The forum selection

provision will not be applicable to lawsuits arising from the federal securities laws. The provision may have the effect of limiting

the ability of investors to bring a legal claim against us due to geographic limitations. There is also the possibility that the exclusive

forum provision may discourage stockholder lawsuits with respect to matters arising under laws other than the federal securities laws,

or limit stockholders’ ability to bring such claims in a judicial forum that they find favorable for disputes with us and our officers

and directors. Alternatively, if a court were to find this exclusive forum provision inapplicable to, or unenforceable in respect of,

one or more of the specified types of actions or proceedings, we may incur additional costs associated with resolving such matters in

other jurisdictions, which could adversely affect our business and financial condition.

Investors in

this offering may not be entitled to a jury trial with respect to claims arising under the subscription agreements, which could result

in less favorable outcomes to the plaintiff(s) in any action under the agreements.

Investors in this

offering will be bound by the subscription agreements, each of which includes a provision under which investors waive the right to a

jury trial of any claim they may have against us arising out of or relating to the subscription agreement, including any claims made

under the federal securities laws.

If we opposed a jury

trial demand based on the waiver, a court would determine whether the waiver was enforceable based on the facts and circumstances of

that case in accordance with the applicable state and federal law. We believe that a contractual pre-dispute jury trial waiver

provision is generally enforceable, including under the laws of the State of Florida, which governs the subscription agreement, in a

court of competent jurisdiction in the State of Florida. In determining whether to enforce a contractual pre-dispute jury trial

waiver provision, courts will generally consider whether the visibility of the jury trial waiver provision within the agreement is sufficiently

prominent such that a party knowingly, intelligently and voluntarily waived the right to a jury trial. We believe that this is the case

with respect to the subscription agreement. You should consult legal counsel regarding the jury waiver provision before entering into

the subscription agreement.

If you bring a claim

against us in connection with matters arising under the subscription agreement, including claims under federal securities laws, you may

not be entitled to a jury trial with respect to those claims, which may have the effect of limiting and discouraging lawsuits against

us. If a lawsuit is brought against us under the subscription agreement, it may be heard only by a judge or justice of the applicable

trial court, which would be conducted according to different civil procedures and may result in different outcomes than a trial by jury

would have had, including results that could be less favorable to the plaintiff(s) in such an action.

Nevertheless, if

the jury trial waiver provision is not permitted by applicable law, an action could proceed under the terms of the subscription agreement

with a jury trial. No condition, stipulation, or provision of the subscription agreement serves as a waiver by any holder of common shares

or by us of compliance with any provision of the federal securities laws and the rules and regulations promulgated under those laws.

In addition, when

shares of our Common Stock are transferred, the transferee is required to agree to all the same conditions, obligations and restrictions

applicable to those securities or to the transferor with regard to ownership of those securities, that were in effect immediately prior

to the transfer of the Common Stock, including but not limited to the subscription agreement. Therefore, purchasers in secondary transactions

will be subject to this provision.

Future fundraising

may affect the rights of investors.

In order to expand,

we are likely to raise funds again in the future, either by offerings of securities (including post-qualification amendments to this

offering) or through borrowing from banks or other sources. The terms of future capital raising, such as loan agreements, may include

covenants that give creditors greater rights over our financial resources.

Holders of

our Preferred Stock may be entitled to potentially significant liquidation preferences over holders of our Common Stock if we are liquidated,

including upon a sale of our company.

Holders of our outstanding

Preferred Stock may have liquidation preferences over holders of Common Stock being offered in this offering. This liquidation preference

is paid if the amount a holder of Preferred Stock would receive under the liquidation preference is greater than the amount such holder

would have received if such holder’s shares of Preferred Stock had been converted to Common Stock immediately prior to the liquidation

event.

Our Common

Stock is thinly traded.

Our Common Stock

trades on the OTC Markets. It has low daily trading volume and is thinly traded. While this may change as demand for our services and

Common Stock changes, there is no guarantee that adequate demand exists. Even if we seek an up-listing on the OTC Markets or another

alternative trading system or “ATS,” there may not be frequent trading and therefore a lack of liquidity for the Common Stock.

You will need

to keep records of your investment for tax purposes.

