Jade Art Group Announces Third Quarter 2008 Financial Results

November 20 2008 - 10:58AM

Business Wire

Jade Art Group Inc. (OTCBB: JADA) (the �Company�), a seller and

distributor of raw jade sourced from the SheTai Jade mine in China,

today announced its operating results for the third quarter ended

September 30, 2008. Revenue from the sale of raw jade was $7.6

million during the third quarter ending September 30, 2008. Since

Jade Art Group transitioned its business from decorative

woodcarving to the sale of raw jade in January 2008 there are no

comparable sales during 2007. Net income for the quarter ending

September 30, 2008 was approximately $4.0 million, or $0.05 per

diluted share. �I am very pleased with our third-quarter revenue of

$7.6 million considering the major disruption caused by the June

10th earthquake,� said Hua-Cai Song, CEO of Jade Art Group.

�Despite loss of access to the main supply road to the mine by

heavy trucking until late September, our customers were able to

pick up a total of 2,300 metric tons of raw jade within the last

seven days of the quarter. Our dedicated team of professionals, the

XiKai mine and our loyal customers worked together to overcome

challenging obstacles and I�m extremely proud of our

accomplishments.� Third Quarter and First Nine Months Highlights

Revenue from the sale of raw jade was $7.6 million during the third

quarter ending September 30, 2008, compared to $6.7 million for the

three months ended June 30, 2008. Raw jade shipments from the

SheTai Jade Mine were halted as a result of the June 10 earthquake

in Inner Mongolia, China, which damaged the main supply road.

However, even with almost no access to the mine aside from a small

service road, XiKai Mining was still able to prepare raw jade at

their on-site warehouse. As a result, customers were able to

immediately collect orders when the main supply road was reopened

on September 23, 2008. The increase in reported cost of sales to

$1.4 million during the three months ended September 30, 2008, from

$1.2 million during the three months ended June 30, 2008 resulted

from the increase in the amount of raw jade which the Company

purchased from SheTai mine and the amortization of the intangible

assets pertaining to the exclusive distribution rights of the

SheTai mine�s jade. Under the Exclusive Distribution Agreement

signed with XiKai Mining, the purchase price for raw jade is RMB

2,000 per metric ton, which is presently equivalent to

approximately $285. The resulting gross profit for the three months

ended September 30, 2008 was $6.2 million, which represented

approximately 82 percent of the revenue, compared to $5.5 million

for the three months ended June 30, 2008, which corresponds to the

same ratio. Selling, general and administrative expenses (SG&A)

were $0.6 million for the three months ended September 30, 2008,

compared to $0.8 million for the three months ended June 30, 2008.

The decrease in SG&A was mainly due to the decrease in the

Company�s normal operational activities during the period when

shipments of raw jade were interrupted by the road damage caused by

the earthquake. The income tax expense pertaining to continuing

operations for the three months ended September 30, 2008 was $1.7

million, compared to $1.5 million for the three months ended June

30, 2008. Net income for the three months ended September 30, 2008

was $4.0 million or 52 percent of revenue, compared to $3.0 million

or 44 percent of revenue for the three months ended June 30, 2008.

This increase in the ratio of net income to revenue is primarily

due to a decrease in interest expense, as well as a decrease in

SG&A. Fiscal 2008 Outlook As a result of the interruption in

the transport of raw jade, the Company�s revenues were lower than

anticipated in its second quarter ended June 30, 2008 and its third

quarter ended September 30, 2008. Jade Art Group Inc. has

subsequently adjusted 2008 full-year financial guidance. The

following projections exclude results from discontinued operations.

- Revenues are expected to be between $32 million and $35 million.

- Net income is expected to be between $21 million and $23 million.

- Diluted earnings per share are expected to be between $0.26 and

$0.29. �Obviously the earthquake affected our sales, however the

road to the mine has been re-opened and our customers were able to

collect a substantial amount of raw jade before the end of the

quarter,� said Mr. Song. �No contracts were cancelled and all of

our customers were extremely supportive and understanding,

considering the extreme circumstances surrounding the event. We

expect to attain higher sales levels in future quarters now that

full access to the mine has been restored.� About Jade Art Group

Inc. Jade Art Group Inc., through its wholly owned subsidiary,

Jiangxi SheTai Jade Industrial Co., Ltd., sells and distributes raw

jade sourced from the SheTai Jade mine throughout China, with uses

ranging from decorative construction material to high-end jewelry.

