Oil Prices Inch Up on Weaker Dollar

June 07 2016 - 7:50AM

Dow Jones News

Crude oil prices rose Tuesday as the dollar weakened after an

imminent increase in U.S. interest rates became less likely.

Global crude benchmark Brent's August contract was up 0.28% to

$50.31 a barrel, while its U.S. counterpart, West Texas

Intermediate, was up 0.26% at $49.81 for July deliveries.

The weak dollar is dominating the oil agenda after Friday's

disappointing employment data from the U.S. offered a tailwind to

prices. However, gains were tempered by Federal Reserve Chairwoman

Janet Yellen's statement Monday that she still expects gradual

interest rate increases this year.

Recent price gains could also become self-defeating, as they

motivate increased production.

At $50 a barrel, the oil price could revive some shale oil

drilling, according to Norbert Rucker, head of commodities research

at the Swiss bank Julius Baer. In a note, the analyst said that

last week's uptick in U.S. rigs in operation could be the first

sign that production is slowly starting to stabilize. The analyst

remained cautious, however.

"The big picture is unchanged," said Mr. Rucker. "Sluggish

global growth, abundant supplies and persistent cost deflation

should keep a lid on commodity prices longer-term."

But production remains challenged in key regions. In Nigeria, a

group calling itself the Niger Delta Avengers, which has been

bombing pipelines, vowed on its purported Twitter account to reduce

the country's production to zero.

The campaign by the group has taken as much as 1 million barrels

a day of Nigerian supply out of the market, meaning that Angola has

now replaced the country as Africa's leading producer.

The American Petroleum Institute releases its weekly inventory

forecasts today ahead of Wednesday's official data from the Energy

Information Administration. Michael Poulsen, oil risk manager from

Copenhagen-based Global Risk Management, said the consensus is a

3.5 million barrel fall in crude oil inventories.

Other factors that could affect U.S. oil prices this week

include tropical storm Colin in the Gulf of Mexico, which is

reportedly picking up speed but hasn't affected offshore oil

infrastructure in the area as yet.

Nymex reformulated gasoline blendstock for July—the benchmark

gasoline contract—was up 0.3% to points to $1.59 a gallon, while

July diesel traded at $1.51, 0.69% higher.

ICE gas oil for June changed hands at $444.25 a metric ton, down

$0.75 from Monday's settlement.

Jenny W. Hsu contributed to this article.

Write to Kevin Baxter at Kevin.Baxter@wsj.com

(END) Dow Jones Newswires

June 07, 2016 08:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

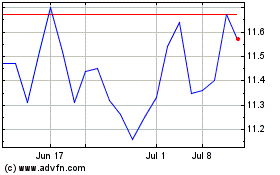

Julius Baer (PK) (USOTC:JBAXY)

Historical Stock Chart

From Dec 2024 to Jan 2025

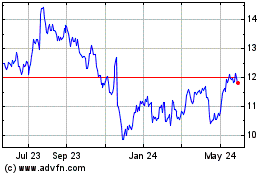

Julius Baer (PK) (USOTC:JBAXY)

Historical Stock Chart

From Jan 2024 to Jan 2025