As with all investments

in securities, if you sell the Common Stock, you will probably need to pay tax on the long- or short-term capital gains that

you realize if sold at a profit or set any loss against other income. If you do not have a regular brokerage account, or your regular

broker will not hold the Common Stock for you (and many brokers refuse to hold Regulation A securities for their customers) there will

be nobody keeping records for you for tax purposes and you will have to keep your own records, and calculate the gain on any

sales of any securities you sell.

The price for our Common Stock may

be volatile.

The market price

of our Common Stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which

are beyond our control, including the following:

·

The size and volume of our trading market.

·

Having adequate capital to fulfill any reporting obligations.

·

Inability to successfully compete against current or future competitors

·

Adverse regulations from regulators.

·

Departures of key personnel.

In addition, the

securities markets have from time-to-time experienced significant price and volume fluctuations that are unrelated to the operating performance

of particular companies. These market fluctuations may also materially and adversely affect the market price of our securities. As a

result, you may be unable to resell your securities at a desired price.

RISKS

SPECIFIC TO THE BEHAVIORAL HEALTHCARE INDUSTRY

Regulation

is and licensing is very stringent.

The State regulatory

body in Florida is the Department of Children and Families (DCF). Facilities must comply with rigid guidelines to obtain and continue

to keep its licensing. In addition, many insurance companies will not pay a provider unless they are Joint Commission accredited. This

accreditation is by a national provider of accreditation to healthcare facilities. ARIA is both DCF licensed and Joint Commission accredited.

In addition, ARIA is legit script certified which allows the company to market itself through google pay per click advertising. There

are stringent guidelines to become legit script certified and ARIA has its certification form Legit Script. ARIA must comply with all

of the national healthcare laws and HIPPA requirements. There are national laws protecting individuals from patient brokering which ARIA

must strictly comply with.

Limited

Ability to Set Prices for Services Provided.

Behavioral

healthcare providers depend upon reimbursement for services from insurance companies and other funders, including government funders,

and have only a limited ability to set and negotiate prices for the services provided. Therefore, there is no guarantee that reimbursement

for the services provided will either meet the costs of providing them or generate an operating profit. In addition, providers must negotiate

reimbursement rates with each insurance company and funder, thus substantially increasing administrative costs and overhead.

Insurance

Companies and Funders Determine What Providers They Choose to Contract for Services.

Even as

a fully licensed behavioral healthcare provider, insurance companies and government funders are under no obligation whatsoever to choose

to use ARIA– or any other provider - as a contracted service provider. Insurance Companies and Funders choose providers and may

cancel contracts and service relationships at their discretion.

The

Need for Highly Differentiated, Customizable Treatment is Expensive.

Providing

effective behavioral healthcare requires clinical expertise to a diverse population with many different diagnoses, symptoms, needs, and

wants. Effective providers need to therefore offer a broad array of customizable treatment platforms and justify their effectiveness

to clients and funders alike. Customizing treatment and services is expensive, requiring providers to attract, retain, and train skilled

staff who are specialized in treating many specific disorders. Therefore, more staff and more expensive staff is required to treat a

diverse population, thereby increasing the cost of staffing and the cost of providing treatment.

Insurance

Companies Push for Lower Levels of Care and Shorter Stays.

Because

a provider recommends a particular level of care and treatment regimen does not equate to an insurance company or funder agreeing to

pay for the provider’s recommendation with respect to level of care, services and treatment needed, or length of stay. For the

past 25 years, managed care (insurance companies) has consistently pushed for lower levels of care with shorter stays. Insurance companies

consistently report they are not dictating treatment, but rather only authorizing the reimbursement of treatment they are willing to

pay for. In turn, providers must either spend more time and effort obtaining authorization for treatment, decline clients for further

treatment or refer them elsewhere or provide treatment without insurance reimbursement or only partial reimbursement, all of which result

in increased operating costs and/or decreased revenue and profitability.

Higher

Acuity Patients Are Managed at the Outpatient Level.

As a result

of insurance companies and funders pushing for lower levels of care and shorter stays (which reduce insurance companies’ reimbursement

costs), providers are managing higher acuity patients at lower levels of care. Higher acuity patients require more staff and better trained

staff which increase operating expenses and present additional risk management challenges to the organization. These operating realities

add to administrative costs and management oversight responsibilities, and negatively impact the organization’s ability to operate

at a profit.

DILUTION

Dilution means a

reduction in value, control or earnings of the shares the investor owns.

