Current Report Filing (8-k)

October 01 2019 - 5:16AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of the earliest event reported): October 1, 2019 (September 26, 2019)

GREENWAY

TECHNOLOGIES, INC.

(Exact

name of registrant as specified in its charter)

|

TEXAS

|

|

000-55030

|

|

90-0893594

|

|

(State

or other jurisdiction

of

incorporation or organization)

|

|

(Commission

File

Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

1521

North Cooper Street, Suite 205

Arlington,

Texas 76011

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: 800-289-2515

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item

1.01

|

Entry

into a Material Definitive Agreement.

|

On

September 26, 2019, Greenway Technologies, Inc. f/k/a UMED Holdings, Inc., a Texas corporation (the “Company”)

entered into that certain settlement agreement (the “Agreement”) by and between Southwest Capital Funding,

Ltd., a Texas limited partnership (“Southwest”) and the Company.

Southwest

and the Company are parties to Southwest Capital Funding Ltd. v. Mamaki Tea, Inc., et al., No. 16-1-0342, pending in the

Circuit Court of the Third Circuit, State of Hawaii (the “Litigation”). In accordance with the Agreement, the

Company and Southwest agreed to the entry of a stipulated judgment in the Litigation, in which Southwest is awarded judgment against

the Company for the amount of $740,000.00. The Company also agreed to issue to Southwest: (a) a promissory note (the “Note”),

in the amount of $525,000.00, with a three year term, at a 7.7% simple interest-only, payable semi-annually, with interest due

calculated on a 365-day year, default interest at 18%, with the principal amount due at maturity; and (b) 1,000,000 shares of

the Company’s class A common stock, par value $0.0001 per share. Pursuant to the Agreement, both Southwest and the Company

agreed to release all claims against one another relating to the Litigation.

The

foregoing descriptions of the Agreement and the Note do not purport to be complete and are qualified in their entirety by reference

to the full text of the Agreement and the Note, which are filed herewith as Exhibit 10.1, and incorporated herein by reference.

|

Item

2.03

|

Creation of a Direct Financial Obligation or

an Obligation under an Off-Balance Sheet

Arrangement of a Registrant.

|

The

discussion under Item 1.01 relating to the Agreement, the Stipulated Judgment, and the Note are incorporated herein by

reference.

|

Item

9.01

|

Financial

Statements and Exhibits

|

SIGNATURES

Pursuant

to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended the registrant has duly caused this

report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

GREENWAY

TECHNOLOGIES, INC.

|

|

Date:

October 1, 2019

|

|

|

|

|

|

|

|

|

By:

|

/s/

Raymond Wright

|

|

|

|

Raymond

Wright

|

|

|

|

Chairman

of the Board

|

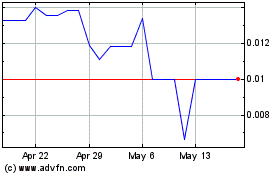

Greenway Technologies (PK) (USOTC:GWTI)

Historical Stock Chart

From Feb 2025 to Mar 2025

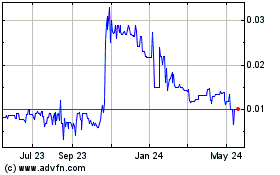

Greenway Technologies (PK) (USOTC:GWTI)

Historical Stock Chart

From Mar 2024 to Mar 2025