Intesa Sanpaolo Agrees to Sell Units for EUR1.04 Billion to Private Equity Firms

May 02 2016 - 2:19AM

Dow Jones News

By Liam Moloney

ROME--Intesa Sanpaolo SpA (ISNPY) said on Monday it has agreed

to sell two units for 1.04 billion euros ($1.20 billion) in cash to

a consortium comprising private-equity funds Advent, Bain Capital

and Clessidra, as part of the Italian bank's focus on core

businesses.

In a statement, Intesa Sanpaolo said it entered into a

sales-and-purchase agreement with Mercury U.K. Holdco Ltd. for its

Setefi and Intesa Sanpaolo Card payments unit.

The deal is expected to be finalized by the end of this year and

will generate a net capital gain of about EUR892 million in Intesa

Sanpaolo's 2016 consolidated income statement, the lender

added.

Last week, The Wall Street Journal cited a person familiar with

the matter as saying the Italian bank was in talks with a number of

buyers to sell its Setefi payments unit in a deal that could value

the business around EUR1 billion.

Write to Liam Moloney at liam.moloney@wsj.com

(END) Dow Jones Newswires

May 02, 2016 03:04 ET (07:04 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

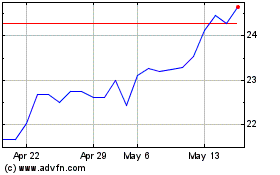

Intesa Sanpaolo (PK) (USOTC:ISNPY)

Historical Stock Chart

From Apr 2024 to May 2024

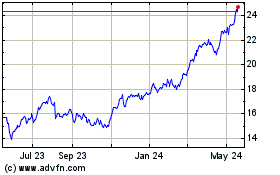

Intesa Sanpaolo (PK) (USOTC:ISNPY)

Historical Stock Chart

From May 2023 to May 2024