Immediate dilution

An emerging growth

company typically sells its shares (or grants options exercisable for its shares) to its founders and early employees at a very low cash

cost because they are, in effect, putting their “sweat equity” into the company. When the company seeks cash investments

from outside investors, like you, the new investors typically pay a much larger sum for their shares than the founders or earlier investors,

which means that the cash value of your stake is diluted because all the shares are worth the same amount, and you paid more than earlier

investors for your shares.

The

following table illustrates the per share dilution to new investors discussed above, assuming the sale of, respectively, $1,000,000.00,

$2,000,000.00, $4,000,000.00, and $5,000,000.00 of the shares offered for sale in this Offering (before our estimated offering expenses

of $50,000.00) and based on an offering price of $0.0012 per share($0.12 per Unit). The below table reflects the dilution based upon

each share of Common Stock sold instead of Units to better reflect the impact on investors:

| | |

$1,000,000

Raise | |

$2,000,000

Raise | |

$4,000,000

Raise | |

$5,000,000

Raise |

| Net

Value | |

$ | 880,000 | | |

$ | 1,790,000 | | |

$ | 3,610,000 | | |

$ | 4,520,000 | |

| #

Total Shares | |

| 833,333,334 | | |

| 1,666,666,667 | | |

| 3,333,333,334 | | |

| 4,166,666,666 | |

| Net

Tangible Book Value Per Share | |

$ | (.0018 | ) | |

$ | (0.0013 | ) | |

$ | (0.0008 | ) | |

$ | (0.0006 | ) |

| Increase

in Tangible book value per share | |

$ | 0.0006 | | |

$ | 0.0011 | | |

$ | 0.0016 | | |

$ | 0.0018 | |

| Dilution

to new shareholders | |

$ | (0.0030 | ) | |

$ | (0.0025 | ) | |

$ | (0.0020 | ) | |

$ | (0.0018 | ) |

| Percentage

Dilution to New Investors | |

| (247.6 | )% | |

| (210.7 | )% | |

| (163.1 | )% | |

| (146.9 | )% |

Future dilution

Another important

way of looking at dilution is the dilution that happens due to future actions by the company. The investor’s stake in a company

could be diluted due to the company issuing additional shares. In other words, when

the company issues

more shares, the percentage of the company that you own will go down, even though the value of the company may go up. You will own a

smaller piece of that company. This increase in number of shares outstanding could result from a stock offering (such as an initial public

offering, a subsequent Regulation A offering, a venture capital round, or angel investment), employees exercising stock options, or by

conversion of certain instruments (e.g., convertible bonds, preferred shares or warrants) into stock.

If the company decides

to issue more shares, an investor could experience value dilution, with each share being worth less than before, and control dilution,

with the total percentage an investor owns being less than before. There may also be earnings dilution, with a reduction in the amount

earned per share (though this typically occurs only if the company offers dividends, and most early-stage and emerging growth companies

are unlikely to offer dividends, preferring to invest any earnings into the company).

This type of dilution

might also happen upon conversion of convertible notes into shares. Typically, the terms of convertible notes issued by emerging growth

companies provide that note holders may be able to convert the balance of their convertible notes into shares at a discounted price,

or a premium is added to the note allowing for a higher principal balance to be converted into shares than was initially invested. Either

way, the holders of the convertible notes get more shares for their money than new investors. In the event that the price drops below

the offering price in this offering, the holders of the convertible notes will dilute existing equity holders, even more than the new

investors do, because they get more shares for their money. Investors should pay careful attention to the total amount of the convertible

notes that the company has issued (and may issue in the future), and the terms of those notes.

If you are making

an investment expecting to own a certain percentage of us or expecting each share to hold a certain amount of value, it’s important

to realize how the value of those shares can decrease by actions taken by us. Dilution can make drastic changes to the value of each

share, ownership percentage, voting control, and earnings per share.

PLAN OF DISTRIBUTION

We seeking to raise up to $5 million in total. The

company will raise the money through the sale of up to 4,166,666,660 shares of Common Stock through the sale of 416,666,666 Units with

each Unit containing 100 shares of Common Stock. Under a Tier 2 offering pursuant to Regulation A, we may only offer $75,000,000 in securities

during a rolling 12-month period. As of the date of this Offering Circular, we have not offered or sold any securities pursuant to Regulation

A in the past twelve (12) months. From time to time, we may seek to qualify additional shares.

