PURA PPS Periodic Surge Bolstered By Post COVID-19 Market Rally

February 25 2020 - 10:08AM

InvestorsHub NewsWire

New

York, NY -- February 25,

2020 -- via NextBigTicker.com

Puration, Inc. (USOTC:PURA)

opened up today from yesterday’s close as the PPS continues to show

signs that it could potentially experience one of its historic

periodic PPS surges. PURA hit $0.09 last September after

trading in the $0.04 range days prior. Last March, PURA hit

$0.15 after trading in the $0.06 range days prior. Yesterday,

PURA received a BUY recommendation from

AmericanBulls, a BULLISH rating from

BullishInvestor and a VERY BULLISH rating from

StockTA. Though the PPS did not see a strong increase

yesterday, it did manage to maintain its $0.03 range and not lose

any ground in one of the biggest market wide down day performances

in the last two years. With the market recovering today from

yesterday’s COVID-19 reaction, PURA is again well positioned to see

the PPS continue to climb.

The

PURA PPS recently experienced a retrace from just shy of $0.05 to

$0.03. The retrace was a healthy consolidation with less than

half the volume of the climb the week earlier. PURA is

showing clear signs that is ready to restart one if its periodic

breakout climbs that could see the PPS run back to its $0.15

52-week high. A PURA PPS accelerated climb could be triggered

at any moment news from the company’s recently launched acquisition

campaign.

MarketWatch

“U.S. stocks rallied

at the market open Tuesday as investors attempted to assess growing

headwinds like the spread of COVID-19 outside China against the

backdrop of positive economic

growth.

Global stocks were

hammered Monday, with the Dow Jones Industrial Average and S&P

500 index charting their biggest one-day percentage losses in more

than two years.”

PURA has recently launched an acquisition

campaign fueled by a $5 million investment. The company has

announced that it expects to close the acquisition of a CBD Infused

Pet Products operation later this week.

Analyst Speculative Buy and $0.35 PPS

Target

PURA recently

announced a next iteration of an ongoing CBD consumer survey

conducted by Goldman Research on behalf of PURA to gauge and refine

the company’s ongoing approach to the CBD consumer

market.

The Goldman CBD consumer survey included a PURA

speculative BUY recommendation and at $0.35 target PPS. PURA

closed yesterday at $0.29. Realizing the target PPS could

deliver a 1000% ROI. |

The full CBD consumer

survey update can be viewed at GOLDMAN CBD

SURVEY.

Other cannabis stocks that appear to be enjoying

today’s rally include Hemp (HEMP),

Medical Marijuana (MJNA)

and KushCo Holdings, (KSHB).

Disclaimer:

NextBigTicker.com (NBT)is a

third party publisher and news dissemination service

provider. NBT is NOT affiliated in any manner with any company

mentioned herein. NBT is news dissemination solutions provider and

are NOT a registered broker/dealer/analyst/adviser, holds no

investment licenses and may NOT sell, offer to sell or offer to buy

any security. NBT's market updates, news alerts and corporate

profiles are NOT a solicitation or recommendation to buy, sell or

hold securities. The material in this release is intended to be

strictly informational and is NEVER to be construed or interpreted

as research material. All readers are strongly urged to perform

research and due diligence on their own and consult a licensed

financial professional before considering any level of investing in

stocks. All material included herein is republished content

and details which were previously disseminated by the companies

mentioned in this release or opinion of the writer. NBT is not

liable for any investment decisions by its readers or subscribers.

Investors are cautioned that they may lose all or a portion of

their investment when investing in stocks. NBT has not been

compensated for this release and HOLDS NO SHARES OF ANY

COMPANY NAMED IN THIS RELEASE.

Disclaimer/Safe Harbor:

This news release contains forward-looking statements within the

meaning of the Securities Litigation Reform Act. The statements

reflect the Company's current views with respect to future events

that involve risks and uncertainties. Among others, these risks

include the expectation that any of the companies mentioned herein

will achieve significant sales, the failure to meet schedule or

performance requirements of the companies' contracts, the

companies' liquidity position, the companies' ability to obtain new

contracts, the emergence of competitors with greater financial

resources and the impact of competitive pricing. In the light of

these uncertainties, the forward-looking events referred to in this

release might not occur.

Source: www.nextbigticker.com

Hemp (CE) (USOTC:HEMP)

Historical Stock Chart

From Oct 2024 to Nov 2024

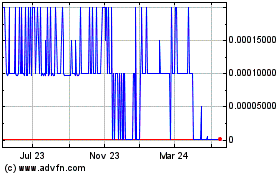

Hemp (CE) (USOTC:HEMP)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Hemp Inc (CE) (OTCMarkets): 0 recent articles

More Hemp Inc (PK) News Articles