LONDON MARKETS: British Stocks Rise To Near 11-month High As Johnson Elected As Conservative Party Leader

July 23 2019 - 11:15AM

Dow Jones News

By Steve Goldstein, MarketWatch

British stocks rose to nearly an 11-month high on Wednesday, as

the Conservative Party's election of Boris Johnson to lead the

party was set against a backdrop of global optimism for stocks.

The U.K. FTSE 100 rose 0.6% to 7,556.86. The FTSE 100's 52-week

high was 7,776.65, on Aug. 8, 2018.

The mid-cap FTSE 250 , which is more exposed to the British

economy, rose 0.5% to 19,752.30.

The British pound edged lower to $1.2442 vs. the dollar, but rose to 1.1141 euros.

Read: Boris Johnson announced as Britain's next prime minister

-- what happens next for markets

(http://www.marketwatch.com/story/brace-yourselves-for-britains-new-prime-minister---heres-how-markets-will-react-2019-07-22)

What's moving markets

To the surprise of few, Johnson won the Conservative party

leadership race handily over Jeremy Hunt,

(http://www.marketwatch.com/story/boris-johnson-says-hell-unite-the-country-deliver-brexit-and-fend-off-the-labour-party-2019-07-23)setting

the stage for the former mayor of London to become the prime

minister.

Analysts at UBS say the market is pricing in nearly a 50% chance

of a no-deal Brexit, which the brokerage thinks is overstating

those risks. UBS point out Johnson faces barriers including the

party's lack of a majority in Parliament and that the party that is

not united. "So although a no-deal Brexit remains possible, we

believe the U.K. is more likely to ask for a further extension to

exit day, whether due to a change in stance from Mr. Johnson, or

due to a no-confidence vote followed by a general election."

Citi expects a general election in the autumn. "Mr. Johnson's

best chance of success is to position himself as being 'forced'

into an election by 1) adopting an initially conciliatory tone

vis-à-vis negotiations with the EU and 2) continuing to demand a

renegotiation of the backstop or no deal," analysts there said.

Outside the U.K., the focus was on a debt-ceiling deal

tentatively reached in the U.S. and reports of progress on

U.S.-China trade talks.

Focus stocks

Shares of U.K.-listed currency printer De La Rue (DLAR.LN)

dropped 16% as the company said the UK Serious Fraud Office has

opened an investigation into suspected corruption in the conduct of

business in South Sudan. De La Rue says it intended to cooperate

with the probe. It said it is not possible "to predict reliably

what effect their outcome may have on De La Rue."

Supermarket giants Tesco (TSCO.LN) and J Sainsbury (SBRY.LN)

each lost about 2% after Kantar reported the two losing market

share.

Shares of Standard Life Aberdeen (SLA.LN) rose 1.9% as the

company's former unit, Standard Life Assurance, agreed to pay a

GBP30.7 million fine over annuity sales. Phoenix Group (PHNX.LN) ,

its new owner, rose 0.4%.

Lloyd's syndicate member Beazley (BEZ.LN) shares rose 5.2% after

reporting a near tripling of pretax profits on 12% higher

premiums.

(END) Dow Jones Newswires

July 23, 2019 12:00 ET (16:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

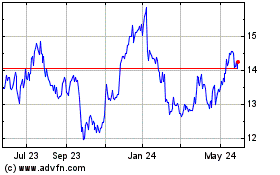

J Sainsbury (QX) (USOTC:JSAIY)

Historical Stock Chart

From Dec 2024 to Jan 2025

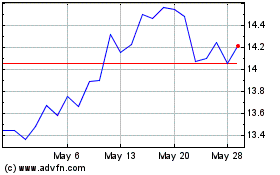

J Sainsbury (QX) (USOTC:JSAIY)

Historical Stock Chart

From Jan 2024 to Jan 2025