We are offering a

maximum of 4,166,666,660 shares of Common Stock through the sale of 416,666,666 Units with each Unit containing 100 shares of Common

Stock on a “best effort” basis.

DealMaker Securities LLC

We entered

into an agreement with DealMaker Securities LLC, which has been engaged to provide the administrative and compliance related functions

in connection with this offering, and as broker-dealer of record, but not for underwriting or placement agent services. The term of the

agreement commenced on March 8, 2023 and will terminate following completion of this Offering. However, the Broker may terminate the

agreement if we default on our obligations thereunder. The Broker is not purchasing any of the Units in this Offering and is not required

to sell any specific number or dollar amount of the Units. We have been advised by the Broker that it will only assist us with this Offering

in jurisdictions where it is registered or licensed as a broker-dealer in compliance with applicable federal and state securities laws

and the rules of self-regulatory organizations including FINRA.

Commissions and

Discounts

The Broker

will receive a cash commission equal to one percent (1%) of the amount raised in the Offering. Additionally, the Broker and its affiliates

will receive certain other fees described specifically in the agreement with Broker filed as an exhibit to the Offering Statement of

which this Offering Circular forms a part, based on the actual number of investors accepted into the Offering and the methods of payment

in connection therewith. Total payment processing expenses incurred in connection with the Offering, which are payable to

an affiliate of the Broker, are expected to be approximately six and 94/100 percent (6.94%) of the Offering proceeds. The

aggregate fees payable to the Broker and its affiliates will not exceed nine percent (9%) of the Offering, or a maximum of $450,000,

in the event that the Offering is fully subscribed.

Other Terms

DealMaker Securities,

LLC, the Broker, a broker-dealer registered with the Commission and a member of FINRA, has been engaged to provide the administrative

and compliance related functions in connection with this offering, and as broker-dealer of record, but not for underwriting or placement

agent services:

| |

● |

Reviewing

investor information, including identity verification, performing Anti-Money Laundering (“AML”) and other compliance

background checks, and providing issuer with information on an investor in order for issuer to determine whether to accept such investor

into the Offering; |

| |

● |

If

necessary, discussions with us regarding additional information or clarification on a Company-invited investor; |

| |

● |

Coordinating

with third party agents and vendors in connection with performance of services; |

| |

● |

Reviewing

each investor’s subscription agreement to confirm such investor’s participation in the Offering and provide a recommendation

to us whether or not to accept the subscription agreement for the investor’s participation; |

| |

● |

Contacting

and/or notifying us, if needed, to gather additional information or clarification on an investor; |

| |

● |

Providing

a dedicated account manager; and |

| |

● |

Providing

ongoing advice to us on compliance of marketing material and other communications with the public, including with respect to applicable

legal standards and requirements. |

Such services shall

not include providing any investment advice or any investment recommendations to any investor.

We have agreed to

pay Broker and its affiliates fees consisting of the following:

| |

|

A

one-time $35,000 advance against accountable expenses anticipated to be incurred, and refunded

to extent no actually incurred for fees to assist the Company with the following:

o Reviewing

and performing due diligence on our Company and our management and principals and consulting with us regarding same;

o Consulting

with our Company on best business practices regarding this raise in light of current market conditions and prior self-directed capital

raises;

o White

labelled platform customization to capture investor acquisition through the Broker’s platform’s analytic and communication

tools;

o Consulting

with our Company on question customization for investor questionnaire;

o Consulting

with our Company on selection of webhosting services;

o

Consulting with our Company on completing template for the Offering campaign page;

o

Advising us on compliance of marketing materials and other communications with the public with applicable legal standards

and requirements;

o

Providing advice to our Company on preparation and completion of this Offering Circular;

o

Advising our Company on how to configure our website for the Offering working with prospective investors;

o

Provide extensive, review, training and advice to our Company and our personnel on how to configure and use the electronic

platform for the Offering powered by DealMaker.tech, an affiliate of the Broker;

o

Assisting our Company in the preparation of state, Commission and FINRA filings related to the Offering; and

o

Working with our personnel and counsel in providing information to the extent necessary |

| · | A

Monthly Platform Hosting and Maintenance Fee of $1,500 per month for use of DealMaker.tech

