Current Report Filing (8-k)

April 17 2023 - 6:11AM

Edgar (US Regulatory)

0000845819

false

0000845819

2023-04-06

2023-04-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of earliest event reported: April 6, 2023

KonaTel, Inc.

(Exact name of Registrant as specified in its charter)

N/A

(Former name or address, if changed since last report)

| Delaware |

|

001-10171 |

|

80-0973608 |

|

(State or Other Jurisdiction

Of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

500 N. Central Expressway, Suite 202

Plano, Texas 75074

(Address of Principal

Executive Offices, Including Zip Code)

(214) 323-8410

(Registrant’s

Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the Registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the Registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter or Rule 12b-2 of the Securities

and Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark

if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

FORWARD LOOKING STATEMENTS

This Current Report contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”). In some cases, you can identify forward-looking statements

by the following words: “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,”

“project,” “should,” “will,” “would,” or the negative of these terms or other comparable

terminology, although not all forward-looking statements contain these words. Forward-looking statements are not a guarantee of future

performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will

be achieved. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown

risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different

from the information expressed or implied by the forward-looking statements in this Current Report. We cannot assure you that the forward-looking

statements in this Current Report will prove to be accurate, and therefore, prospective investors are encouraged not to place undue reliance

on forward-looking statements. You should carefully read this Current Report completely, and it should be read and considered with all

other reports filed by us with the United States Securities and Exchange Commission (the “SEC”). Other than as required by

law, we undertake no obligation to update or revise these forward-looking statements, even though our situation may change in the future.

EXPLANATORY NOTES

Except as otherwise indicated by context, references

to the “Company,” “we,” “our,” “us” and words of similar import refer to “KonaTel,

Inc.,” a Delaware corporation, formerly named Dala Petroleum Corp., which is the Registrant (“KonaTel”), and our wholly-owned

subsidiaries, KonaTel, Inc., a Nevada corporation (“KonaTel Nevada”), Apeiron Systems, Inc., a Nevada corporation (“Apeiron

Systems”), and IM Telecom, LLC, an Oklahoma limited liability company doing business as “Infiniti Mobile” (“IM

Telecom” or “Infiniti Mobile”).

Section 1 - Registrant’s Business and Operations

Item 1.01 Entry into a Material Definitive Agreement.

On January 24, 2023, we entered into a non-material

Membership Interest Purchase Agreement to acquire 100% of Tempo Telecom, LLC, a Georgia limited liability company, an Eligible Telecommunications

Carrier (“ETC”), authorized to provide Lifeline services in twenty-one (21) states (respectively, the “Purchase Agreement”

and “Tempo”), the closing of which is subject to the approval of the Federal Communications Commission (the “FCC”)

and applicable state and other governmental agencies, among other conditions.

On April 6, 2023, pursuant to a Purchase of Contract

Rights Agreement between the Company and Insight Mobile, Inc., a Delaware corporation (respectively, the “Agreement” and “Insight

Mobile”), we and Insight Mobile executed and delivered an Assumption of Membership Interest Purchase Agreement (the “Assignment

Agreement”), which shall be held in escrow by counsel for Insight Mobile (the “Escrow Agent”) pending satisfaction of

all conditions to the Closing of the Purchase Agreement, and whereby Insight Mobile agreed to pay us the “Purchase Price”

of $4,500,000 for our “Contract Rights” under the Purchase Agreement. All capitalized terms herein shall have the meanings

ascribed to them in these respective agreements.

The Purchase Price is payable as follows: (a)

upon execution of the Agreement, Insight Mobile shall deposit $500,000 in readily available funds into an “Escrow Account”

with the Escrow Agent; (b) upon the execution of a Master Distribution Agreement yet to be created (the “MDA”) between IM

Telecom and Excess Telecom, an affiliated company of Insight Mobile, and when Excess Telecom has the ability to start activations under

the MDA, the Escrow Agent shall pay us $250,000 to an account designated by us, which payment is deemed to be an interest free loan from

Insight Mobile to KonaTel (the funds in clauses (a) and (b) above are collectively referred to as the “Deposit”); and (c)

upon receipt of all required Government Approvals (other than approvals from any of the State Authorities), including the FCC, $4,000,000

in readily available funds shall be paid by Insight Mobile into an account designated by KonaTel, and the Deposit in the Escrow Account

shall be paid to KonaTel (and the portion of the Deposit held by us in clause (b) above shall be fully earned by KonaTel).