This mine�s operating capacity is estimated to reach 40,000 metric

tons per year in 2009 and it contains one of the largest jade

reserves in China. The mine is owned by XiKai Mining, with which

Jade Art Group signed an agreement to acquire exclusive

distribution rights to sell 90% of the SheTai Jade produced from

the mine for the next 50 years. According to a survey report issued

by the Inner Mongolia Geological Institution, the mine has proven

and probable reserves of approximately 6 million tons. Several

national jade experts have noted the high quality of SheTai Jade as

compared to the other existing varieties of Chinese jade. For more

information, please visit: www.jadeartgroupinc.com FORWARD-LOOKING

STATEMENTS: This document includes forward-looking statements.

Forward-looking statements include, but are not limited to,

statements concerning estimates of, and increases in, production,

projected volume of customer orders, performance by customers,

including timely payment, under existing and future agreements,

cash flows and values, statements relating to the continued

advancement of Jade Art Group�s projects and other statements which

are not historical facts. When used in this document, the words

such as "could," "plan," "estimate," "expect," "intend," "may," and

similar expressions are forward-looking statements. Although Jade

Art Group believes that its expectations reflected in these

forward-looking statements are reasonable, such statements involve

risks and uncertainties and no assurance can be given that actual

results will be consistent with these forward-looking statements.

Important factors that could cause actual results to differ from

these forward-looking statements include, but are not limited to,

those set forth in our reports filed with the Securities and

Exchange Commission, together with the risks discussed in our press

releases and other communications to shareholders issued by us from

time to time, such as our ability to raise capital as and when

required, our ability to pay notes and obligations when due, the

possibility that our customers and other third parties will be

unable to make timely payments, the availability of raw products

and other supplies, competition, the costs of goods, government

regulations, and political and economic factors in the People's

Republic of China in which our subsidiaries operate. � Jade Art

Group Inc.and Subsidiaries � Selected Consolidated Statements of

Operations (in millions, except per share amounts) � � �

(unaudited) Three months ended September 30 (unaudited) Nine months

ended September 30 2008 � 2007 2008 � 2007 � Sales $ 7.6 $ - $ 25.0

$ - Cost of sales (1.4 ) - (4.2 ) - Selling, general and admin

expenses (0.6 ) - (2.2 ) - Income from operations 5.6 - 18.6 -

Interest expense - - (0.2 ) - � Income tax expense (1.7 ) - (5.5 )

- Net income from continued operations 4.0 - 13.0 - Net income from

discontinued operations - 2.7 55.4 6.7 � Net income $ 4.0 � $ 2.7 $

68.4 � $ 6.7 � Basic earnings per share Income from continuing

operations $ 0.05 $ - $ 0.16 $ - Income from discontinued

operations - � 0.04 0.69 � 0.09 Total basic earnings per share 0.05

� 0.04 0.85 � 0.09 � Diluted earnings per share Income from

continuing operations $ 0.05 $ - $ 0.16 $ - Income from

discontinued operations - � 0.04 0.68 � 0.09 Total diluted earnings

per share 0.05 � 0.04 0.84 � 0.09 � Weighted average number of

shares Basic 79,980,000 74,980,000 79,980,000 74,980,000 Diluted

80,980,000 � 74,980,000 80,917,956 � 74,980,000 � NOTE: The above

numbers may not total correctly due to rounding. � Jade Art Group,

Inc.and Subsidiaries Selected Consolidated Balance Sheet Items (in

millions) � (unaudited) September 30, 2008 � Cash $ 0.5 Accounts

receivable 8.1 Notes receivable 13.2 Dividends payable 14.3

Accounts payable and accrued expenses 1.1 Taxes payable 2.7 Total

stockholders� equity $ 60.5 � NOTE: The above numbers may not total

correctly due to rounding. Selected Consolidated Cash Flow Items

(in millions) � (unaudited) Nine months ended September 30 2008 �

2007 � Net cash provided by operating activities $ 13.0 $ -

Purchases of property and equipment - - Notes receivable (14.7 ) -

Proceeds from loans (including loan from related party) 10.0 - Net

increase in cash $ 0.2 $ (0.1 ) � NOTE: The above numbers may not

total correctly due to rounding.

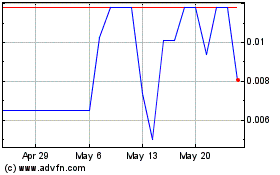

Jade Art (PK) (USOTC:JADA)

Historical Stock Chart

From Oct 2024 to Nov 2024

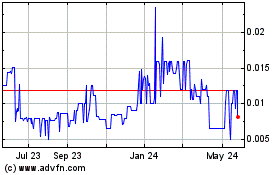

Jade Art (PK) (USOTC:JADA)

Historical Stock Chart

From Nov 2023 to Nov 2024