software, tracking, and full analytics suite, not to exceed a maximum fee of $18,000. |

| · | For

each subscription processed, there are also the following Transaction Fees relating to the

processing of payments through third-party processors: |

| o | $15

per electronic signature executed on DealMaker platform |

| o | $15

per payment reconciled via DealMaker platform |

| o | 2.00%

of total for Secure bank-to-bank payments |

| o | 4.50%

of total for Credit Card processing |

| o | 1.00%

of total for express wires |

| o | $50.00

for investor refunds |

| o | $5.00

for failed payment fee |

| o | $250

for a full reconciliation report |

| o | $2.50

for Individual searches |

| o | $5.00

for Corporate searches |

The transaction fees

described above associated with General, Payment Processing and AML Searches will not exceed 347,000 (6.94 %) of the maximum fees paid

to Broker.

All forms of compensation

paid to Broker are subject to the provisions of the maximum fees in the Offering not exceeding $450,000 or 9% if fully subscribed.

Offering Period and Expiration Date

This Offering will

start on or after the Qualification Date and will terminate at our discretion or, on the Termination Date.

Procedures for

Subscribing

After the Commission

has qualified the Offering Statement, the Offering will be conducted using the online subscription processing platform of Novation Solutions

Inc. O/A DealMaker, an affiliate of the Broker, through the website: invest.ethemahealth.com whereby investors in the Offering will receive,

review, execute, and deliver subscription agreements electronically. Payment of the purchase price for the Shares will be made through

a third-party processor by ACH debit transfer or wire transfer or credit card to an account designated by us. The Broker is not participating

as an underwriter or placement agent in the Offering and will not solicit any investments, recommend our securities, provide investment

advice to any prospective investor, or distribute the Offering Circular or other offering materials to potential investors. All inquiries

regarding the Offering should be made directly to our Company.

Right to

Reject Subscriptions. After we receive your complete, executed subscription agreement and the funds required under the subscription

agreement have been deposited to the Company’s account, we have the right to review and accept or reject your subscription in whole

or in part, for any reason or for no reason. We will return all monies from rejected subscriptions immediately to you, without interest

or deduction.

Acceptance of

Subscriptions. Upon our acceptance of a subscription agreement, we will countersign the subscription agreement and issue the Shares

subscribed at closing. Once you submit the subscription agreement and it is accepted, you may not revoke or change your subscription

or request your subscription funds. All accepted subscription agreements are irrevocable.

No

Escrow

The proceeds of this

offering will not be placed into an escrow account. We will offer our Common Stock on a best effort’s basis. As there is no minimum

offering, upon the approval of any subscription to this Offering Circular, we will immediately deposit said proceeds into the bank account

of the Company and may dispose of the proceeds in accordance with the Use of Proceeds at Management’s discretion.

Investment Limitations

Generally, no sale

may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or

net worth (please see below on how to calculate your net worth). Different rules apply to accredited investors and non-natural persons.

Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C)

of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

Because this is a

Tier 2, Regulation A Offering, most investors must comply with the 10% limitation on investment in the Offering. The only investor in

this Offering exempt from this limitation is an “accredited investor” as defined under Rule 501 of Regulation D under the

Securities Act (an “Accredited Investor”). If you meet one of the following tests you should qualify as an Accredited Investor:

| |

(i) |

You are a natural person

who has had individual income in excess of $200,000 in each of the two most recent years, or joint income with your spouse in excess

of $300,000 in each of these years, and have a reasonable expectation of reaching the same income level in the current year; |

| |

(ii) |

You are a natural person

and your individual net worth, or joint net worth with your spouse, exceeds $1,000,000 at the time you purchase Offered Shares (please

see below on how to calculate your net worth); |

| |

(iii) |

You are an executive officer

or general partner of the issuer or a manager or executive officer of the general partner of the issuer; |

| |

(iv) |

You are an organization

described in Section 501(c)(3) of the Internal Revenue Code of 1986, as amended, or the Code, a corporation, a Massachusetts or similar

business trust or a partnership, not formed for the specific purpose of acquiring the Offered Shares, with total assets in excess

of $5,000,000; |

| |

(v) |

You are a bank or a savings

and loan association or other institution as defined in the Securities Act, a broker or dealer registered pursuant to Section 15

of the Exchange Act, an insurance company as defined by the Securities Act, an investment company registered under the Investment