The Agreement provides that all of the foregoing

funds shall be returned to Insight Mobile if the Purchase Agreement is terminated for Cause; provided, however, the Deposit is not refundable

if this Agreement is terminated without Cause. The term “Cause” means: (i) the denial by the FCC or regulatory denial of Government

Approvals; (ii) reaching the Drop Dead Date prior to FCC approval; (iii) Insight Mobile’s written notification to KonaTel, given

within 60 days of the date of this Agreement (the “Due Diligence Period”) that that due diligence is not satisfactory in its

sole discretion; or (iv) in the event of material adverse events occurring after the Due Diligence Period that were not disclosed in writing

to Insight Mobile prior to the expiration of the Due Diligence Period in connection with Tempo, as determined in Insight Mobile’s

reasonable discretion and in good faith, including without limitation, issuance of Oral Requests, Letter of Inquiry (“LOI”),

Citations, Notice of Violation (“NOV”), Subpoenas, Compulsory Testimony, Admonishment, Monetary Forfeiture, or Notice of Apparent

Liability (“NAL”) by the FCC Enforcement Bureau and any of is subdivisions, or any other Governmental Authority that are not

capable of being cured or addressed prior to the Drop Dead Date. If the Agreement is terminated without Cause, KonaTel shall be distributed

fifty percent (50%) of the Deposit (the “Break Up Fee”), which shall amount to $250,000, and the balance of the Deposit shall

be returned to Insight Mobile.

Notwithstanding anything to the contrary, the

Agreement and the Assignment Agreement or documents contemplated to be executed thereby shall only be effective upon the Closing of the

Purchase Agreement and the full payment of the Purchase Price under the Agreement; and if the Purchase Agreement is terminated for any

reason, all such documents, at KonaTel’s election, become null and void and of no further force and effect and the counterpart signature

pages of all such documents, including, without limitation, the Assignment Agreement, shall be returned to the respective Parties delivering

them or destroyed.

Further, notwithstanding any provision in the

Assignment Agreement or this Agreement to the contrary, in the event that Insight Mobile does not receive all necessary Government Approvals

for the change in ownership/control of Tempo from the FCC and the State Authorities for the Communications Licenses as set forth in the

Purchase Agreement by June 1, 2024 (the “Drop Dead Date”), unless: (a) an extension is obtained pursuant to the terms of the

Purchase Agreement; (b) the FCC denies the change in ownership/control of Tempo; or (c) if the Purchase Agreement is terminated in accordance

with the terms thereof, this Agreement and the Assignment Agreement will be terminated, the Deposit will be returned to Insight Mobile,

along with any payments of the Purchase Price made by Insight Mobile towards the Deposit, and the interest free loan as set forth in Section

2 (b) above, within five (5) business days in any such case. In the event of termination, both Parties shall be relieved of any obligations

set forth in this Agreement, except Sections 12 (Indemnification) and 18 (Confidentiality).

The Agreement also contains provisions regarding

payment of regulatory costs related to any FCC filing and State Approvals; and customary provisions on acting in good faith; to refrain

from interference with the other Party’s rights under the Purchase Agreement or to exercise remedies thereunder without the other

Party’s consent; governing law and jurisdiction; notices; counterparts; binding nature on heirs, executors, administrators, successors

and assigns; indemnification; lack of third party beneficiaries; the relationships of the Parties; each Party bearing their respective

costs and expenses related to the Agreement; the lack of broker commissions; and confidentiality.

No assurance whatsoever can be given that the

Agreement, the Assignment Agreement or the Purchase Agreement will be completed.

The Assignment Agreement simply assigns all

of KonaTel’s right, title and interest in the Purchase Agreement to Insight Mobile.

The Agreement is attached hereto and incorporated

herein by reference in Section 9, Item 9.01 hereof, and the foregoing summary is modified in its entirety to this attached Agreement.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

KonaTel, Inc. |

| |

|

| Date: April 17, 2023 |

By: |

/s/ D. Sean McEwen |

| |

|

D. Sean McEwen |

| |

|

Chairman and Chief Executive Officer |

4

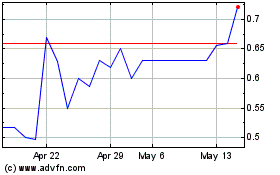

KonaTel (QB) (USOTC:KTEL)

Historical Stock Chart

From May 2024 to Jun 2024

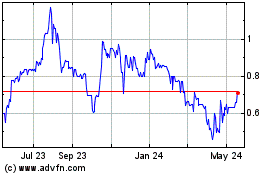

KonaTel (QB) (USOTC:KTEL)

Historical Stock Chart

From Jun 2023 to Jun 2024