Company Act of 1940 (the “Investment Company Act”), or a business development company as defined in that act, any Small

Business Investment Company licensed by the Small Business Investment Act of 1958 or a private business development company as defined

in the Investment Advisers Act of 1940; |

| |

(vi) |

You are an entity (including

an Individual Retirement Account trust) in which each equity owner is an accredited investor; |

| |

(vii) |

You are a trust with total

assets in excess of $5,000,000, your purchase of Offered Shares is directed by a person who either alone or with his purchaser representative(s)

(as defined in Regulation D promulgated under the Securities Act) has such knowledge and experience in financial and business matters

that he is capable of evaluating the merits and risks of the prospective investment, and you were not formed for the specific purpose

of investing in the Offered Shares; or |

| |

(viii) |

You are a plan established

and maintained by a state, its political subdivisions, or any agency or instrumentality of a state or its political subdivisions,

for the benefit of its employees, if such plan has assets in excess of $5,000,000. |

Issuance of Shares

The information regarding

the ownership of the Common Stock will be recorded with the stock transfer agent.

Jury Trial Waiver

The

subscription agreement provides that subscribers waive the right to a jury trial of any claim they may have against us arising out of

or relating to the subscription agreement, including any claim under federal securities laws. If we opposed a jury trial demand

based on the waiver, a court would determine whether the waiver was enforceable given the facts and circumstances of that case in accordance

with applicable case law. See “RISK FACTORS.”

Selling Shareholders

No securities are

being sold for the account of shareholders; all net proceeds of this offering will go to the company.

USE OF PROCEEDS

TO ISSUER

We estimate that

if we sell the maximum amount under this Offering of $5 million from the sale of Common Stock through the sale of the Units, the net

proceeds to us in this offering will be approximately $4,550,000, after deducting the estimated offering expenses of approximately $450,000.00

(including payment to marketing, legal and accounting professional fees and other expenses).

The table below shows

the net proceeds we would receive from this offering assuming an offering size of $1 million, $2 million and $5 million, and the intended

use of those proceeds. There is no guarantee that we will be successful in selling any of the shares we are offering.

| | |

If $1,250,000.00 of the

Offering is Raised | |

If $2,500,000.00 of the

Offering is Raised | |

If $5,000,000.00 of the

Offering is Raised |

| Cost of the Offering (1) | |

| 142,500 | | |

| 255,000 | | |

| 480,000 | |

| Net Proceeds | |

| 1,107,500 | | |

| 2,245,000 | | |

| 4,520,000 | |

| Acquisitions | |

$ | 100,000 | | |

$ | 500,000 | | |

$ | 2,250,000 | |

| Debt Repayment | |

$ | 750,000 | | |

$ | 1,150,000 | | |

$ | 1,200,000 | |

| Business administration & operational costs | |

$ | 57,500 | | |

$ | 95,000 | | |

$ | 70,000 | |

| Equipment | |

$ | 50,000 | | |

$ | 100,000 | | |

$ | 100,000 | |

| Marketing | |

$ | 0 | | |

$ | 100,000 | | |

$ | 100,000 | |

| Professional fees (including Offering Costs | |

$ | 20,000 | | |

$ | 50,000 | | |

$ | 50,000 | |

| Public company expense | |

$ | 30,000 | | |

$ | 50,000 | | |

$ | 50,000 | |

| Salaries | |

$ | 100,000 | | |

$ | 200,000 | | |

$ | 200,000 | |

| Warehouse and office Purchase | |

$ | 0 | | |

$ | 0 | | |

$ | 500,000 | |

| TOTAL | |

$ | 1,107,500 | | |

$ | 2,245,000 | | |

$ | 4,520,000 | |

| (1) |

|

Represents

legal and accounting fees, and other Offering commissions, fees and expenses including amounts payable to the Broker, and the Technology

Provider. For more information on the fees and related services, see the cover page and “Plan of Distribution.” |

We anticipate acquisitions

to be our largest expected expenditure. We are looking to acquire facilities to increase the number of patients we can treat and expand

the geographical footprint of our product offerings. These acquisition-related costs may consist of acquiring ownership of facilities,

leasing existing facilities, acquiring existing operations in areas, in which, we hope to expand our operations. As our facilities and

footprint expand, we expect to hire additional product development and quality assurance specialists. These employees will assist with

improving our ability to service the needs of our patients.

We reserve the

right to change the above use of proceeds if management believes it is in our best interest.

The allocation of

the net proceeds of the offering set forth above represents our estimates based upon our current plans, assumptions we have made regarding

the industry and general economic conditions and our future revenues (if any) and expenditures.

Investors are cautioned

that expenditures may vary substantially from the estimates above. Investors will be relying on the judgment of our management, who will

have broad discretion regarding the application of the proceeds from this offering. The amounts and timing of our actual expenditures

will depend upon numerous factors, including market conditions, cash generated by our operations (if any), business developments and

the rate of our growth. We may find it necessary or advisable to use portions of the proceeds from this offering for other purposes.

In the event that

we do not raise the entire amount we are seeking, then we may attempt to raise additional funds through private offerings of our securities

or by borrowing funds. We do not have any committed sources of financing.

THE COMPANY’S

BUSINESS

Business

Model and Strategy

The

ARIA Business Model and Strategy has been developed through a critical examination of current industry best- practice practices, emerging

market trends, and the ARIA leadership team’s 12+ year track record of launching and operating successful addition treatment facilities.

The ARIA Business Model and Strategy is built on a secure foundation of six key fundamental factors and strategies.

The

Six ARIA Fundamental Business Model & Strategy Factors

| |

1. |

ARIA

knows business and the business of behavioral health. Our skilled, multidisciplinary entrepreneurial leadership team has a proven

track record creating and operating profitable addiction treatment facilities, is currently running a 41-bed addiction treatment

facility providing five different levels of care delivering high-impact treatments and services. |

Clearly,

our primary service is expert behavioral health services for our clients, and that requires credentialed, experienced, and committed

healthcare professionals throughout the continuum of care. Our established competencies to select, hire, and retain exceptional staff

is central to our success and our Personnel Plan reflects the time, thought, and energy we have committed and provides us another competitive

advantage.

Our

expert medical and clinical team is one half of the ARIA success equation. The other factor in the equation is the staff needed to operate

the business side of the house. From marketing to billing, accounting to facility management, IT to human resources, the business and

administrative leaders and staff provide the critical business acumen to realize our growth, revenue, and income objectives.

Finally,

the ARIA business model demonstrates seamless integration, collaboration, and coordination across the entire organization. While our

clinical staff must focus and prioritize their clinical work, they do so with an understanding of the exigencies of our business model.

Similarly, administrative staff recognize our primary business is delivering behavioral healthcare services, and service delivery takes

precedence. Our organizational structure and core operating protocols support specialization of function while encouraging collaboration

and integration.

| |

2. |

ARIA

is poised for rapid response in a diverse market with new opportunities. The market is primed for innovative, for-profit,

professional organizations that have the vision, resources, and expertise to meet the behavioral health needs of a changing population.

For example, recent researchi indicates a 445% overall increase in substance abuse treatment admissions for abuse of pain

relievers across the entire adolescent and adult spectrum, including older adults. |

Changes in substance abuse usage

patterns is just one of many examples. Consider other trends reported by leading epidemiological studies: (Oltmanns, T. F. & Emery,

R. E. (2015). Abnormal Psychology (8th ed.). Boston, MA: Pearson).

| |

· |

In a given year, 18% of

adults have an anxiety disorder, 10% have a mood disorder, and 40% with one disorder have a comorbid disorder. |

| |

· |

In a given year, 37% of

men and 20% of women ages 20 – 35 who use alcohol have moderate to severe alcohol- related symptoms and need treatment. But

less than one in four receive treatment. |

| |

· |

Depression is the leading

cause of disability in the U.S. and worldwide, accounting for 10% of all disability. It’s expected to become an even greater

problem by 2022. |

| |

· |

Younger people are experiencing higher rates of depression

than their predecessors and doing so at an earlier age. |

| |

· |

The

incidence and prevalence of eating disorders, and particularly anorexia nervosa, are increasing for adolescent girls and young women.

Anorexia is more common among young women who are affluent, high users of media, and those who most strongly endorse mainstream American

culture and the culture of thinness. |

| |

· |

By

2030, the aging population will result in an 80% increase in the number of people with behavioral health problems who need treatment. |

ARIA is in the market